Global Membrane Electrode Assembly Market Size, Share, and COVID-19 Impact Analysis, By Product (3-Layer MEA, 5-Layer MEA, and Others), By Application (PEMFC, DMFC, Electrolyzers, Hydrogen / Oxygen Fuel Cells, and Others), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Energy & PowerGlobal Membrane Electrode Assembly Market Insights & Forecast to 2035

-

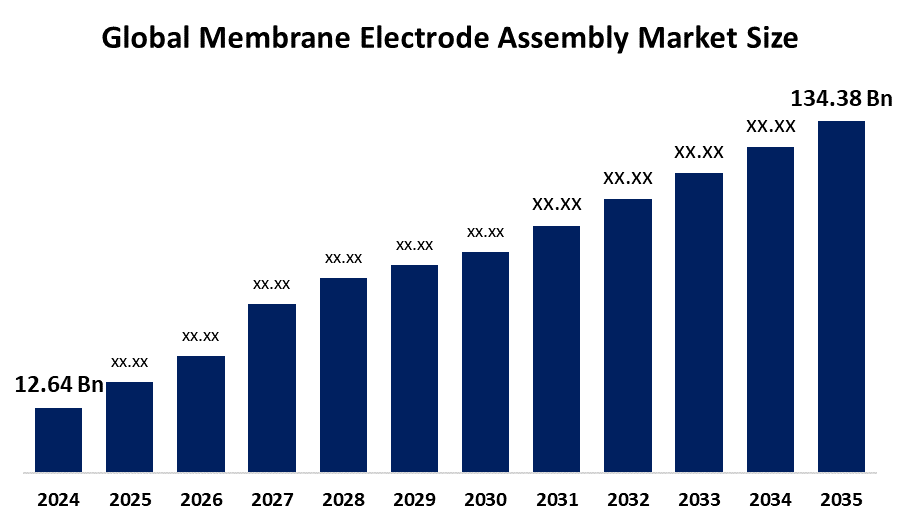

The global membrane electrode assembly market size was estimated at USD 12.64 billion in 2024.

-

The market is expected to grow at a CAGR of approximately 23.97% from 2025 to 2035.

-

The worldwide membrane electrode assembly market size is projected to reach USD 134.38 billion by 2035.

-

North America is expected to be the fastest-growing region during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the global membrane electrode assembly market was valued at approximately USD 12.64 billion in 2024 and is projected to reach around USD 134.38 billion by 2035, growing at a compound annual growth rate (CAGR) of 23.97% from 2025 to 2035. Future opportunities in the membrane electrode assembly market include the growing adoption of hydrogen fuel cells, expanding demand for electric vehicles, increased integration of renewable energy, and rising investments in clean energy infrastructure worldwide.

Market Overview

A membrane electrode assembly (MEA) is the core component of fuel cells and electrolyzers, consisting of a proton exchange membrane, catalyst layers, and gas diffusion layers that enable electrochemical reactions. The MEA market is driven by the rapid adoption of hydrogen fuel cells across transportation, stationary power generation, and portable energy systems. Growing demand for clean energy, increasing electric vehicle penetration, and continuous advancements in fuel cell efficiency further support market growth.Strong government initiatives are accelerating adoption, with countries such as the U.S., Japan, China, and EU member states allocating billions of dollars toward hydrogen programs, national hydrogen roadmaps, and net-zero emission targets by 2050. Incentives, subsidies, and large-scale pilot projects continue to expand MEA deployment globally.

Report Coverage

This research report categorizes the membrane electrode assembly (MEA) market based on various segments and regions, forecasts revenue growth, and analyzes trends across each submarket. The report examines key growth drivers, opportunities, and challenges influencing the MEA market. Recent market developments and competitive strategies such as expansions, product launches, developments, partnerships, mergers, and acquisitions—are included to illustrate the competitive landscape. The report also strategically identifies and profiles key market players and analyzes their core competencies across each sub-segment of the membrane electrode assembly market.

