Global Meat Mixer Market Size, hare, and COVID-19 Impact Analysis, By Product Type (Automatic Meat Mixers, Manual Meat Mixers, Countertop Meat Mixers, and Industrial Meat Mixers), By Application (Commercial Meat Processing, Retail Meat Processing, Home Use, and Industrial Meat Manufacturing), By End User (Meat Processing Plants, Supermarkets and Retail Stores, Food ServicSe Providers, and Households), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Food & BeveragesGlobal Meat Mixer Market Insights Forecasts to 2035

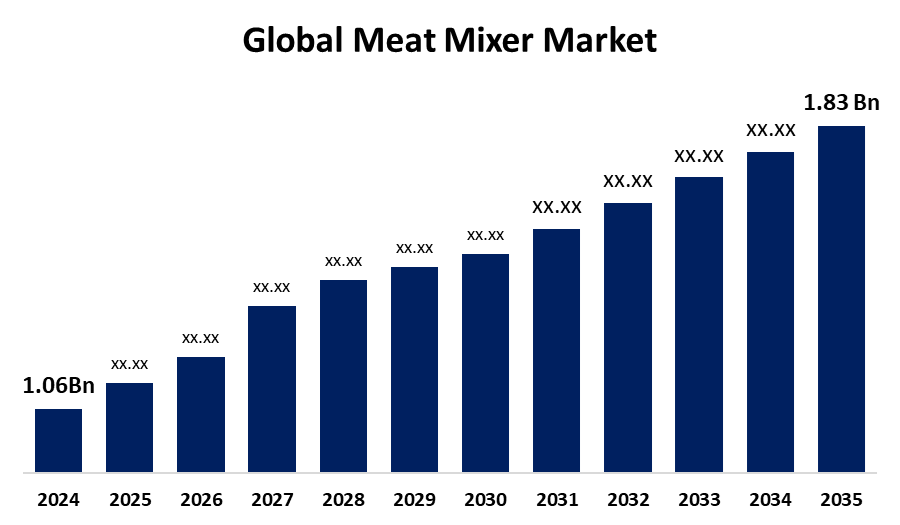

- The Global Meat Mixer Market Size Was Estimated at USD 1.06 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.09% from 2025 to 2035

- The Worldwide Meat Mixer Market Size is Expected to Reach USD 1.83 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Meat Mixer Market size was worth around USD 1.06 Billion in 2024 and is predicted to grow to around USD 1.83 Billion by 2035 with a compound annual growth rate (CAGR) of 5.09% from 2025 and 2035. Increasing demand for processed meat products, mixers' technology upgrades, growth in global meat processing industries, and growth in quick-service restaurants propel the meat mixer market through increasing efficiency, consistency of products, and satisfying growing consumer convenience requirements.

Market Overview

The meat mixer industry involves the manufacturing, sales, and distribution of equipment that is used to mix meat with spices, additives, and other ingredients. Meat mixers are dedicated machines that are used to mix meat with spices, additives, and other ingredients to create different processed meat products such as sausages, patties, and ready-to-eat foods. The market consists of various kinds of mixers manual, automatic, countertop, and industrial that serve various end users including meat processing plants, food service providers, retail stores, and households. Meat mixers provide a variety of advantages that promote the quality and efficiency of meat processing operations. First, they achieve consistent mixing of meat with spices, preservatives, and other ingredients, ensuring consistency in flavor and product texture essential for consumer satisfaction. They minimize labor and processing time, enabling processors to increase production while keeping quality intact. Modern mixers with automated systems enhance operating efficiency, reducing human errors and batch variations. Hygienic design elements, like stainless steel and Clean-in-Place (CIP) systems, minimize contamination threats and meet stringent food safety requirements, safeguarding consumer health. Further, mixers are being developed to accommodate plant-based meat alternatives and alternative proteins based on changing consumer patterns. Small-footprint and portable mixers are being created for retail use and small-scale processors. Combined, these advances are making meat mixing a more efficient, safe, and adaptable process.

Report Coverage

This research report categorizes the meat mixer market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the meat mixer market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the meat mixer market.

Global Meat Mixer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.06 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.09% |

| 2035 Value Projection: | USD 1.83 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Product Type, By Application, By End User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Metos, ABM Company, Industries Castellvall, Groupe PSV, Industrial Fuerpla, OMET FOODTECH SRL, Storm Engineering, Schroder Maschinenbau GmbH, M Inc - Equipamientos Caicos, Swedlinghaus, Cato, Lakidis, METALBUD NOWICKI and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Shifts in consumer lifestyles, urbanization, and greater demand for convenience food have created a boost in the consumption of processed meat such as sausages, patties, and ready-to-eat foods. These need to be mixed effectively with ingredients, spices, and binders generating high demand for high-tech meat mixers in industrial as well as commercial processing facilities. Additionally, new meat mixers provide automation, programmable control, vacuum systems, and Clean-in-Place (CIP) functionality, boosting efficiency, cleanliness, and consistency. These innovations draw meat processors looking to improve productivity and meet rigorous food safety requirements, thus making technology adoption a major factor for growth in developed markets and emerging economies.

