Mexico Carbon Nanotubes Market Size, Share, and COVID-19 Impact Analysis, By Product (MWCNTs and SWCNTs), By Application (Polymers, Energy, Electrical & Electronics, and Others), and Mexico Carbon Nanotubes Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsMexico Carbon Nanotubes Market Size Insights Forecasts To 2035

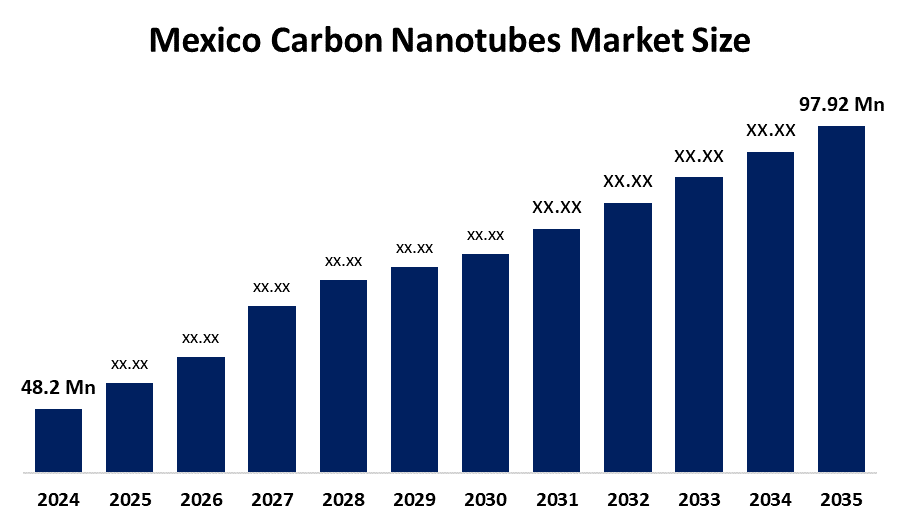

- The Mexico Carbon Nanotubes Market Size is Was Estimated at USD 48.2 Million in 2024

- The Mexico Carbon Nanotubes Market Size is Expected to Grow at a CAGR of Around 6.66% from 2025 to 2035

- The Mexico Carbon Nanotubes Market Size is Expected to Reach USD 97.92 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Mexico Carbon Nanotubes Market Size Is Anticipated To Reach USD 97.92 Million By 2035, Growing At A CAGR Of 6.66% From 2025 To 2035. The Mexico carbon nanotube market is driven by rising demand from automotive, electronics, aerospace, and energy storage industries, where carbon nanotubes are used for lightweight composites, batteries, sensors, and conductive materials. Growing manufacturing activity, R&D investments, and the adoption of advanced materials to improve performance and durability are further supporting market growth.

Market Overview

The Mexico carbon nanotubes (CNTs) market size essentially covers the entire scope, from the research, development, and manufacturing of carbon nanotubes to their commercialization and various industry applications within Mexico. Carbon nanotubes refer to carbon atoms made into tubular nanostructures, which are generally divided into single-walled (SWCNTs) and multi-walled (MWCNTs). These nanotubes are highly appreciated due to their remarkably high mechanical strength, good electrical conductivity, outstanding thermal stability, and extremely lightweight. The market is driven by a range of factors, including increasing industrialization, growth in the electronics and automotive manufacturing sectors, and a rise in research and development activities. These factors together have made carbon nanotubes a crucial advanced material for the high-performance and next-generation technologies in Mexico.

Mexico’s advanced manufacturing and technology sectors have been rapidly growing, leading to a strong demand for carbon nanotubes (CNTs). This demand is largely driven by the country's deep involvement in the electronics, automotive, aerospace, and materials industries, which all require high-performance materials for their components to be lighter, stronger, and more efficient. The development of manufacturing clusters in Mexico City, Guadalajara, and Monterrey further highlights the requirement for advanced materials like carbon nanotubes to improve product performance and competitiveness in the global market. Collaborations between research institutions and the industry are enabling Mexico to increasingly use nanomaterials in commercial supply chains, thus matching demand with international value chains.

The market size is heavily backed by the Mexican government. CONAHCYT and ISM research centers, such as CIMAV, are the primary sources of funding for projects involving nanotechnology and CNTs. For the years 2024 and 2026, an amount of approximately MXN 1.5-1.6 billion (USD 85-88 million) was reserved for R&D purposes, thus driving innovation, commercialization, and industrial application at the same time. This mix of industrial demand, strategic public funding, and national innovation programs clearly indicates the significance and development potential of carbon nanotubes (CNTs) in Mexico.