Membrane Electrode Assembly Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12.64 billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 23.97% |

| 2035 Value Projection: | USD 134.38 billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 155 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product,By Application |

| Companies covered:: | Ballard Power Systems, W. L. Gore & Associates, Inc., Danish Power Systems, BASF SE, Giner Inc., FuelCellsEtc, IRD Fuel Cells, Greenrity GmBH, Plug Power Inc., Hyplat, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The membrane electrode assembly market is driven by the increasing adoption of hydrogen fuel cells in transportation, rising demand for clean and low-emission energy solutions, and the rapid growth of electric and fuel cell vehicles. Advancements in catalyst materials and membrane durability are improving system performance and efficiency. Additionally, the expanding use of fuel cells in stationary and portable power applications, along with growing investments in hydrogen infrastructure and renewable energy integration, further supports sustained global market growth.

Restraining Factors

High production costs, limited availability of platinum-based catalysts, durability challenges, and complex manufacturing processes restrict the large-scale adoption of membrane electrode assemblies, particularly in cost-sensitive applications.

Market Segmentation

The membrane electrode assembly market share is classified into product and application.

- The 5-layer MEA segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on product, the membrane electrode assembly market is segmented into 3-layer MEA, 5-layer MEA, and others. Among these, the 5-layer MEA segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance of the 5-layer MEA segment is attributed to its enhanced electrochemical performance, improved water and thermal management, and higher durability compared to 3-layer designs. Its ability to support higher power density and longer operational life makes it widely preferred in automotive, stationary, and commercial fuel cell applications, thereby driving strong adoption and sustained market growth.

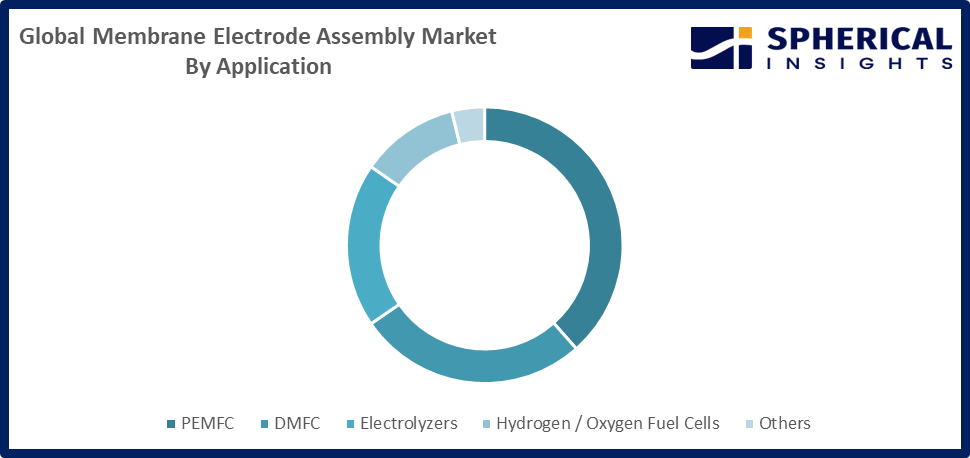

- The PEMFC segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on application, the membrane electrode assembly market is segmented into PEMFC, DMFC, electrolyzers, hydrogen/oxygen fuel cells, and others. Among these, the PEMFC segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance of the PEMFC segment is attributed to its high efficiency, quick start-up capability, and suitability for automotive and stationary power applications. Furthermore, the growing adoption of fuel cell vehicles and the expansion of hydrogen infrastructure are expected to support strong market growth.

