Global Metals Market Size, Share, and COVID-19 Impact Analysis, Russia-Ukraine War Impact, Tariff Analysis, By Metal Type (Precious Metals (Gold, Silver, Platinum, Palladium, Others), Base Metals (Copper, Aluminum, Nickel, Zinc, Lead, Tin), Ferrous Metals (Iron Ore, Carbon Steel, Alloy Steel, Stainless Steel, Cast Iron), Special & Alloy Metals (Titanium, Cobalt, Molybdenum, Tungsten, Vanadium, Others), Rare Earth Elements (Neodymium, Praseodymium, Dysprosium, Others), and Liquid Metals (Gallium, Mercury, Eutectic Alloys, Indium-Based Alloys, Bismuth-Based Alloys), By Form (Ingots, Powders, Sheets & Plates, Bars & Rods, Pipes & Tubes, Wires & Cables, Strips & Foils, and Others) By Application (Construction, Industrial Manufacturing, Automotive, Electrical & Electronics, Jewelry & Decorative Arts, Investment, Packaging, Aerospace & Defense, Energy & Power Generation, Medical & Dental, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Consumer GoodsMetals Market Summary, Size & Emerging Trends

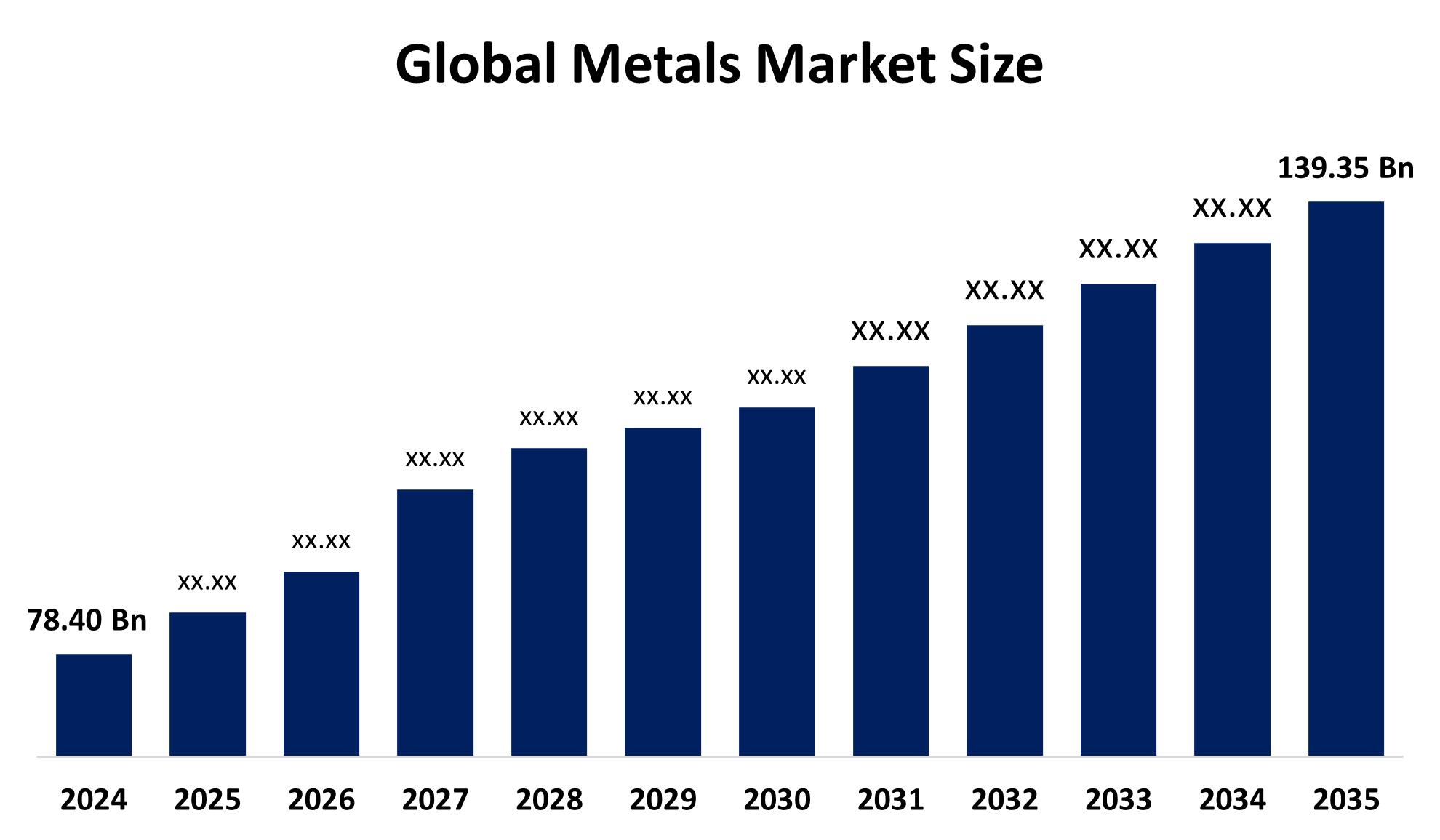

According to Spherical Insights, The Global Metals Market Size is Expected To Grow From USD 78.40 Billion in 2024 to USD 139.35 Billion by 2035, at a CAGR of 5.37% during the Forecast Period 2025-2035. The market for metals has opportunities due to supply chain optimization, technological improvements, growing investments in strategic and sustainable metal resources, and increasing demand from electric vehicles, renewable energy, and infrastructure development.

Get more details on this report -

Key Market Insights

- Asia Pacific is expected to account for the largest share in the metals market during the forecast period.

- In terms of metal type, the base metals segment is projected to lead the metals market in terms of equipment throughout the forecast period

- In terms of form, the bars & rods segment captured the largest portion of the market

