Global Medical Implants Precision Machining Services Market Size, Share, and COVID-19 Impact Analysis, By Service Type (5-axis Precision Machining Service, 6-axis Precision Machining Service, and Others), By Implant Type (Orthopedic Implants, Dental Implants, and Neurological Implants), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Medical Implants Precision Machining Service Market Insights Forecasts To 2035

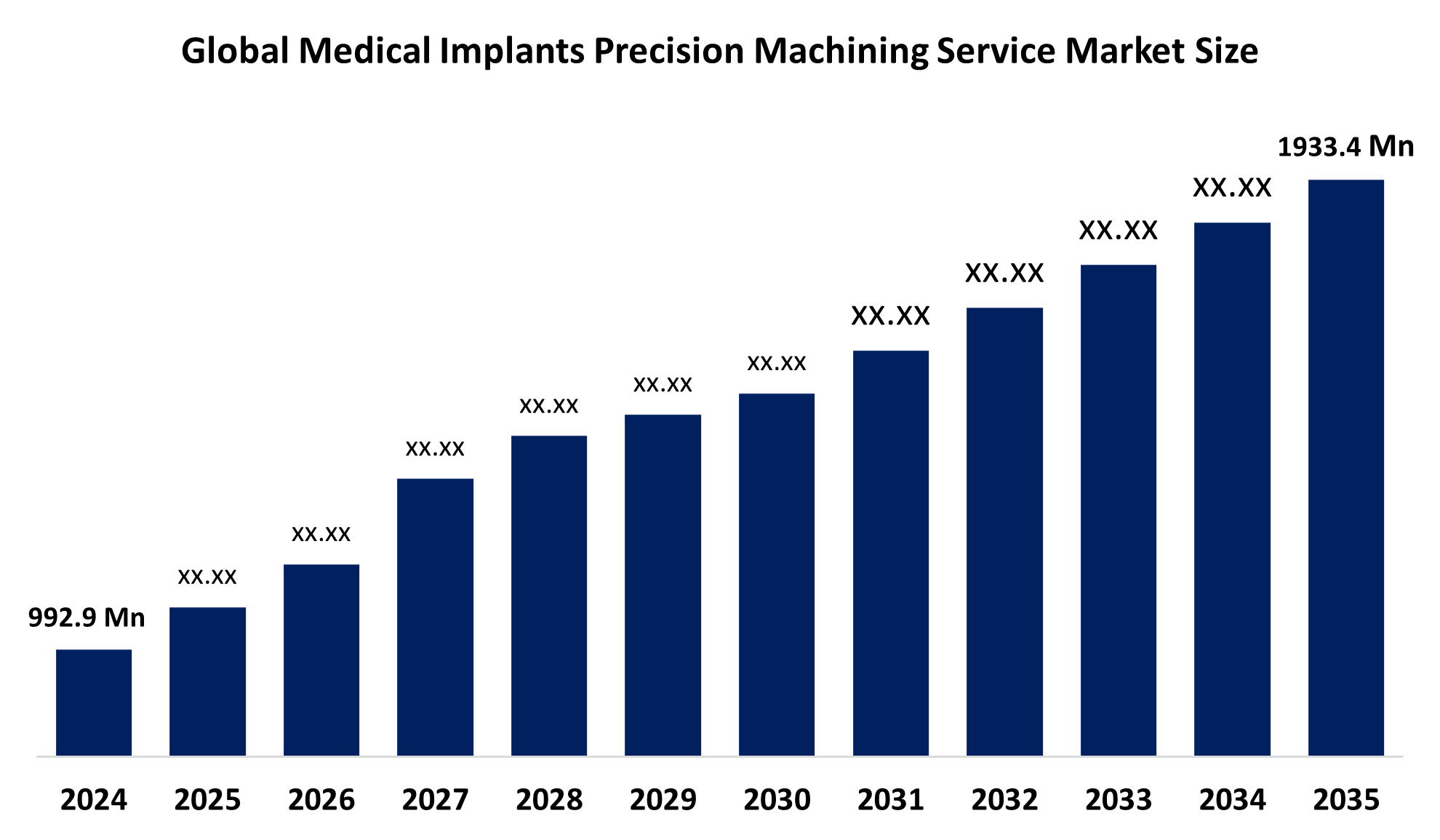

- The Global Medical Implants Precision Machining Service Market Size Was Estimated at USD 992.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.25% from 2025 to 2035

