Global Medical Cold Chain Storage Equipment Market Size, Share, and COVID-19 Impact Analysis, By Equipment Type (Refrigerators, Freezers, Cryogenic Storage Systems, Cold Rooms, and Others), By End User (Hospitals & Clinics, Pharmaceutical Companies, Research Laboratories, Blood Banks, Pharmacies, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Machinery & EquipmentGlobal Medical Cold Chain Storage Equipment Market Insights Forecasts to 2035

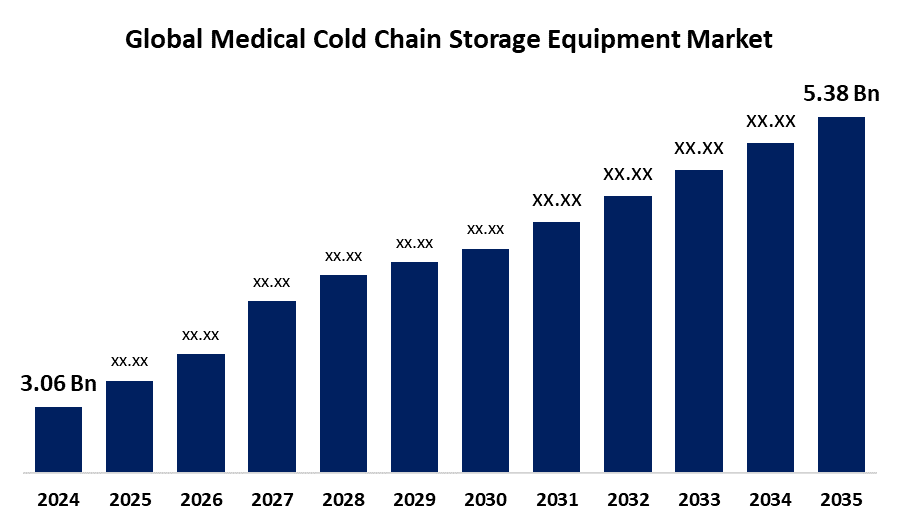

- The Global Medical Cold Chain Storage Equipment Market Size Was Estimated at USD 3.06 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.26% from 2025 to 2035

- The Worldwide Medical Cold Chain Storage Equipment Market Size is Expected to Reach USD 5.38 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Medical Cold Chain Storage Equipment Market size was worth around USD 3.06 Billion in 2024 and is predicted to grow to around USD 5.38 Billion by 2035 with a compound annual growth rate (CAGR) of 5.26% from 2025 and 2035. Advanced IoT-based monitoring, environmentally friendly refrigeration solutions, growing pharmaceutical supply chains, rising vaccine demand, higher healthcare investments, and compliance-driven innovations that improve efficiency and reliability are all opportunities in the medical cold chain storage equipment market.

Market Overview

The sector devoted to the creation, production, distribution, and use of temperature-controlled storage solutions for pharmaceutical and healthcare items is known as the medical cold chain storage equipment market. Product safety, effectiveness, and adherence to international health regulations are all guaranteed by effective cold chain storage. In order to preserve the integrity of vaccines, biologics, blood products, and other temperature-sensitive medical products, this market includes refrigeration systems, cold rooms, freezers, and monitoring equipment. Its expansion is driven by regulatory norms, technological developments, and rising healthcare demands. Energy-efficient storage solutions and adherence to environmental regulations are ensured by sustainability concerns and the use of eco-friendly refrigerants, which also include market trends.

Growing investments in the biotechnology and pharmaceutical industries, which place a premium on accurate temperature control and dependable storage, support medical cold chain storage equipment market expansion. The equipment used for medical cold chain storage is changing in tandem with technological advancements. Pharmaceutical products are kept and transported within the necessary temperature ranges due to Internet of Things (IoT) sensors that allow for real-time temperature and humidity monitoring.

Report Coverage

This research report categorizes the medical cold chain storage equipment market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the medical cold chain storage equipment market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the medical cold chain storage equipment market.

Medical Cold Chain Storage Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.06 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.26% |

| 2035 Value Projection: | USD 5.38 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 315 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Equipment Type, By End User and By Region |

| Companies covered:: | Cardinal Health, Azenta, Summit Appliance, Philipp Kirsch, Binder, Hoshizaki America, Memmert, Darwin Chambers, Farrar, Haier Biomedical, Elanpro, Roemer Industries, Carebios Biological Technology, Kendall Cold Chain System, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A number of important reasons are driving the medical cold chain storage equipment market. Advanced cold storage solutions are required due to the growing need for biologics, vaccines, and medications that are sensitive to temperature. The medical cold chain storage equipment market expansion is also fueled by strict regulatory requirements for the distribution and storage of pharmaceuticals. Technology advancements like Internet of Things-enabled temperature monitoring improve dependability and efficiency. Growing investments in healthcare infrastructure provide market prospects, especially in emerging economies. The need for temperature-controlled storage is further driven by the global medical cold chain storage equipment and the rising incidence of chronic diseases.

