Global Methenamine Market Size Size, Share, and COVID-19 Impact Analysis, By Form (Tablets, Powder, and Granules), By Application (Urinary Tract Infection (UTI) Treatment, Industrial Use, Fuel Tablets, Rubber Vulcanization, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Methenamine Market Size Insights Forecasts to 2035

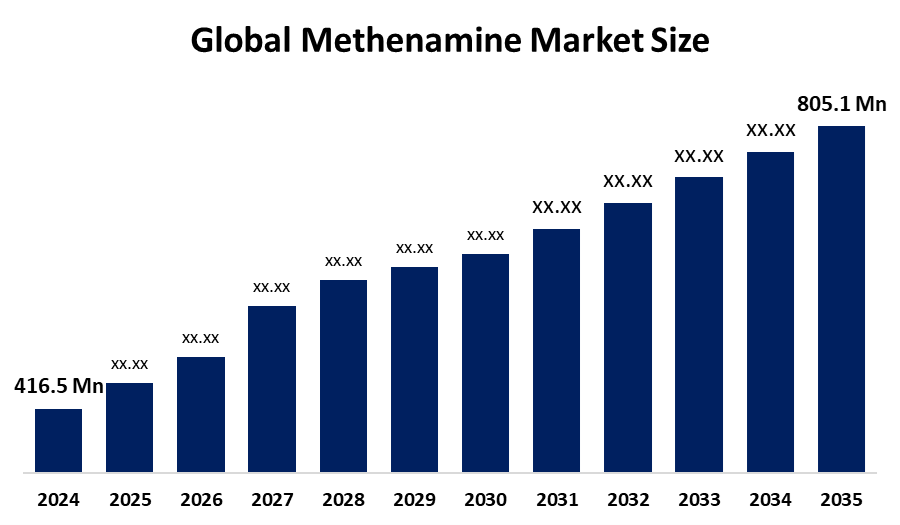

- The Global Methenamine Market Size Was Estimated at USD 416.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.17% from 2025 to 2035

- The Worldwide Methenamine Market Size is Expected to Reach USD 805.1 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Methenamine Market Size was worth around USD 416.5 Million in 2024 and is predicted to grow to around USD 805.1 Million by 2035 with a compound annual growth rate (CAGR) of 6.17% from 2025 to 2035. The global demand for methenamine is increasing because more people suffer from urinary tract infections, and there is a growing need for non-antibiotic solutions to fight antimicrobial resistance. The demand from polymer and rubber, and phenolic resin markets, drives higher product usage.

Market Overview

The Global Methenamine Market Size revolves around methenamine (hexamethylenetetramine), a white crystalline heterocyclic compound produced by reacting formaldehyde with ammonia. The compound serves various purposes because people use it as a urinary antiseptic through methenamine hippurate, and for making phenolic and amino resins, rubber and explosives, agrochemicals and solid fuel tablets. The healthcare industry, construction and automotive sectors, and industrial growth in developing countries are driving market expansion. The development of coatings, adhesives and molding compounds leads to increased product usage.

The United States International Trade Commission ruled in December 2025 that U.S. manufacturers suffered financial losses due to unfairly priced hexamine imports from Germany, India, and Saudi Arabia. The U.S. Department of Commerce found evidence of dumping from the three countries and established antidumping duties while creating countervailing duties specifically for Indian products. Specialty chemical applications and high-performance resins, as well as Asia-Pacific manufacturing expansion, present business opportunities for companies. Hexion Inc., INEOS Group, Mitsubishi Gas Chemical Company Inc., Metafrax Chemicals and Shandong Efirm Biochemistry and Environmental Protection Co., Ltd. are important companies in the global Methenamine Market Size.

Report Coverage

This research report categorizes the Methenamine Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Methenamine Market Size. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Methenamine Market Size.

Methenamine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 416.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.17% |

| 2035 Value Projection: | USD 805.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Form, By Application |

| Companies covered:: | Hexion Inc., INEOS Group, Aspen Pharmacare, Cipla Ltd., Aurobindo Pharma, Mitsubishi Gas Chemical Company Inc., Sina Chemical Industries Company, Metafrax Chemicals, BASF SE, Teva Pharmaceutical, Sandoz, Zydus Lifesciences Ltd., Evonik Industries AG, Shandong Efirm Biochemistry, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global Methenamine Market Size depends mainly on its function as a vital curing agent that phenolic resins need to produce plywood, MDF and particleboard for construction purposes. The rising automotive market requires robust rubber materials, which include tires and gaskets, thus increasing its demand as a vulcanization accelerator. The pharmaceutical industry requires methenamine because urinary tract infections (UTIs) occur at high rates, thus creating a need for non-antibiotic antiseptics with low resistance. The market maintains continuous growth because the product serves as a base for slow-release fertilisers and solid fuel tablets, while the company expands its manufacturing operations throughout the Asia-Pacific.

