Mexico Acetone Market Size, Share, and COVID-19 Impact Analysis, By Application (Solvents, Methyl Methacrylate, Bisphenol A, and Others), By Grade (Technical Grade and Specialty Grade), and Mexico Acetone Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsMexico Acetone Market Insights Forecasts to 2035

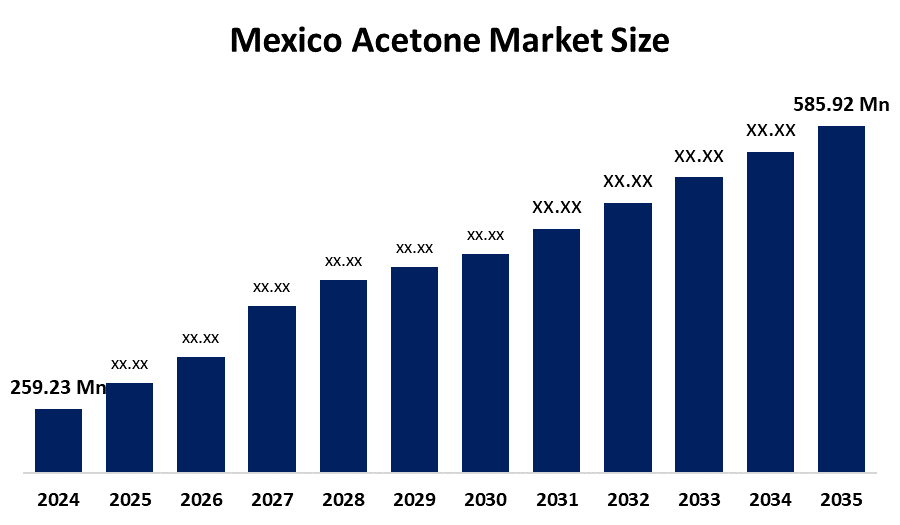

- The Mexico Acetone Market Size Was Estimated at USD 259.23 Million in 2024

- The Mexico Acetone Market Size is Expected to Grow at a CAGR of Around 7.7% from 2025 to 2035

- The Mexico Acetone Market Size is Expected to Reach USD 585.92 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Mexico acetone market size is anticipated to reach USD 585.92 million by 2035, growing at a CAGR of 7.7% from 2025 to 2035. The Mexico acetone market is driven by rising demand from paints & coatings, pharmaceuticals, cosmetics, and adhesives, along with growth in the automotive, construction, and manufacturing sectors. Increasing chemical production, export activities, and foreign investments in Mexico’s industrial base further support steady market growth.

Market Overview

The Mexico acetone market encompasses the production, distribution, and consumption of acetone, a highly volatile organic chemical solvent used primarily as a chemical intermediate and industrial solvent. In Mexico, acetone application is mainly focused on the production of bisphenol A (BPA), methyl methacrylate (MMA), pharmaceutical products, paints coatings, adhesives, cosmetics, and cleaning products, with the growth of the petrochemical, automotive, and construction sectors in the country serving as a solid base for these industries.

Mexicos adoption conditions for the acetone market are essentially determined by its large and rapidly growing population more than 130 million people and fast industrialization. Increasing demand for automotive parts, construction materials, pharmaceuticals, personal care products, paints, and coatings has resulted in a higher requirement for acetone, which is used as a solvent and chemical intermediate. Problems such as the expansion of urban infrastructure, increased healthcare usage, and the rise of manufacturing output point to the role of acetone in the supply of plastics, resins BPA, MMA and medical formulations, thus making it a crucial market in the industrial value chain of Mexico.

The government backs the market by introducing industrial development policies, investing in petrochemicals, and granting R&D funds. For instance, CONACYT and other similar institutions dedicate sizable annual financial resources to chemical research and environmentally friendly processes. At the same time, trade facilitation via USMCA and the Infrastructure Enhancement Act acts as incentives for local production, thus characterizing acetone as a strategically significant market in Mexico.

Report Coverage

This research report categorizes the market for the Mexico acetone market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Mexico acetone market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Mexico acetone market.

