Mexico Hydrogen Market Size, Share, By Sales Channel (Direct Sale and Indirect Sale), By End-Use (Refining, Ammonia, Chemical, Fuel, and Others), Mexico Hydrogen Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsMexico Hydrogen Market Insights Forecasts to 2035

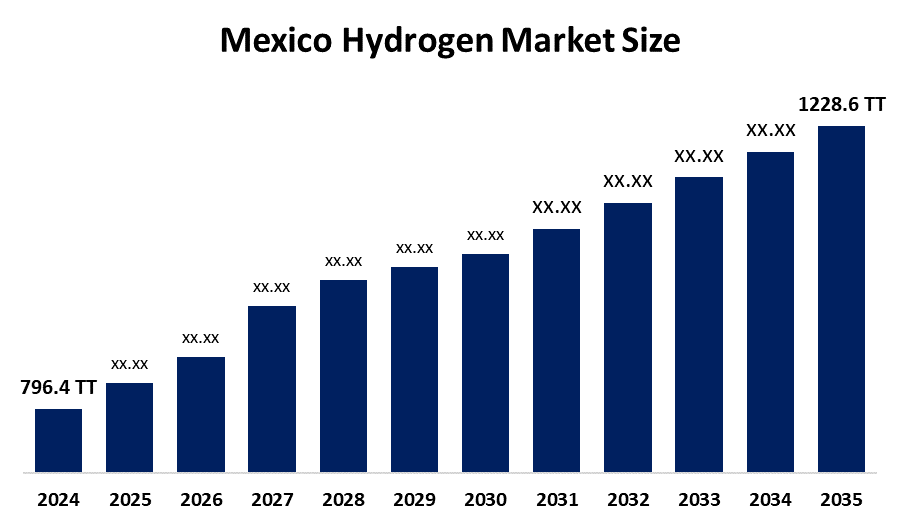

- Mexico Hydrogen Market Size 2024: 796.4 thousand tonnes

- Mexico Hydrogen Market Size 2035: 1228.6 thousand tonnes

- Mexico Hydrogen Market CAGR 2024: 4.02%

- Mexico Hydrogen Market Segments: Sales Channel and End-Use

Get more details on this report -

The Mexico Hydrogen Market Size includes all aspects of hydrogen, which include its production and distribution and usage as an industrial feedstock, refinery fuel and emerging clean energy carrier and grey, blue and green hydrogen. The process mainly finds application in oil refining through hydro treating, in ammonia and methanol production and chemical manufacturing, in steel production, and in recent adoption for clean transportation, electricity generation, and energy storage.

The Mexican Association of Hydrogen & Mobility (AMH2), together with Mexico’s Ministry of Energy (SENER), supports the launch of 18 hydrogen projects throughout Mexico that will use advanced production technologies, including methane pyrolysis.

The federal environmental authority SEMARNAT authorized a US $1.3 billion green hydrogen project in Sinaloa, which will use solar power as its energy source. This project becomes the first approved project under Mexico's new hydrogen policy. This shows that the government actively supports the development of large-scale renewable hydrogen power generation plants.

Mexico provides excellent prospects for green hydrogen production, which will serve international markets, support refinery decarbonisation, produce green ammonia and enable clean transportation because the country has abundant solar energy resources and rising industrial requirements.

Market Dynamics of the Mexico Hydrogen Market:

The Mexico Hydrogen Market Size is driven by the rising demand for clean energy, refinery decarbonisation needs, growing fertilizer and chemical industries, abundant renewable resources, government-backed hydrogen projects, and increasing private investments supporting green hydrogen production and infrastructure development.

The Mexico Hydrogen Market Size is restrained by high production costs of green hydrogen, limited hydrogen infrastructure, regulatory uncertainty, lack of clear incentives, and dependence on fossil-based hydrogen in existing industrial applications.

The future of Mexico hydrogen market is bright and promising, with the expanding green hydrogen investments, supportive government initiatives, strong renewable energy potential, rising export opportunities, and increasing adoption across refining, chemicals, transportation, and power generation sectors.

Mexico Hydrogen Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 796.4 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.02% |

| 2035 Value Projection: | 1228.6 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By End Use, By Sales Channel |

| Companies covered:: | Pemex Federal Electricity Commission (Cfe) Linde Plc Air Liquide S.A. Cryo-Infra Copenhagen Infrastructure Partners Tarafert Iberdrola Hdf Energy Pacifico Mexinol Others And Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Mexico Hydrogen Market share is classified into sales channels and end-use.

By Sales Channel:

The Mexico Hydrogen Market Size is divided by sales channel type into direct sales and indirect sales. Among these, the direct sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The direct sales segment leads due to long-term supply contracts, direct partnerships with industrial consumers, cost efficiencies, better pricing control, and increasing hydrogen demand from refining, chemicals, and clean energy projects in Mexico.

By End-Use:

The Mexico Hydrogen Market Size is divided by end-use into refining, ammonia, chemical, fuel, and others. Among these, the refining segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The refining segment dominates due to high hydrogen consumption in hydrocracking and desulfurization processes. Growing fuel quality regulations, refinery modernization, and rising demand for cleaner fuels in Mexico support strong CAGR growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Mexico hydrogen market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Mexico Hydrogen Market:

- Pemex

- Federal Electricity Commission (Cfe)

- Linde Plc

- Air Liquide S.A.

- Cryo-Infra

- Copenhagen Infrastructure Partners

- Tarafert

- Iberdrola

- Hdf Energy

- Pacifico Mexinol

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Mexico, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Mexico hydrogen market based on the below-mentioned segments:

Mexico Hydrogen Market, By Sales Channel

- Direct Sale

- Indirect Sale

Mexico Hydrogen Market, By End-Use

- Refining

- Ammonia

- Chemical

- Fuel

- Others

Frequently Asked Questions (FAQ)

-

What is the Mexico hydrogen market size?Mexico hydrogen market is expected to grow from 796.4 thousand tonnes in 2024 to 1228.6 thousand tonnes by 2035, growing at a CAGR of 4.02% during the forecast period 2025-2035

-

What are the key growth drivers of the market?Market growth is driven by the rising demand for clean energy, refinery decarbonization needs, growing fertilizer and chemical industries, abundant renewable resources, government-backed hydrogen projects, and increasing private investments supporting green hydrogen production and infrastructure development

-

What factors restrain the Mexico hydrogen market?Constraints include the high production costs of green hydrogen, limited hydrogen infrastructure, regulatory uncertainty, lack of clear incentives, and dependence on fossil-based hydrogen in existing industrial applications.

-

How is the market segmented by sales channel?The market is segmented into direct sales and indirect sales.

-

Who are the key players in the Mexico hydrogen market?Key companies include Pemex, Federal Electricity Commission (CFE), Linde Plc, Air Liquide S.A., Cryo-Infra, Copenhagen Infrastructure Partners, Tarafert, Iberdrola, HDF Energy, Pacifico Mexinol, and others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?