Restraining Factors

The global Methenamine Market Size faces major limitations because environmental regulations impose strict controls on formaldehyde emissions, and producers must incur costly compliance costs while safer chemical alternatives are available. The industry faces growth obstacles because raw material prices fluctuate and supply chain interruptions occur, and there are few available over-the-counter medical products.

Market Segmentation

The Methenamine Market Size share is classified into form and application.

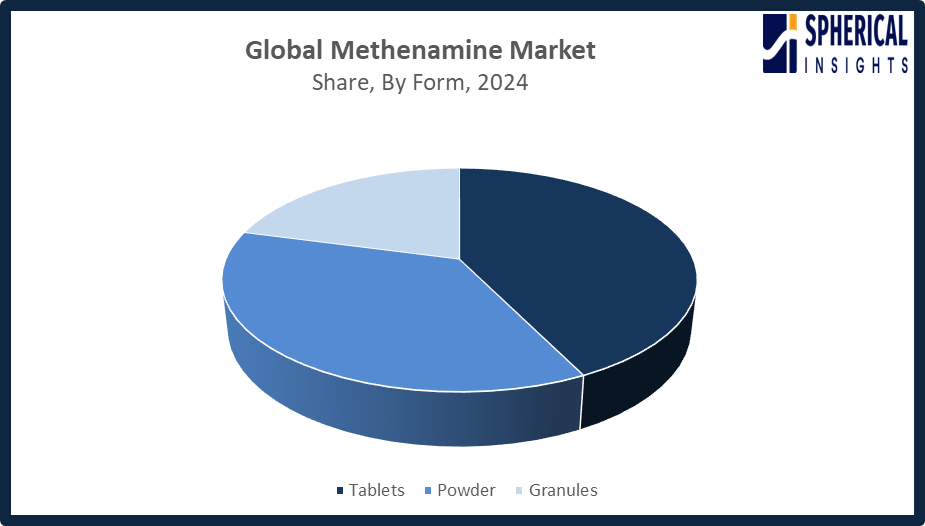

- The tablets segment dominated the market in 2024, approximately 43% and is projected to grow at a substantial CAGR during the forecast period.

Based on the form, the Methenamine Market Size is divided into tablets, powder, and granules. Among these, the tablets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The Methenamine Market Size exists in its current condition because healthcare facilities use tablets as their primary institutional medication. The product emerges as the best choice because it delivers exact dosing to users who maintain high treatment compliance. The tablets enable continuous medication delivery, which protects against urinary tract infections while decreasing medication mistakes and providing better protection against moisture damage and easier product transportation.

Get more details on this report -

- The urinary tract infection (UTI) treatment segment accounted for the highest market revenue in 2024, approximately 47% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the Methenamine Market Size is divided into urinary tract infection (UTI) treatment, industrial use, fuel tablets, rubber vulcanization, and others. Among these, the urinary tract infection (UTI) treatment segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The demand for methenamine in urinary tract infection (UTI) treatment continues to rise due to its established effectiveness and its function as a non-antibiotic treatment. The product achieves its bactericidal effect through formaldehyde release, which occurs in acidic urine without generating antimicrobial resistance. The worldwide health organization reports that more than 150 million people develop urinary tract infections each year, which creates ongoing market growth because of increasing recurrence rates and rising resistance issues.

Regional Segment Analysis of the Methenamine Market Size

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the Methenamine Market Size over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the Methenamine Market Size over the predicted timeframe. North America is expected to have a 42% share of the Methenamine Market Size due to its strong demand from pharmaceuticals, its developed healthcare system and its increasing cases of recurrent urinary tract infections. The United States leads the region, supported by high diagnosis rates, growing awareness of antimicrobial resistance, and rising preference for non-antibiotic prophylaxis such as methenamine. The Canadian population benefits from improved healthcare access, which addresses the needs of its elderly citizens. The existing chemical production facilities and established regulatory systems enable companies to develop their industrial production processes. Brazil started an anti-dumping investigation against Chinese phenolic resin imports in January 2026, which ended up affecting South American hexamine trade patterns.

