Global Medical Disposables Market Size, Share, and COVID-19 Impact Analysis, By Product (Wound Management, Drug Delivery, Diagnostic & Laboratory Disposables, Dialysis Disposables, Incontinence, Respiratory Supplies, Sterilization Supplies, Non woven Disposables, Disposable Masks, and Others), By Raw Material (Plastic Resin, Nonwoven Material, Rubber, Paper and Paperboard, Metals, Glass, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Medical Disposables Market Insights Forecasts to 2035

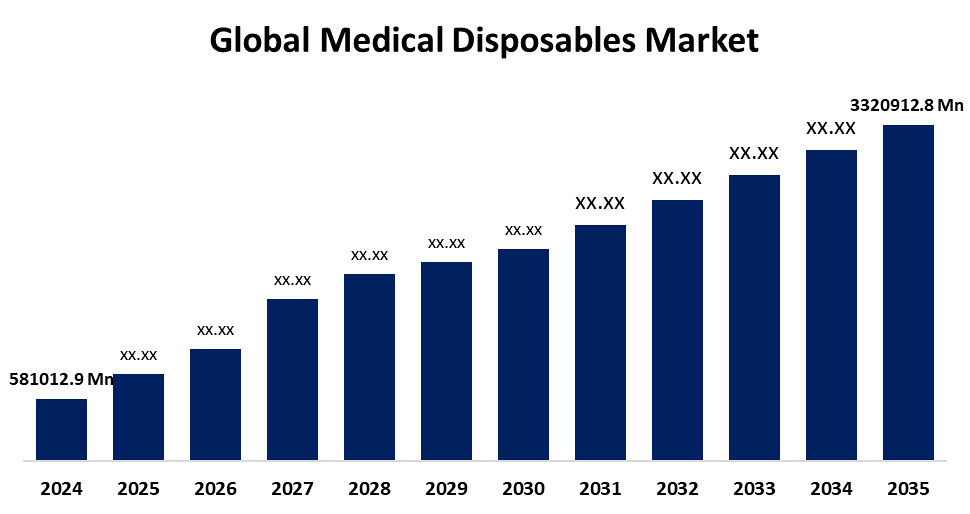

- The Global Medical Disposables Market Size Was Estimated at USD 581012.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 17.17% from 2025 to 2035

- The Worldwide Medical Disposables Market Size is Expected to Reach USD 3320912.8 Million by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Medical Disposables Market Size was worth around USD 581012.9 Million in 2024 and is projected to Grow from USD 680912.6 Million in 2025 to around USD 3320912.8 Million by 2035 at a compound annual growth rate (CAGR) of 17.17% during the forecast period (2025–2035). One of the key opportunities is the growing number of surgical procedures, the aging population worldwide, the rising incidence of hospital acquired infections, and the prevalence of chronic disorders that result in prolonged hospital stays.

Global Medical Disposables Market Forecast and Revenue Size

- 2024 Market Size: USD 581012.9 Million

- 2025 Market Size: USD 680912.6 Million

- 2035 Projected Market Size: USD 3320912.8 Million

- CAGR (2025-2035): 17.17%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

Medical disposables are single use products made for patient care, safety, and infection prevention. As highlighted in the World Health Organization's reports by 2022, the issue outlined about Healthcare Associated Infections in acute care hospitals is of utmost concern. The increase in the population of elderly patients worldwide will only widen the development of the medical disposables market in the near future. Based on WHO accounts from 2022, by 2050, nearly 80% of the senior population will be residing within low or middle income countries. The future demographic picture was further defined by the anticipated rise of older individuals who are 80 years of age and over, which is expected to be nearly 426 million in the world by 2050. Moreover, a major shift in demographic trends is established by the rapid growth patterns of older and aged populations in crucial countries like China, Japan, Italy, Germany, the UK, and Brazil to outpace growth rates in other areas. Furthermore, the chance of chronic and non communicable disease increases with age. Therefore, in order to provide patients with effective preventive therapy, the expanding elderly population further increased the demand for medical disposable supplies.

The National Medical Devices Policy 2023 seeks to establish India as a global leader in the medical device industry by promoting research innovation and skill development, bolstering standards and testing facilities, and enhancing infrastructure through medical device parks and clusters. By promoting home production of both completed devices and essential components, the Production Linked Incentive Scheme for Medical Devices encourages investment and lessens reliance on imports. To boost the industry, a special Rs.500 crore plan has been introduced that includes infrastructure support, clinical research, skill development, and the encouragement of domestic manufacture.

Key Market Insights

- North America is expected to account for the largest share in the medical disposables market during the forecast period.

