Global Medical Furniture Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Beds, Cabinets, Chairs, Lockers, and Others), By End User (Hospitals, Ambulatory Surgical Centers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Medical Furniture Market Size Insights Forecasts to 2035

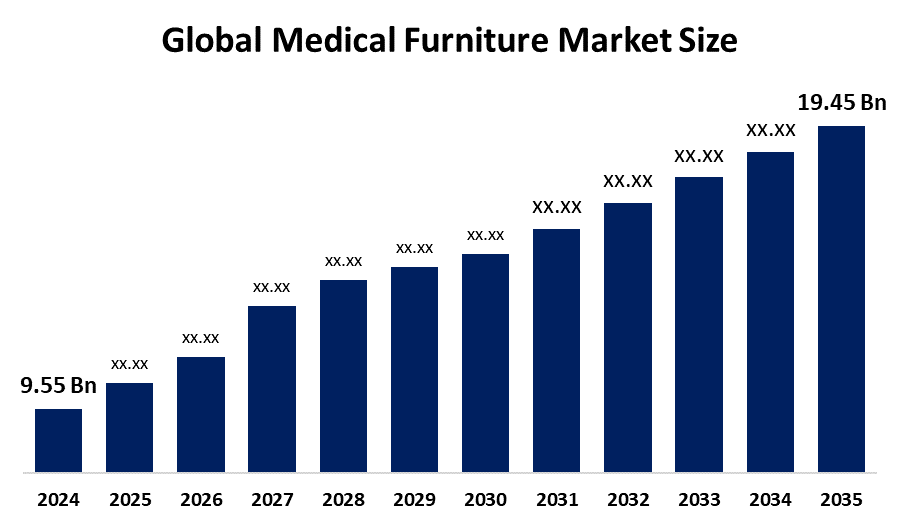

- The Global Medical Furniture Market Size Was Estimated at USD 9.55 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.68% from 2025 to 2035

- The Worldwide Medical Furniture Market Size is Expected to Reach USD 19.45 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Medical Furniture Market Size was worth around USD 9.55 Billion in 2024 and is predicted to Grow to around USD 19.45 Billion by 2035 with a compound annual growth rate (CAGR) of 6.68% from 2025 and 2035. The market for medical furniture has several opportunities to grow due to a growing healthcare infrastructure investment, which is allowing the expansion and modernization of hospitals, clinics, ambulatory care centers, and home care settings. An aging global population and an increasing burden of chronic diseases are driving up demand for long-term care and specialized furniture.

Market Overview

Medical furniture can be defined as a movable article that is primarily used by every healthcare centre, like hospitals, clinics, operating theatres, and nursing homes, to assist patients and visitors. Different types of medical furniture include stretchers, medical beds, medical carts, tables, and chairs for bedridden individuals. According to reports published by the World Health Organization, in June 2021, traffic crashes caused the death of over 1.2 million individuals around the world. An estimated 20-50 million population sustain non fatal injuries from accidents that could leave them permanently disabled. Road accidents are becoming increasingly common around the world, and they are causing serious damage to people's lives that needs to be valued. The medical furniture industry is very fragmented due to a number of local and international companies operating in the many segments of this market. However, many marketers are opening doors for the market of difficult medical equipment to bring benefits to the work and ease of life of medical staff and patients. For instance, in August 2022, Doze and MidMark.pvt. Ltd., two of the leading companies in medical furniture in India, launched a connected bed platform to integrate and collect patient monitor systems in non ICU hospital beds.

In India, makers of medical equipment, including hospital furniture components, can receive financial incentives through the Production Linked Incentive Scheme for Medical Equipment, which was introduced in 2020. Targeting industries including radiography, implants, and cancer care, it has an investment of Rs. 3,420 crore. The program seeks to boost home production and lessen reliance on imports. Furthermore, by offering funds of up to Rs. 100 crore per park, the Scheme for Promotion of Medical Device Parks encourages the creation of Medical Device Parks. These parks are intended to provide shared infrastructure, which lowers production costs and promotes the expansion of businesses that produce medical furnishings.

Report Coverage

This research report categorizes the medical furniture market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the medical furniture market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub segment of the medical furniture market.

