Global Metalized Flexible Packaging Market Size By Material Type (Aluminum, Chromium, Nickel), By Packaging Type (Pouches, Bags, Roll stock, Wraps), By End-Use Industry (Food and Beverage, Pharmaceutical, Personal Care, Pet Food), By Region, And Segment Forecasts, By Geographic Scope And Forecast

Industry: Advanced MaterialsGlobal Metalized Flexible Packaging Market Size Insights Forecasts to 2032

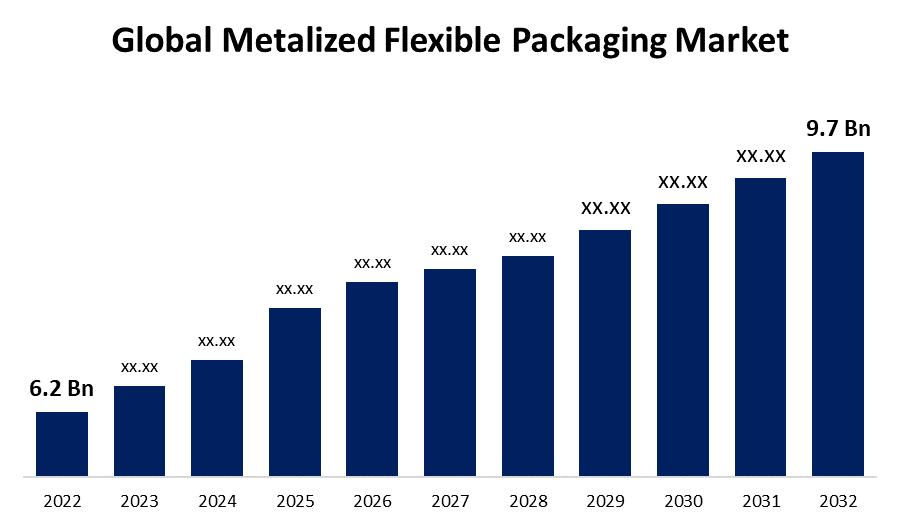

- The Metalized Flexible Packaging Market Size was valued at USD 6.2 Billion in 2022.

- The Market Size is Growing at a CAGR of 7.5% from 2022 to 2032

- The Worldwide Metalized Flexible Packaging Market Size is expected to reach USD 9.7 Billion by 2032

- North America is expected to Grow the fastest during the forecast period

Get more details on this report -

The global Metalized Flexible Packaging Market Size is expected to reach USD 9.7 Billion by 2032, at a CAGR of 7.5% during the forecast period 2022 to 2032.

A type of packaging known as metalized flexible packaging combines the benefits of a thin metal layer with the flexibility of plastic or other flexible substrates. Although other metals like copper or silver can also be utilised, aluminium is the most common metal used in this layer. In the metalization process, a thin layer of metal is deposited onto a flexible substrate, frequently using methods like vapour deposition or sputtering. The Market Size for flexible packaging, especially metalized films, has increased in response to the Growing desire for portable and handy food goods. These components aid in extending food items' shelf lives, which is essential in the food sector. The demand for reliable packing solutions has increased with the expansion of e-commerce. Various things offered online are sent and protected using metalized flexible packaging. The need for packaged goods is rising in developing nations with expanding middle classes, which in turn is boosting demand for cutting-edge packaging options like metalized flexible packaging. The Market Size is expanding as a result of ongoing improvements in packaging technology, including better metalization procedures and eco-friendly solutions.

Metalized Flexible Packaging Market Size Price Analysis

Pricing includes a considerable amount of the cost of the base material, which is frequently a flexible polymer like polyethylene (PE) or polypropylene (PP). The foundation material's nature and quality can differ, which affects the final price. The price can vary depending on the packaging material's printability, including the design's complexity and the quantity of colours utilised. High-quality printing and graphics may increase the price. Due to the additional usefulness and protection it provides, packaging with superior barrier capabilities, such as extraordinary resistance to moisture, oxygen, and light, may command a premium price. Pricing can be impacted by the degree of competition among packaging suppliers in a specific area or Market Size sector. Competitive pricing may result from increased competition. The price of raw materials, particularly the metal required for metalization, can change depending on the state of the Market Size and supply. The final price can also be impacted by shipping expenses, particularly if the package needs to be delivered across vast distances.

