Global Medical Device Packaging Market Size, Share, and COVID-19 Impact Analysis, By Material (Plastic, Aluminium, Paper & Paperboard, and Others), By Product Type (Boxes & Cartons, Bags & Pouches, Trays, Clamshell, Laminates, Films, and Others), By Application (Disposable Consumables, Therapeutic Equipment, and Monitoring & Diagnostic Equipment), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Medical Device Packaging Market Insights Forecasts to 2035

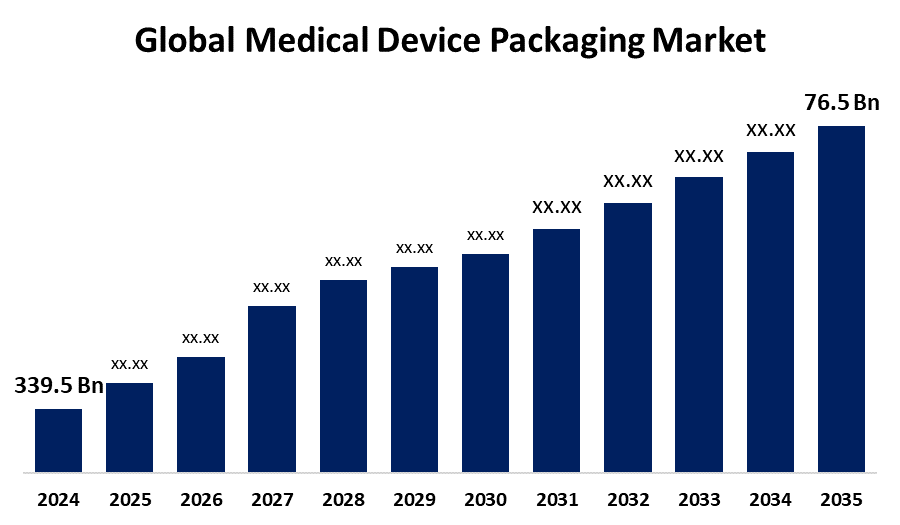

- The Global Medical Device Packaging Market Size Was Estimated at USD 39.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.19% from 2025 to 2035

- The Worldwide Medical Device Packaging Market Size is Expected to Reach USD 76.5 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Medical Device Packaging Market Size was Worth around USD 39.5 Billion in 2024 and is Predicted to Grow to around USD 76.5 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 6.19% from 2025 to 2035. The Growing healthcare spending, increasing aging population, and advancements in medical device technologies are contributing to driving the medical device packaging market globally.

Market Overview

The medical device packaging market refers to the materials and services used for protecting and preserving the sterility and functionality of medical devices during storage, transportation, and use. Medical device packaging is used to safely contain, protect, and preserve healthcare products, including medical devices and pharmaceuticals. Specialized packaging is required for medical devices in order to preserve the sterility and integrity of complex healthcare products. Further, there are surging trends of adopting sustainable packaging materials, like biodegradable plastics and recycled materials, for reducing environmental impact.

With the upsurging development of healthcare infrastructure, sophisticated medical solutions, such as advanced medical device packaging, are being developed to meet the higher healthcare standards. Innovative packaging solutions prioritizing product integrity and safety are creating market opportunities in the emerging economies.

Report Coverage

This research report categorizes the medical device packaging market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the medical device packaging market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the medical device packaging market.

Global Medical Device Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 39.5 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.19% |

| 2035 Value Projection: | USD 76.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Material, By Product Type, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Amcor, 3M Company, DuPont, AR Packaging, Shanghai Jianzhong Medical Packaging Co., Ltd., Printpack, Avient Corporation, Oliver Healthcare Packaging, Steril Medipac, Dordan Manufacturing, Inc and Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Stringent regulations on robust packaging are contributing to driving the market demand. For instance, under FDA and EU MDR/IVDR stringent standards for the sterility of approved medical devices, manufacturers are required to undergo thorough testing to demonstrate a package’s resistance to environmental factors that could compromise the contents’ sterility. Advancements, including smart packaging, anti-counterfeiting features, and the use of innovative materials, are the factors that are escalating the market growth for medical device packaging. Sterile packaging of medical devices contributes to disease control within healthcare settings. Thus, the growing emphasis on patient safety and infection prevention contributes to propelling the market for medical device packaging.