- In terms of product, the sterilization supplies segment is projected to lead the medical disposables market throughout the forecast period

- In terms of raw material, the plastic resin segment captured the largest portion of the market

Medical Disposables Market Trends

- Sustainability & Biodegradable Materials

- Rise in Home Healthcare & Point of Care Use

- Focus on Infection Control & Safety

- Integration of Smart Features & Digital Tracking

- Raw Material Innovations & Cost Pressures

Report Coverage

This research report categorizes the medical disposables market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the medical disposables market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the medical disposables market.

Global Medical Disposables Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 581012.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 17.17% |

| 2035 Value Projection: | USD 3320912.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 267 |

| Tables, Charts & Figures: | 116 |

| Segments covered: | By Product, By Raw Material and COVID-19 Impact Analysis |

| Companies covered:: | 3M Company, Abbott Laboratories, AMMEX Corporation, Ansell Ltd., B Braun Melsungen AG, Becton Dickinson and Company, Boston Scientific Corporation, Cardinal Health Inc., Medline Industries LP, Medtronic plc, Narang Medical Limited, Smith & Nephew plc, Terumo Cardiovascular Systems Corporation, Bayer AG, BD, and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis |

Get more details on this report -

Driving factors:

Rising global demand for healthcare services drives the medical disposables market.

One major contributing factor to the medical disposables market is the increasing demand for healthcare services throughout the world. The aging population, increasing prevalence of chronic diseases, and improved healthcare knowledge are all contributing to the need for medical disposable products for single use, such as bandages. IceCure Medical Ltd. announced in March 2023 that the Chinese National Medical Products Administration had approved the commercial use of the company's disposable cryoprobes, IceSense3. These cryoprobes are meant to be used with the IceSense3 console, which has already been approved by the NMPA. A major step forward in the commercialization of IceCure Medical Ltd.'s cryoablation technology in the Chinese market was marked by this regulatory milestone.

Restraining Factor:

Increasing environmental concerns restrict the market.

The market for medical disposables is restricted by several important factors, such as the growing concern about the environment. Environmental issues arise from the buildup of non biodegradable waste caused by the extensive use of single use plastics. The manufacturers' production costs have been increasing due to the regulatory pressure to curb plastic use.

Market Segmentation

The global medical disposables market is divided into product and raw materials.

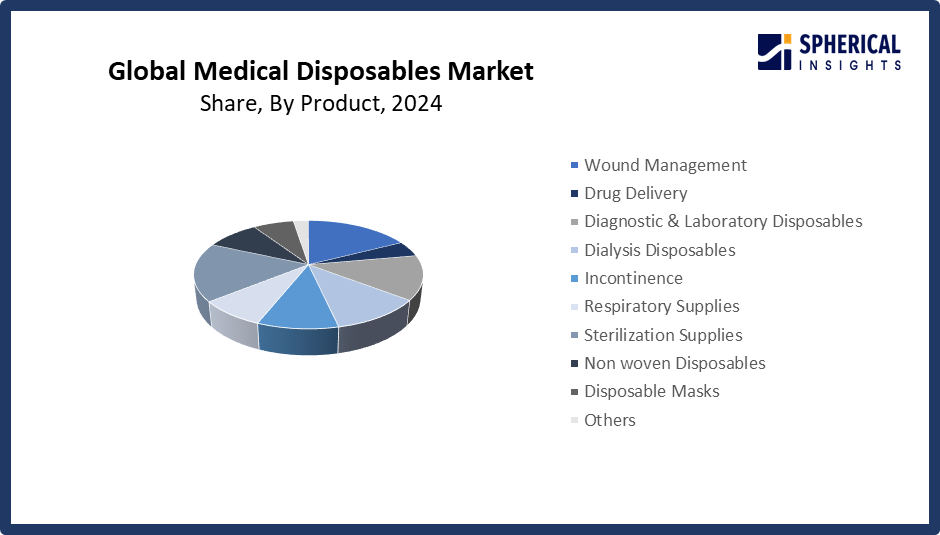

Global Medical Disposables Market, By Product:

Why does the sterilization supplies segment hold the largest revenue share in the global medical disposables market, accounting for approximately 10.98% of the total market during the forecast period?

The sterilization supplies segment led the medical disposables market, generating the largest revenue share. The sterilization supplies are praised for their priority for health care facilities. The use of contaminated medical devices, as well as supplies, can lead to healthcare associated infections, which place patients at tremendous risk and increase healthcare costs. Sterilization supplies, such as autoclaves, sterilization pouches, and chemical indicators, are critical in assuring medical devices and instruments are free of pathogens and safe for patients. Advanced Sterilization Products made a noteworthy addition to its Sterilization Monitoring line, which was announced in October 2023. The product expansion features the introduction of innovative steam monitoring solutions to enhance the capabilities of sterile processing departments in health care settings. These new products intend to improve sterility assurance, as well as efficiency, to address critical issues facing health care.

