Global Micro-Mobility Market Size, Share, and COVID-19 Impact Analysis, By Battery Type (Sealed Lead Acid, NiMH, Li-ion, Others), By Voltage (Below 24V, 36V, 48V, and Greater than 48V) By Vehicle Type (Electric Bikes, Electric Scooters, Skateboards, Golf Carts, Kick Scooters, One-Wheel, Personal Transporters, Roller Skates, Segways, Unicycles, Tricycles, Handcycles, Mobility Scooter, Quadracycles, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Automotive & TransportationGlobal Micro-Mobility Market Insights Forecasts to 2032

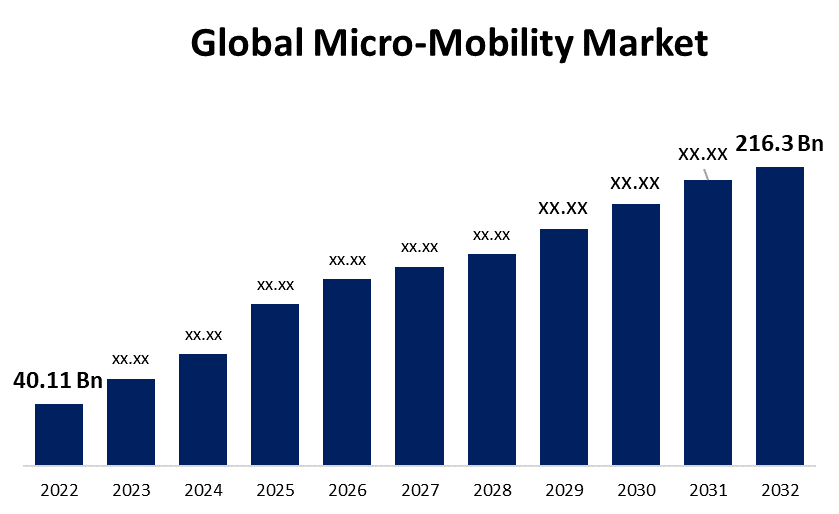

- The Micro-Mobility Market Size was valued at USD 40.11 Billion in 2022.

- The Market is Growing at a CAGR of 18.35% from 2022 to 2032

- The Worldwide Micro-Mobility Market Size is expected to reach USD 216.3 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Micro-Mobility Market Size is expected to reach USD 216.3 Billion by 2032, at a CAGR of 18.35% during the forecast period 2022 to 2032.

Micro-mobility, sometimes referred to as micro mobility, corresponds to a class of small, light-weight vehicles that travel at speeds of up to 25 km/h and are driven by individuals themselves over short distances. Micromobility may involve both human-powered and electric vehicles; however, electric vehicles cannot have internal combustion engines or travel faster than 45 km/h to be considered micro-mobility. Micromobility devices include bicycles, e-bikes, electric scooters, electric skateboards, shared bicycle fleets, and electric pedal assisted bicycles. Micro mobility can be either privately owned or available as rental vehicles, mostly in the form of dockless sharing.

The majority of micro-mobility vehicles, such as electric bicycles, electric scooters, electric skateboards, electric unicycles, and one-wheels, are also classified as light electric vehicles (LEVs). The possibility for micromobility to replace conventional automobile trips, combined with the commercial possibilities offered by the huge administration of investment capital into the industry, has prompted major automobile manufacturers such as the Ford Motor Company and General Motors, among others, to invest in micromobility products and services. Micromobility products have grown in popularity and utilization as a direct consequence of ridesharing and rental scooters, which might enable them to be utilized in more densely populated areas. However, because helmet use is limited, this may increase the likelihood of an accident.

Global Micro-Mobility Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 40.11 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 18.35% |

| 2032 Value Projection: | USD 216.3 Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Battery Type, By Voltage, By Vehicle Type, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Lyft, Inc., Bird Global, Inc., Motherson Sumi Systems Ltd., Lime Micromobility, Airwheel Holding Ltd., Accell Group, JIANGSU XINRI E-VEHICLE CO., LTD., SWAGTRON, Beam Mobility Holdings, AGC Inc., Xiaomi, Bird Rides Inc., GoJek, SEGWAY INC., Derby Cycle, YAMAHA MOTOR CO., LTD., Dott, Floatility GmbH, Fuyao Glass Industry Group Co., Ltd., Central Glass Co., Ltd., Micro Mobility Systems Ltd. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

Micromobility is growing rapidly around the world, demonstrating to be an increasingly common means of transportation for numerous consumers. Many producers in markets are researching micromobility as a replacement method for short-term travel and active modes of transport because of the rising demand for biking and walking facilities in urban cities and towns. Furthermore, shared micromobility devices such as bicycles, electric bicycles, and e-scooters have the potential to establish a more diverse, useful, and easily accessible transportation network, providing more transportation options, reducing traffic congestion, and improving the citizen everyday life.

