Global Microfluidics Market Size, Share, and COVID-19 Impact Analysis, By Material (Silicon, Glass & Others), By Product (Chip & Device, Instrument & System, Software, Service & Others), By End User (Healthcare, Research Institutes, Biotechnology, Pharmaceutical & Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Microfluidics Market Insights Forecasts to 2033.

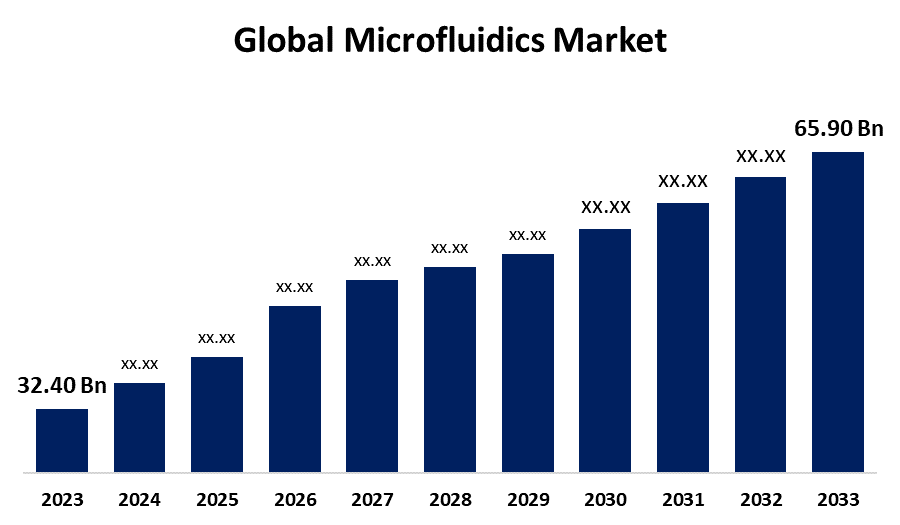

- The Global Microfluidics Market Size was Valued at USD 32.40 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.36% from 2023 to 2033.

- The Worldwide Microfluidics Market Size is Expected to Reach USD 65.90 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Microfluidics Market Size is Anticipated to Exceed USD 65.90 Billion by 2033, Growing at a CAGR of 7.36% from 2023 to 2033.

Market Overview

The scientific and technological area of microfluidics studies the behavior, alteration, and control of fluids at the micro scale, usually in channels of micrometer-scale diameters. It includes the careful manipulation of tiny fluid quantities to carry out a variety of operations, including mixing, separating, reacting, and analyzing. Micro fabrication methods are commonly applied in the fabrication of microfluidic devices, allowing sophisticated functionality to be integrated into tiny chips or platforms. This technique offers benefits including quick analysis, decreased sample and reagent usage, and more control over experimental settings. Furthermore, because of their simplicity in use, low sample requirements, and affordability, lab-on-a-chip and organ-on-a-chip technologies have become increasingly popular as a result of technical advances in microfluidics systems. Numerous industries, such as chemical synthesis, pharmaceutical, biomedical, medical science, biosensing, and drug discovery, are using microfluidics extensively, which is fueling market expansion. Over the projection period, the microfluidics industry outlook would be strengthened by these factors.

Report Coverage

This research report categorizes the market for the global microfluidics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global microfluidics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global microfluidics market.

Global Microfluidics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 32.40 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 7.36% |

| 2033 Value Projection: | USD 65.90 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material, By Product, By End User, By Region |

| Companies covered:: | Illumina, Inc., F. Hoffmann-La Roche Ltd, PerkinElmer, Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, Abbott, Thermo Fisher Scientific, Standard BioTools, and Other Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving factor

The global microfluidics market is driven by various factors, including the rising incidence of chronic and infectious diseases such as cancer, diabetes, cardiovascular disease, and others, which is driving up point-of-care testing. Over the course of the projected period, this need is expected to propel the microfluidics market. For example, according to the IDF's 2022 forecasts, there were around 6.1 million diabetics in Germany in 2021; by 2030, that number is predicted to increase to 6.5 million. Consequently, the expected increase in the number of diabetes cases raises the need for novel porosity microcapsules encasing cells for diabetes therapy using microfluidic electrospray technology. In addition, all market participants implemented point-of-care diagnostics, which resulted in early illness detection and fewer hospital visits. Due to advancements in technology, companies in the market are now differentiating their products with precision, speed, and minimum intrusive features. Hence, microfluidics has established itself in the IVD sector. Furthermore, major competitors in the industry, including Abbott, Roche, and Danaher, have already integrated microfluidics technology into their current diagnostic products. A number of important firms are investigating digital microfluidics in light of technological improvements.

