Middle East & Africa Polyvinyl Chloride Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Rigid PVC, Flexible PVC, Low-Smoke Zero-Halogen PVC, and Others), By Application (Pipes and Fittings, Films and Sheets, Wires and Cables, and Others), By End-User (Building and Construction, Automotive and Mobility, and Others), and Middle East & Africa Polyvinyl Chloride Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsMiddle East & Africa Polyvinyl Chloride Market Insights Forecasts to 2035

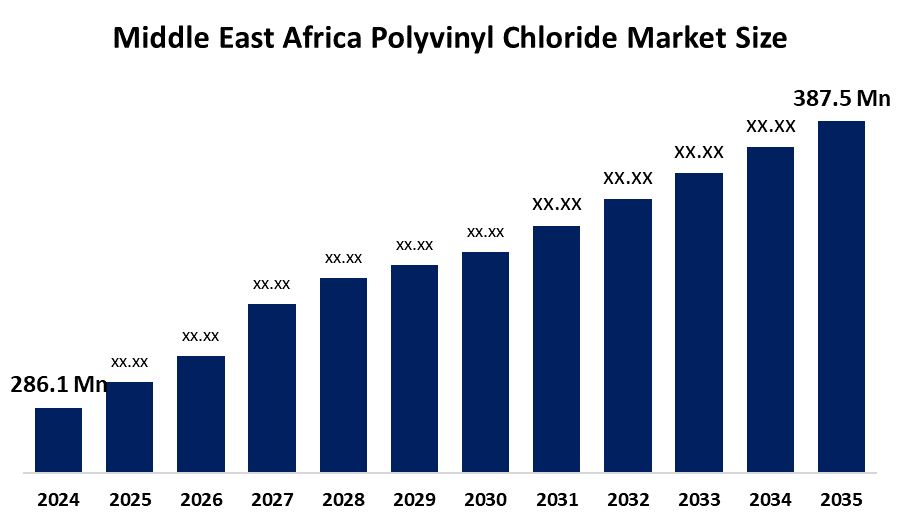

- The Middle East & Africa Polyvinyl Chloride Market Size Was Estimated at USD 286.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 2.8% from 2025 to 2035

- The Middle East & Africa Polyvinyl Chloride Market Size is Expected to Reach USD 387.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Middle East & Africa Polyvinyl Chloride Market size is anticipated to reach USD 387.5 Million by 2035, growing at a CAGR of 2.8% from 2025 to 2035. The market is driven by higher efficiency, and less harmful emissions are the outcomes of technological advancements in PVC production. The PVC industry concentrates on being more sustainable as environmental consciousness grows.

Market Overview

PVC is a synthetic plastic polymer that serves multiple industrial applications. The process of making PVC starts with the polymerization of vinyl chloride monomer VCM, which is derived from ethylene dichloride EDC and chlorine. Rigid PVC material serves as the main component for manufacturing pipes, window profiles and flooring products, while flexible PVC material finds its application in plumbing systems, electrical cables and medical devices. PVC serves various industrial applications throughout the building sector, healthcare industry, and automotive market.

The Saudi Ministry of Environment introduced new sustainability standards for PVC pipe manufacturing, which mandate recycled material usage and environmentally sustainable manufacturing methods throughout the Kingdom's pipe production sector. National programs like Saudi Arabia's Vision 2030 and projects in Nigeria and Egypt require governments to invest extensively in infrastructure development, water supply systems, sanitation facilities and renewable energy projects, increasing demand for PVC pipes and associated products.

Saudi Arabia held 23.90 of the Middle East Africa poly vinyl chloride PVC market in 2025, supported by Vision 2030 capital expenditure on water infrastructure and mixed use giga projects. The UAE market closely follows the Kingdoms volume because it relies on Veolia's desalination facility construction and solar-park cabling requirements, which total USD 320 million.

The future of PVC will focus on developing recycling methods that reduce its ecological footprint. The development of bio-based PVC combined with advanced recycling technologies will create sustainable solutions that will increase the material's use in environmentally friendly products and applications.

Report Coverage

This research report categorises the Middle East & Africa polyvinyl chloride market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Middle East & Africa polyvinyl chloride market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Middle East & Africa polyvinyl chloride market.

Middle East Africa Polyvinyl Chloride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 286.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 2.8% |

| 2035 Value Projection: | USD 387.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | SABIC,Egyptian Petrochemical Co,Sasol,TCI Sanmar Chemicals,Africa PVC Industries Ltd,Qatar Vinyl Company,Weatlake Chemical Co,Formosa Plastics Co And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The polyvinyl chloride market in Middle East Africa is driven by the requirement for PVC materials, which has increased because healthcare facilities and medical equipment production facilities are expected to spend 120 billion by 2026. The ongoing development of infrastructure continues to progress through multiple sectors, which include residential areas, commercial spaces and agricultural land. The agricultural sector depends on PVC pipes to establish irrigation systems, which enable it to maintain crop production in areas where water resources are limited. The manufacturing sector in the region receives support from PVC demand because it improves the production capacity of vital products, which are needed by both local markets and international markets.