- The Worldwide Medical Implants Precision Machining Service Market Size is Expected to Reach USD 1933.4 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Medical Implants Precision Machining Service Market size was worth around USD 992.9 Million in 2024 and is Predicted to grow to around USD 1933.4 Million by 2035 with a compound annual growth rate (CAGR) of 6.25% from 2025 to 2035. Market expansion is driven by a growing older population requiring implants for long-term illnesses, advances in medical technology that allow for sophisticated, bespoke devices, increased demand for minimally invasive procedures, and heightened worldwide health awareness. Accurate machining for producing the intricately detailed, high-precision parts needed for these sophisticated implantable medical devices is key.

Global Medical Implants Precision Machining Service Market Analysis

- 2024 Market Size: USD 992.9 Million

- 2035 Projected Market Size: USD 1933.4 Million

- CAGR (2025-2035): 6.25%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The medical implants precision machining service market refers to the contract manufacturing of implantable medical device components, such as orthopedic, dental, cardiovascular, and neurological implants, by applying high-precision machining technologies, including CNC, multi-axis machining, and fine milling. The services guarantee adherence to rigorous biocompatibility, dimensional, surface finish, and regulatory requirements. Examples of applications include hip and knee replacements, dental abutments, spinal cages, stents, and pacemaker leads. Market expansion is fueled by an aging population, increasing chronic disease incidence, and patient-specific implant demand. Technological innovation in 5-axis and 6-axis machining, next-generation biomaterials, and the trend towards less invasive procedures also stimulate demand.

Emerging markets, hybrid manufacturing, next-generation surface treatments, automation, AI-based quality control, and custom, small-volume implant demand in changing healthcare systems offer opportunities. Key players include precision machining companies and contract manufacturers such as RapidDirect, Impro, Zintilon Technology, Proto Labs, Owens Industries, ARCH Medical Solutions, Donatelle, Xometry, and so on. Supported by PLI schemes and Make in India, India is very quickly enhancing its medical device manufacturing. Now in the top 20 world markets, it seeks to capture 10% of world share by 2030 with a target of US$50 billion. Innovation and effective policies are powering this healthcare manufacturing shift.

Key Market Insights

- North America is expected to account for the largest share in the medical implants precision machining service market during the forecast period.

- In terms of service type, the 5-axis precision machining service segment is projected to lead the medical implants precision machining service market throughout the forecast period

- In terms of implant type, the dental implants segment captured the largest portion of the market

Medical Implants Precision Machining Service Market Trends

- Rising preference for minimally invasive surgical procedures boosts market growth.

- A growing aging population drives increased demand for medical implants.

- Advancements in medical technology enable more complex and personalized implants.

- Increasing global healthcare awareness supports greater implant adoption.

- Precision machining ensures high accuracy and quality in implant components.

Report Coverage

This research report categorizes the medical implants precision machining service market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the medical implants precision machining service market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the medical implants precision machining service market.

Driving factors

Major drivers of the medical implants precision machining industry are an aging population, advancing technology, minimally invasive procedures, increasing awareness about healthcare, and the need for customized implants drive growth. The aging population boosts demand for implants to correct age-related and chronic diseases. Advancing technology allows for more complex, accurate, and customized implants to be created. Minimally invasive procedures are favored due to less pain and quicker recovery, which results in increased use of implants. Increased healthcare awareness makes patients seek more advanced treatments.

Restraining Factor

High prices, stringent laws, supply chain disruptions, technological sophistication, and lack of skilled labor top the restraining forces of the medical implants precision machining industry. High prices restrict affordability and uptake, and stringent laws slow down approvals and raise compliance costs. Technological sophistication demands sophisticated tools and expertise, and a lack of skilled workforce impedes effective precision machining and innovation in the industry.

Market Segmentation

The global medical implants precision machining service market is divided into service type and implant type.

