Global Medium and Large Satellite Market Size By Mass (500 kg -1000 kg (Medium satellites), and >1000 kg (Large Satellites)), By Application (Navigation and Mapping, Communication, Others), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Medium and Large Satellite Market Insights Forecasts to 2033

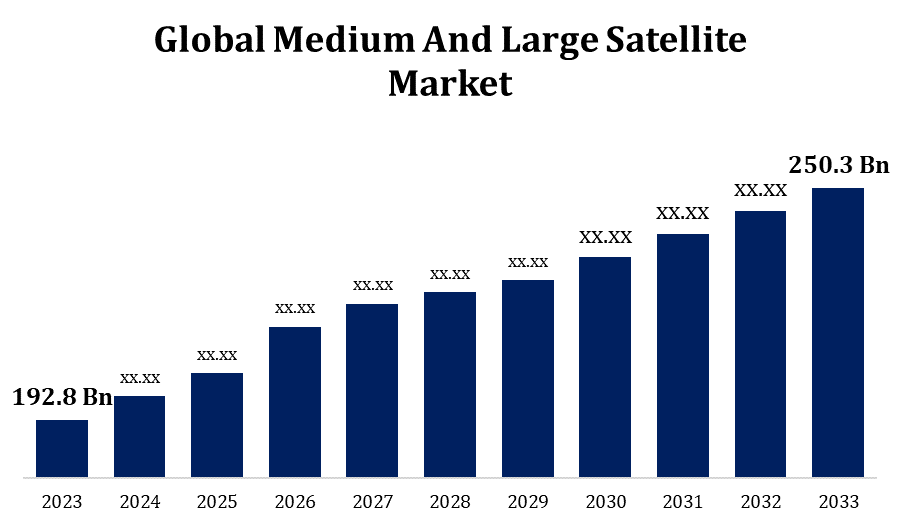

- The Global Medium and Large Satellite Market Size was valued at USD 192.8 Billion in 2023

- The Market Size is growing at a CAGR of 2.64% from 2023 to 2033

- The Worldwide Medium and Large Satellite Market Size is expected to reach USD 250.3 Billion by 2033

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Medium and Large Satellite Market Size is expected to reach USD 250.3 Billion by 2033, at a CAGR of 2.64% during the forecast period 2023 to 2033.

In order to deliver voice, data, and multimedia services to telecommunications firms, internet service providers, broadcasting networks, and government agencies, medium and large satellites are essential components of worldwide communication networks. In this sector, two notable examples are high-throughput satellites (HTS) and geostationary communication satellites. Medium and large satellites aid in defence and surveillance activities by giving military forces and national security agencies communication, reconnaissance, intelligence, surveillance, and reconnaissance (ISR), and reconnaissance capabilities. In addition to supporting military operations and monitoring important areas and hotspots, these satellites improve situational awareness. Satellite broadcasting, remote sensing data services, satellite imaging, and geospatial analytics are just a few of the commercial services that medium and large satellites may provide. Commercial satellite operators use their fleets of satellites to provide value-added services, sell data, and charge for service subscriptions.

Medium And Large Satellite Market Value Chain Analysis

Research and development expenditures are made by satellite producers and space agencies in order to create novel technologies, materials, and systems for satellites. The goal of R&D is to meet changing market demands by enhancing satellite performance, reliability, and cost-effectiveness. Conceptualization, design, and system optimisation are all part of satellite design and engineering. Scientists and engineers work together to create satellite architectures, subsystems, and parts that satisfy mission-specific specifications while taking communication capabilities, power generation, thermal control, and payload capacity into account. Solar panels, batteries, propulsion systems, communication antennas, payload instruments, and onboard computers are just a few of the parts and subsystems that manufacturers make for satellites. Facilities dedicated to satellite assembly and integration put together individual satellite parts to create whole spacecraft. To guarantee the efficient use and functionality of their satellite fleets, satellite operators oversee mission operations. Applications such as telecommunications, broadcasting, navigation, Earth observation, weather forecasting, disaster management, agriculture, environmental monitoring, and national security are just a few of the uses for which end customers employ satellite services and data.

Medium And Large Satellite Market Opportunity Analysis

High-speed internet connectivity is becoming more and more necessary in underserved and distant places of the world. By bringing satellite internet services to areas without terrestrial infrastructure, medium-sized and large satellites can significantly contribute to the expansion of broadband connectivity. By providing high-throughput, dependable, and reasonably priced satellite broadband solutions, satellite operators may take advantage of this market. In order to link cell towers and facilitate high-bandwidth data transfer, the implementation of 5G networks necessitates a strong backhaul infrastructure. In 5G backhaul networks, medium- and large-sized satellites can play a crucial role in connecting isolated or rural locations where terrestrial backhaul is either impossible or too expensive. In order to provide satellite-based 5G backhaul solutions, satellite operators can collaborate with telecom firms.

