Global Methoxy Propyl Acetate Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Industrial Grade, Pharmaceutical Grade, and Others), By End-Use (Automotive, Electronics, Pharmaceuticals, Paints & Coatings, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Methoxy Propyl Acetate Market Insights Forecasts to 2035

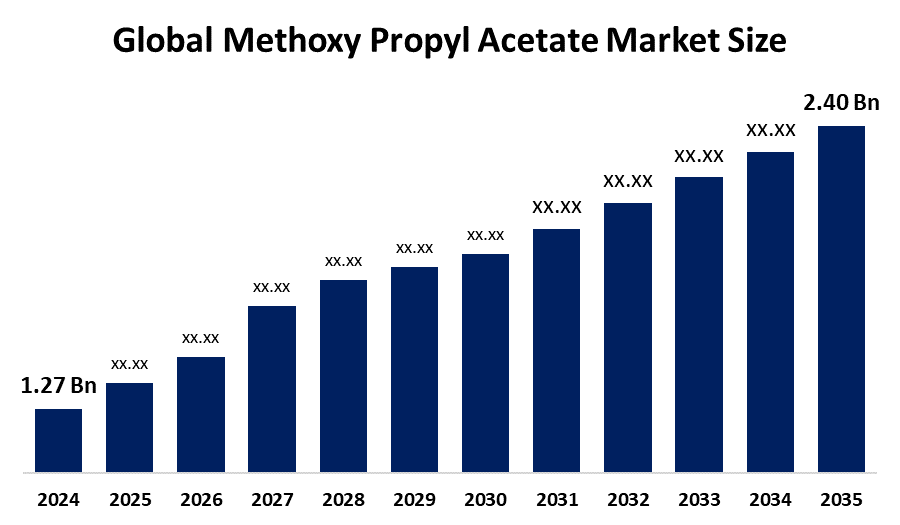

- The Global Methoxy Propyl Acetate Market Size Was Estimated at USD 1.27 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.96% from 2025 to 2035

- The Worldwide Methoxy Propyl Acetate Market Size is Expected to Reach USD 2.40 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Methoxy Propyl Acetate Market Size was worth around USD 1.27 Billion in 2024 and is predicted to grow to around USD 2.40 Billion by 2035 with a compound annual growth rate (CAGR) of 5.96% from 2025 and 2035. The market for methoxy propyl acetate has a number of opportunities to grow due to the trend towards eco-friendly solvents and global commitment to environmentally friendly product formulations.

Market Overview

The global industry of methoxy propyl acetate refers to the global supply, demand, and trade of propylene glycol monomethyl ether acetate (PMA), which is a high-performance glycol ether ester solvent used in paints, coatings, printing inks, electronics, and cleaning products. Methoxy propyl acetate is a clear liquid having limited miscibility with water, and is a medium volatility solvent with a mild odour, having the formula C6H12O3. With good solvent power for many resins and dyes, it is extensively used for furniture polish or wood stains, and in dye solutions and pastes for printing. It is also used in processes of colouring leather and textiles, and in ball-point pen pastes.

An increasing need for sustainable and eco-friendly solvents leads to innovations in production and formulations. Further, an increasing emphasis on higher purity grades and specialized applications with increasing technological advancements across various industries is supporting the methoxy propyl acetate market.

Report Coverage

This research report categorizes the methoxy propyl acetate market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the methoxy propyl acetate market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the methoxy propyl acetate market.

Global Methoxy Propyl Acetate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.27 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.96% |

| 2035 Value Projection: | USD 2.40 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product Type, By End-Use and By Region |

| Companies covered:: | Dow Chemical Company, Eastman Chemical Company, BASF SE, LyondellBasell Industries N.V., Shell Chemicals, INEOS Group Holdings S.A., Celanese Corporation, Solvay S.A., Arkema Group, Mitsubishi Chemical Corporation, LG Chem Ltd., SABIC (Saudi Basic Industries Corporation), ExxonMobil Chemical Company, Huntsman Corporation, Sasol Limited, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

An increasing use of methoxy propyl acetate in paints and coatings across industries like automotive, construction, and industrial sectors is significantly contributing to driving the market expansion. The prioritization of environmentally friendly chemicals over toxic solvents is contributing to the growth of the methoxy propyl acetate market. Innovation in the manufacturing processes of methoxy propyl acetate, including the development of more efficient and sustainable methods, is propelling the market growth.