Global Medical Implants Precision Machining Services Market, By Service Type:

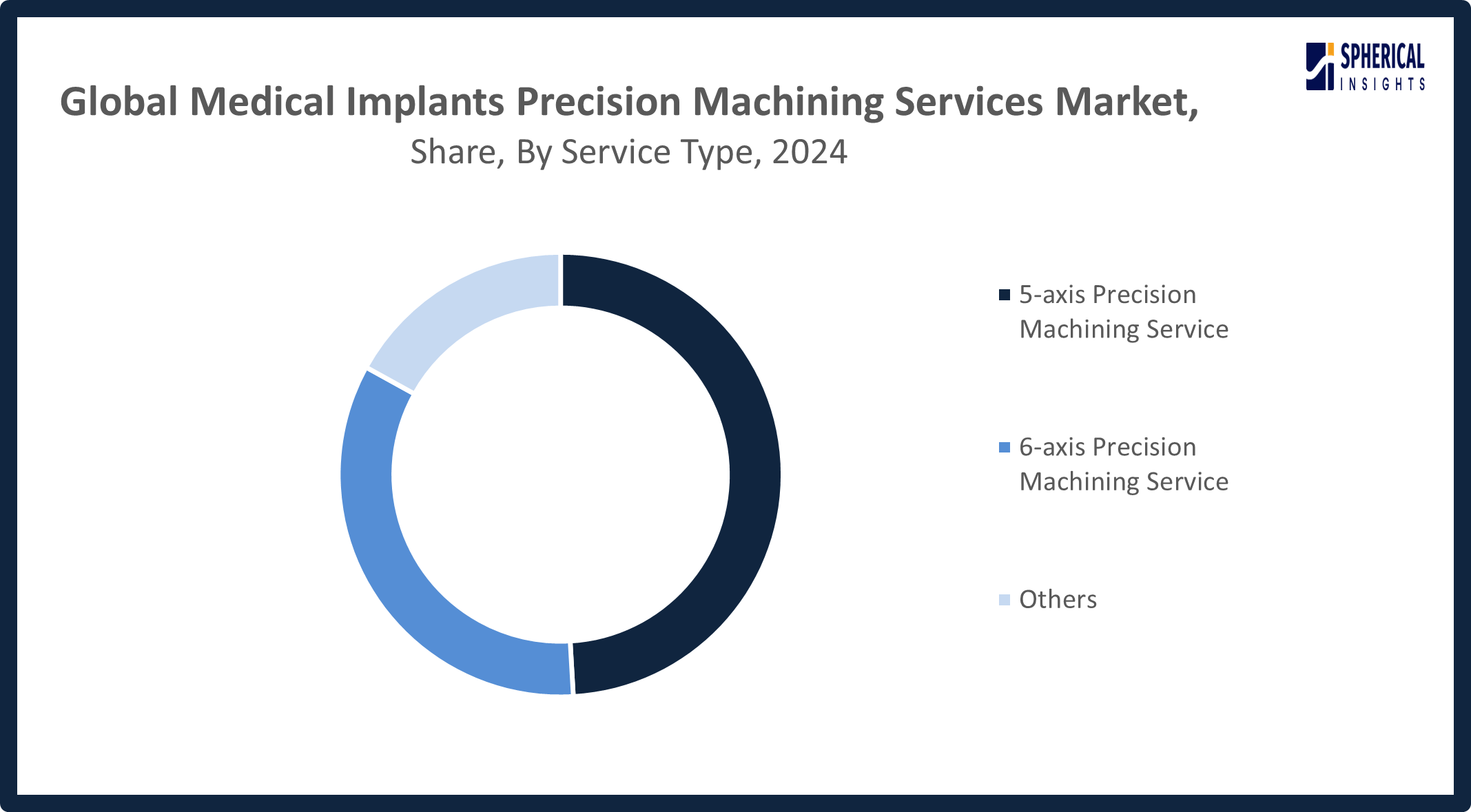

- The 5-axis precision machining service segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on service type, the global medical implants precision machining service market is segmented into 5-axis precision machining service, 6-axis precision machining service, and others. Among these, the 5-axis precision machining service segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment for 5-axis precision machining services is expected to command 49% of the market for medical implants precision machining. This is due to its capacity for making complex geometries with single-setup efficiency and higher-quality surface finishes. As the need for advanced, high-precision implants increases, 5-axis machining remains at the center of high-tech medical device manufacturing.

