Middle East & Africa Hydrogen Market Size, Share, and COVID-19 Impact Analysis, By Value Chain Stage (Hydrogen Production, Hydrogen Storage, Hydrogen Transportation & Distribution, Hydrogen Refuelling Infrastructure, and Others), By Technology (Production Technologies, Fuel Cell Technologies), By End User (Transportation, Industrial Manufacturing, Utilities & Energy Storage, Residential & Commercial), and Middle East & Africa Hydrogen Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsMiddle East & Africa Hydrogen Market Size Insights Forecasts To 2035

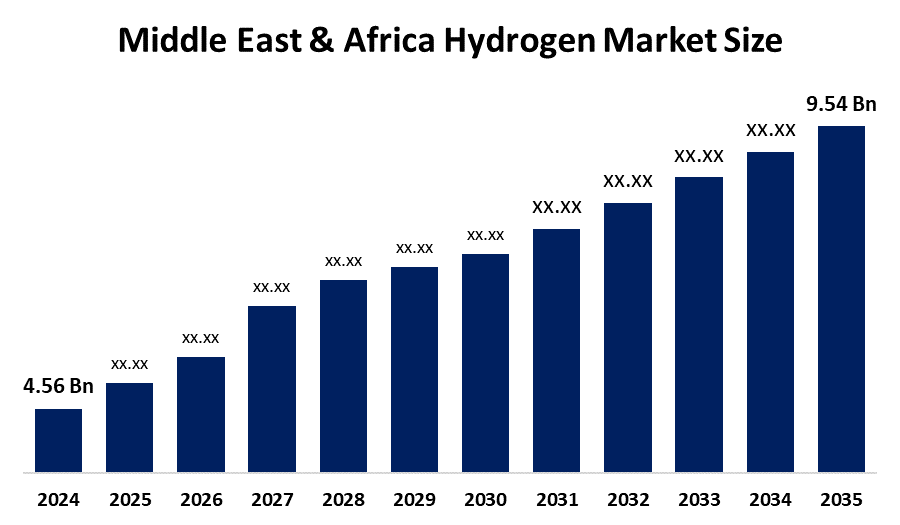

- The Middle East & Africa Hydrogen Market Size Was Estimated At USD 4.56 Billion In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 6.94% From 2025 To 2035

- The Middle East & Africa Hydrogen Market Size Is Expected To Reach USD 9.54 Billion By 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Middle East & Africa Hydrogen Market Size Is Anticipated To Reach USD 9.54 Billion By 2035, Growing At A CAGR Of 6.94% From 2025 To 2035. The market size is driven by the increasing trend of switching to low-emission and sustainable energy solutions for transportation, power generation, and industrial uses.

Market Overview

The hydrogen market size is leading a technological revolution due to the region's dedication to developing clean, sustainable power sources. Green hydrogen results from renewable energy-powered water electrolysis and has become essential for worldwide carbon emission reduction efforts that aim to create a low-carbon future. Hydrogen which scientists recognize as the first element of the periodic table, belongs to the group of elements that exist in greater quantities than any other element. The element exhibits multiple chemical properties and compound characteristics, yet various industries identify hydrogen by its standard gaseous form, which exists as H2.

A number of African countries, such as South Africa, Egypt, Mauritania and Morocco, aim to capitalize on their vast renewable resources to competitively produce green hydrogen both for domestic use as well as to serve markets experiencing a surge in demand, such as Europe. The Middle East develops its low-carbon hydrogen industry by combining investments in both blue hydrogen and green hydrogen technologies.

The Saudi government has implemented active measures to support the establishment of a green hydrogen sector. Green hydrogen serves as a vital component for Saudi Arabia's Vision 2030 national transformation plan, which aims to achieve economic diversification and environmental sustainability. The governments of the MEA region have begun to recognize green hydrogen as a strategic resource and they are currently implementing measures to promote its progress. The public sector and private companies are funding advanced technologies and innovative solutions to improve both the production efficiency and the economic viability of green hydrogen.

Report Coverage

This research report categorises the Middle East & Africa hydrogen market size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Middle East & Africa hydrogen market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Middle East & Africa hydrogen market.

Middle East & Africa Hydrogen Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.56 Billion |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 6.94% |

| 2023 Value Projection: | USD 9.54 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Value Chain Stage, By Technology |

| Companies covered:: | Strandmollen, SOL Group, Messer Group, Air Liquide SA, Masdar Clean Energy, Linde Plc, Siemens, ADNOC, Total Energies, Saudi Aramco, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The hydrogen market size in Middle East & Africa is driven by the renewable energy resources from solar and wind power, which provide ideal conditions for creating green hydrogen. The development of green hydrogen projects has advanced due to both sustainable practices and environmental regulations from governments and businesses, which have become more important in recent times. The MEA green hydrogen market shows great potential but it encounters particular obstacles. The establishment of green hydrogen production facilities needs advanced systems which require significant financial investment.