Restraining Factors

The polyvinyl chloride market in Middle East & Africa is restrained by the production and waste management of PVC materials, which create environmental problems because they release hazardous chemicals and produce waste that cannot decompose. The development of low-emission production methods and recycling technologies for PVC has gained traction in the industry.

Market Segmentation

The Middle East & Africa polyvinyl chloride market share is categorised into product type, application and end user.

- The rigid PVC segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Middle East & Africa polyvinyl chloride market is segmented by product type into rigid PVC, flexible PVC, low-smoke zero-halogen PVC, and others. Among these, the rigid PVC segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Rigid grades accounted for 57.70% of the Middle-East and Africa polyvinyl chloride (PVC) market size in 2025, driven by pipeline and construction orders. The material has extensive applications in construction through its use in pipe profiles and window frames. Flexible PVC stands as the fastest growing market section because customers now seek it for healthcare, automotive and consumer goods products.

- The pipes and fittings segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Middle East & Africa polyvinyl chloride market is segmented into pipes and fittings, films and sheets, wires and cables, and others. Among these, the pipes and fittings segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Pipes and fittings contributed 45.70% of the Middle-East Africa poly vinyl chloride (PVC) market share in 2025; electrical wires and cables will experience a 2.59% CAGR growth rate until 2031. The construction sector, together with water supply and infrastructure projects, has seen a rise in demand for films and sheets, which now represent the fastest growing market segment.

- The building and construction segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Middle East & Africa polyvinyl chloride market is segmented by end user into building and construction, automotive and mobility, and others. Among these, the building and construction segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The building and construction sector maintained a 49.60% market share of the polyvinyl chloride (PVC) market in 2025 due to ongoing GCC megaprojects, which have extended their construction timelines. The area needs infrastructure, plumbing and electrical systems which use this material. The healthcare sector has developed into the fastest-growing market due to increasing demand for medical equipment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Middle East & Africa polyvinyl chloride market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SABIC

- Egyptian Petrochemical Co.

- Sasol

- TCI Sanmar Chemicals

- Africa PVC Industries Ltd

- Qatar Vinyl Company

- Weatlake Chemical Co.

- Formosa Plastics Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In July 2025, Qatar Vinyl Co to launch the nation’s first PVC plant in September 2025. With a nameplate capacity of 350,000 tons/year, the facility marks a strategic milestone in Qatar’s industrial diversification and is expected to alter the nation's footprint in the global vinyl market.

Market Segment

This study forecasts revenue at the Middle East & Africa, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Middle East & Africa Polyvinyl Chloride Market based on the below-mentioned segments:

Middle East & Africa Polyvinyl Chloride Market, By Product Type

- Rigid PVC

- Flexible PVC

- Low-Smoke Zero-Halogen PVC

- Others

Middle East & Africa Polyvinyl Chloride Market, By Application

- Pipes and Fittings

- Films and Sheets

- Wires and Cables

- Others

Middle East & Africa Polyvinyl Chloride Market, By End User

- Building and Construction

- Automotive and Mobility

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Middle East & Africa polyvinyl chloride market size?A: The Middle East & Africa Polyvinyl Chloride market size is expected to grow from USD 286.1 million in 2024 to USD 387.5 million by 2035, growing at a CAGR of 2.8% during the forecast period 2025-2035.

-

Q: What is Polyvinyl chloride, and its primary use?A: PVC is a synthetic plastic polymer that serves multiple industrial applications. The process of making PVC starts with the polymerization of vinyl chloride monomer (VCM), which is derived from ethylene dichloride (EDC) and chlorine.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the requirement for PVC materials, which has increased because healthcare facilities and medical equipment production facilities are expected to spend $120 billion by 2026.

-

Q: What factors restrain the Middle East & Africa polyvinyl chloride market?A: The market is restrained by the production and waste management of PVC materials, which create environmental problems because they release hazardous chemicals and produce waste that cannot decompose.

-

Q: How is the market segmented by product type?A: The market is segmented into rigid PVC, flexible PVC, low-smoke zero-halogen PVC, and others.

-

Q: Who are the key players in the Middle East & Africa polyvinyl chloride market?A: Key companies include SABIC, Egyptian Petrochemical Co., Sasol, TCI Sanmar Chemicals, Africa PVC Industries Ltd, Qatar Vinyl Company, Weatlake Chemical Co., and Formosa Plastics Co.

Need help to buy this report?