Get more details on this report -

The 6-axis precision machining service segment in the medical implants precision machining service market is expected to grow at the fastest CAGR over the forecast period. The 6-axis precision machining segment is anticipated to grow around 34% based on its increased flexibility, capability to machine intricate implant shapes, decreased setup times, and higher accuracy, which satisfies the increasing demand for complex, high-precision medical implants.

Global Medical Implants Precision Machining Services Market, By Implant Type:

- The dental implants segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on implant type, the global medical implants precision machining service market is segmented into orthopedic implants, dental implants, and neurological implants. Among these, the dental implants segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dental implants category is poised to dominate the medical implants precision machining service market, capturing 38.3% of demand. The reasons for this growth include growing demand for restorative and cosmetic dental care, demand for intricate geometries, and growing dental awareness across the world. Developments in digital dentistry and patient-specific solutions further enhance demand for accurate machining services.

The orthopedic implants segment in the generative AI in telecom market is expected to grow at the fastest CAGR over the forecast period. The orthopedic implants segment within the generative AI in telecom market is poised to grow at the fastest rate due to surging demand for innovative implant technology and AI-based manufacturing solutions, accounting for a 34.4% market share.

Regional Segment Analysis of the Global Medical Implants Precision Machining Service Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Medical Implants Precision Machining Service Market Trends

North America is expected to hold the largest share of the global medical implants precision machining service market over the forecast period.

North America accounts for approximately 40% of the maximum share in the global medical implants precision machining service market throughout the forecast period, owing to its established healthcare system, high rate of adoption of sophisticated medical technologies, and robust presence of top market players. High investments in research and development activities, combined with a growing geriatric population and rising need for complex, high-precision implants, also assist the region in remaining dominant in the global market.

U.S. Medical Implants Precision Machining Service Market Trends

The U.S. medical implants precision machining industry is anticipated to expand at a 6.02% CAGR (2025-2035), fueled by an aging population, high health expenditures, growing implant demand, sophisticated surgical technologies, and ongoing innovation in sophisticated, high-precision implant production.

Asia Pacific Medical Implants Precision Machining Service Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the medical implants precision machining service market during the forecast period. Asia Pacific is rapidly growing CAGR during the forecast period, capturing approximately 30% of the market share, in the medical implants precision machining service market due to Improving healthcare infrastructure at a rapid pace, increased healthcare expenditure, and an increasing aging population are the primary drivers. Moreover, heightened awareness of innovative medical treatments, growing medical tourism, and government policies such as India's National Medical Devices Policy and China's Healthy China 2030 are driving market growth. The lower cost of manufacturing in the region, along with increasing demand for high-precision patient-specific implants, is drawing worldwide manufacturers, turning the Asia Pacific into a dynamic and fast-growing market.

India Medical Implants Precision Machining Service Market Trends

India's precision machining for the medical implants market is expected to grow at a 6.0% CAGR (2025–2035), led by increasing healthcare needs, medical tourism, lifestyle-related diseases, low-cost manufacturing, availability of skilled labor, and increasing usage of advanced machining technologies, drawing worldwide medical device manufacturers.

China Medical Implants Precision Machining Service Market Trends

China's medical implants precision machining industry is expected to expand at a 6.1% CAGR (2025–2035) with a push from expanding healthcare, an aging population, increasing chronic ailments, cost-efficient production, and local application of high-tech processes, making China a worldwide business leader.

Japan Medical Implants Precision Machining Service Market Trends

Japan's medical implants precision machining industry is anticipated to rise at a 4.7% CAGR during 2025-2035 due to an aging population, increasing implant demand, and innovative manufacturing technology. Robotics and AI adoption further solidify Japan's position as a regional powerhouse in precision machining.

Europe Medical Implants Precision Machining Service Market Trends

The European medical implants precision machining services (PMS) market is expected to develop at a CAGR of 5.7% during the forecast period, fueled by sophisticated healthcare infrastructure, increasing need for orthopedic and dental implants, and growing geriatric population. High-precision manufacturing is fuelled by stringent regulatory requirements, while robust R&D spending and uptake of cutting-edge machining technologies, such as automation and AI, also reinforce market growth in major countries such as Germany, France, and the UK.

Germany Medical Implants Precision Machining Service Market Trends

The precision machining market for medical implants in Germany is expected to expand at a 5.6% CAGR (2025-2035), stimulated by growing implant demand, technologically advanced healthcare infrastructure, robust innovation, and capabilities in the manufacture of intricate, high-quality, customized medical implants.