Metalized Flexible Packaging Market Size Distribution Analysis

Metalized flexible packaging is first created by manufacturers and converters. The basic flexible materials are created by manufacturers, and they are frequently plastic films made of polyethylene or polypropylene. The metalization layer, as well as any printing or customising, is subsequently added to these materials by converters. Multiple tiers of converters, each specialising in a distinct component of production, may be involved in distribution. Flexible metalized packaging materials are bought by packaging businesses or manufacturers from wholesalers or distributors. They then process these materials to produce final packaging items, including bags, pouches, wrappers, and labels, that are suited to the needs of their clients, who may include brand owners, food producers, pharmaceutical businesses, and others. Flexible packaging that has been metalized is sold outside of domestic Market Sizes. Global operations are common among manufacturers and converters, and their goods can be sold outside. Complex export-import and logistical procedures are involved.

Global Metalized Flexible Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 6.2 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.5% |

| 2032 Value Projection: | USD 9.7 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material Type, By Packaging Type, By End-Use Industry, By Region and COVID 19 Impact. |

| Companies covered:: | Amcor Limited, Mondi Group, Sealed Air Corp, Sonoco Products Company, Polyplex Corporation Limited, Huhtamaki, Transcontinental Inc, Cosmo Films Ltd., Kendall Packaging Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth & Analysis. |

Get more details on this report -

Market Size Dynamics

Metalized Flexible Packaging Market Size Dynamics

Increasing busy lifestyles of customers

Due to their hectic schedules, consumers frequently lack the time to prepare sit-down meals and meals from scratch. The need for packaged and convenient goods that require packaging to maintain freshness and extend shelf life is fueled by this. Metalized flexible packaging is a desirable option for consumers looking for quick and simple meal options because of its superior barrier qualities, which help keep food goods fresh. People who lead hectic lives frequently choose meals that can be heated up and eaten right away. These goods frequently come in microwave- and oven-friendly metalized flexible packaging that offers convenience without sacrificing food quality. E-commerce platforms are becoming more and more important for the needs of busy consumers. For the safe and secure delivery of online-ordered goods, metalized flexible packaging is crucial.

Restraints & Challenges

Pressure on input costs to hamper the Market Size

Raw materials like polymer films and the metalization layer (usually aluminium) are the main components of flexible packaging. Manufacturers of metalized flexible packaging may incur greater manufacturing costs if the cost of these raw materials rises as a result of variables such as changes in commodity prices, disruptions in the supply chain, or increased demand. The total cost of inputs may be influenced by labour expenses, including manufacturing and skilled labour pay and benefits. Production costs may Grow as a result of factors like labour shortages, pay hikes, or the demand for specialised skills. Fuel price variations, a Growth in the demand for logistics services, and problems with the transportation infrastructure can all result in an increase in the cost of carrying raw materials to production facilities and finished goods to customers.