Restraining Factors

The hydrogen market size in Middle East & Africa is restrained by the establishment of electrolysis plants together with storage systems needs substantial initial financial backing, which acts as a primary obstacle for African countries that have not reached full economic development. Electrolysis for hydrogen production needs large quantities of water for its operation. Many MEA countries face extreme water stress, requiring expensive desalination processes to provide the necessary feedstock, which further increases total costs.

Market Segmentation

The Middle East & Africa hydrogen market share is categorised into value chain stage, technology, and end user.

- The hydrogen production segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Middle East & Africa hydrogen market size is segmented by value chain stage into hydrogen production, hydrogen storage, hydrogen transportation & distribution, hydrogen refuelling infrastructure, and others. Among these, the hydrogen production segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the decarbonization process, which benefits from both advancements in hydrogen production technology and hydrogen's growing importance. Hydrogen remains an effective energy storage solution that specifically addresses the challenges of intermittent renewable energy power generation.

- The production technologies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on technology, the Middle East & Africa hydrogen market size is segmented into production technologies, fuel cell technologies. Among these, the production technologies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the advancements in electrolysis and renewable energy technologies, combined with the increasing demand for cleaner energy sources. The existing hydrogen infrastructure development projects, which include storage and transportation systems, are essential for enabling hydrogen technology to achieve its full potential.

- The industrial manufacturing segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Middle East & Africa hydrogen market size is segmented by end user into transportation, industrial manufacturing, utilities & energy storage, residential & commercial. Among these, the industrial manufacturing segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the increasing need for environmentally friendly fuels, combined with new hydrogen production methods. Hydrogen serves as a vital component in multiple industrial operations, which include methanol production, ammonia manufacturing and metal extraction processes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Middle East & Africa hydrogen market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Strandmollen

- SOL Group

- Messer Group

- Air Liquide SA

- Masdar Clean Energy

- Linde Plc

- Siemens

- ADNOC

- Total Energies

- Saudi Aramco

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2025, UAE's clean energy company, Masdar, signed a non-binding Letter of Intent (LOI) with OMV, Austria's integrated energy firm, for jointly exploring the development of green hydrogen, synthetic sustainable aviation fuel and other eco-friendly projects.

Market Segment

This study forecasts revenue at the Middle East & Africa, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Middle East & Africa Hydrogen Market size based on the below-mentioned segments:

Middle East & Africa Hydrogen Market, By Value Chain Stage

- Hydrogen Production

- Hydrogen Storage

- Hydrogen Transportation & Distribution

- Hydrogen Refuelling Infrastructure

- Others

Middle East & Africa Hydrogen Market, By Technology

- Production Technologies

- Fuel Cell Technologies

Middle East & Africa Hydrogen Market, By End User

- Transportation

- Industrial Manufacturing

- Utilities & Energy Storage

- Residential & Commercial

Frequently Asked Questions (FAQ)

-

What is the Middle East & Africa hydrogen market size?Middle East & Africa Hydrogen market size is expected to grow from USD 4.56 billion in 2024 to USD 9.54 billion by 2035, growing at a CAGR of 6.94% during the forecast period 2025-2035.

-

What is hydrogen, and its primary use?The hydrogen market is currently leading a technological revolution because the region dedicates itself to developing clean sustainable power sources. Green hydrogen results from renewable energy-powered water electrolysis and has become essential for worldwide carbon emission reduction efforts that aim to create a low-carbon future.

-

What are the key growth drivers of the market?Market growth is driven by the availability of solar and wind renewable energy sources creates optimal conditions for producing green hydrogen.

-

What factors restrain the Middle East & Africa hydrogen market?The market is restrained by the establishment of electrolysis plants together with storage systems needs substantial initial financial backing, which acts as a primary obstacle for African countries that have not reached full economic development.

-

How is the market segmented by technology?The market is segmented into production technologies, fuel cell technologies.

-

Who are the key players in the Middle East & Africa hydrogen market?Key companies include Strandmollen, SOL Group, Messer Group, Air Liquide SA, Masdar Clean Energy, Linde Plc, Siemens, ADNOC, Total Energies, and Saudi Aramco.

Need help to buy this report?