Restraining Factors

The methoxy propyl acetate market is restricted by strict regulations governing the use of industrial solvents for reducing VOCs and promoting environmental sustainability. Furthermore, raw material price fluctuation, supply chain disruptions, and competition with alternative solvents & substitutes are challenging the market growth.

Market Segmentation

The methoxy propyl acetate market share is classified into product type and end-use.

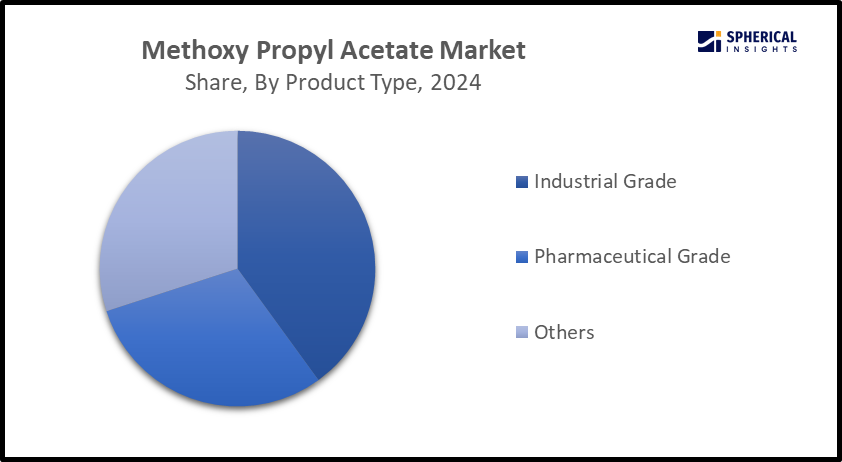

- The industrial grade segment dominated the market in 2024, accounting for around 45 – 70% market share and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the methoxy propyl acetate market is divided into industrial grade, pharmaceutical grade, and others. Among these, the industrial grade segment dominated the market in 2024, accounting for around 45 – 70% market share and is projected to grow at a substantial CAGR during the forecast period. Methoxy propyl acetate is widely used across industries, especially in coatings and inks, offering excellent solvency and a moderate evaporation rate. An increasing industrial-grade methoxypropyl acetate demand across the automotive and electronics industries is driving the market.

Get more details on this report -

- The paints & coatings segment is dominating the methoxy propyl acetate market in 2024, accounting for roughly 35-60% share and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the methoxy propyl acetate market is divided into automotive, electronics, pharmaceuticals, paints & coatings, and others. Among these, the paints & coatings segment is dominating the methoxy propyl acetate market in 2024, accounting for roughly 35-60% share and is anticipated to grow at a significant CAGR during the forecast period. Methoxy propyl acetate is used in dyes for furniture polish or wood stains, as well as in dye solutions and pastes for printing. In coatings, it is used as a coalescent, especially suitable for coatings containing polyisocyanates. Its excellent solvency and evaporation rate for providing top-quality coatings is contributing to propel market demand.

Regional Segment Analysis of the Methoxy Propyl Acetate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the methoxy propyl acetate market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of around 35.5% in the methoxy propyl acetate market over the predicted timeframe. Industries' increasing preference towards eco-friendly and sustainable alternatives, along with the evolving government regulatory landscape, are enhancing the methoxy propyl acetate market. Further, methoxy propyl acetate has a lower production cost, which makes it preferable to manufacture by the industries which are responsible for propelling market growth. The market for methoxy propyl acetate has been further driven by the region's advanced R&D capabilities for introducing new applications and innovations in solvent technology.

