Global Medical Fluoropolymers Market Size, Share, and COVID-19 Impact Analysis, By Product (Ethylene Tetrafluoroethylene (ETFE), Polytetrafluoroethylene (PTFE), Polyvinylidene Fluoride, Fluoroelastomers, and Others), By Application (Medical Tubing, Catheters, Medical Bags, Drug Delivery Device, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Medical Fluoropolymers Market Size Insights Forecasts to 2035

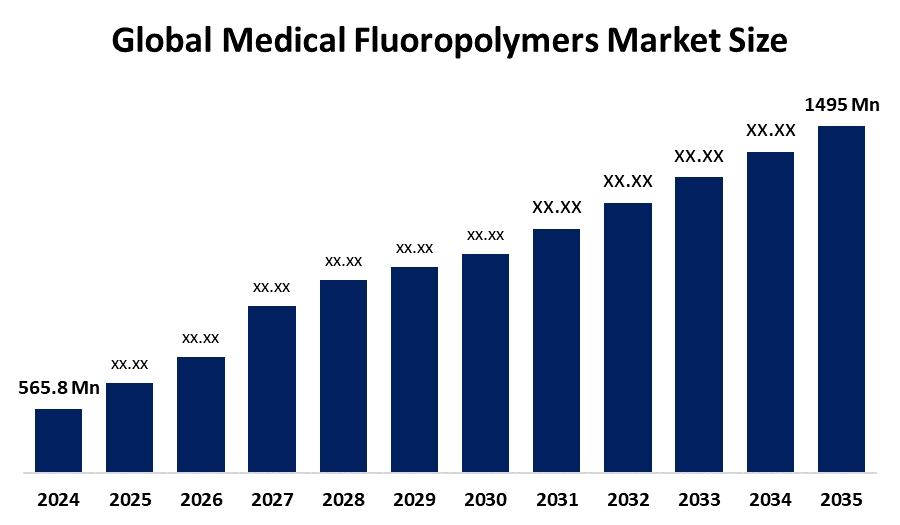

- The Global Medical Fluoropolymers Market Size Was Estimated at USD 565.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.23% from 2025 to 2035

- The Worldwide Medical Fluoropolymers Market Size is Expected to Reach USD 1495.0 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Medical Fluoropolymers Market Size was worth around USD 565.8 Million in 2024 and is predicted to Grow to around USD 1495.0 Million by 2035 with a compound annual growth rate (CAGR) of 9.23% from 2025 and 2035. The market for medical fluoropolymers has a number of opportunities to grow due to its increased applications in medical technology, increasing sustainability & regulatory requirements.

Market Overview

The global industry of medical fluoropolymers focused on fluorinated polymers used in healthcare applications such as medical devices, surgical instruments, and pharmaceutical packaging. Fluoropolymers, a type of polymer containing fluorine atoms, are vital for providing effective medical treatment for patients, particularly in the format of long-term interventions. Medical fluoropolymers have been used for coating medical devices and in the production of life-saving implants, tubes, and surgical tools. Further, they are commonly used in coating surgical instruments, creating implants & prosthetics, and producing tubes & catheters. There is ongoing research on fluoropolymers, including poly(tetrafluoroethylene) (PTFE) or poly(vinylidene difluoride) (PVDF), and the US Food and Drug Administration (FDA) has declared in August 2025 that PFAS (per- and polyfluoroalkyl substances) polymers in medical devices are safe and currently irreplaceable.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures and the strategic move to enhance operational flexibility and ensure a more reliable supply. For instance, in August 2025, the Chemours Company (Chemours), a global chemistry company with leading market positions in Thermal & Specialized Solutions (TSS), Titanium Technologies (TT), and Advanced Performance Materials (APM), announced the signing of strategic agreements with SRF Limited (SRF), a diversified, chemical-based multi-business conglomerate headquartered in India. With an increasing need for minimally invasive surgical procedures, fluoropolymer-integrated advanced medical devices, and technological advancements in fluoropolymer synthesis & processing are driving a huge surge in the global medical fluoropolymers market.

Report Coverage

This research report categorizes the medical fluoropolymers market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the medical fluoropolymers market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the medical fluoropolymers market.