Get more details on this report -

Regional Segment Analysis of the Membrane Electrode Assembly Market

• North America: U.S., Canada, Mexico

• Europe: Germany, France, the U.K., Italy, Spain, and the Rest of Europe

• Asia-Pacific: China, Japan, India, and the Rest of APAC

• South America: Brazil and the Rest of South America

• Middle East & Africa: UAE, South Africa, and the Rest of MEA

The Asia-Pacific region is anticipated to hold the largest share of the membrane electrode assembly market over the forecast period. This dominance is driven by strong government support for hydrogen energy initiatives, rapid expansion of fuel cell vehicle production, and increasing investments in electrolyzer projects. Countries such as China, Japan, and South Korea are actively implementing national hydrogen roadmaps, supporting large-scale manufacturing, and promoting clean energy adoption, thereby driving sustained regional market growth.North America is expected to grow at a rapid CAGR during the forecast period. This growth is attributed to increasing investments in hydrogen infrastructure, rising adoption of fuel cell vehicles, and strong government support through clean energy policies. Additionally, expanding R&D activities, ongoing technological advancements, and the growing deployment of fuel cells in stationary and backup power applications are accelerating regional market growth.

Competitive Analysis

The report provides a comprehensive analysis of the key organizations involved in the membrane electrode assembly market, along with a comparative evaluation based on product offerings, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. It also includes an in-depth assessment of recent developments such as product innovations, partnerships, joint ventures, mergers & acquisitions, and strategic alliances, enabling a clear understanding of the competitive landscape.

List of Key Companies

• Ballard Power Systems

• W. L. Gore & Associates, Inc.

• Danish Power Systems

• BASF SE

• Giner Inc.

• FuelCellsEtc

• IRD Fuel Cells

• Greenrity GmbH

• Plug Power Inc.

• HyPlat

Key Target Audience

• Market Players

• Investors

• End-users

• Government Authorities

• Consulting and Research Firms

• Venture Capitalists

• Value-Added Resellers (VARs)

Recent Developments

In August 2025, Advent Technologies Holdings, Inc. released its latest SEC Form 10-Q, reporting significantly lower revenue compared to 2024 and continued operational losses, reflecting ongoing financial challenges.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the membrane electrode assembly market based on the following segments:

Global Membrane Electrode Assembly Market, By Product

• 3-Layer MEA

• 5-Layer MEA

• Others

Global Membrane Electrode Assembly Market, By Application

• PEMFC

• DMFC

• Electrolyzers

• Hydrogen/Oxygen Fuel Cells

• Others

Global Membrane Electrode Assembly Market, By Regional Analysis

North America

• U.S.

• Canada

• Mexico

Europe

• Germany

• U.K.

• France

• Italy

• Spain

• Russia

• Rest of Europe

Asia-Pacific

• China

• Japan

• India

• South Korea

• Australia

• Rest of Asia-Pacific

South America

• Brazil

• Argentina

• Rest of South America

Middle East & Africa

• UAE

• Saudi Arabia

• Qatar

• South Africa

• Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the membrane electrode assembly market over the forecast period?The global membrane electrode assembly market is projected to expand at a CAGR of 23.97% during the forecast period.

-

2. What is the market size of the membrane electrode assembly market?The global membrane electrode assembly market size is expected to grow from USD 12.64 billion in 2024 to USD 134.38 billion by 2035, at a CAGR of 23.97 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the membrane electrode assembly market?Asia Pacific is anticipated to hold the largest share of the membrane electrode assembly market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global membrane electrode assembly market?Ballard Power Systems, W. L. Gore & Associates, Danish Power Systems, BASF SE, Giner Inc., FuelCellsEtc, IRD Fuel Cells, Greenrity GmbH, Plug Power Inc., and HyPlat.

-

5. What factors are driving the growth of the membrane electrode assembly market?Growth is driven by rising hydrogen fuel cell adoption, expanding electric vehicle demand, clean energy policies, technological advancements, and increasing investments in hydrogen infrastructure worldwide.

-

6. What are the market trends in the membrane electrode assembly market?Key trends include low-platinum catalysts, scalable manufacturing, green hydrogen integration, improved durability, and rising partnerships supporting fuel cell and electrolyzer commercialization globally.

-

7. What are the main challenges restricting the wider adoption of the membrane electrode assembly market?High production costs, limited platinum availability, durability issues, complex manufacturing processes, and slow infrastructure development restrict wider adoption of Membrane Electrode Assemblies.

Need help to buy this report?