Regional Forecasts

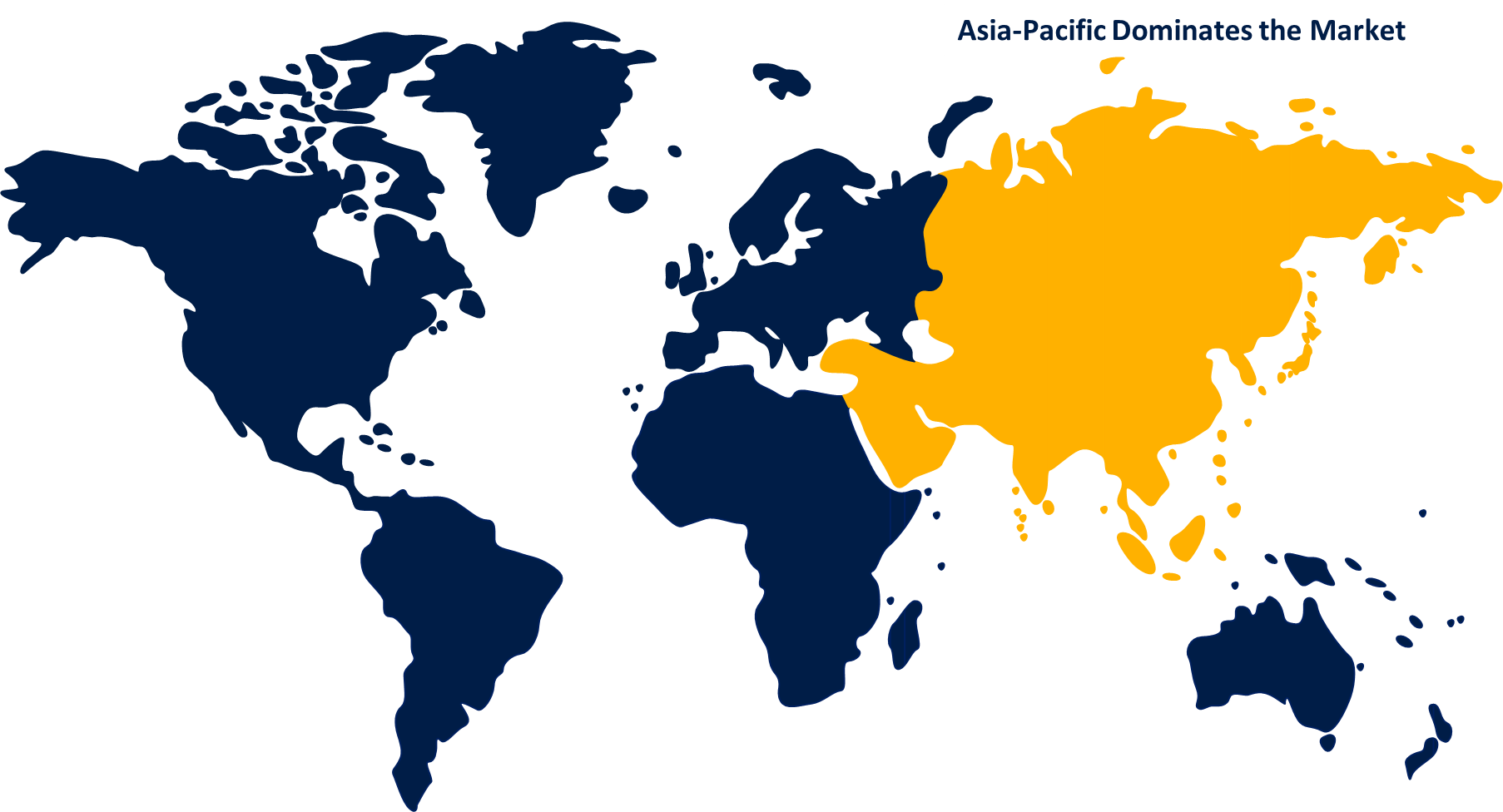

Asia Pacific Market Size Statistics

Get more details on this report -

Asia Pacific is anticipated to dominate the Metalized Flexible Packaging Market Size from 2023 to 2032. The need for flexible packaging solutions, particularly metalized choices, has increased as a result of the industrialization and Growth of the manufacturing sectors in nations like China, India, and Southeast Asian countries. From industrial items to food packaging, these materials are employed in a variety of applications. In the Asia-Pacific region, the Market Size for metalized flexible packaging is significantly driven by the food and beverage industry. The demand for flexible packaging materials, which offer extended shelf life and protection from environmental elements, has increased as customer preferences change towards convenience foods and ready-to-eat meals. In addition to China and India, the metalized flexible packaging industry is seeing significant Growth in Southeast Asian developing nations including Vietnam, Indonesia, and Thailand. These nations' developing economies and rising consumer demand are fostering Market Size expansion.

North America Market Size Statistics

North America is witnessing the fastest Market Size Growth between 2023 to 2032. In North America, the food and beverage sector is a significant consumer of metalized flexible packaging. Manufacturers in this industry utilise metalized materials to increase the visual attractiveness of their products, increase their shelf life, and shield them from moisture and light. There are several domestic and foreign competitors in the North American Market Size for metalized flexible packaging. Competitive pricing and innovation are driven by competition.