Get more details on this report -

Global Medical Disposables Market

The diagnostic & laboratory disposables segment in the medical disposables market is expected to grow at the fastest CAGR over the forecast period. The diagnostic & laboratory disposables segment, due to the demand for diagnostic testing, has significantly increased due to the aging population, the prevalence of chronic diseases, and an increasing awareness of preventative health care. Disposables used for laboratory and diagnostics are necessary for secure and accurate testing processes.

Global Medical Disposables Market, By Raw Material:

Why does plastic resin represent the largest application segment, capturing approximately 57% market share during the forecast period in the global medical disposables market?

The plastic resin segment held the largest market share in the medical disposables market. Health care facilities must focus on infection control. Plastic resin is critical to the manufacturing of medical disposables, such as needles, gloves, and packaging. It is mainly present in polymers, such as polyethylene, polypropylene, polyvinyl chloride, or its polymer homologue. These polymers were selected for their inherent attributes of flexibility, toughness, and ease of molding. For example, GE Plastics' Lexan HPX Resin may enhance the Intlock ITL S Disposable Blade in PENTAX's latest Airway Scope.

The non-woven disposables segment in the medical disposables market is expected to grow at the fastest CAGR over the forecast period, because non-woven materials have unique qualities that are imperative for infection prevention and control in health care settings, due to their ability to act as a functional barrier to bacterial transmission.

Regional Segment Analysis of the Global Medical Disposables Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Medical Disposables Market Trends

Get more details on this report -

What factors contribute to the North America region holding the largest share, approximately 35.5%, of the global medical disposables market during the forecast period?

North America is dominant in the global medical disposables market, with an estimated 35.5% share during the forecast period. The medical disposables market in North America has expanded greatly in recent years, mainly because of the focus on providing excellent patient care with innovative techniques. Additionally, because of the healthcare costs in the region, medical disposables can be purchased indefinitely to comply with stringent infection control measures. The practice of using single use items is primarily due to the focus on infection control and patient safety, creating continued demand for medical disposables. Additionally, North America has strict quality standards and regulatory processes in place to ensure medical disposable items meet the highest standards for safety and efficacy, which creates consumer confidence in these items, thereby increasing demand for medical disposables.

Why does the United States lead the North American medical disposables market?

The medical disposables market in the United States is driven by the continuing increase in chronic diseases that require routine medical procedures, diagnostic tests, and long term patient care. Chronic diseases such as diabetes, cancer, and heart disease rank as the leading cause of death and disability in the US. They are also primarily responsible for the nation’s $4.5 trillion in annual healthcare spending. With an aging population and increased prevalence of diabetes, heart disease, and cancer, the need for products like gloves, syringes, and catheters is growing rapidly. Hospitals and outpatient clinical environments are focusing on the use of single use items to minimize cross contamination risk.

Asia Pacific Medical Disposables Market Trends

How is the Asia Pacific region expected to capture the medical disposables market by 2025, with the fastest growth rate?

Asia Pacific is expected to capture the medical disposables market by 2025 with the fastest growth rate due to several key factors. The APAC region growth is due to the growing risk of infections in healthcare facilities. The India TB Report 2024 highlights risk factors such as HIV, diabetes, and malnutrition. Moreover, the data indicate that 95% of diagnosed individuals in India received treatment. The healthcare industry is increasingly moving to single use products due to concerns about hospital acquired illnesses from urban geographic areas and the rapid growth of hospital networks. At the same time, patients and healthcare providers have also become more aware of appropriate hygiene practices. Similarly, sterile disposables used for clinical purposes are being promoted by government health initiatives addressing infection prevention practices.

Why is Japan expected to register the highest CAGR in the medical disposables market during the forecast period?

The Japanese medical disposables market is also expected to develop throughout the forecast due to government programs and policies to improve healthcare quality and access to medical services. Government spending on healthcare infrastructure could increase demand for disposable medical devices.

Europe Medical Disposables Market Trends

Europe is promoting the use of medical disposables in response to growing environmental conservation activities that affect healthcare procurement regulations. According to Eurostat, EU spending on environmental protection grew by 1.5% a year between 2006 and 2023, from €52 billion to €67 billion. Regulatory frameworks are increasingly emphasizing the use of recyclable, biodegradable, and disposable medical equipment as well as environmentally friendly materials to reduce medical waste. In an effort to satisfy sustainability goals, healthcare facilities are eschewing reusable supplies that require a lot of water and energy to sanitize. The necessity for environmental conservation has spurred innovation in the development of single use, low impact items that encourage hygiene and environmental responsibility.

