Global Medical Adhesives Market Size, Share, and COVID-19 Impact Analysis, By Resin Type (Semi-synthetic & Synthetic and Natural), By Application (Medical Devices & Equipment, External Medical Applications, Dental, Internal Medical Applications, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: HealthcareGlobal Medical Adhesives Market Insights Forecasts to 2035

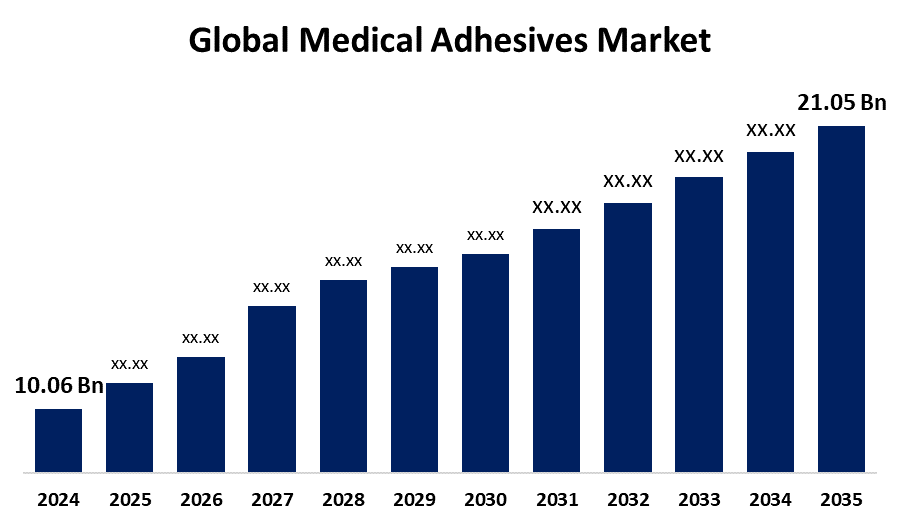

- The Global Medical Adhesives Market Size Was Estimated at USD 10.06 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.94% from 2025 to 2035

- The Worldwide Medical Adhesives Market Size is Expected to Reach USD 21.05 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Medical Adhesives Market Size was worth around USD 10.06 Billion in 2024 and is predicted to Grow to around USD 21.05 Billion by 2035 with a compound annual growth rate (CAGR) of 6.94% from 2025 and 2035. The prevalence of chronic conditions, the rising aging population, innovation in the adhesives formulation, and the application of medical adhesives in non-invasive and wearable medical devices are several factors that are driving the worldwide medical adhesives market.

Market Overview

The medical adhesives market refers to the industry for adhesives used in diverse medical applications, such as wound closure, surgical procedures, and device attachment. Medical adhesives provide secure and reliable bonding, specifically designed for mucous linings and epithelial cells with their exceptional surface qualities and biocompatibility. Films, textiles, and nonwovens are the different materials of medical adhesives that are extensively used for various purposes due to their better manufacturing flexibility and strong adhesion. Further, medical adhesives are extensively used, ranging from internal medical applications like heart surgeries & external medical applications to medical device assembly. An increasing demand for single-use medical products over traditional stainless steel systems due to advantages like decreased risk of cross-contamination, fewer regulatory concerns, reduced validation requirements, and increased assurance of sterility is propelling the market for medical adhesives. Furthermore, an increasing demand for medical adhesives for wound dressings, wearable medical devices, and skin therapies is providing growth opportunities in the medical adhesives market.

Report Coverage

This research report categorizes the medical adhesives market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the medical adhesives market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the medical adhesives market.

Global Medical Adhesives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10.06 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.94% |

| 2035 Value Projection: | USD 21.05 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Resin Type (Semi-synthetic & Synthetic and Natural), By Application (Medical Devices & Equipment, External Medical Applications, Dental, Internal Medical Applications, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) |

| Companies covered:: | Glue Dots, 3M, MASTERBOND, Panacol-Elosol GmbH, Dymax, Scapa, Permabond, Boyd, G A Lindberg, AVERY DENNISON CORPORATION, Baxter International Inc., H.B. Fuller Company, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing prevalence of chronic conditions like diabetes, cardiovascular diseases, and ulcers, driving the need for advanced wound care and surgical procedures, is leading to propel market demand for medical adhesives. Further, the rising aging population is also responsible for driving the medical adhesives market demand in medical devices, surgical interventions, and wound care products. Innovation in the formulation of adhesives, including bio-compatible and tissue-friendly adhesives, is driving the market growth. Further, an increasing use of medical adhesives in non-invasive and wearable medical devices, including glucose monitoring systems and patches, is responsible for escalating the market.

Restraining Factors

The challenges associated with medical adhesives, including the biocompatibility issues, which can lead to complications in patients, may hamper the market for medical adhesives. The supply chain disruption that impacts the raw material availability and product manufacturing is challenging the market. Increasing healthcare costs and regulatory hurdles may hamper the market growth.

Market Segmentation

The medical adhesives market share is classified into resin type and application.