Report Coverage

This research report categorizes the market size for the Mexico carbon nanotubes market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Mexico carbon nanotubes market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Mexico carbon nanotubes market.

Mexico Carbon Nanotubes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 48.2 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 6.66% |

| 2023 Value Projection: | USD 97.92 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Nanocyl SA, OCSiAl, Cabot Corporation, SHOWA DENKO K.K., Cnano Technology, Carbon Solutions, Inc., Arkema SA, Hanwha Corporation, Cheap Tubes, Inc., Thomas Swan & Co. Ltd., Continental Carbon Company, Nanoshel LLC, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Mexico carbon nanotubes (CNTs) market size is driven by increasing demand from automotive, electronics, aerospace, and energy storage sectors; accelerating industrialization; utilization of high-performance materials, and vigorous government-backed R&D initiatives promoting CNT applications.

Restraining Factors

The Mexico carbon nanotubes (CNTs) market size is restrained due to expensive production and raw material costs as well as complex manufacturing processes. Limited large-scale domestic production capacity can also be considered a constraint to the market. Moreover, the technical difficulties in using CNTs in traditional products, the absence of extensive knowledge, and the implementation of tough regulatory standards for nanomaterials are all factors that hinder the market adoption.

Market Segmentation

The Mexico carbon nanotubes market share is classified into product and application.

- The MWCNTs segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Mexico carbon nanotubes market size is segmented by product into MWCNTs and SWCNTs. Among these, the MWCNTs segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The MWCNTs segment is growing because multi-walled carbon nanotubes offer superior mechanical strength, thermal stability, and electrical conductivity at a lower cost compared to single-walled CNTs. Their wide applicability in automotive composites, electronics, and energy storage devices drives strong demand in Mexico’s industrial and technological sectors.

- The electrical & electronics segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Mexico carbon nanotubes market size is segmented by application into polymers, energy, electrical & electronics, and others. Among these, the electrical & electronics segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The electrical & electronics segment is growing because carbon nanotubes enhance conductivity, thermal management, and miniaturization in electronic components, making them ideal for sensors, flexible circuits, batteries, and high-performance devices. Rising demand for advanced electronics and energy-efficient devices in Mexico drives the dominance and growth of this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Mexico carbon nanotubes market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nanocyl SA

- OCSiAl

- Cabot Corporation

- SHOWA DENKO K.K.

- Cnano Technology

- Carbon Solutions, Inc.

- Arkema SA

- Hanwha Corporation

- Cheap Tubes, Inc.

- Thomas Swan & Co. Ltd.

- Continental Carbon Company

- Nanoshel LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Mexico, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Mexico carbon nanotubes market based on the below-mentioned segments:

Mexico Carbon Nanotubes Market, By Product

- MWCNTs

- SWCNTs

Mexico Carbon Nanotubes Market, By Application

- Polymers

- Energy

- Electrical & Electronics

- Others

Frequently Asked Questions (FAQ)

-

1. What is the Mexico carbon nanotubes market size in 2024?The Mexico carbon nanotubes market size was estimated at USD 48.2 million in 2024.

-

2. What is the projected market size of the Mexico carbon nanotubes market by 2035?The Mexico carbon nanotubes market size is expected to reach USD 97.92 million by 2035.

-

3. What is the CAGR of the Mexico carbon nanotubes market?The Mexico carbon nanotubes market size is expected to grow at a CAGR of around 6.66% from 2024 to 2035.

-

4. What are the key growth drivers of the Mexico carbon nanotubes market?The Mexico carbon nanotube market is driven by rising demand from automotive, electronics, aerospace, and energy storage industries, where carbon nanotubes are used for lightweight composites, batteries, sensors, and conductive materials. Growing manufacturing activity, R&D investments, and the adoption of advanced materials to improve performance and durability are further supporting market growth.

-

5. Which application segment dominated the market in 2024?The electrical & electronics segment dominated the market in 2024.

-

6. What segments are covered in the Mexico carbon nanotubes market report?The Mexico carbon nanotube market is segmented on the basis of product and application.

-

7. Who are the key players in the Mexico carbon nanotubes market?Key companies include Nanocyl SA, OCSiAl, Cabot Corporation, SHOWA DENKO K.K., Cnano Technology, Carbon Solutions, Inc., Arkema SA, Hanwha Corporation, Cheap Tubes, Inc., Thomas Swan & Co. Ltd., Continental Carbon Company, Nanoshel LLC, and others.

-

8. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?