U.K. Medical Implants Precision Machining Service Market Trends

The UK medical implants precision machining industry is also forecasted to have a 5.2% CAGR (2025-2035) on account of increasing orthopedic and dental implant demand, improved healthcare infrastructure, increased demand for customized implants, and high medical R&D with high global market competitiveness.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global medical implants precision machining service market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Medical Implants Precision Machining Service Market Include

- Impro

- Proto Labs, Inc

- RapidDirect

- Donatelle Tamshell

- Xometry

- Owens Industries

- ZOLLERN

- Zintilon Technology

- IPE Group

- Elimold

- McCormick Industries

- ARCH Medical Solutions Corp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In October 2024, Shenzhen Rapid Direct Co., Ltd. launched its Custom Online CNC Machining Services, offering instant quotes for metal and plastic parts, rapid prototyping to production, with 100+ materials and 60 surface finishes for unmatched customization.

- In May 2024, Dallas-based Precision Aerospace Holdings LLC, a leading aerospace and defense components manufacturer, acquired Owens Machine and Tool Company, following its formation through a partnership between CIC Partners and Juniper Capital Management.

- In October 2023, Tamshell is an AS9100 and ISO 13485 certified precision CNC machine shop specializing in high-performance plastics, aluminum, brass, and steel. With expertise in medical device manufacturing, we deliver quality, compliant components for the industry.

- In November 2022, ARCH Medical Solutions acquired Alpha Manufacturing & Design to enhance innovation and meet growing customer demands. Alpha specializes in complex orthopedic surgical devices, complementing ARCH’s precision manufacturing across orthopedics, robotics, dental, and life sciences markets.

- In July 2022, ARCH Medical Solutions acquired MedTorque, a precision manufacturer of orthopedic instruments and implants with facilities in Wisconsin and Illinois. MedTorque excels in spinal, extremity, joint reconstruction, trauma, and robotic surgery applications, previously owned by private equity firm Parallel49 Equity.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the medical implants precision machining service market based on the following segments:

Global Medical Implants Precision Machining Service Market, By Service Type

- 5-axis Precision Machining Service

- 6-axis Precision Machining Service

- Others

Global Medical Implants Precision Machining Service Market, By Implant Type

- Orthopedic Implants

- Dental Implants

- Neurological Implants

Global Medical Implants Precision Machining Service Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the medical implants precision machining service market over the forecast period?The global medical implants precision machining service market is projected to expand at a CAGR of 6.25% during the forecast period.

-

2. What is the medical implants precision machining service market?The medical implants precision machining service market involves manufacturing highly accurate, complex implant components using advanced machining techniques to meet strict medical standards and patient-specific needs.

-

3. What is the market size of the medical implants precision machining service market?The global medical implants precision machining service market size is expected to grow from USD 992.9 million in 2024 to USD 1933.4 million by 2035, at a CAGR 6.25% of during the forecast period 2025-2035.

-

4. Which region holds the largest share of the medical implants precision machining service market?North America is anticipated to hold the largest share of the medical implants precision machining service market over the predicted timeframe.

-

5. What factors are driving the growth of the medical implants precision machining service market?Growth in the medical implants precision machining service market is driven by an aging population, rising chronic diseases, demand for custom implants, technological advancements, and increased healthcare investments globally.

-

6. What are the main challenges restricting the wider adoption of medical implants precision machining service market?Key challenges include high production costs, strict regulatory requirements, skilled labor shortages, and limited access to advanced machining technologies in some regions.

-

7. What are the market trends in the medical implants precision machining service market?The medical implants precision machining service market is seeing rising demand for multi‑axis machining, custom implants, biocompatible materials, automation/AI‑based quality control, hybrid manufacturing, and sustainability initiatives.

-

8. Who are the top 10 companies operating in the global medical implants precision machining service market?The major players operating in the medical implants precision machining service market are Impro, Proto Labs, Inc., RapidDirect, Donatelle Tamshell, Xometry, Owens Industries, ZOLLERN, Zintilon Technology, IPE Group, Elimold, McCormick Industries, ARCH Medical Solutions Corp, and Others.

Need help to buy this report?