Global Medical Furniture Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.55 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.68% |

| 2035 Value Projection: | USD 19.45 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 267 |

| Tables, Charts & Figures: | 135 |

| Segments covered: | By Product Type, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Biomedical Solutions, Getinge, GPC Medical Limited, Herman Miller, Hill-Rom Holdings, Invacare Corporation, J&J Medical Specialties LLC, Kovonax, LINET, Met Lak, Promotal, Skytron, STERIS Corporation, Stiegelmeyer, Stryker Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The medical furniture market is driven by the rising incidence of chronic diseases, such as diabetes, heart disease, and cancer, which is likely to bolster demand for medical furniture so that patients receive the necessary treatment from trained medical professionals. For instance, the National Diabetes Statistics Report indicates that about 11.4 percent of Americans are diagnosed with the disease. Hospitalizations and medical emergencies during the COVID pandemic contributed to the industry as well, which has led to recent spikes. The global medical furniture market is further supported by medical faculties focusing on enhancing the examination and diagnosis field.

Restraining Factors

The medical furniture market is restricted by factors like the price and ease of access these products provide consumers, almost every manufacturer is adopting these types of products. Refurbished products are used in healthcare institutions because of high demand and constant movement. With many hospital administration practices purchasing refurbished products to meet patient demand, the market.

Market Segmentation

The medical furniture market share is classified into product type and end user.

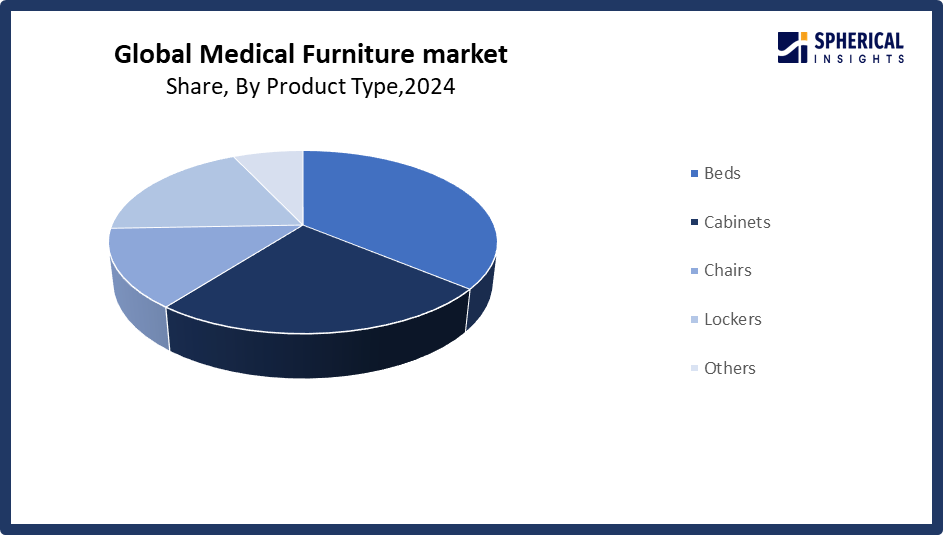

- The beds segment dominated the market in 2024, accounting for approximately 46.78% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the medical furniture market is divided into beds, cabinets, chairs, lockers, and others. Among these, the beds segment dominated the market in 2024, accounting for approximately 46.78% and is projected to grow at a substantial CAGR during the forecast period. The segment is driven by digital hospitals, which also highlight beds by incorporating smart bells, such as built in patient lift systems, bed exit alarms, and automatic weight sensing. One example of a large system connecting clinical return on investment to purchasing furniture was Prisma Health's USD 41 million purchase of 1,500 smart beds with both fall protection and with Hercules repositioning. The medical furniture market for five beds will continue to expand as developing nations bypass traditional ICU furniture, moving directly to electric ICUs.

Get more details on this report -

- The hospitals segment accounted for the largest share in 2024, accounting for approximately 63.25% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the medical furniture market is divided into hospitals, ambulatory surgical centers, and others. Among these, the hospitals segment accounted for the largest share in 2024, accounting for approximately 63.25% and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to large systems standardizing bed fleets, consolidating purchasing power, and developing multi year replacement roadmaps. Recent transformation budgets have focused on ICU expansion and behavioral health wings, and mother baby units that can deliver specific seating, safe cabinetry, and casework that can endure negative pressure. Comfort and aesthetic value are by far 86% of respondents representing facilities, since patient experience reviews are a component of reimbursement.

Regional Segment Analysis of the Medical Furniture Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share, representing nearly 7.53% of the medical furniture market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share, representing nearly 7.53% of the medical furniture market over the predicted timeframe. In the North American market, the market is rising due to the presence of publicly provided healthcare infrastructures and facilities, especially in industrialized nations like the United States of America and Canada. The healthcare system in these countries is usually supported by favorable healthcare policies designed for workers in the public and commercial sectors and their families. The government is also increasingly bringing in legislation to support older populations in the event of a medical emergency, and this is expected to drive the medical furniture market in North America. About 16.9% of Americans are over 65, according to figures provided by the World Bank in 2021. This is expected to rise to up to 22% in the next 18 years.

