Mexico Lecithin Market Size, Share, and COVID-19 Impact Analysis, By Source (Soy, Sunflower, Rapeseed, and Others) and By End-Use (Bakery, Convenience Foods, Animal Feed, Industrial, Pharmaceutical, Personal Care & Cosmetics, and Others), and Mexico Lecithin Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesMexico Lecithin Market Insights Forecasts to 2035

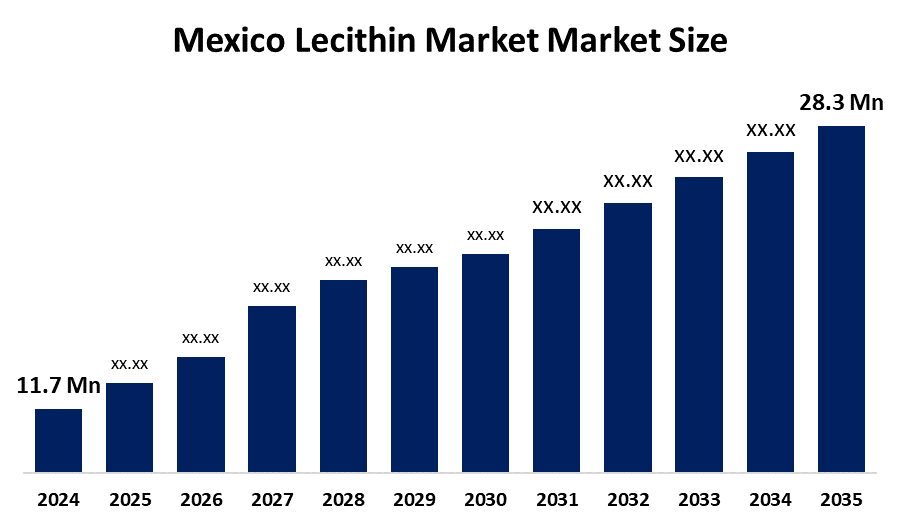

- The Mexico Lecithin Market Size Was Estimated at USD 11.7 million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.3% from 2025 to 2035

- The Mexico Lecithin Market Size is Expected to Reach USD 28.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Mexico Lecithin Market Size Is Anticipated To Reach USD 28.3 Million By 2035, Growing At A CAGR Of 8.3% From 2025 To 2035. The Mexico Lecithin is driven by increasing demand for natural emulsifiers in processed foods, rising consumption of bakery and convenience foods, expanding livestock feed industry, and growing adoption of plant-based ingredients in pharmaceutical and cosmetic formulations.

Market Overview

The Mexico Lecithin Market Size is the industry that produces, processes, and distributes lecithin extracted mainly from soybeans, serving as an all-natural emulsifier, stabilizer, wetting agent, and dispersing agent for a range of industrial applications. Soybean lecithin has found widespread use in food processing, animal feed, pharmaceutical, and personal care products owing to its functional properties and competitive advantages as an alternative to synthetic agents for maintaining and enhancing food appeal, stability, and functionality, all while offering greater cost effectiveness and appealing to consumers’ demands and preferences for clean labels and natural food agents and additives. Moreover, support for market expansion also comes from the increasing processed food industry and growing demand for processed and ready-to-eat food, owing to rising consumption habits and increasing inclination towards an urban way of life.

The Mexico Lecithin Market Size is going through a few major trends, which will decide its future. First of all, there exists a strong trend of clean-label food ingredients, which forces food manufacturers to shift toward natural food emulsifiers such as lecithin. Its usage is also increasing in plant-based diets, which would allow it to be used in the formulation of vegan food products. Additionally, its requirement is on the increase from the cosmetic and pharmaceutical sectors due to its moisturizing actions.

Government regulations supporting food safety standards and labelling transparency, along with increasing investment in food processing infrastructure, are further supporting market expansion. Technological advancements in degumming and extraction processes are also improving lecithin purity and functionality, making it suitable for high-value applications.

Report Coverage

This research report categorizes the market for the Mexico Lecithin market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Mexico Lecithin market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Mexico Lecithin market.

Mexico Lecithin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 8.3% |

| 2035 Value Projection: | USD 28.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Source, By End User |

| Companies covered:: | Cargill Inc. ADM (Archer Daniels Midland Company) Bunge Limited Lipoid GmbH Stern-Wywiol Gruppe Lasenor Emul SL Clarkson Specialty Lecithins Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The major driver of the Mexico lecithin market is the increasing demand for processed and packaged food products that require emulsifiers and stabilizers. The growth of the bakery and confectionery industry, and the increasing popularity of convenience foods, favour the demand for the soy-based lecithin market. The growth of the animal feed sector also increases the demand and usage of the product, as it provides various advantages in the fat digestion process. Moreover, the increasing consumer demand for natural and clean label products is facilitating the use of soy-based lecithin, as it is largely preferred to other synthetic products. The growth of the pharmaceutical and personal care industry, in which the product is used as a carrier and moisturizer, is also a major contributor to the soy-based lecithin market.

Restraining Factors

There are restraints in the soy lecithin market in the form of changing soybean prices and supply chain risks affecting the cost of the raw materials used. The supply of lecithin alternatives, such as sunflower lecithin for non-GMO applicable food products, might also be a restraint for the use of soy lecithin products. Moreover, genetically modified soybeans and the changing scenario of food allergen labelling could also restrain the use of soy lecithin products in some high-quality food products.

Market Segmentation

The Mexico lecithin market share is classified into source and end user.

- The soy segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Mexico Lecithin Market Size is segmented by fuel type into soy, sunflower, rapeseed, and others. Among these, the soy segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is due to its easy availability, cost-effectiveness, and strong emulsification properties when compared with other plant sources. The consistent imports of soybeans into Mexico and well-developed processing infrastructures help greatly in its wide usage both in the food and feed industries. Rising consumer demand for low-fat, non-allergenic, and clear-label, plant-based products in Mexico strengthens the soy lecithin market.

- The bakery segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end user, the Mexico Lecithin Market size is segmented into bakery, convenience foods, animal feed, industrial, pharmaceutical, personal care & cosmetics, and others. Among these, the bakery segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. since it is readily available, reasonably priced, and has superior emulsifying activity as compared to other plant sources. The bakery sector is lecithin's biggest consumer, using it to enhance breads, cakes, and pastries' texture, stability, and shelf life. Lecithin improves baked foods' volume, moisture retention, and dough extensibility. In large-scale manufacture, it is an essential ingredient.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Mexico lecithin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill Inc.

- ADM (Archer Daniels Midland Company)

- Bunge Limited

- Lipoid GmbH

- Stern-Wywiol Gruppe

- Lasenor Emul SL

- Clarkson Specialty Lecithins

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Mexico, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Mexico lecithin market based on the below-mentioned segments:

Mexico Lecithin Market, By Source

- Soy

- Sunflower

- Rapeseed

- Others

Mexico Lecithin Market, By End User

- Bakery

- Convenience Foods

- Animal Feed

- Industrial

- Pharmaceutical

- Personal Care & Cosmetics

- Others

Frequently Asked Questions (FAQ)

-

What is the Mexico lecithin market size?Mexico Lecithin market size is expected to grow from USD 11.7 million in 2024 to USD 28.3 million by 2035, growing at a CAGR of 8.3% during the forecast period 2025-2035

-

What are the key drivers of the Mexico lecithin market?Growth of processed food consumption, clean-label demand, expansion of feed industry, and increasing use in pharmaceuticals and cosmetics

Need help to buy this report?