Global Medical Flexible Packaging Market Size, Share, and COVID-19 Impact Analysis, By Material (Plastic, Paper, Aluminum, and Bioplastics), By Product (Seals, High Barrier Films, Wraps, Pouches & Bags, Lids & Labels, and Others), By End-use (Pharmaceutical Manufacturing, Medical Device Manufacturing, Implant Manufacturing, Contract Packaging, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: HealthcareGlobal Medical Flexible Packaging Market Insights Forecasts to 2035

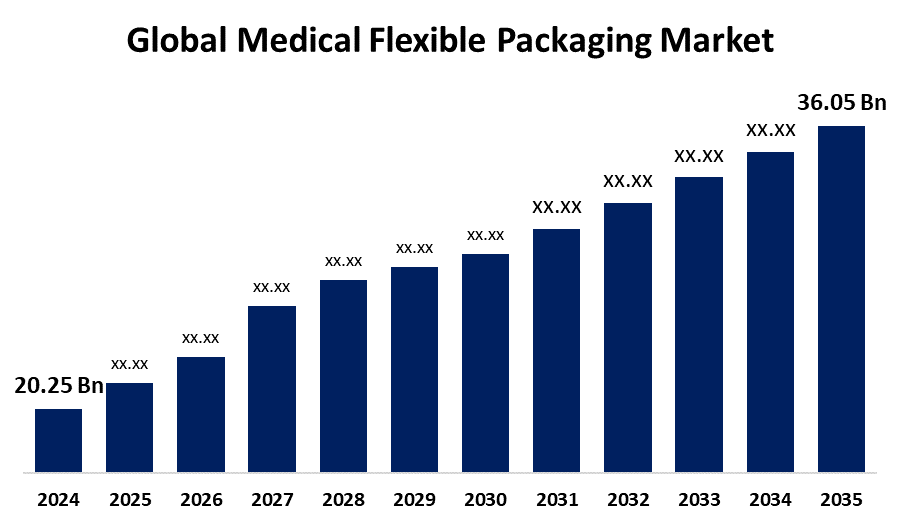

- The Global Medical Flexible Packaging Market Size Was Estimated at USD 20.25 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.38% from 2025 to 2035

- The Worldwide Medical Flexible Packaging Market Size is Expected to Reach USD 36.05 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Medical Flexible Packaging Market Size was worth around USD 20.25 Billion in 2024 and is predicted to Grow to around USD 36.05 Billion by 2035 with a compound annual growth rate (CAGR) of 5.38% from 2025 to 2035. Advancements in healthcare technology and the need for specialized packaging solutions for ensuring safety & efficacy are driving the medical flexible packaging market globally.

Market Overview

The medical flexible packaging market refers to the industry emphasizing the creation and supply of packaging solutions for medical devices and pharmaceuticals using flexible materials. Medical flexible packaging includes packaging materials like films, pouches, and wraps used for protecting and delivering medical products. With the growing pharmaceutical industry in the emerging economies, there is an increasing need for drug delivery devices and blister packaging, which triggers the demand for medical flexible packaging solutions. There is a growing healthcare sector inclination towards portability and convenience, along with the adoption of flexible packaging in the medical field. Furthermore, manufacturers are striving towards the incorporation of recycled material, offering sustainable and recyclable packaging solutions, which is propelling the market growth for medical flexible packaging. Introduction of innovative products by the leading manufacturing companies, as well as the demand for sustainable packaging solutions, with the upsurging advancement in medical device and equipment designing and packaging, are offering growth opportunities among key market players in the medical flexible packaging market.

Report Coverage

This research report categorizes the medical flexible packaging market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the medical flexible packaging market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the medical flexible packaging market.

Global Medical Flexible Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 20.25 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.38% |

| 2035 Value Projection: | USD 36.05 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Material, By Product, By End-use and By Region |

| Companies covered:: | Amcor plc, AptarGroup, Inc., BD (Becton, Dickinson and Company), Berry Global Inc., WINPAK LTD., Sealed Air, Mondi, Huhtamaki Oyj, Coveris, WestRock Company, Datwyler Holding Inc., Catalent, Inc., CCL Industries, Inc., Gerresheimer, Bemis Company, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The adoption of advanced healthcare technology across several developing and developed nations, with government support contributing to driving the market for medical flexible packaging. For instance, in April 2025, Amcor opened an advanced coating facility for healthcare packaging in Malaysia. The company in Asia is capable of producing both top and bottom substrates for medical device packaging at a single site. The upsurging need for specialized packaging solutions for ensuring safety & efficacy is contributing to propel the market growth.

Restraining Factors

Price volatility in raw materials is impacting the profitability of the packaging industry, ultimately hampering the market growth. Further, the development of sustainable products owing to stringent environmental concerns is challenging the market.

Market Segmentation

The medical flexible packaging market share is classified into material, product, and end-use.

- The plastic segment dominated the market with the largest revenue share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the material, the medical flexible packaging market is divided into plastic, paper, aluminum, and bioplastics. Among these, the plastic segment dominated the market with the largest revenue share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Polyethylene and polypropylene are popularly used plastic materials for medical flexible packaging owing to their flexibility, chemical resistance, and affordability. Several properties of plastic materials for medical packaging, including moisture barrier, oxygen barrier, sterilization compatibility, and durability, are responsible for driving the market.