Global Medium and Large Satellite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 192.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.64% |

| 2033 Value Projection: | USD 250.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Mass, By Application, By Region, By Geographic Scope |

| Companies covered:: | EchoStar Corporation, Airbus D&S, Lockheed Martin Corporation, Space Exploration Technologies Corp., Inmarsat PLC, AMOS Spacecom, and Other Key Vendors. |

| Growth Drivers: | Low manufacturing cost to boost market growth |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Medium And Large Satellite Market Dynamics

Low manufacturing cost to boost market growth

Through economies of scale, increasing production volume can reduce manufacturing costs per unit. To cut costs and increase production output, satellite makers might standardise components, streamline supply chains, and optimise production processes. Reusing common parts and subsystems across many satellite programmes is made possible by manufacturers by standardising satellite platforms and implementing modular design concepts. By reducing customisation and rework, this method minimises design complexity, shortens development cycles, and decreases manufacturing costs. Reducing procurement costs and minimising supply chain disruptions can be achieved by optimising the satellite supply chain by acquiring components from reputable suppliers, negotiating advantageous contracts, and monitoring inventory levels. Costs can be reduced and processes can be streamlined with the use of just-in-time production techniques and smart supplier agreements.

Restraints & Challenges

The high upfront investment required for the development, manufacturing, and launch of medium and large satellites can limit the scalability of satellite programmes and create a barrier to entry for new competitors in the market. Complex systems and cutting-edge technology, including propulsion systems, communication payloads, and high-resolution image sensors, must be integrated while building medium- and large-sized satellites. It might be difficult to maintain technical complexity and guarantee system compatibility, particularly for multi-mission satellites. Schedules for satellite deployment might be impacted, and satellite operators may have to pay more as a result of launch delays, malfunctions, and disruptions. Geopolitical concerns, regulatory restrictions, and a lack of launch vehicles can all add uncertainty and risk to the planning and execution of satellite launches.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Medium And Large Satellite Market from 2023 to 2033. Leading commercial satellite operators with global reach, such as Intelsat, SES, and ViaSat, are based in North America and offer satellite communication services, broadband internet access, and Earth observation data. These operators use medium- and large-sized satellites to provide top-notch services to a wide range of markets and industries. Satellite services are in high demand in North America in a number of industries, including national security, television, telecommunications, navigation, and Earth observation. In order to meet the region's needs for communication, networking, and surveillance, satellite-based solutions are required due to its vast terrain, diverse economy, and sophisticated infrastructure. New satellite market niches include satellite servicing, on-orbit assembly, space tourism, and lunar exploration are opening up for business in North America.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. In the Asia-Pacific region, startups and satellite operators are funding satellite constellation projects to offer connectivity solutions, remote sensing services, and broadband internet coverage worldwide. Large and medium-sized satellite constellations are being deployed by businesses like SpaceX, OneWeb, and Starlink in an effort to close the digital divide and reach underserved areas. The demand for satellite-based Earth observation data and analytics is being driven by environmental issues, including natural catastrophes, urbanisation, and climate change, in the Asia-Pacific area. Medium and large satellites are used by governments, academic institutions, and private businesses to track environmental changes, manage natural resources, and aid in disaster relief operations.

Segmentation Analysis

Insights by Mass

The fixed wing segment accounted for the largest market share over the forecast period 2023 to 2033. With payload capacities that typically range from 500 kg to several metric tonnes, medium-sized satellites are ideal for a variety of uses, such as scientific research, navigation, Earth observation, and communication. The market is expanding due to rising demand for medium-capacity satellites, especially in developing nations. The need for medium satellites is being driven by emerging businesses including satellite broadband, Internet of Things (IoT) connectivity, and Earth observation analytics. Growth prospects for the market are being created by satellite operators deploying medium satellites to meet growing applications including environmental monitoring, disaster monitoring, precision agriculture, and rural connection.

Insights by Application

The communication segment accounted for the largest market share over the forecast period 2023 to 2033. High-speed broadband connectivity is in greater demand globally, especially in underdeveloped and distant locations with poor or nonexistent terrestrial infrastructure. The provision of broadband internet connectivity to residential, commercial, and industrial customers is facilitated by medium and large satellites, which in turn propels expansion within the communication segment. For mobile and cellular networks, medium- and large-sized satellites are crucial backhaul links that provide coverage to isolated and rural locations where it is not financially possible to use terrestrial backhaul. The need for communication satellite capacity is fueled by the ability of mobile operators to reach additional users, enhance the quality of their services, and expand their networks using satellite-based backhaul solutions. There is a rising need for reliable and secure satellite communication systems due to rising geopolitical tensions and cybersecurity concerns.

Recent Market Developments

- In May 2023, NASA's Kennedy Space Centre in Florida successfully launched the first satellite of the global ViaSat-3 constellation.

Competitive Landscape

Major players in the market

- EchoStar Corporation

- Airbus D&S

- Lockheed Martin Corporation

- Space Exploration Technologies Corp.

- Inmarsat PLC

- AMOS Spacecom

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Medium And Large Satellite Market, Mass Analysis

- 500 kg -1000 kg (Medium satellites),

- >1000 kg ( Large Satellites)

Medium And Large Satellite Market, Application Analysis

- Navigation and Mapping

- Communication

- Others

Medium And Large Satellite Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Medium and Large Satellite Market?The global Medium and Large Satellite Market is expected to grow from USD 192.8 billion in 2023 to USD 250.3 billion by 2033, at a CAGR of 2.64% during the forecast period 2023-2033.

-

2. Who are the key market players of the Medium and Large Satellite Market?Some of the key market players of the market are EchoStar Corporation, Airbus D&S, Lockheed Martin Corporation, Space Exploration Technologies Corp., Inmarsat PLC, and AMOS Spacecom.

-

3. Which segment holds the largest market share?The communication segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Medium and Large Satellite Market?North America is dominating the Medium and Large Satellite Market with the highest market share.

Need help to buy this report?