Global Medical Professional Liability Insurance Market Size, Share, and COVID-19 Impact Analysis, By Claim Type (Medication Errors, Surgical Errors, Misdiagnosis or Delayed Diagnosis, Childbirth Injuries, and Others), By Distribution Channel (Agents and Brokers, Direct Response, Banks, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Medical Professional Liability Insurance Market Insights Forecasts to 2033

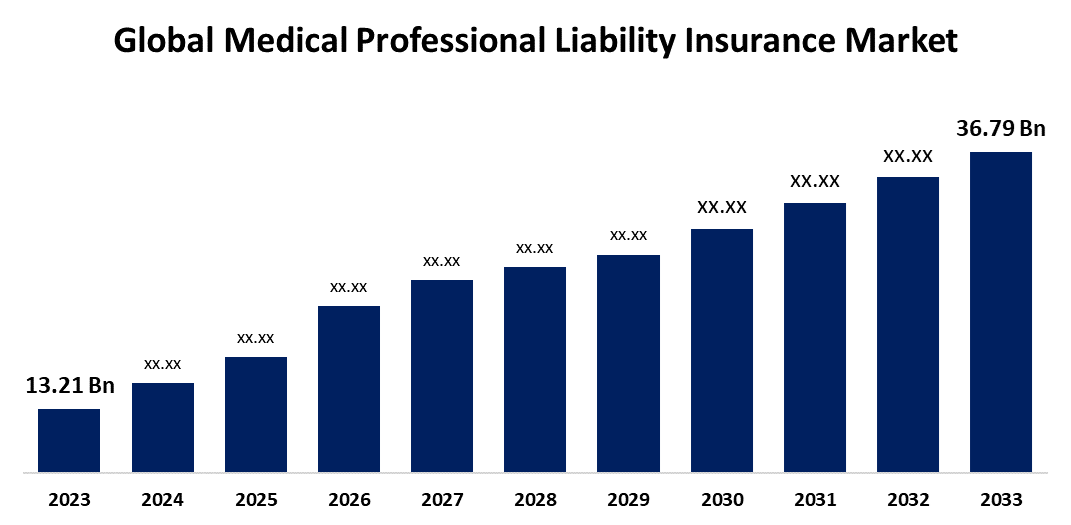

- The Global Medical Professional Liability Insurance Market Size was estimated at USD 13.21 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 10.79% from 2023 to 2033

- The Worldwide Medical Professional Liability Insurance Market Size is Expected to Reach USD 36.79 Billion by 2033

- Asia-Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Medical Professional Liability Insurance Market Size is Expected to Cross USD 36.79 Billion by 2033, Growing at a CAGR of 10.79% from 2023 to 2033.

Market Overview

The global medical professional liability insurance market includes policies that protect healthcare professionals such as physicians, surgeons, nurses, and allied health providers from legal claims based on alleged malpractice, negligence, or errors in medical judgment. These policies typically cover legal defense fees, settlements, and damages resulting from patient lawsuits. The global medical professional liability insurance market offers numerous growth opportunities. Telemedicine and digital health advancements have broadened the scope of liability, resulting in a demand for virtual care-specific insurance products. Emerging markets, particularly Asia-Pacific and Latin America, are experiencing rapid healthcare sector expansion, resulting in higher insurance penetration. Furthermore, the integration of artificial intelligence and machine learning in healthcare is introducing new risk management tools, which improve insurers' ability to assess and mitigate risks.

Report Coverage

This research report categorizes the medical professional liability insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the medical professional liability insurance market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the medical professional liability insurance market.

Medical Professional Liability Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 13.21 Billion |

| Forecast Period: | 2022 - 2033 |

| Forecast Period CAGR 2022 - 2033 : | 10.79% |

| 2033 Value Projection: | USD 36.79 Billion |

| Historical Data for: | 2019 - 2023 |

| No. of Pages: | 237 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Claim Type, By Distribution Channel, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Berkshire Hathaway Specialty Insurance, Zurich Insurance Group, Travelers Insurance, Chubb Limited, ProAssurance Corporation, NORCAL Mutual Insurance Company, CNA Financial Corporation, The Doctors Company, Coverys, MedPro Group, Allied World Assurance Company Holdings, AG, Liberty Mutual Insurance, AXA XL, MagMutual Insurance Company, ISMIE Mutual Insurance Company and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Several key factors are driving the expansion of the medical professional liability insurance market. The growing frequency of medical malpractice claims, combined with rising healthcare costs, has increased the need for comprehensive liability coverage. Furthermore, the expansion of healthcare services and specialties has created new areas of risk, necessitating specialized insurance products. Regulatory changes and legal reforms in different regions also have an impact on insurance requirements and coverage terms. Furthermore, increasing awareness among healthcare professionals of the importance of liability insurance for financial and career security is helping to drive market growth. Technological advancements, such as the use of electronic health records and telemedicine, have created new complexities and potential liabilities, increasing the demand for comprehensive insurance solutions.