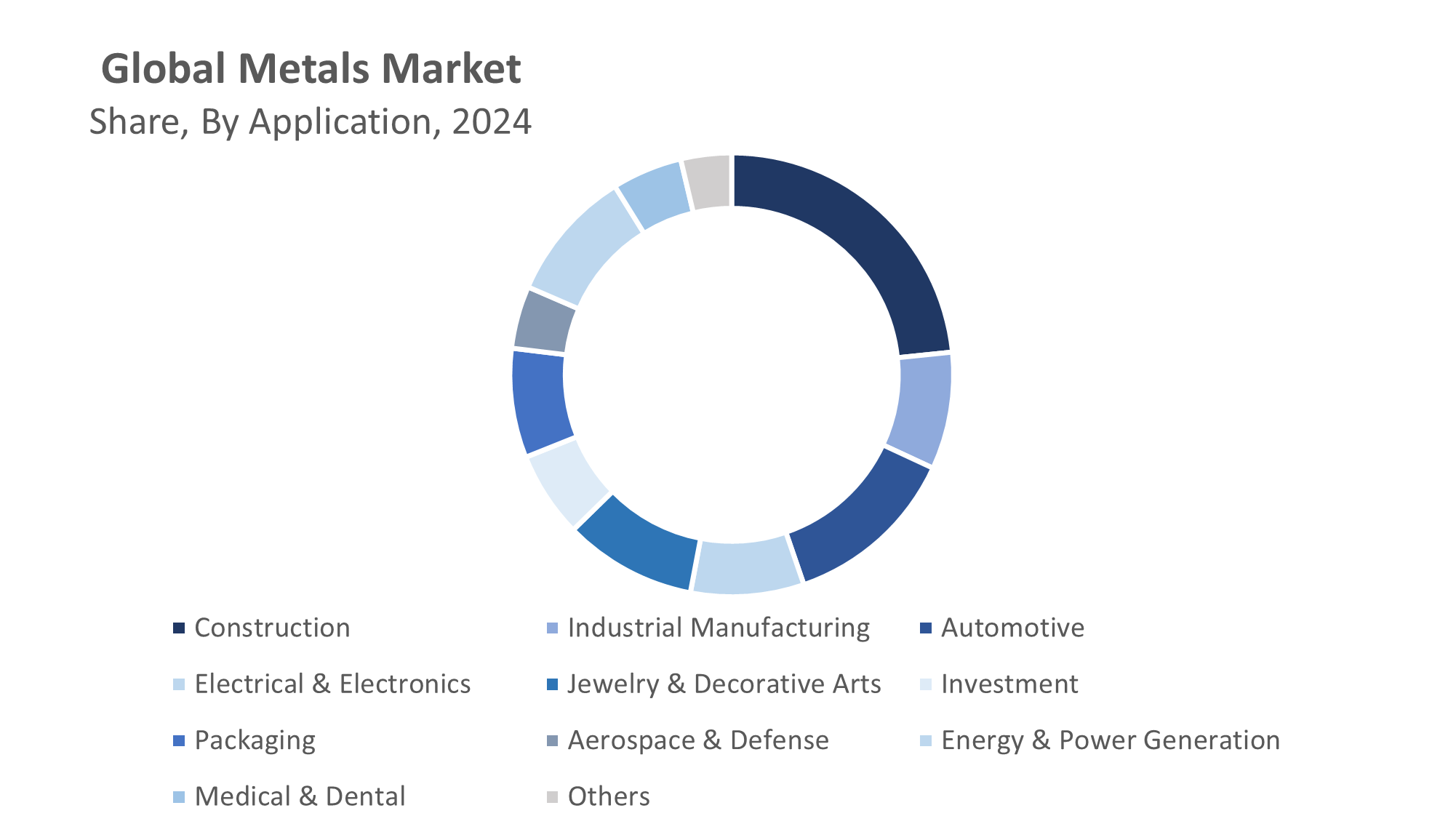

- In terms of application, the construction segment captured the largest portion of the market

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 78.40 Billion

- 2035 Projected Market Size: USD 139.35 Billion

- CAGR (2025-2035): 5.37%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Metals Market

The global market for the extraction, manufacturing, trade, and consumption of different metal commodities, including ferrous and non-ferrous metals, is known as the metals market. Metals are vital raw materials in a variety of industries, including manufacturing, electronics, aircraft, automobile, construction, and energy. The market is run through over-the-counter (OTC) deals, physical exchanges, and futures contracts on exchanges like COMEX and the London Metal Exchange (LME). Global industries' supply and demand dynamics are driven by a number of interconnected elements that drive the metals market. The efficiency and applicability of metal are boosted by manufacturing process innovations like 3D printing and advanced metallurgy, which raise demand in high-tech industries like electronics, aircraft, and defense. Especially in emerging economies, industrialization and urbanization are major drivers of the demand for metals used in manufacturing, infrastructure, and building.

Metals Market Trends

- Sustainability & Green Initiatives: To lower carbon footprints and advance circular economies, there is an increasing focus on ecologically friendly mining and metal recycling methods.

- Growing Demand from EV and Renewable Energy Sectors: As electric vehicles and renewable energy technologies proliferate, there is a corresponding rise in the use of vital metals such as nickel, cobalt, and lithium.