Even though micro-mobility devices can be purchased individually, the increase in the number of devices in metropolitan areas is primarily the result of private companies deploying shared fleets. Shared micromobility platforms have been installed in specific service areas and tend to be designed to facilitate brief trips such as first and last-mile connections to complete excursions made by other modes of transportation, including their travels. Furthermore, increasing expenditures on renewable energy sources and governmental attempts to reduce greenhouse gas emissions are anticipated to increase demand for electric kick scooters, electric skateboards, and e-bikes. These are some of the key market drivers driving the growth of the micro-mobility market.

The government from numerous regions is collaborating with OEMs and other industry stakeholders to better understand the effects of micromobility on the transportation network and to discover ways to support the development of novel multimodal alternatives to travel that will be safer and more effective for all multimodal device consumers. Furthermore, cities have been experimenting with a variety of strategies that actively coordinate micro-mobility programs in order to achieve optimistic safety and equity conclusions. Manufacturers are additionally researching micro-mobility parking requirements in accordance with concerns about sidewalk accessibility for disabled pedestrians. Furthermore, sophisticated transport networks and increasing efforts from governments to develop bike-sharing infrastructure are expected to provide numerous opportunities for the global micro-mobility market to develop over the forecast period.

Restraining Factors

However, the development of the global micro-mobility market is being restricted by low internet accessibility in developing countries and a rise in bike damage or theft. In addition, bike theft and damage are major issues in many metropolitan areas that have introduced micro-mobility services. Some users have reported the theft of batteries, helmets, bicycles, and other components such as motors, mirrors, and tires.

Market Segmentation

By Battery Type Insights

The Li-ion segment is dominating the market with the largest revenue share over the forecast period.

On the basis of battery type, the global micro-mobility market is segmented into sealed lead acid, NiMH, Li-ion, and others. Among these, the Li-ion segment is dominating the market with the largest revenue share of 37.2% over the forecast period. As a result of their low cost, these batteries are the most common option for manufacturers. The increasing recognition of the benefits of using environmentally friendly batteries over sealed-lead acid and NiMH batteries has increased demand for lithium-ion batteries. Because these batteries are more expensive than the other two battery types, their popularity has resulted in an increase in the price of electric vehicles in nations that are developing. However, as technology advances and consumer demand for such batteries grows and the cost of Li-ion batteries is decreasing. Over the next decade, the cost of lithium-ion batteries is expected to fall by 13% per year, directly influencing the price of electric vehicles.

By Voltage Insights

The below 24V segment accounted for the largest market share over the forecast period.

On the basis of voltage, the global micro-mobility market is segmented into below 24V, 36V, 48V, and greater than 48V. Among these, the below 24V segment accounted for the largest market share over the forecast period. Micro-mobility vehicles, such as skateboards, scooters, and bicycles, typically use below 24V batteries, such as 12V or 18V rechargeable lithium-ion batteries, that deliver enough power for their drives but have a limited range contrasted to other types of vehicles. In order to decrease vehicle weight while enhancing efficiency in general, manufacturers of electric vehicles use a pair of 12V or 18V lithium-ion batteries rather than sealed lead-acid battery packs.

By Vehicle Type Insights

The electric bikes segment accounted the largest revenue share of more than 44.7% over the forecast period.

On the basis of vehicle type, the global micro-mobility market is segmented into electric bikes, electric scooters, skateboards, golf carts, kick scooters, one-wheel, personal transporters, roller skates, segways, unicycles, tricycles, handcycles, mobility scooter, quadracycles, and others. Among these, electric bikes are dominating the market with the largest revenue share of 44.7% over the forecast period because they are the most cost-effective and easily accessible choice for public transportation. Several countries are attempting to boost the use of electric bikes through regulatory and subsidy changes in order to reduce the strain on transportation networks. Additionally, in comparison to other modes of transportation such as buses and taxis, electric bikes are simple to charge, affordable, and do not necessitate large investments in supporting infrastructure. As a result, there is an increase in demand for electric bikes all over the world.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 43.6% market share over the forecast period. The market for micro-mobility in the North America is increasing rapidly due to growing concerns about challenges such as congestion, pollution in the atmosphere, and carbon dioxide emissions, which have increased because of the flourishing urban population, as well as increasing expenditures by multiple significant players in those major countries. In the forecasted time frame, the United States is expected to dominate the regional micro mobility market. This is primarily due to the fact that the majority of disruptive mobility start-ups are headquartered in the United States, and as a result, it has the highest concentration in North America. Furthermore, the growing number of micro-mobility businesses, increasing internet penetration, and increasing demand for short-distance commutes will drive market growth. Bird Global, Inc., Lyft, Inc., Lime, Helbiz Inc., Veo, and others are among the leading companies in this region.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. Governments in countries such as India, China, and Japan are developing norms and guidelines for vehicle electrical charging stations, which is expected to boost market expansion in the region. The most common vehicle types in the Asia-Pacific micro-mobility market have been bicycles and electric scooters because of their widespread use, low cost, and environmental friendliness. The Asia-Pacific micro-mobility market is being driven by factors such as rising urbanization, a greater emphasis on sustainability, and increased adoption of last-mile transit solutions.