Why is the medical disposables market growing in India?

The market for medical disposables in India is expanding due to an aging population, an increase in orthopedic procedures, and developments in synthetic bioactive materials that improve biocompatibility and speed up recovery, like bioactive glass and ceramics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global medical disposables market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The Medical Disposables Market Include

- 3M Company

- Abbott Laboratories

- AMMEX Corporation

- Ansell Ltd.

- B Braun Melsungen AG

- Becton Dickinson and Company

- Boston Scientific Corporation

- Cardinal Health Inc.

- Medline Industries LP

- Medtronic plc

- Narang Medical Limited

- Smith & Nephew plc

- Terumo Cardiovascular Systems Corporation

- Bayer AG

- BD

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In May 2025, U.S. Medical Glove Company launched a fully operational face mask production unit in Harvard, Illinois, to enhance domestic output of medical disposables. The facility is equipped to produce over 75 million 3-ply disposable face masks annually, with scalability for emergencies.

- In April 2025, Edinburgh based start up Mask Logic secured funding to advance its development of sustainable medical disposables, particularly focusing on PPE. The company aims to reduce environmental impact by creating biodegradable and recyclable alternatives to traditional single-use medical products. This initiative addresses the growing demand for eco-friendly solutions in healthcare, especially in the wake of increased PPE usage during the COVID-19 pandemic.

- In April 2025, INTCO Medical launched its patented Syntex Synthetic Disposable Latex Gloves, surpassing traditional medical disposables in elasticity, puncture resistance, and comfort while eliminating natural latex allergy risks. The gloves meet EN455, EN374, FDA, and EU CE standards and support EUDR compliance by avoiding deforestation-linked materials.

- In March 2025, Visby Medical announced that the FDA had granted De Novo authorization to its Visby Medical Women’s Sexual Health test. This single use at home testing kit enables rapid and reliable testing for sexually transmitted diseases, such as Gonorrhea, Chlamydia, and Trichomoniasis.

- In March 2025, Johnson & Johnson initiated a program that allows recycling of its MedTech single-use products portfolio across the UK.

- In February 2025, Rockwell Medical announced that the company had signed a distribution services agreement with a leading manufacturer of medical disposables products, equipment, including hemodialysis machines and automated fluid balance systems. Under this agreement, Rockwell Medical will distribute its newly launched single-use bicarbonate cartridge to its customers at hospital-based outpatient centers, dialysis centers, and nursing facilities.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the medical disposables market based on the following segments:

Global Medical Disposables Market, By Product

- Wound Management

- Drug Delivery

- Diagnostic & Laboratory Disposables

- Dialysis Disposables

- Incontinence

- Respiratory Supplies

- Sterilization Supplies

- Non woven Disposables

- Disposable Masks

- Others

Global Medical Disposables Market, By Raw Material

- Plastic Resin

- Nonwoven Material

- Rubber

- Paper and Paperboard

- Metals, Glass

- Others

Global Medical Disposables Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the medical disposables market over the forecast period?The global medical disposables market is projected to expand at a CAGR of 17.17% during the forecast period.

-

2. What is the market size of the medical disposables market?The global medical disposables market size is expected to grow from USD 581012.9 million in 2024 to USD 3320912.8 million by 2035, at a CAGR 17.17% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the medical disposables market?North America is anticipated to hold the largest share of the medical disposables market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global medical disposables market?3M Company, Abbott Laboratories, AMMEX Corporation, Ansell Ltd., B Braun Melsungen AG, Becton Dickinson and Company, Boston Scientific Corporation, Cardinal Health Inc., Medline Industries LP, Medtronic plc, Narang Medical Limited, Smith & Nephew plc, Terumo Cardiovascular Systems Corporation, Bayer AG, BD, and Others.

-

5. What factors are driving the growth of the medical disposables market?The medical disposables market growth is driven by the rising incidence of chronic diseases like diabetes, heart disease, and cancer. Disposable medical devices are used more frequently as a result of these conditions' constant need for monitoring, testing, and management.

-

6. What are the market trends in the medical disposables market?The medical disposables market trends include sustainability & biodegradable materials, rise in home healthcare & point of care use, focus on infection control & safety, integration of smart features & digital tracking, and raw material innovations & cost pressures.

-

7. What are the main challenges restricting wider adoption of the medical disposables market?The medical disposables market trends include more waste and governmental attention. Continuous investment in paperwork and audits is required to comply with strict rules, such as ISO and CE certifications.

Need help to buy this report?