- Technological Innovation: Developments in alloy creation, extraction, and processing that improve the quality, efficiency, and use of metal in a variety of industries.

- Geopolitical Influence and Supply Chain Optimization: Attempts to protect and diversify metal supply chains in the face of resource nationalism, trade disruptions, and geopolitical tensions.

Metals Market Dynamics

Global Metals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 78.40 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.37% |

| 2035 Value Projection: | USD 139.35 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 213 |

| Segments covered: | By Metal Type, By Form, By Application |

| Companies covered:: | BHP Group, Rio Tinto, Glencore, Vale S.A., Anglo American, Codelco, Freeport-McMoRan, Newmont Corporation, Southern Copper Corporation, Alcoa, Rusal, Hindalco Industries, ArcelorMittal, Nippon Steel, POSCO Holdings, Nucor Corporation, Norilsk Nickel, Thyssenkrupp AG, JSW Steel, Tata Steel, China Baowu Steel Group, JFE Steel, Wheaton Precious Metals, Grupo México, Jiangxi Copper Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors: Geopolitics and trade dynamics drive metals market.

The metals market is further driven by geopolitical events and global trade dynamics, which have a positive effect on supply chain logistics, tariffs, mining activities, and trade regulations. Furthermore, the rapid expansion of the electric vehicle (EV) and renewable energy sectors is driving up demand for rare and key earth metals like nickel, cobalt, and lithium, which are essential for battery technology and clean energy systems. A number of economic, technological, environmental, and geopolitical variables work together to drive the metals market's expansion and development.

Restrain Factors: Price volatility and regulations restrict metals market.

