Global Medical Composites Market Size By Fiber Type (Ceramic Fiber, Carbon Fiber, Others); By Application (Composite body implants, Diagnostic imaging, Surgical instruments, Dental instruments, Others), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Chemicals & MaterialsGlobal Medical Composites Market Insights Forecasts to 2033

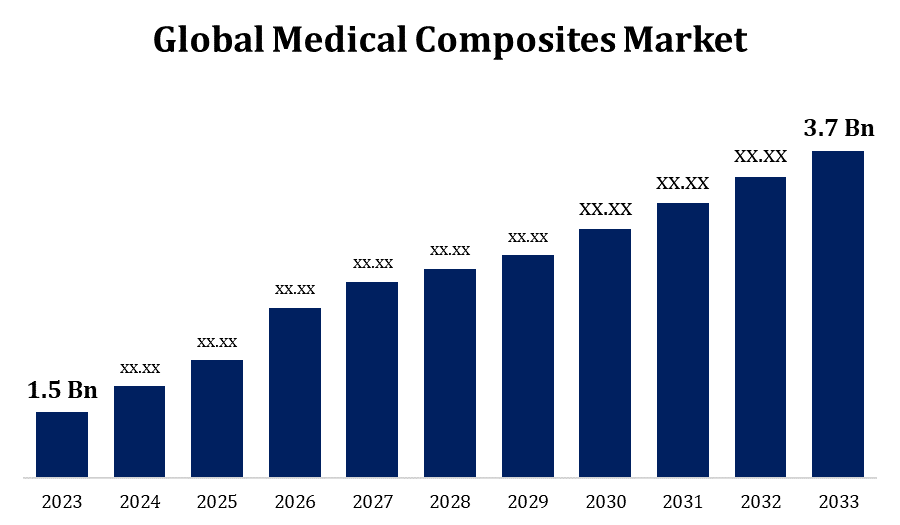

- The Global Medical Composites Market Size was valued at USD 1.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 9.45% from 2023 to 2033.

- The Worldwide Medical Composites Market Size is expected to reach USD 3.7 Billion By 2033

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Medical Composites Market Size is expected to reach USD 3.7 Billion by 2033, at a CAGR of 9.45% during the forecast period 2023 to 2033.

Due to their excellent strength-to-weight ratio and lightweight nature, medical composites are frequently used in the development of medical equipment. Globally, the ageing population is driving demand for improved medical treatments and devices. This demographic trend, combined with rising healthcare costs, adds to the expansion of the medical composites industry. Because of their biocompatibility and ability to mirror the mechanical qualities of natural bone, medical composites are widely employed in orthopaedic applications, including implants and prosthetics. The advancement of modern medical imaging technology such as CT scans, MRIs, and X-rays has raised demand for radiolucent composite materials.

Medical Composites Market Value Chain Analysis

To make medical-grade composites, manufacturers blend and treat raw ingredients. This includes procedures like fibre impregnation, curing, and moulding. Companies invest in research and development to create new composite materials with specialised qualities that are suited for medical applications. Biocompatibility, radiolucency, and mechanical strength are all design issues. Making certain that the medical composites manufactured meet regulatory criteria and receiving the requisite certifications for usage in medical devices. Medical composites are utilised in the production of a wide range of medical devices, including prosthetics, implants, dental components, and diagnostic equipment. The supply chain is managed by distributors and wholesalers, who ensure that medical devices reach healthcare facilities, clinics, and end users. Medical devices are used in patient care by healthcare providers for diagnostic, therapeutic, or rehabilitative purposes.

Medical Composites Market Opportunity Analysis

Continued R&D to build innovative composite materials with greater biocompatibility, improved mechanical qualities, and specialised functionality. Meeting the changing needs of medical applications while also staying ahead of regulatory regulations might provide a competitive edge. Creating customisable composite solutions for orthopaedic implants and prostheses while taking patient-specific needs into account. Optimising for specific patient demands and tailoring materials to mimic the mechanical qualities of natural bone can improve patient results. Investing in biodegradable and resorbable composites for temporary medical implants. Such materials can be employed in situations when temporary support is required, avoiding the need for a second surgery to remove the implant. A greater emphasis is being placed on composite materials for dental applications such as crowns, bridges, and dental implants.

Global Medical Composites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.45% |

| 2033 Value Projection: | USD 3.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Fiber Type, By Application, By Region And Segment Forecasts, By Geographic Scope And Forecast |

| Companies covered:: | 3M (U.S.), Toray Industries, Inc. (Japan), CeramTec GmbH (Germany), Dentsply Sirona (U.S.), Royal DSM (Netherlands), SGL Carbon (Germany), Mitsubishi Chemical Corporation (Japan), Avient (U.S.), Composiflex (U.S.), Polygon Company (India), ACP Composites, Inc.(U.S.), Icotec ag (Switzerland), IDI Composites International (U.S.), Kulzer GmbH (Germany), Zeus Industrial Products, Inc. (U.S.), and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Medical Composites Market Dynamics

Manufacturing of body implants

Medical composites have the advantage of allowing materials to be tailored to be biocompatible, reducing the risk of rejection or unpleasant reactions. Continuous advancements in composite materials enable the production of implants with increased strength, durability, and tissue integration. In orthopaedic applications including joint replacements and spinal implants, medical composites are frequently used. The ability of these implants to imitate the mechanical qualities of bone contributes to their success. Medical composites' cosmetic and practical features help dental applications such as crowns, bridges, and dental implants. These materials can be matched to the natural colour and look of teeth. Medical composites are used in cardiovascular implants such as stents and heart valve components. Composites' lightweight and corrosion-resistant properties can be advantageous in applications.