Asia Pacific is expected to grow at a rapid CAGR in the Methenamine Market Size during the forecast period. The Methenamine Market Size in the Asia Pacific shows rapid growth, with an approximate 28% share through chemical manufacturing expansion, rising healthcare spending, and increasing UTI occurrences. China maintains its position as the top producer and exporter because its resin and rubber sectors function effectively. Pharmaceutical demand in India increases because the country improves its healthcare system and establishes more generic drug production facilities, while Japan maintains its constant demand for regulated pharmaceuticals. South Korea implemented stricter chemical regulations for methenamine producers through its updated Chemical Control Act and K-REACH regulations in September 2025.

The growth of Europe Methenamine Market Size expansion occurs because of three factors, which include strong pharmaceutical standards, rising UTI cases and established chemical manufacturing operations. Germany leads the market through its advanced resin and chemical production facilities, while France enables market growth through its controlled pharmaceutical distribution system and expanding healthcare requirements. The United Kingdom supports two initiatives, which include antimicrobial stewardship and the use of non-antibiotic prophylactic treatments. The European Chemicals Agency published its new guidelines in June 2025 to strengthen REACH Annexe XVII restrictions on formaldehyde across all consumer product categories.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Methenamine Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hexion Inc.

- INEOS Group

- Aspen Pharmacare

- Cipla Ltd.

- Aurobindo Pharma

- Mitsubishi Gas Chemical Company Inc.

- Sina Chemical Industries Company

- Metafrax Chemicals

- BASF SE

- Teva Pharmaceutical

- Sandoz

- Zydus Lifesciences Ltd.

- Evonik Industries AG

- Shandong Efirm Biochemistry

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Cipla Ltd. launched Methenamine Hippurate under the brand HUENA in India for recurrent urinary tract infections. As the first to introduce this non-antibiotic therapy in the country, Cipla strengthens efforts against antimicrobial resistance and supports responsible antimicrobial stewardship initiatives.

- In June 2025, BASF SE began operations at its new world-scale hexamethylenediamine plant in Chalampe, France, raising annual capacity to 260,000 metric tons. The investment strengthens BASF’s European chemical production and supports the expansion of its PA 6.6 business, including growth in Freiburg, Germany.

- In March 2025, Zydus Lifesciences Ltd. received FDA approval for generic Methenamine Hippurate Tablets USP, 1 gram, manufactured in Ahmedabad, targeting $32.6 million U.S. annual sales. Zydus also agreed to acquire 85.6% of Amplitude Surgical SA for €257 million to expand its MedTech portfolio.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Methenamine Market Size based on the below-mentioned segments:

Global Methenamine Market Size, By Form

- Tablets

- Powder

- Granules

Global Methenamine Market Size, By Application

- Urinary Tract Infection (UTI) Treatment

- Industrial Use

- Fuel Tablets

- Rubber Vulcanization

- Others

Global Methenamine Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Methenamine Market Size over the forecast period?The global Methenamine Market Size is projected to expand at a CAGR of 6.17% during the forecast period.

-

2. What is the global Methenamine Market Size?The global Methenamine Market Size involves production, distribution, and consumption of methenamine for pharmaceutical, resin, rubber, and fuel applications worldwide.

-

3. What is the market size of the Methenamine Market Size?The global Methenamine Market Size is expected to grow from USD 416.5 million in 2024 to USD 805.1 million by 2035, at a CAGR of 6.17% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the Methenamine Market Size?North America is anticipated to hold the largest share of the Methenamine Market Size over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global Methenamine Market Size?Hexion Inc., INEOS Group, Aspen Pharmacare, Cipla Ltd., Aurobindo Pharma, Mitsubishi Gas Chemical Company Inc., Sina Chemical Industries Company, Metafrax Chemicals, BASF SE, Teva Pharmaceutical, and Others.

-

6. What factors are driving the growth of the Methenamine Market Size?Methenamine Market Size growth is driven by rising, recurrent urinary tract infections (UTIs) (requiring non-antibiotic treatments), increasing demand for phenol-formaldehyde resins in construction/automotive industries, and its use in rubber vulcanization.

-

7. What are the market opportunities in the Methenamine Market Size?Key opportunities include growing UTI treatment demand (non-antibiotic), phenolic resin curing in construction/automotive, and agricultural uses for slow-release nitrogen fertilizers.

-

8. What are the main challenges restricting wider adoption of the Methenamine Market Size?Main challenges restricting wider Methenamine Market Size adoption include strict environmental regulations on formaldehyde emissions, competition from newer antibiotics (nitrofurantoin, fosfomycin), low clinician familiarity, and reliance on acidic urine for efficacy.

Need help to buy this report?