The price volatility of raw materials, strict environmental restrictions, and the high energy consumption of metal mining and processing are some of the restricting factors in the metals market. Trade restrictions and geopolitical unrest can impede industry expansion and upset supply systems. Furthermore, conventional mining operations face difficulties due to the availability of metal alternatives and growing demand to embrace environmental methods, which could restrict profitability and long-term investment in the industry.

Opportunity: EVs, renewables, and infrastructure drive metals opportunities.

The expanding demand from electric vehicles, renewable energy, and infrastructure construction is driving the metals business, which offers substantial opportunities. Technological developments in mining and recycling improve environmental sustainability and operational efficiency. Emerging markets present unrealized opportunities for research and investment, especially in Asia and Africa. Additionally, heightened attention to crucial metals like lithium, cobalt, and rare earth elements fosters innovation in electronics and energy storage. Long-term expansion in the global metals business is further facilitated by government programs supporting sustainable development and clean energy.

Challenges: Supply chain issues and regulations challenge metals.

Supply chain interruptions, price volatility, and pressure to comply with regulations are some of the issues challenging the metals market. Mining operations are made more difficult and costly by environmental concerns and strict sustainability criteria. Global metal availability and mobility are also impacted by trade barriers and geopolitical concerns. The industry must invest in cutting-edge technologies due to the depletion of high-quality mineral resources.

Global Metals Market Ecosystem Analysis

The ecosystem of the global metals market is made up of interrelated parties such as manufacturers, traders, mining corporations, and end users from sectors including electronics, automotive, and construction. The availability of raw materials, technological developments, environmental laws, and geopolitical events all have an impact on this ecosystem. Supply chains integrate extraction, processing, and delivery over several geographical areas. Economic movements, trade policy, and demand-supply mismatches all influence market prices. The metals market ecosystem is becoming more resilient and innovative due to the growing importance of sustainable practices and circular economy initiatives.

Global Metals Market, By Metal Type

The base metals segment led the metals market, generating the largest revenue share. base metals owing to their many industrial uses and strong demand in important industries, including electronics, automotive, infrastructure, and construction. Global economic activity depends on metals like copper, aluminum, nickel, and zinc since they are necessary for electrical and manufacturing systems.

The rare earth elements segment in the metals market is expected to grow at the fastest CAGR over the forecast period. The growing need for high-performance magnets, batteries, and sophisticated electronics, particularly in electric vehicles, renewable energy technologies, and defense applications across international markets, is the main factor propelling the expansion of the rare earth elements segment.

Global Metals Market, By Form

The bars & rods segment held the largest market share in the metals market. The primary explanation for the widespread use of bars & rods is that they are essential parts for strengthening concrete structures in the infrastructure and construction industries. The extensive use of bars and rebars has been greatly aided by the strong demand for urban development, infrastructure expansion, and industrial growth on a global scale.

The wires and cables segment in the metals market is projected to register the fastest CAGR. The growing need for wires and cables in the telecommunications, electrical infrastructure, and renewable energy sectors is fueling their expansion, which is indicative of their vital position in contemporary industrial and technical applications.

Global Metals Market, By Application

The construction segment held the largest market share in the metals market. The strong demand for metals like copper, aluminum, and steel in building and infrastructure development projects around the world is what propels the construction industry. Metals are indispensable in the building business since they are used for plumbing, electrical wiring, finishing materials, and structural frameworks.

Get more details on this report -

The automotive segment in the metals market is projected to register the fastest CAGR. The growing production of electric vehicles (EVs), which need significant amounts of specialized metals like lithium, cobalt, nickel, and copper for batteries and electrical components, as well as developments in lightweight and high-strength materials to improve performance and fuel efficiency, is driving the automotive sector.

Asia Pacific is expected to account for the largest share of the metals market during the forecast period.

Get more details on this report -

Rapid urbanization, industrialization, and rising infrastructure spending are some of the forces propelling the Asia-Pacific area. Strong economic growth is being seen by nations like China, India, Japan, and Southeast Asia, which in turn is driving up demand for metals in a variety of industries, including manufacturing, electronics, automotive, and construction.

India is experiencing steady growth in the metals market. Rapid industrialization, infrastructural expansion, and rising demand from the construction and automobile industries are the main drivers of India's economy. The development of India's metals sector is further supported by government programs that encourage manufacturing and renewable energy.