Restraining Factors

Despite its expansion, the medical professional liability insurance market faces numerous challenges. Rising premiums, particularly in high-risk specialties and litigious regions, can be difficult for healthcare providers to manage. Furthermore, the complexities of insurance policies and the variation in coverage terms can cause confusion and potential gaps in protection.

Market Segmentation

The medical professional liability insurance market share is classified into claim type and distribution channel.

- The surgical errors segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the claim type, the medical professional liability insurance market is divided into medication errors, surgical errors, misdiagnosis or delayed diagnosis, childbirth injuries, and others. Among these, the surgical errors segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Surgical errors are among the most common and costly claims in medical malpractice insurance, owing to the complexity and risks associated with surgeries. As medical advancements progress, the complexity of procedures grows, increasing the likelihood of errors, driving demand for liability coverage.

- The agents and brokers segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe.

Based on the distribution channel, the medical professional liability insurance market is divided into agents and brokers, direct response, banks, and others. Among these, the agents and brokers segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe. This dominance stems from the personalized service and expert advice provided by agents and brokers, who assist healthcare professionals in navigating the complexities of insurance coverage, claims, and premiums. Agents and brokers play an important role in tailoring insurance policies to the specific needs of healthcare providers, fostering trust and long-term relationships, which has contributed to this distribution channel's consistent growth and dominance in the market.

Regional Segment Analysis of the Medical Professional Liability Insurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the medical professional liability insurance market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the medical professional liability insurance market over the predicted timeframe. This is primarily due to well-established healthcare systems, high rates of medical malpractice claims, and strong regulatory frameworks in countries such as the United States and Canada. The growing number of healthcare professionals, combined with rising litigation rates and awareness of malpractice risks, is driving up demand for medical professional liability insurance in the region. Furthermore, the prevalence of specialized insurance products, as well as the significant presence of leading insurance providers, helps to solidify North America's market leadership.

Asia-Pacific is expected to grow at the fastest CAGR of the medical professional liability insurance market during the forecast period. This growth is being driven by rapid healthcare sector expansion, rising healthcare standards, and increased awareness of medical malpractice risks in emerging markets such as China, India, and Japan. Furthermore, the growing number of healthcare professionals, modernization of healthcare infrastructure, and increased adoption of insurance policies in these countries all contribute to the rapid expansion of the Asia-Pacific medical professional liability insurance market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the medical professional liability insurance market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Berkshire Hathaway Specialty Insurance

- Zurich Insurance Group

- Travelers Insurance

- Chubb Limited

- ProAssurance Corporation

- NORCAL Mutual Insurance Company

- CNA Financial Corporation

- The Doctors Company

- Coverys

- MedPro Group

- Allied World Assurance Company Holdings, AG

- Liberty Mutual Insurance

- AXA XL

- MagMutual Insurance Company

- ISMIE Mutual Insurance Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the medical professional liability insurance market based on the below-mentioned segments:

Global Medical Professional Liability Insurance Market, By Claim Type

- Medication Errors

- Surgical Errors

- Misdiagnosis or Delayed Diagnosis

- Childbirth Injuries

- Others

Global Medical Professional Liability Insurance Market, By Distribution Channel

- Agents and Brokers

- Direct Response

- Banks

- Others

Global Medical Professional Liability Insurance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the medical professional liability insurance market over the forecast period?The medical professional liability insurance market is projected to expand at a CAGR of 10.79% during the forecast period.

-

2. What is the market size of the medical professional liability insurance market?The Global Medical Professional Liability Insurance Market Size is Expected to Grow from USD 13.21 Billion in 2023 to USD 36.79 Billion by 2033, at a CAGR of 10.79% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the medical professional liability insurance market?North America is anticipated to hold the largest share of the medical professional liability insurance market over the predicted timeframe.

Need help to buy this report?