The United States leads due to its high healthcare spending, robust infrastructure, robust regulatory backing, aging and chronically ill population, and early adoption of cutting edge medical furniture technologies.

Asia Pacific is expected to grow at a rapid CAGR, representing nearly 7% in the medical furniture market during the forecast period. The Asia Pacific area has a thriving market for medical furniture because it has all the top companies in the region present and driving market growth. Companies are constantly coming out with new products to improve the hospital facility infrastructure. One of the best funded alternative countries for hospital infrastructure has been India in recent years. For example, the Telangana government has set aside USD 270.5 million to build the state's super specialty hospitals and medical colleges, in accordance with the financial announcement made in 2023.

China dominates the Asia Pacific medical furniture market due to its sizable, aging population, high prevalence of chronic illnesses, significant investments in healthcare infrastructure, expansion of private institutions, and robust, low cost local manufacturing capabilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the medical furniture market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Biomedical Solutions

- Getinge

- GPC Medical Limited

- Herman Miller

- Hill-Rom Holdings

- Invacare Corporation

- J&J Medical Specialties LLC

- Kovonax

- LINET

- Met Lak

- Promotal

- Skytron

- STERIS Corporation

- Stiegelmeyer

- Stryker Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2025, Paramount Bed launched the Arius Series ICU Bed featuring the industry first ParaDrive transport assist function, designed to reduce physical burden on healthcare workers and improve operational efficiency during patient transport.

- In April 2025, Saikang launched its C8c Smart Electric Hospital Bed and Z7Z Smart Bed at CMEF 2025. Key features include quick release bed boards for easy cleaning, adaptive bed sensing & adjustment, integration with hospital devices, and data driven decision support.

- In February 2025, Stryker introduced the ProCeed hospital bed (outside the U.S. It emphasizes durability, safety, low bed height to reduce falls, features to reduce caregiver strain (like an extra central wheel for better steering), and two headboard options.

- In November 2024, MIGA Holdings LLC acquired Invacare's North American business to enhance market growth and operational optimization, leveraging CA Globals manufacturing and sales expertise to better serve regional customer needs.

- In December 2023, Godrej Interio expanded its offline presence in North India and opened 15 new stores in the northern market. At present, the brand has a market share of 18 per cent in the organized furniture sector.

- In July 2022, SKYTRON, LLC. partnered with Arthrex, a company focused on minimally invasive surgical technology, to offer a broad array of total room solutions designed to address the future needs and challenges of operative care facilities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the medical furniture market based on the below-mentioned segments:

Global Medical Furniture Market, By Product Type

- Beds

- Cabinets

- Chairs

- Lockers

- Others

Global Medical Furniture Market, By End User

- Hospitals

- Ambulatory Surgical Centers

- Others

Global Medical Furniture Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the medical furniture market over the forecast period?The global medical furniture market is projected to expand at a CAGR of 6.68% during the forecast period.

-

2. What is the market size of the medical furniture market?The global medical furniture market size is expected to grow from USD 9.55 Billion in 2024 to USD 19.45 Billion by 2035, at a CAGR of 6.68% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the medical furniture market?North America is anticipated to hold the largest share of the medical furniture market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global medical furniture market?Biomedical Solutions, Getinge, GPC Medical Limited, Herman Miller, Hill-Rom Holdings, Invacare Corporation, J&J Medical Specialties LLC, Kovonax, LINET, Met Lak, Promotal, Skytron, STERIS Corporation, Stiegelmeyer, Stryker Corporation, and Others.

-

5. What factors are driving the growth of the medical furniture market?The medical furniture market growth is driven by an aging population with more chronic diseases, increased government spending and policies to improve patient care, technological advancements, e.g., smart beds, IoT, ergonomics, and a growing focus on infection control standards, patient comfort, hygiene, and safety.

-

6. What are the market trends in the medical furniture market?The medical furniture market trends include smart and connected medical furniture, ergonomic and modular designs, infection control through antimicrobial surfaces, sustainable and eco-friendly materials, and expansion of healthcare infrastructure.

-

7. What are the main challenges restricting wider adoption of the medical furniture market?The medical furniture market trends include that limited funds are unable to purchase specialized, technologically integrated furniture due to its high initial cost, particularly in developing nations.

Need help to buy this report?