North America is expected to grow at the fastest CAGR in the metals market during the forecast period. Increased investments in car manufacturing, renewable energy projects, and infrastructure upgrades in the US and Canada are the main drivers of North America's prosperity. The region's focus on technological development and the use of cutting-edge metal processing methods improves productivity and product quality, which helps to promote market growth.

United States is the largest market for metals. The United States' advanced manufacturing sector, large industrial base, massive infrastructure development, and high demand from the construction, automobile, and aerospace industries are its main drivers. Its market is further strengthened by strong investments and technological developments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the metals market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

WORLDWIDE TOP KEY PLAYERS IN THE METALS MARKET INCLUDE

- BHP Group

- Rio Tinto

- Glencore

- Vale S.A.

- Anglo American

- Codelco

- Freeport-McMoRan

- Newmont Corporation

- Southern Copper Corporation

- Alcoa

- Rusal

- Hindalco Industries

- ArcelorMittal

- Nippon Steel

- POSCO Holdings

- Nucor Corporation

- Norilsk Nickel

- Thyssenkrupp AG

- JSW Steel

- Tata Steel

- China Baowu Steel Group

- JFE Steel

- Wheaton Precious Metals

- Grupo México

- Jiangxi Copper Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Product Launches in the Metals

- In September 2025, World EV Day, Vedanta Limited announced that it had invested over 12,500 crore to increase its capacity to manufacture metals for India's expanding electric vehicle market These projects include ferrochrome production facilities, zinc alloy plants, and aluminum smelters

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the metals market based on the below-mentioned segments:

Global Metals Market, By Metal Type

- Precious Metals

- Gold

- Silver

- Platinum

- Palladium

- Others

- Base Metals

- Copper

- Aluminum

- Nickel

- Zinc

- Lead

- Tin

- Ferrous Metals

- Iron Ore

- Carbon Steel

- Alloy Steel

- Stainless Steel

- Cast Iron

- Special & Alloy Metals

- Titanium

- Cobalt

- Molybdenum

- Tungsten

- Vanadium

- Others

- Rare Earth Elements

- Neodymium

- Praseodymium

- Dysprosium

- Others

- Liquid Metals

- Gallium

- Mercury

- Eutectic Alloys

- Indium-Based Alloys

- Bismuth-Based Alloys

Global Metals Market, By Form

- Ingots

- Powders

- Sheets & Plates

- Bars & Rods

- Pipes & Tubes

- Wires & Cables

- Strips & Foils

- Others

Global Metals Market, By Application

- Construction

- Industrial Manufacturing

- Automotive

- Electrical & Electronics

- Jewelry & Decorative Arts

- Investment

- Packaging

- Aerospace & Defense

- Energy & Power Generation

- Medical & Dental

- Others

Global Metals Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the metals market over the forecast period?The global metals market is projected to expand at a CAGR of 5.37% during the forecast period.

-

2. What is the market size of the metals market?The global metals market Size is expected to grow from USD 78.40 billion in 2024 to USD 139.35 billion by 2035, at a CAGR of 5.37% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the metals market?Asia Pacific is anticipated to hold the largest share of the metals market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global metals market?Key players include BHP Group, Rio Tinto, Glencore, Vale S.A., Anglo American, Codelco, Freeport-McMoRan, Newmont Corporation, Southern Copper Corporation, Alcoa, Rusal, Hindalco Industries, ArcelorMittal, Nippon Steel, POSCO Holdings, Nucor Corporation, Norilsk Nickel, Thyssenkrupp AG, JSW Steel, Tata Steel, China Baowu Steel Group, JFE Steel, Wheaton Precious Metals, Grupo México, Jiangxi Copper Corporation, and others.

-

5. What factors are driving the growth of the metals market?The growth of the metals market is driven by rising industrialization, increasing demand from the automotive and construction sectors, technological advancements, urban infrastructure development, and the global shift toward renewable energy solutions.

-

6. What are the main challenges restricting wider adoption of the metals market?The metals market faces challenges including fluctuating raw material prices, environmental regulations, high energy consumption, supply chain disruptions, and limited availability of critical minerals essential for advanced technological and industrial applications.

Need help to buy this report?