Global Medical Isotopes Market Size, Share, and COVID-19 Impact Analysis, By Type (Stable Isotopes, and Radioisotopes), By Application (Diagnostic, and Nuclear Therapy), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Medical Isotopes Market Insights Forecasts to 2035

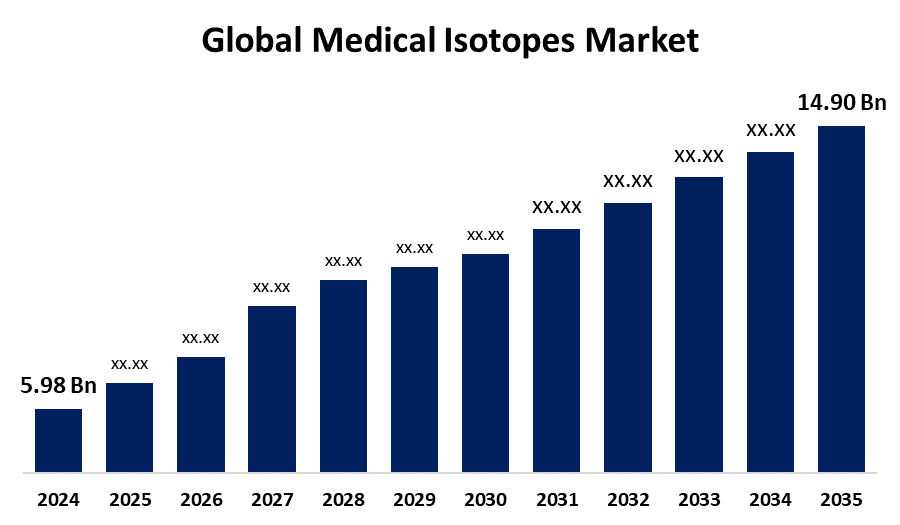

- The Global Medical Isotopes Market Size Was Estimated at USD 5.98 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.65% from 2025 to 2035

- The Worldwide Medical Isotopes Market Size is Expected to Reach USD 14.90 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Medical Isotopes Market size was Worth around USD 5.98 Billion in 2024 and is Predicted to Grow to around USD 14.90 Billion by 2035 with a compound annual growth rate (CAGR) of 8.65% from 2025 and 2035. The need for medical isotopes is mostly driven by the rising incidence of cardiovascular and cancer disorders around the world. In order to diagnose, stage, and treat these illnesses, isotopes are important.

Market Overview

The manufacturing, distribution, and use of radioactive and stable isotopes for nuclear therapy, diagnostic imaging, and medical research are all included in the medical isotopes market. These isotopes are essential for targeted radionuclide treatments, Positron Emission Tomography (PET), and Single Photon Emission Computed Tomography (SPECT). Integration improves patient convenience and early intervention while also making healthcare more widely available, particularly for people residing in remote or undeveloped areas as a result, the market for medical isotopes has the potential to expand. For Instance, in July 2023, Canada announced that the Canadian Medical Isotope Ecosystem (CMIE) has been established. Initiatives to create, develop, and market radiopharmaceuticals and medical isotopes are receiving up to CAD35 million in funding over five years.

Government investments in infrastructure for isotope production and funding for nuclear medical research and development are driving the medical isotopes market growth. The aging of the global population is increasing the demand for healthcare services, especially nuclear medicine treatments employing medicinal isotopes. Growing patient awareness of radiation and radiation therapy is the primary driver of the medical isotopes market.

Report Coverage

This research report categorizes the medical isotopes market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the medical isotopes market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the medical isotopes market.

Global Medical Isotopes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.98 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.65% |

| 2035 Value Projection: | USD 14.90 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Region, By Application and COVID-19 Impact Analysis |

| Companies covered:: | GE Healthcare, Nordion Inc., Curium, Mallinckrodt Pharmaceuticals, Jubilant Radiopharma, IBA Radiopharma Solutions, Eczacibasi-Monrol Nuclear Products, Northstar medical radioisotopes, LLC, Canadian Nuclear Laboratories (CNL), Isotopen Technologien München (ITM), and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The need for a range of medical isotopes is driven by ongoing developments in nuclear medicine, such as the creation of novel radiopharmaceuticals and imaging methods. The success of initiatives to make radiation therapy more accessible, such as increasing the hospital infrastructure or deploying mobile units, is higher when patients are aware of its benefits and availability. The increased availability exacerbates the need for medical isotopes, which propels the medical isotopes market. In such individualized methods, isotopes contribute to the delivery of accurate and focused treatment which drives the medical isotope market. The market is growing as a result of more medical isotopes being used for therapy and diagnostics, particularly in the treatment of cancer.