Restraining Factors

The volatility in raw material prices, strict regulatory requirements, and environmental concerns regarding the packaging waste are challenging the medical device packaging market.

Market Segmentation

The medical device packaging market share is classified into material, product type, and application.

- The plastic segment dominates the market with the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the material, the medical device packaging market is divided into plastic, aluminium, paper & paperboard, and others. Among these, the plastic segment dominates the market with the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Plastic materials, including polyethylene, polypropylene, polyvinyl chloride, and polystyrene, are popularly used for medical device packaging owing to their biocompatibility, resistance to sterilization methods, and cost-effectiveness.

- The trays segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the medical device packaging market is divided into boxes & cartons, bags & pouches, trays, clamshell, laminates, films, and others. Among these, the trays segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Rigidity and strength are provided by medical trays to support medical devices, providing protection, sterility, visibility, and other beneficial features to meet defined packaging requirements.

- The disposable consumables segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the medical device packaging market is divided into disposable consumables, therapeutic equipment, and monitoring & diagnostic equipment. Among these, the disposable consumables segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The use of medical disposables, including syringes, gloves, catheters, and wound care products, owing to the demographic shifts, is anticipated to drive the market demand for medical device packaging.

Regional Segment Analysis of the Medical Device Packaging Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the medical device packaging market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the medical device packaging market over the predicted timeframe. The presence of highly developed and advanced healthcare infrastructure, hospitals, clinics, and medical facilities in the region is responsible for driving the market for medical device packaging. An increasing number of surgeries is driving the trend of medical device packaging products, which is leading to the market for medical device packaging.

Asia Pacific is expected to grow at a rapid CAGR in the medical device packaging market during the forecast period. Adoption of single-use medical equipment, owing to the awareness about infection driving innovation in medical device packaging, leading to market growth. With the growing healthcare spending, an increasing demand for medical devices is anticipated to propel the market demand.

Europe is expected to hold a significant share of the medical device packaging market during the projected timeframe. A robust healthcare ecosystem, where medical technology plays a vital role in the economy, thereby escalating the market for medical device packaging. Demand for reliable sterile packaging for preventing cross-contamination, owing to the preference for single-use medical devices, is escalating the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the medical device packaging market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amcor

- 3M Company

- DuPont

- AR Packaging

- Shanghai Jianzhong Medical Packaging Co., Ltd.

- Printpack

- Avient Corporation

- Oliver Healthcare Packaging

- Steril Medipac

- Dordan Manufacturing, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2023, Amcor, a global leader in developing and producing responsible packaging solutions, announced the launch of the next generation of its Medical Laminates solutions.

- In November 2023, Medical packaging manufacturer Coveris is set to launch a new recyclable, flexible thermoforming film solution, called Formpeel P, for use in various medical packaging applications.

- In April 2022, UK-based sustainable packaging provider DS Smith developed a corrugated cardboard box for e-commerce shipments of medical devices. DS Smith created the sustainable packaging for an undisclosed company that serves the Asian market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the medical device packaging market based on the below-mentioned segments:

Global Medical Device Packaging Market, By Material

- Plastic

- Aluminium

- Paper & Paperboard

- Others

Global Medical Device Packaging Market, By Product Type

- Boxes & Cartons

- Bags & Pouches

- Trays

- Clamshell

- Laminates

- Films

- Others

Global Medical Device Packaging Market, By Application

- Disposable Consumables

- Therapeutic Equipment

- Monitoring & Diagnostic Equipment

Global Medical Device Packaging Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the medical device packaging market over the forecast period?The global medical device packaging market is projected to expand at a CAGR of 6.19% during the forecast period.

-

2. What is the market size of the Medical Device Packaging market?The global Medical Device Packaging market size is expected to grow from USD 39.5 Billion in 2024 to USD 76.5 Billion by 2035, at a CAGR of 6.19% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the medical device packaging market?North America is anticipated to hold the largest share of the medical device packaging market over the predicted timeframe.

Need help to buy this report?