Global Medical Fluoropolymers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 565.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.23% |

| 2035 Value Projection: | USD 1495.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 248 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Daikin Industries, Ltd., The Chemours Company, Solvay SA, Arkema, Adtech Polymer Engineering Ltd., Dongyue Group Limited, Saint-Gobain, W. L. Gore & Associates, Inc., Hitachi, Ltd., Holscot Fluoropolymers Ltd., 3M Company, Kuraray Co., Ltd., Solvay Specialty Polymers, Zhejiang Juhua Co., Ltd., Asahi Glass Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The medical fluoropolymers market is primarily driven by the increasing demand for medical treatments and devices due to the prevalence of chronic diseases. With the increasing medical device needs, the use of fluoropolymers is being explored in the development of innovative catheter materials, like composite tubes and novel tubes. Further, minimally invasive procedures driving the use of medical fluoropolymers for safer and more efficient surgeries are significantly propelling the market growth.

Restraining Factors

Increased production costs, regulatory complexities, and environmental concerns restrict the medical fluoropolymers market. Non-biodegradability and the use of persistent chemicals in the production of fluoropolymers are driving the demand for sustainable alternatives, which pose significant challenges in the medical fluoropolymers market.

Market Segmentation

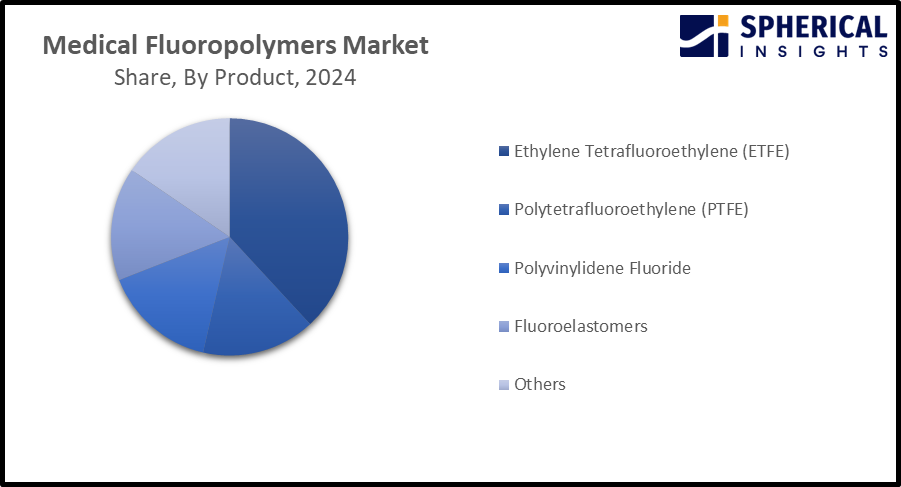

The medical fluoropolymers market share is classified into product and application.

- The polytetrafluoroethylene (PTFE) segment accounted for the largest revenue share of 37.4% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the medical fluoropolymers market is divided into ethylene tetrafluoroethylene (ETFE), polytetrafluoroethylene (PTFE), polyvinylidene fluoride, fluoroelastomers, and others. Among these, the polytetrafluoroethylene (PTFE) segment accounted for the largest revenue share of 37.4% in 2024 and is projected to grow at a substantial CAGR during the forecast period. Advantages of polytetrafluoroethylene (PTFE) in medical applications include biological inertia, chemical resistance, low friction & non-adhesive properties, porous structure, sterilization & cleanliness, temperature resistance, and electrical insulation. Continuous technical developments for improving PTFE functionality in medical devices, along with favourable regulatory compliance, are supporting the market.

Get more details on this report -

- The medical tubing segment dominated the market with over 65% share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the medical fluoropolymers market is divided into medical tubing, catheters, medical bags, drug delivery device, and others. Among these, the medical tubing segment dominated the market with over 65% share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Use of fluoropolymer tubing in catheters, surgical instruments, diagnostic devices, and fluid delivery systems for critical medical applications requiring safety, precision, and reliability is driving the segmental market demand. For instance, in October 2025, Fluoropolymer technologies company Junkosha announced a new advancement in its medical tubing portfolio at MD&M Midwest, the Thin Wall Etched PTFE Liner range with wall thicknesses as thin as 0.00075 inches (19 µm).