Mexico Acetone Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 259.23 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.7% |

| 2035 Value Projection: | USD 585.92 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Application,By Grade |

| Companies covered:: | Shell Chemicals,INEOS Group Ltd,SABIC,LyondellBasell Industries,Mitsui Chemicals Inc,Formosa Plastics Corporation,Cepsa,Mitsubishi Chemical Corporation,Sinopec,Sigma Aldrich Química SA de CV importer And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Mexico’s acetone market growth is driven by increased demand from the sectors of paints coatings, pharmaceuticals, cosmetics, and plastics industries, which is in turn supported by rapid urbanization and growth of construction and automotive manufacturing. Additionally, growing petrochemical capacity, the benefits of trade policies under USMCA, and the rising application of acetone as a solvent and chemical intermediate are all speeding up the market growth.

Restraining Factors

The Mexico acetone market is restrained by the fluctuations in the prices of the raw materials, especially benzene and propylene, which in turn impact the production costs and the profit margins. Besides, the imposition of stringent environmental regulations relating to the VOC emissions, the health risks of acetone, and the increasing use of green or bio-based solvent alternatives are the factors that restrict the growth of the market.

Market Segmentation

The Mexico acetone market share is classified into application and grade.

- The solvents segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Mexico acetone market is segmented by application into solvents, methyl methacrylate, bisphenol A, and others. Among these, the solvents segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The solvents segment is growing because acetone is widely used as an efficient and fast evaporating solvent in paints coatings, adhesives, pharmaceuticals, and personal care products. Rising industrial activity, expansion of the construction and automotive sectors, and increasing demand from Mexico’s manufacturing and export-oriented industries continue to drive strong consumption of acetone as a solvent.

- The technical grade segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Mexico acetone market is segmented by grade into technical grade and specialty grade. Among these, the technical grade segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The technical grade segment is growing because it is cost-effective and widely used in large-volume industrial applications such as paints & coatings, adhesives, plastics, and cleaning formulations. Strong demand from Mexicos expanding manufacturing, construction, and automotive sectors drives higher consumption of technical-grade acetone compared to specialty grades.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Mexico acetone market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shell Chemicals

- INEOS Group Ltd.

- SABIC

- LyondellBasell Industries

- Mitsui Chemicals Inc.

- Formosa Plastics Corporation

- Cepsa

- Mitsubishi Chemical Corporation

- Sinopec

- Sigma-Aldrich Química S.A. de C.V. (importer)

- Univar Solutions México S. de R.L. de C.V. (importer)

- Alveg Distribución Química S.A. de C.V. (importer)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Mexico, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Mexico acetone market based on the below-mentioned segments:

Mexico Acetone Market, By Application

- Solvents

- Methyl Methacrylate

- Bisphenol A

- Others

Mexico Acetone Market, By Grade

- Technical Grade

- Specialty Grade

Frequently Asked Questions (FAQ)

-

1. What is the Mexico acetone market size in 2024?The Mexico acetone market size was estimated at USD 259.23 million in 2024.

-

2. What is the projected market size of the Mexico acetone market by 2035?The Mexico acetone market size is expected to reach USD 585.92 million by 2035.

-

3. What is the CAGR of the Mexico acetone market?The Mexico acetone market size is expected to grow at a CAGR of around 7.7% from 2024 to 2035.

-

4. What are the key growth drivers of the Mexico acetone market?The Mexico acetone market is driven by rising demand from paints & coatings, pharmaceuticals, cosmetics, and adhesives, along with growth in the automotive, construction, and manufacturing sectors. Increasing chemical production, export activities, and foreign investments in Mexico’s industrial base further support steady market growth.

-

5. Who are the key players in the Mexico acetone market?Key companies include Shell Chemicals, INEOS Group Ltd., SABIC, LyondellBasell Industries, Mitsui Chemicals Inc., Formosa Plastics Corporation, Cepsa, Mitsubishi Chemical Corporation, Sinopec, Sigma-Aldrich Química S.A. de C.V. (importer), Univar Solutions México S. de R.L. de C.V. (importer), Alveg Distribución Química S.A. de C.V. (importer), and others.

-

6. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?