List of Key Market Players

- Lyft, Inc.

- Bird Global, Inc.

- Motherson Sumi Systems Ltd.

- Lime Micromobility

- Airwheel Holding Ltd.

- Accell Group

- JIANGSU XINRI E-VEHICLE CO., LTD.

- SWAGTRON

- Beam Mobility Holdings

- AGC Inc.

- Xiaomi

- Bird Rides Inc.

- GoJek

- SEGWAY INC.

- Derby Cycle

- YAMAHA MOTOR CO., LTD.

- Dott

- Floatility GmbH

- Fuyao Glass Industry Group Co., Ltd.

- Central Glass Co., Ltd.

- Micro Mobility Systems Ltd.

Key Market Developments

- On April 2023, Bird Global, Inc., a pioneer in environmentally friendly electric transportation, unveiled a suite of technology solutions tailored to the needs of its city partners. The new technologies have been designed and integrated into the Bird rider experience to promote safe and compliant riding and parking. Bird's technology allows it to pinpoint the location of parked scooters and e-bikes using years of Google 3D scanning, augmented reality (AR) technology, and Street View data from around the world.

- On March 2022, Segway-Ninebot, a global leader in micromobility and robotics technology, announced its latest innovations to meet the changing needs of modern transportation. The new Segway GT- and P-series, as well as the E110A, combine performance with dependability and sustainability, allowing riders to commute in comfort and style. Segway also released the Shredder Kit for Ninebot S, Ninebot S Pro, and Ninebot S MAX owners to help them transform their experiences.

- On December 2022, In collaboration with Mazda, Micro Mobility Systems Ltd. launched a stylish, compact, and convenient e-scooter for the last mile. The 10-kilo gram Micro Commuter is ideal for commuters and short-distance riders who place a premium on portability. The Mazda Commuter can be connected to the corresponding app on the smartphone via Bluetooth®, which displays useful driving information such as speed, distance, and battery charge status.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Micro-Mobility Market based on the below-mentioned segments:

Micro-Mobility Market, Battery Type Analysis

- Sealed Lead Acid

- NiMH

- Li-ion

- Others

Micro-Mobility Market, Voltage Analysis

- Below 24V

- 36V

- 48V

- Greater than 48V

Micro-Mobility Market, Vehicle Type Analysis

- Electric Bikes

- Electric Scooters

- Skateboards

- Golf Carts

- Kick Scooters

- One-Wheel

- Personal Transporters

- Roller Skates

- Segways

- Unicycles

- Tricycles

- Handcycles

- Mobility Scooter

- Quadracycles

- Others

Micro-Mobility Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Micro-Mobility market?The Global Micro-Mobility Market is expected to grow from USD 40.11 billion in 2022 to USD 216.3 billion by 2032, at a CAGR of 18.35% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?Lyft, Inc., Bird Global, Inc., Motherson Sumi Systems Ltd., Lime Micromobility, Airwheel Holding Ltd., Accell Group, JIANGSU XINRI E-VEHICLE CO., LTD., SWAGTRON, Beam Mobility Holdings, AGC Inc.

-

3. Which segment dominated the Micro-Mobility market share?The electric bikes segment in industry type dominated the Micro-Mobility market in 2022 and accounted for a revenue share of over 44.7%.

-

4. What are the elements driving the growth of the Micro-Mobility market?The micro-mobility market is expected to be driven by elements such as increased road congestion, rising oil and gas prices, ease of parking, and saturation in the automotive sector.

-

5. Which region is dominating the Micro-Mobility market?North America is dominating the Micro-Mobility market with more than 43.6% market share.

-

6. Which segment holds the largest market share of the Micro-Mobility market?The Li-ion segment based on battery type holds the maximum market share of the Micro-Mobility market.

Need help to buy this report?