Regional Segment Analysis of the Medical Fluoropolymers Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the medical fluoropolymers market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of about 41.0% in the medical fluoropolymers market over the predicted timeframe. The market ecosystem in North America is strong, with the industries’ increasing emphasis on advancements in material engineering. The market for medical fluoropolymers has been driven by the region's increasing healthcare infrastructure spending and demand for medical fluoropolymers in the development of drug delivery devices, medical tubing, catheters, etc. The U.S. is dominating the medical fluoropolymers market in the North America region, with a 9.3% CAGR during the forecast period, driven by the ongoing development of fluoropolymer formulas and processing technologies and applications in the healthcare sector.

Asia Pacific is expected to grow at a rapid CAGR of nearly 9.7% in the medical fluoropolymers market during the forecast period. The Asia Pacific area has a thriving market for medical fluoropolymers due to the adoption of fluoropolymers in minimally invasive procedures, stringent regulations on fluoropolymer usage, and increased focus on eco-friendly production. For instance, in June 2025, Clariant launched innovative PFAS-free polymer processing aids for more sustainable polyolefin extrusion. China is the leading country in the Asia Pacific medical fluoropolymers market, with the fastest CAGR during the projected period, driven by an increasing demand for reliable, safe, and superior-performing medical solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the medical fluoropolymers market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Daikin Industries, Ltd.

- The Chemours Company

- Solvay SA

- Arkema

- Adtech Polymer Engineering Ltd.

- Dongyue Group Limited

- Saint-Gobain

- W. L. Gore & Associates, Inc.

- Hitachi, Ltd.

- Holscot Fluoropolymers Ltd.

- 3M Company

- Kuraray Co., Ltd.

- Solvay Specialty Polymers

- Zhejiang Juhua Co., Ltd.

- Asahi Glass Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Cargill, a global leader in polymer additives, is introducing Incroflo P50 additive, a next-gen polymer processing aid (PPA) for polyolefins.

- In August 2023, Kureha Corporation announced its plan to increase production capacity for polyvinylidene fluoride (PVDF) at its Iwaki Factory in Fukushima, Japan.

- In June 2023, Arkema, a PVDF fluoropolymer producer, responded to the public consultation on the EU restriction proposal submitted by 5 countries aiming at banning the manufacture, use and placing on the market of PFAS.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Medical Fluoropolymers market based on the below-mentioned segments:

Global Medical Fluoropolymers Market, By Produc

- Ethylene Tetrafluoroethylene (ETFE)

- Polytetrafluoroethylene (PTFE)

- Polyvinylidene Fluoride

- Fluoroelastomers

- Others

Global Medical Fluoropolymers Market, By Application

- Medical Tubing

- Catheters

- Medical Bags

- Drug Delivery Device

- Others

Global Medical Fluoropolymers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the medical fluoropolymers market?The global medical fluoropolymers market size is expected to grow from USD 565.8 Million in 2024 to USD 1495.0 Million by 2035, at a CAGR of 9.23% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the medical fluoropolymers market?North America is anticipated to hold the largest share of the medical fluoropolymers market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Medical fluoropolymers Market from 2024 to 2035?The market is expected to grow at a CAGR of around 9.23% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Medical fluoropolymers Market?Key players include Daikin Industries, Ltd., The Chemours Company, Solvay SA, Arkema, Adtech Polymer Engineering Ltd., Dongyue Group Limited, Saint-Gobain, W. L. Gore & Associates, Inc., Hitachi, Ltd., Holscot Fluoropolymers Ltd., 3M Company, Kuraray Co., Ltd., Solvay Specialty Polymers, Zhejiang Juhua Co., Ltd., and Asahi Glass Co., Ltd.

-

5. Can you provide company profiles for the leading medical fluoropolymers manufacturers?Yes. For example, The Chemours Company is a global leader in industrial and specialty chemicals, has its corporate headquarters in Wilmington, Delaware, United States. Solvay SA is a Belgian-French multinational chemical company, with its headquarters located in Neder-Over-Heembeek, Brussels, Belgium, following its demerger with the creation of the new Syensqo entity, Solvay has specialized in essential chemistry and employs over 9,000 people in 40 countries.

-

6. What are the main drivers of growth in the medical fluoropolymers market?Increasing demand for medical treatments and devices & development of innovative solutions are major market growth drivers of the medical fluoropolymers market.

-

7. What challenges are limiting the medical fluoropolymers market?Increased production costs, regulatory complexities, and environmental concerns remain key restraints in the medical fluoropolymers market.

Need help to buy this report?