Restraining Factors

Future market expansion faces more difficulties as microfluidic devices become more standardized and commercialized. On the other side, throughout the projected period, the microfluidics market's expansion is anticipated to be impeded by the complex and difficult regulatory approval procedure.

Market Segmentation

The Global Microfluidics Market share is classified into material, product, and end user.

- The PDMS segment is expected to hold the largest share of the global microfluidics market during the forecast period.

Based on the material, the global microfluidics market is divided into silicon, glass, PDMS, and others. Among these, the PDMS segment is expected to hold the largest share of the global microfluidics market during the forecast period. PDMS is a polymer that is frequently utilized in microfluidics because of its many benefits. Nontoxicity, durability, optical clarity, permeability to gas and oxygen, biocompatibility, elastomeric characteristics, low cost, and intricate designs of microfluidic devices by stacking many layers are some of the benefits of PDMS.

- The instruments and systems segment is expected to hold the largest share of the global microfluidics market during the forecast period.

Based on the product, the global microfluidics market is divided into chip & device, instrument & system, software, service and others. Among these, the instruments and systems segment is expected to hold the largest share of the global microfluidics market during the forecast period. The increasing use of microfluidic devices and systems across a range of sectors, including medical, pharma, and research, is fueling this growth. These systems are crucial for many applications because they offer advanced features for precise fluid management, analysis, and automation.

- The healthcare segment is expected to hold the largest share of the global microfluidics market during the forecast period.

Based on the end user, the global microfluidics market is divided into healthcare, research institutes, biotechnology, pharmaceutical, and others. Among these, the healthcare segment is expected to hold the largest share of the global microfluidics market during the forecast period. The increasing demand for microfluidic devices in the healthcare sector is being driven by the rise in chronic diseases globally, the benefits of integrated microfluidic devices over conventional medical devices, the need for more frequent testing, and the growing need for fast and accurate test results. Due to the COVID-19 epidemic, uFluidix stated in June 2021 that it is increasing its manufacturing capacity in order to fulfill the increased demand for integrated microfluidic devices. The need for microfluidics in the healthcare industry is being driven by these advancements.

Regional Segment Analysis of the Global Microfluidics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global microfluidics market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global microfluidics market over the predicted timeframe. The region's market is expanding because of the existence of industrialized countries with well-established healthcare systems, the application of cutting-edge miniaturized technologies, and ongoing government and private sector research and development programs. After obtaining emergency use permission (EUA) in the United States, LexaGene declared in January 2021 that the MiQLab system is available for use in SARS-CoV-2 virus detection, first for research purposes. These advancements contribute to the North American microfluidics market's growth.

Asia-Pacific is expected to grow the fastest during the forecast period. Because of high-tech research infrastructure, growing economies, and cheap labor. The unexplored APAC microfluidics market is attracting the interest of international investors. Foreign companies hold a significant market share in the microfluidic diagnostic test industry. However, prominent companies in the area are putting out creative and intriguing performance- and, more importantly, cost-effective solutions that enable them to increase their market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global microfluidics along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd

- PerkinElmer, Inc.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Abbott

- Thermo Fisher Scientific

- Standard BioTools

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2022, using microfluidics technology, Standard BioTools introduced the X9 Real-time PCR System, a highly productive and adaptable high-capacity genomics platform.

- In March 2022, a small, user-friendly digital microfluidics platform called Miro Canvas was introduced by Microculus to facilitate the on-demand automation of intricate next-generation sequencing (NGS) sample preparation procedures.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Microfluidics Market based on the below-mentioned segments:

Global Microfluidics Market, By Material

- Silicon

- Glass

- Others

Global Microfluidics Market, By Product

- Chip and Device

- Instrument and System

- Software

- Service

- Others

Global Microfluidics Market, By End User

- Healthcare

- Research Institutes

- Biotechnology

- Pharmaceutical

- Others

Global Microfluidics Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. In the microfluidics market, which region accounted for the highest share?North America is anticipated to hold the largest share of the global microfluidics market over the predicted timeframe.

-

2. What is the value of microfluidics market in 2023?In 2023, the global microfluidics market was estimated to be worth USD 32.40 billion.

-

3. What is the market size for microfluidics?By 2033, it is projected that the size of the global microfluidics market would surpass USD 65.90 billion.

Need help to buy this report?