Restraining Factors

Governments might implement stricter laws and inspection protocols, which would further complicate the market and increase operating costs for medical isotope suppliers can restricts the medical isotopes market.

Market Segmentation

The medical isotopes market share is classified into type and application.

- The radioisotopes segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the medical isotopes market is divided into stable isotopes and radioisotopes. Among these, the radioisotopes segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The efficiency and availability of creating a variety of radioisotopes have grown due to advancements in reactor and cyclotron technologies, ensuring a steady supply to meet mounting demand. Research and development initiatives continue to produce new radiopharmaceuticals that improve the effectiveness of medicinal and diagnostic procedures.

- The diagnostic segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the medical isotopes market is divided into diagnostic and nuclear therapy. Among these, the diagnostic segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. As chronic diseases like cancer, heart disease, and neurological disorders become more common, there is an increasing demand for diagnostic imaging testing. Medical isotopes known as radiopharmaceuticals are essential for the early detection, management, and monitoring of a number of diseases.

Regional Segment Analysis of the Medical Isotopes Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the medical isotopes market over the predicted timeframe.

Get more details on this report -

North America anticipated to hold the largest share of the medical isotopes market over the predicted timeframe. In North America, numerous public-private collaborations help in the discovery and production of medicinal isotopes. The market for medical isotopes in North America is expected to grow due to technical developments including hybrid imaging, the release of new radioisotopes for diagnosis, improvements in imaging methods, and the existence of major market participants. A major driver of the regional market's expansion is the rising incidence of chronic illnesses. Increased investment in industry research and initiatives is expected to boost the North American market.

Asia Pacific is expected to grow at a rapid CAGR in the medical isotopes market during the forecast period. The medical isotopes market in Asia Pacific is the benefits of nuclear medicine are becoming more widely recognized among patients and healthcare providers. A more competent workforce is being produced by the growth of training courses and seminars on the application of medical isotopes for diagnosis and treatment. Increased use is being encouraged by public awareness efforts on nuclear medicine's potential for early chronic illness diagnosis and treatment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the medical isotopes market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GE Healthcare

- Nordion Inc.

- Curium

- Mallinckrodt Pharmaceuticals

- Jubilant Radiopharma

- IBA Radiopharma Solutions

- Eczacibasi-Monrol Nuclear Products

- Northstar medical radioisotopes, LLC

- Canadian Nuclear Laboratories (CNL)

- Isotopen Technologien München (ITM)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2025, YAP Therapeutics, Inc. and NorthStar Medical Radioisotopes, LLC collaborated to research and manufacture radiopharmaceuticals for the treatment of cancer and other chronic illnesses.

- In December 2024, Actinium-225 (Ac-225), a therapeutic medical radioisotope, has been supplied by NorthStar Medical Radioisotopes, LLC, a global leader in the development, manufacturing, and marketing of radiopharmaceuticals used for therapeutic applications and medical imaging, and Ariceum Therapeutics, a private biotech company creating radiopharmaceutical products for the diagnosis and treatment of some difficult-to-treat cancers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the medical isotopes market based on the below-mentioned segments:

Global Medical Isotopes Market, By Type

- Stable Isotopes

- Radioisotopes

Global Medical Isotopes Market, By Application

- Diagnostic

- Nuclear Therapy

Global Medical Isotopes Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the medical isotopes market over the forecast period?The global medical isotopes market is projected to expand at a CAGR of 8.65% during the forecast period.

-

2. What is the market size of the medical isotopes market?The global medical isotopes market size is expected to grow from USD 5.98 Billion in 2024 to USD 14.90 Billion by 2035, at a CAGR of 8.65% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the medical isotopes market?North America is anticipated to hold the largest share of the medical isotopes market over the predicted timeframe.

Need help to buy this report?