Asia Pacific is expected to grow at a rapid CAGR of 8.1% in the methoxy propyl acetate market during the forecast period. The Asia Pacific area has a thriving market for methoxy propyl acetate due to the industry's growing emphasis on developing methoxy propyl acetate as well as its favourable environmental profile and lower VOC formulations. The growing automotive, electronics, and pharmaceutical industries in countries like China and India are driving the market expansion in the Asia Pacific region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the methoxy propyl acetate market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dow Chemical Company

- Eastman Chemical Company

- BASF SE

- LyondellBasell Industries N.V.

- Shell Chemicals

- INEOS Group Holdings S.A.

- Celanese Corporation

- Solvay S.A.

- Arkema Group

- Mitsubishi Chemical Corporation

- LG Chem Ltd.

- SABIC (Saudi Basic Industries Corporation)

- ExxonMobil Chemical Company

- Huntsman Corporation

- Sasol Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2025, Innventure has scheduled a conference call about its recent partnership with The Dow Chemical Company and the launch of Refinity, its fourth operating company.

- In October 2024, CHINACOAT, the premier trade show for the coatings and ink industry in China and the Asia-Pacific region, continues to serve as a platform for industry leaders to explore the latest advancements.

- In July 2024, Elementis, a leading supplier of specialty chemicals for paint, coatings, and industrial aqueous applications, announced a significant development to the coatings industry with the expansion of its NiSAT (Non-Ionic Synthetic Associative Thickeners) technology production in China.

- In April 2024, the State Certification and Accreditation Administration announced the release of the CQC-C2101.01-2024 “Implementation Rules for Compulsory Product Certification – Paint Products” by CQC, replacing the earlier version for solvent-based wood coatings.

- In June 2022, AkzoNobel invested in a new production line for water-based texture paints at its Songjiang site in Shanghai, China, boosting capacity for supplying more sustainable products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the methoxy propyl acetate market based on the below-mentioned segments:

Global Methoxy Propyl Acetate Market, By Product Type

- Industrial Grade

- Pharmaceutical Grade

- Others

Global Methoxy Propyl Acetate Market, By End-Use

- Automotive

- Electronics

- Pharmaceuticals

- Paints & Coatings

- Others

Global Methoxy Propyl Acetate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the methoxy propyl acetate market over the forecast period?The global methoxy propyl acetate market is projected to expand at a CAGR of 5.96% during the forecast period.

-

2. What is the market size of the methoxy propyl acetate market?The global methoxy propyl acetate market size is expected to grow from USD 1.27 Billion in 2024 to USD 2.40 Billion by 2035, at a CAGR of 5.96% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the methoxy propyl acetate market?North America is anticipated to hold the largest share of the methoxy propyl acetate market over the predicted timeframe.

-

4. Who are the top companies operating in the Global Methoxy Propyl Acetate Market?Key players include Dow Chemical Company, Eastman Chemical Company, BASF SE, LyondellBasell Industries N.V., Shell Chemicals, INEOS Group Holdings S.A., Celanese Corporation, Solvay S.A., Arkema Group, Mitsubishi Chemical Corporation, LG Chem Ltd., SABIC (Saudi Basic Industries Corporation), ExxonMobil Chemical Company, Huntsman Corporation, and Sasol Limited.

-

5. Can you provide company profiles for the leading methoxy propyl acetate manufacturers?Yes. For example, Dow Chemical Company is an American multinational corporation headquartered in Midland, Michigan, United States, and is a subsidiary of Dow Inc., a publicly traded holding company incorporated under Delaware law. Eastman Chemical Company is an independent global speciality materials company that produces a broad range of advanced materials, chemicals and fibers for everyday purposes, operating 36 manufacturing sites worldwide and employs approximately 14,000 people.

-

6. What are the main drivers of growth in the methoxy propyl acetate market?The growing use of methoxy propyl acetate in the paints & coatings industry and prioritization towards environmentally friendly chemicals are major market growth drivers of the methoxy propyl acetate market.

-

7. What challenges are limiting the methoxy propyl acetate market?The raw material price fluctuation, competition with alternative solvents & substitutes, and stringent regulations remain key restraints in the methoxy propyl acetate market.

Need help to buy this report?