- The pouches & bags segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the medical flexible packaging market is divided into seals, high barrier films, wraps, pouches & bags, lids & labels, and others. Among these, the pouches & bags segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Pouches and bags are designed for use in the modern pharmaceutical and medical sector for protecting products from contamination, chemical resistance, and light while extending shelf life. The ease of handling and usage of medical products is contributing to propel the market in the pouches & bags segment.

- The pharmaceutical manufacturing segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the medical flexible packaging market is divided into pharmaceutical manufacturing, medical device manufacturing, implant manufacturing, contract packaging, and others. Among these, the pharmaceutical manufacturing segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. In pharmaceutical manufacturing, flexible packaging protects capsules, tablets, and other drugs from oxygen, moisture, ensuring their efficacy is maintained until the time of use. The expanding pharmaceutical industry, along with the development of new drugs and therapies, is driving the market for medical flexible packaging.

Regional Segment Analysis of the Medical Flexible Packaging Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

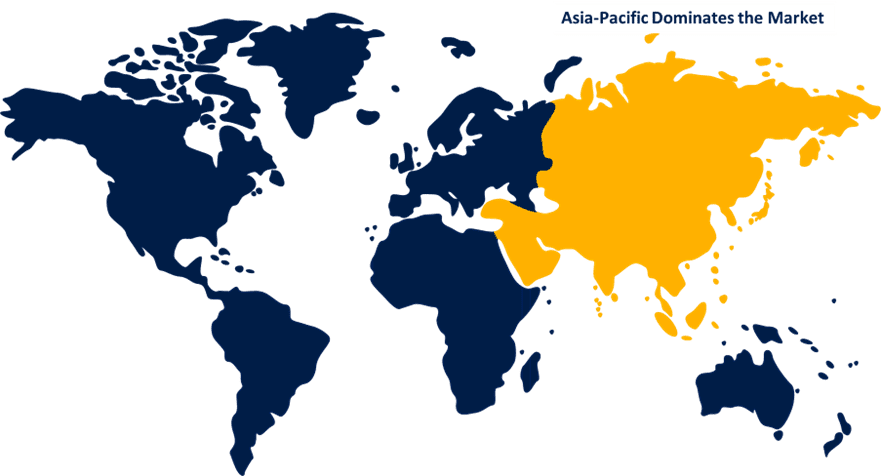

Asia Pacific is anticipated to hold the largest share of the medical flexible packaging market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the medical flexible packaging market over the predicted timeframe. The growing healthcare expenditure, along with an increasing demand for sterile & sustainable packaging solutions, is contributing to driving the market growth for medical flexible packaging. In addition, the demand for convenient packaging, as well as longer shelf life & innovative packaging, is anticipated to drive the medical flexible packaging market.

North America is expected to grow at a rapid CAGR in the medical flexible packaging market during the forecast period. The significant demand for convenience, especially in the healthcare sector, along with the growing shift towards user-friendly and accessible packaging solutions, is driving the market demand. Further, the growth of healthcare blister packaging is contributing to driving the medical flexible packaging market growth.

Europe is anticipated to hold a substantial revenue share of the medical flexible packaging market during the projected timeframe. Strict regulations and standards for medical packaging, including EU’s medical device regulation (MDR) and GMP guidelines, are contributing to driving the market for medical flexible packaging. In addition, the increasing medication demand owing to the region’s aging population and chronic diseases is anticipated to drive the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the medical flexible packaging market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amcor plc

- AptarGroup, Inc.

- BD (Becton, Dickinson and Company)

- Berry Global Inc.

- WINPAK LTD.

- Sealed Air

- Mondi

- Huhtamaki Oyj

- Coveris

- WestRock Company

- Datwyler Holding Inc.

- Catalent, Inc.

- CCL Industries, Inc.

- Gerresheimer

- Bemis Company, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2023, Austrian packaging company Coberis developed and launched a new recyclable thermoforming film packaging solution, called MonoFlex Thermoform. The solution has been designed to serve as a sustainable alternative to replace traditional non-recyclable materials used for thermoforming packaging in the food industry.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the medical flexible packaging market based on the below-mentioned segments:

Global Medical Flexible Packaging Market, By Material

- Plastic

- Paper

- Aluminum

- Bioplastics

Global Medical Flexible Packaging Market, By Product

- Seals

- High Barrier Films

- Wraps

- Pouches & Bags

- Lids & Labels

- Others

Global Medical Flexible Packaging Market, By End-use

- Pharmaceutical Manufacturing

- Medical Device Manufacturing

- Implant Manufacturing

- Contract Packaging

- Others

Global Medical Flexible Packaging Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the medical flexible packaging market over the forecast period?The global medical flexible packaging market is projected to expand at a CAGR of 5.38% during the forecast period.

-

2. What is the market size of the medical flexible packaging market?The global medical flexible packaging market size is expected to grow from USD 20.25 Billion in 2024 to USD 36.05 Billion by 2035, at a CAGR of 5.38% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the medical flexible packaging market?Asia Pacific is anticipated to hold the largest share of the medical flexible packaging market over the predicted timeframe.

Need help to buy this report?