Restraints & Challenges

Medical composite production procedures can be complicated. In order to achieve consistent quality and meet regulatory standards in the production of composite materials, specialised equipment and knowledge may be required. Because there are no standardised testing procedures for medical composites, comparing and validating the performance of different materials is difficult. To maintain consistent quality across the sector, standardisation activities are required. The healthcare industry may be underestimating the benefits and applications of medicinal composites. Lack of understanding and education about the benefits of these products may impede their use in some medical disciplines. The market for medicinal composites is getting increasingly competitive. To sustain a competitive advantage, businesses must differentiate themselves through product innovation, quality, and strategic relationships.

Regional Forecasts

North America Market Statistics

North America is anticipated to dominate the Medical Composites Market from 2023 to 2033. The North American region, which includes the United States, Canada, and Mexico, has a well-developed healthcare system and contributes significantly to the worldwide medical composites market. The ageing population in North America drives the medical composites market. As people age, there is a greater demand for medical items, such as implants and prosthetics, in which composites are often utilised. Orthopaedic applications, such as implants and prosthetics, account for a sizable portion of the North American medical composites industry. The frequency of musculoskeletal problems, as well as the need for joint replacements, drive the market for orthopaedic implants.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Increased healthcare spending, particularly in countries experiencing economic development and growing living standards, adds to the demand for innovative medical materials and technology. The Asia-Pacific area has a sizable, increasingly ageing population. This demographic trend promotes demand for medical products such as implants and prostheses, where medical composites are used. Orthopaedic and dental applications are key segments in the Asia-Pacific medical composites market, as they are in other regions. Market growth is driven by the demand for joint replacements, dental implants, and other orthopaedic and dental equipment. Many Asia-Pacific countries are investing in strengthening their healthcare facilities. This includes the construction of new healthcare facilities as well as the use of innovative medical technologies.

Segmentation Analysis

Insights by Fiber Type

The carbon fiber segment accounted for the largest market share over the forecast period 2023 to 2033. Carbon fibres have radiolucency, which makes them visible to X-rays and other imaging modalities. This characteristic is critical for medical devices such as orthopaedic implants that require good visibility in diagnostic imaging. Carbon fiber-reinforced composites are well-known for their strength, corrosion resistance, and fatigue resistance. These qualities contribute to the lifetime and dependability of carbon fiber-based medical devices. Carbon fibre composites have a wide range of uses in orthopaedics, including bone plates, screws, and joint replacement implants. Because of their compliance with medical imaging and robustness, they are ideal for these applications.

Insights by Application

The diagnostic imaging segment accounted for the largest market share over the forecast period 2023 to 2033. Many medical composites, particularly those containing carbon fibres, are radiolucent. X-rays, CT scans, and other imaging modalities can travel through this property, guaranteeing clear and accurate imaging without interference from the material. The usage of composites in imaging components such as tables and supports aids in the reduction of imaging artefacts. Images with no artefacts are required for accurate diagnosis and interpretation. The increasing popularity of portable and handheld imaging devices is encouraging the usage of lightweight and long-lasting composites. These materials aid in the development of compact and mobile imaging solutions.

Recent Market Developments

- In April 2019, 3M introduced Filtek universal, an extremely restorative composite product. This is a shading technique that produces both aesthetically pleasing and efficient effects.

Competitive Landscape

Major players in the market

- 3M (U.S.)

- Toray Industries, Inc. (Japan)

- CeramTec GmbH (Germany)

- Dentsply Sirona (U.S.)

- Royal DSM (Netherlands)

- SGL Carbon (Germany)

- Mitsubishi Chemical Corporation (Japan)

- Avient (U.S.)

- Composiflex (U.S.)

- Polygon Company (India)

- ACP Composites, Inc.(U.S.)

- Icotec ag (Switzerland)

- IDI Composites International (U.S.)

- Kulzer GmbH (Germany)

- Zeus Industrial Products, Inc. (U.S.)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Medical Composites Market, Fiber Type Analysis

- Ceramic Fiber

- Carbon Fiber

- Others

Medical Composites Market, Application Analysis

- Composite body implants

- Diagnostic imaging

- Surgical instruments

- Dental instruments

- Others

Medical Composites Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Medical Composites Market?The global Medical Composites Market is expected to grow from USD 1.5 billion in 2023 to USD 3.7 billion by 2033, at a CAGR of 9.45% during the forecast period 2023-2033.

-

2. Who are the key market players of the Medical Composites Market?Some of the key market players of market are 3M (U.S.), Toray Industries, Inc. (Japan), CeramTec GmbH (Germany), Dentsply Sirona (U.S.), Royal DSM (Netherlands), SGL Carbon (Germany), Mitsubishi Chemical Corporation (Japan), Avient (U.S.), Composiflex (U.S.), Polygon Company (India), ACP Composites, Inc.(U.S.), Icotec ag (Switzerland), IDI Composites International (U.S.), Kulzer GmbH (Germany), Zeus Industrial Products, Inc. (U.S.).

-

3. Which segment holds the largest market share?The diagnostic imaging segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Medical Composites Market?North America is dominating the Medical Composites Market with the highest market share.

Need help to buy this report?