Restraining Factors

Industrial meat mixers, particularly automated and high-throughput versions, are capital-intensive. Small and medium-sized businesses (SMEs) cannot easily finance this machinery as their budgets are limited. Installation, maintenance, and training costs are additional burdens that cut across the adoption rate, particularly in emerging markets. In addition, meat mixers are highly mechanized pieces of equipment with numerous moving parts that need frequent cleaning and maintenance. Any failure or contamination threat can stop production and generate financial losses. This technical sophistication dissuades smaller processors from investing and creates operation concerns for large users, particularly in areas with less-than-full-service infrastructure.

Market Segmentation

The meat mixer market share is classified into product type, application, and end user.

- The industrial meat mixers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the meat mixer market is divided into automatic meat mixers, manual meat mixers, countertop meat mixers, and industrial meat mixers. Among these,the industrial meat mixers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by industrial meat mixers that are specifically created to take large quantities, usually hundreds of kilograms in one go. This makes them a necessity in meat processing facilities and producers of sausages, nuggets, patties, and other processed foods on a large scale. The capacity to accommodate continuous, high-volume operations makes them the most sought-after mixer type among commercial meat manufacturers.

- The industrial meat manufacturing segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the meat mixer market is divided into commercial meat processing, retail meat processing, home use, and industrial meat manufacturing. Among these, the industrial meat manufacturing segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to industrial meat makers working on an enormous scale, churning out huge volumes of meat products every day. They need high-capacity mixers that are strong enough to withstand continuous use without affecting quality. The need for bulk output in world markets has made industrial producers the dominant clients of high-tech meat-mixing machinery, which earns them a leading share of the market.

- The meat processing plants segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the end user, the meat mixer market is divided into meat processing plants, supermarkets and retail stores, food service providers, and households. Among these, he meat processing plants segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The growth is attributed to meat processing facilities receiving vast amounts of meat daily and needing industrial mixers to keep pace, be consistent, and produce. These processes rely on strong, high-capacity mixers to churn out processed products effectively, hence being the largest customers for meat mixing equipment.

Regional Segment Analysis of the Meat Mixer Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the meat mixer market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the meat mixer market over the predicted timeframe. North America, particularly the U.S., boasts one of the globe's most developed and industrialized meat processing industries. Global giants such as Tyson Foods, JBS USA, and Cargill maintain enormous facilities that need sophisticated, high-volume mixers for beef, poultry, and pork. The processors call for automation, consistency, and cleanliness that necessitate ongoing investment in meat mixing machinery. The region's huge scale of operations generates stable demand for industrial mixers to ensure that North America holds its commanding market share.

Asia Pacific is expected to grow at a rapid CAGR in the meat mixer market during the forecast period. Asia-Pacific is experiencing rapid urbanization, especially in China, India, and Southeast Asia. With increasing numbers of people migrating to cities, their eating habits towards convenience food, such as processed meats, change. Urban consumers demand ready-to-cook or ready-to-eat meat products, which boosts demand for industrial meat mixers that guarantee quick, thorough mixing. To satisfy the increasing demand for mass-produced protein, meat processing businesses are making investments in advanced machinery, urbanization being a key driver of meat mixer market expansion in the region.

Europe is predicted to hold a significant share of the meat mixer market throughout the estimated period. Europe boasts some of the most developed and sophisticated meat processing industries in the world, especially in Germany, France, Spain, and Poland. These countries are where large-scale meat processors and machinery manufacturers exist that require top-notch mixers to make sausages, cured meats, and deli items. Meat traditions long established in the region, paired with world-class infrastructure and automation, provide consistent demand for industrial mixers keeping Europe a dominant force in the global meat mixer market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the meat mixer market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Metos

- ABM Company

- Industries Castellvall

- Groupe PSV

- Industrial Fuerpla

- OMET FOODTECH SRL

- Storm Engineering

- Schroder Maschinenbau GmbH

- M Inc - Equipamientos Caicos

- Swedlinghaus

- Cato

- Lakidis

- METALBUD NOWICKI

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the meat mixer market based on the below-mentioned segments:

Global Meat Mixer Market, By Product Type

- Automatic Meat Mixers

- Manual Meat Mixers

- Countertop Meat Mixers

- Industrial Meat Mixers

Global Meat Mixer Market, By Application

- Commercial Meat Processing

- Retail Meat Processing

- Home Use

- Industrial Meat Manufacturing

Global Meat Mixer Market, By End User

- Meat Processing Plants

- Supermarkets and Retail Stores

- Food Service Providers

- Households

Global Meat Mixer Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the meat mixer market over the forecast period?The global meat mixer market is projected to expand at a CAGR of 5.09% during the forecast period.

-

2. What is the market size of the meat mixer market?The global meat mixer market size is expected to grow from USD 1.06 Billion in 2024 to USD 1.83 Billion by 2035, at a CAGR of 5.09% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the meat mixer market?North America is anticipated to hold the largest share of the meat mixer market over the predicted timeframe.

Need help to buy this report?