- The semi-synthetic & synthetic segment dominated the market with the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the resin type, the medical adhesives market is divided into semi-synthetic & synthetic and natural. Among these, the semi-synthetic & synthetic segment dominated the market with the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Acrylics or cyanoacrylates, silicones, and polyurethanes are semi-synthetic and synthetic resins used for making medical adhesives. The suitability of semi-synthetic & synthetic medical adhesives in various medical procedures and devices, due to their advantages including bonding strength, consistency, and adaptability, is responsible for driving the market.

- The medical devices & equipment segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the medical adhesives market is divided into medical devices & equipment, external medical applications, dental, internal medical applications, and others. Among these, the medical devices & equipment segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The function of medical adhesives in medical devices and equipment includes bonding components, sealing connections, securing devices to the body, and facilitating wound closure. An increasing demand for medical devices and equipment, including wearable, standalone, and implantable is likely to drive the market for medical adhesives.

Regional Segment Analysis of the Medical Adhesives Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

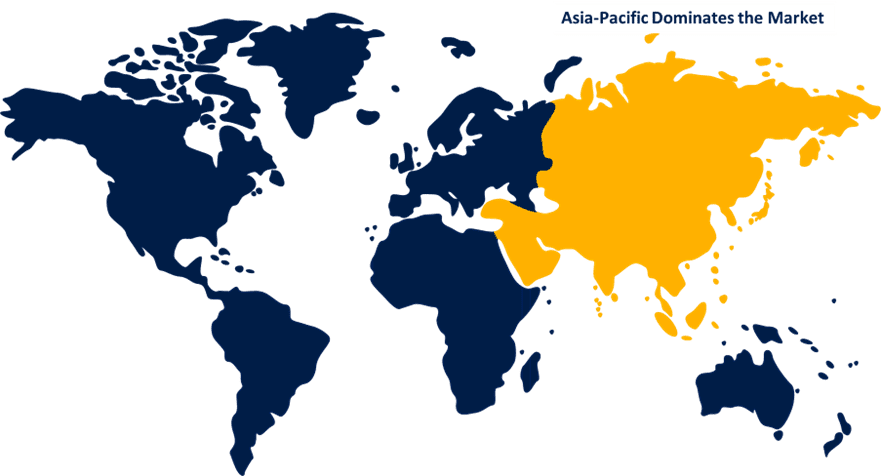

Asia Pacific is anticipated to hold the largest share of the medical adhesives market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the medical adhesives market over the predicted timeframe. The region’s vast population and presence of a large number of diabetic patients are significantly contributing to driving the market demand for medical adhesives. Favourable government policies supporting the healthcare industry, as well as rapid healthcare expenditure in the region, are responsible for propelling the medical adhesives market.

North America is expected to grow at a rapid CAGR in the medical adhesives market during the forecast period. US government support for the development of new medical technologies and products in the country is anticipated to drive the medical adhesives market in the region. An increased investment in medical device innovation and development, as well as the presence of leading pharmaceutical companies in the region, is contributing to driving the market growth.

Europe is expected to hold a significant share of the medical adhesives market during the projected timeframe. An increasing aging population and prevalence of chronic diseases in the region are significantly responsible for driving the medical adhesives market. Further, the advancement in the medical & healthcare industry, including the new product innovation and development of sterilization-resistant and bio-compatible products, is escalating the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the medical adhesives market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Glue Dots

- 3M

- MASTERBOND

- Panacol-Elosol GmbH

- Dymax

- Scapa

- Permabond

- Boyd

- G A Lindberg

- AVERY DENNISON CORPORATION

- Baxter International Inc.

- H.B. Fuller Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2023, Baxter International Inc., a global leader in advancing surgical innovation, announced the launch of PERCLOT Absorbable Hemostatic Powder in the U.S. PERCLOT is a passive, absorbable hemostatic powder that is ready to use and designed for patients with intact coagulation to address mild bleeding.

- In October 2022, DuPont has announced the launch of liveo.dupont.cn, its new DuPont Liveo Healthcare Solutions regional website serving Greater China. The company has actively expanded its global footprint, with a new website being the latest development to better serve customers in China and around the world.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the medical adhesives market based on the below-mentioned segments:

Global Medical Adhesives Market, By Resin Type

- Semi-synthetic & Synthetic

- Natural

Global Medical Adhesives Market, By Application

- Medical Devices & Equipment

- External Medical Applications

- Dental

- Internal Medical Applications

- Others

Global Medical Adhesives Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the medical adhesives market over the forecast period?The global medical adhesives market is projected to expand at a CAGR of 6.94% during the forecast period.

-

2. What is the market size of the Medical Adhesives market?The global medical adhesives market size is expected to grow from USD 10.06 Billion in 2024 to USD 21.05 Billion by 2035, at a CAGR of 6.94% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the medical adhesives market?Asia Pacific is anticipated to hold the largest share of the medical adhesives market over the predicted timeframe.

Need help to buy this report?