Restraining Factors

Innovation can be restricted by the high upfront expenditures of sophisticated infrastructure and technology, which put smaller businesses and emerging markets at a disadvantage. Mismanagement of the intricate logistics of shipping, temperature monitoring, and regulatory compliance can result in inefficiencies.

Market Segmentation

The medical cold chain storage equipment market share is classified into equipment type and end user.

- The freezers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the equipment type, the medical cold chain storage equipment market is divided into refrigerators, freezers, cryogenic storage systems, cold rooms, and others. Among these, the freezers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Ultra-Low Temperature Freezers are in high demand, mostly for storing vaccines, particularly mRNA vaccines, which need extremely low temperatures to be stable. Environmentally friendly refrigerants and energy-efficient technology are the focus of advanced models, which lower operating costs and their negative effects on the environment.

- The pharmaceutical companies segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the medical cold chain storage equipment market is divided into hospitals & clinics, pharmaceutical companies, research laboratories, blood banks, pharmacies, and others. Among these, the pharmaceutical companies segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Pharmaceutical companies are forced by the stringent regulatory environment to purchase pharmaceutical-grade cold chain equipment in order to guarantee adherence to health authority regulations.

Regional Segment Analysis of the Medical Cold Chain Storage Equipment Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the medical cold chain storage equipment market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the medical cold chain storage equipment market over the predicted timeframe. North America is driven by the growing need for biologics and vaccines, the development of healthcare infrastructure, continuous R&D expenditures, and advancements in storage technology. Technological developments, legal regulations, and the ongoing need for secure and efficient storage options for medical products that are sensitive to temperature are the main drivers of this growth. Furthermore, particular storage conditions for pharmaceuticals and biological products are required by stringent regulatory requirements established by organizations like the FDA and the CDC.

Asia Pacific is expected to grow at a rapid CAGR in the medical cold chain storage equipment market during the forecast period. The rising healthcare infrastructure, robust pharmaceutical sector, and advancements in storage technology are driving the rapid growth of the Asia Pacific market for medical cold chain storage equipment. Advanced cold chain storage is becoming more and more in demand as a result of China's post-pandemic healthcare initiatives. China, a significant pharmaceutical market, requires dependable cold storage for biologics and vaccines. The demand for specialist cold storage equipment is rising in tandem with the growth of biopharmaceutical enterprises in India.

Europe is predicted to hold a significant share of the medical cold chain storage equipment market throughout the estimated period. The European market exhibits a range of growth trends among nations. The quality of each country's healthcare infrastructure, legal systems, and technology advancements all have an impact on this difference. The nation is leading the way in the deployment of advanced cold chain technology, such as Internet of Things (IoT)-enabled monitoring devices for temperature tracking in real time.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the medical cold chain storage equipment market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cardinal Health

- Azenta

- Summit Appliance

- Philipp Kirsch

- Binder

- Hoshizaki America

- Memmert

- Darwin Chambers

- Farrar

- Haier Biomedical

- Elanpro

- Roemer Industries

- Carebios Biological Technology

- Kendall Cold Chain System

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In March 2024, Haier Biomedical is going to introduce customized products for hospitals and clinical pharmacists. The temperature homogeneity of their new pharmacy refrigerator is ±1 °C. This function guarantees that drugs are kept in a regulated environment, preserving their integrity and effectiveness.

In February 2023, Cryo Store Pico: Azenta launched a novel automated cryogenic storage system for high-value biological samples that are used in the life sciences at different phases, from discovery to clinical usage. The psico is a new product from Azenta, a company that offers automated cryogenic solutions such as the biostore III cryo and the cryopod carrier. Automated cryogenic technology set up for laboratory and clinical uses is provided by this system.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the medical cold chain storage equipment market based on the below-mentioned segments:

Global Medical Cold Chain Storage Equipment Market, By Equipment Type

- Refrigerators

- Freezers

- Cryogenic Storage Systems

- Cold Rooms

- Others

Global Medical Cold Chain Storage Equipment Market, By End User

- Hospitals and Clinics

- Pharmaceutical Companies

- Research Laboratories

- Blood Banks

- Pharmacies

- Others

Global Medical Cold Chain Storage Equipment Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the medical cold chain storage equipment market over the forecast period?The global medical cold chain storage equipment market is projected to expand at a CAGR of 5.26% during the forecast period.

-

2. What is the market size of the medical cold chain storage equipment market?The global medical cold chain storage equipment market size is expected to grow from USD 3.06 Billion in 2024 to USD 5.38 Billion by 2035, at a CAGR of 5.26% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the medical cold chain storage equipment market?North America is anticipated to hold the largest share of the medical cold chain storage equipment market over the predicted timeframe.

Need help to buy this report?