Segmentation Analysis

Insights by Material Type

The aluminum based flexible films segment accounted for the largest Market Size share over the forecast period 2023 to 2032. Aluminium-based films have excellent barrier qualities, especially when it comes to obstructing light, oxygen, and moisture. They are therefore excellent candidates for packing perishable commodities like food, medicine, and delicate electronics that need to be protected from the environment. Pharmaceutical packaging is crucial for using aluminum-based films, which are used in blister packs and other medicine packaging to shield the contents from moisture and preserve product integrity. Packaging for healthcare and medical devices also benefits from aluminum's protective qualities. The demand for protective packaging materials has increased as e-commerce has Grown, and films made of aluminium are now utilised to package goods for safe shipping and delivery.

Insights by Packaging Type

The pouches segment accounted for the largest Market Size share over the forecast period 2023 to 2032. Pouches are very popular because of how convenient they are. They are perfect for portion management and on-the-go consumption because they are simple to open, reseal, and pour. Customers like pouches' convenience in their hectic lives. Pouches provide lots of surface area for branding and logos, enhancing customer appeal and product visibility. Metalized flexible packaging improves the visual appeal of products on store shelves with its beautiful and reflective appearance. The popularity of e-commerce and online shopping has raised the demand for pouches, particularly for goods that need to be packaged securely and protectively for shipping. Pouches are being used for more than just food and drink; they are also used for industrial, domestic, and personal care products. The pouches segment has expanded as a result of this diversification.

Insights by End Use

The food and beverage segment accounted for the largest Market Size share over the forecast period 2023 to 2032. Easy-to-open, resealable packaging that is ideal for consumption on-the-go is required due to consumers' busy lifestyles and rising demand for convenience meals. For these uses, flexible metalized pouches and sachets work best. Branding and appearance play a big role in the food and beverage business. Metalized materials for packaging provide lots of room for colourful images and branding, making products stand out on store shelves. Metalized packaging is now used for products like protein bars, dietary supplements, and organic meals as a result of the Growing Market Size for health-conscious and wellness goods.

Recent Market Size Developments

- On November 2021, Enhanced Barrier Metalized BOPP Film became available on the Market Size by Cosmo Films Ltd.

Competitive Landscape

Major players in the Market Size

- Amcor Limited

- Mondi Group

- Sealed Air Corp

- Sonoco Products Company

- Polyplex Corporation Limited

- Huhtamaki

- Transcontinental Inc

- Cosmo Films Ltd.

- Kendall Packaging Corporation

Market Size Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Metalized Flexible Packaging Market Size, Material Type Analysis

- Aluminum

- Chromium

- Nickel

Metalized Flexible Packaging Market Size, Packaging Type Analysis

- Pouches

- Bags

- Roll stock

- Wraps

Metalized Flexible Packaging Market Size, End Use Analysis

- Food and Beverage

- Pharmaceutical

- Personal Care

- Pet Food

Metalized Flexible Packaging Market Size, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

What is the Market Size size of the Metalized Flexible Packaging Market Size?The global Metalized Flexible Packaging Market Size is expected to Grow from USD 6.2 Billion in 2023 to USD 9.7 Billion by 2032, at a CAGR of 7.5% during the forecast period 2023-2032.

-

Who are the key Market Size players of the Metalized Flexible Packaging Market Size?Some of the key Market Size players of Market Size are Amcor Limited, Mondi Group, Sealed Air Corp, Sonoco Products Company, Polyplex Corporation Limited, Huhtamaki, Transcontinental Inc, Cosmo Films Ltd., and Kendall Packaging Corporation.

-

Which segment holds the largest Market Size share?Food and beverage segment hold the largest Market Size share and is going to continue its dominance.

-

Which region is dominating the Metalized Flexible Packaging Market Size?Asia Pacific is dominating the Metalized Flexible Packaging Market Size with the highest Market Size share

Need help to buy this report?