Global Mass Spectrometry Market Size, Share, and COVID-19 Impact Analysis, By Product (Instruments, and Consumables & Services), By End User (Government & Academic Institutions, Pharmaceutical & Biotechnology Companies, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Mass Spectrometry Market Insights Forecasts to 2035

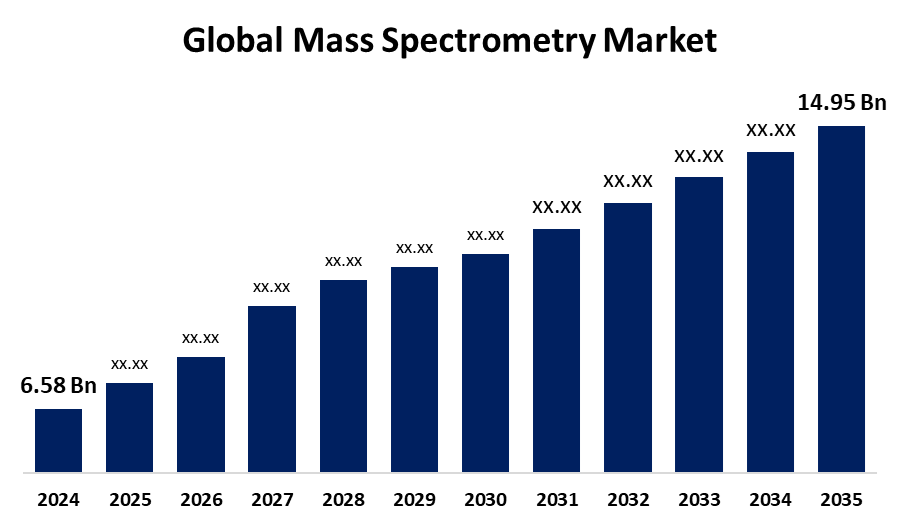

- The Global Mass Spectrometry Market Size Was Estimated at USD 6.58 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.75% from 2025 to 2035

- The Worldwide Mass Spectrometry Market Size is Expected to Reach USD 14.95 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Mass Spectrometry Market Size was Worth around USD 6.58 Billion in 2024 and is predicted to Grow to around USD 14.95 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 7.75% from 2025 and 2035. Food safety, biotechnology, pharmaceuticals, and environmental testing are among the industries with opportunities in the mass spectrometry market. Innovation and market growth are driven by developments in hybrid spectrometers, rising R&D expenditures, regulatory compliance, and the need for precise analytics.

Market Overview

The industry devoted to the creation, manufacturing, and usage of mass spectrometry technology is known as the mass spectrometry market. These analytical instruments identify chemical compounds by measuring the mass-to-charge ratio of ions. The market is driven by the need for food safety, biotechnology, medicines, and environmental testing. The global market for mass spectrometry comprises a range of instruments that are intended to be used in different applications and situations.

The technology of mass spectrometry (MS) is becoming more widely used as a result of the significant new opportunities it is creating in several industrial areas. For instance, in June 2024, A novel tool to improve translational omics research was launched by Thermo Fisher Scientific Inc.: the Thermo Scientific Stellar Mass Spectrometer (MS). Rapid throughput, high sensitivity, and easy operation of this sophisticated equipment allow researchers to more quickly make ground-breaking findings.

The growing focus on food product quality, government medicine safety laws, and rising pharmaceutical R&D expenditures are some of the factors driving the mass spectrometry market. The increase in government support for the pharmaceutical and healthcare industries is a major factor driving mass spectrometry market expansion.

Report Coverage

This research report categorizes the mass spectrometry market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the mass spectrometry market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the mass spectrometry market.

Global Mass Spectrometry Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.58 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.75% |

| 2035 Value Projection: | USD 14.95 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Product, By End User, By Region |

| Companies covered:: | Thermo Fisher Scientific Inc., JEOL Ltd., Ametek Inc, JEOL Ltd., PerkinElmer Inc., Waters Corporation, Shimadzu Corporation, Rigaku Corporation, LECO Corporation, Bruker Corporation, MKS Instruments, Danaher Corporation (SCIEX), Hitachi High-Tech Corporation, Teledyne Technologies Incorporated, and Other Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increased expenditure on medication discovery and development, the rise in the frequency of chronic diseases, and the requirement for innovative diagnostic methods are some of the primary factors driving the mass spectrometry market. The market's expansion is due to the anticipated rise in the use of mass spectrometers for environmental sample testing of analytes such as PFAS and microplastics.

Mass spectrometer use is anticipated to be fueled by rising R&D in the biotechnology and pharmaceutical sectors. Proteomics research developments and the quick expansion of biomedical research are also driving the mass spectrometry market expansion. Mass spectrometer (MS) usage is being driven by the growing R&D investment in the biotechnology and pharmaceutical industries.

Restraining Factors

High equipment costs, complicated operations requiring qualified personnel, regulatory obstacles, and limited acceptance in smaller labs are the main factors restricting the mass spectrometry market. Widespread adoption is further restricted by maintenance costs and technological constraints.

Market Segmentation

The mass spectrometry market share is classified into product and end user.

- The instruments segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the mass spectrometry market is divided into instruments, and consumables & services. Among these, the instruments segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The existence of numerous businesses selling various kinds of mass spectrometry equipment is an explanation for the instruments segment. Large market participants provide a large selection of instruments with multiple uses.

- The pharmaceutical & biotechnology companies segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the mass spectrometry market is divided into government & academic institutions, pharmaceutical & biotechnology companies, and others. Among these, the pharmaceutical & biotechnology companies segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The widespread use of protein sequencing with mass spectrometry in the pharmaceutical business for drug research and development procedures is the reason for the segment of biotechnology and pharmaceutical companies. Additionally, a rise in collaborations among major proteomics firms to promote precision medicine and biopharma research is driving the segment's expansion.

Regional Segment Analysis of the Mass Spectrometry Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the mass spectrometry market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the mass spectrometry market over the predicted timeframe. The market for mass spectrometry in North America is driven by the presence of major industry participants, reputable academic institutions, pharmaceutical firms, and research facilities, as well as abundant financing opportunities for biotechnology and drug discovery and development research and development. For example, several government organizations, including the National Eye Institute (NEI), the National Heart, Lung, and Blood Institute, the National Human Genome Research Institute (NHGRI), and others, sponsor UniProt, a free repository for protein sequencing and functional information.

Asia Pacific is expected to grow at a rapid CAGR in the mass spectrometry market during the forecast period. The Asia Pacific region is the scene of numerous product launches, partnerships, mergers, and acquisitions. The government also offers several research grants. Due to the country's developing biotechnology, precision medicine, and translational research, the mass spectrometry industry in China is expanding at a profitable rate. The market is anticipated to expand quickly despite the nation's relative inexperience in translational medicine.

Europe is predicted to hold a significant share of the mass spectrometry market throughout the estimated period. The growing demand in biotechnology, pharmaceuticals, and environmental testing is driving the expansion of the mass spectrometry market in Europe. Strong pharmaceutical, biopharmaceutical, and biotechnology firms, a strong healthcare system, and higher R&D expenditures for drug discovery and development are all factors contributing to this expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the mass spectrometry market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thermo Fisher Scientific, Inc.

- JEOL Ltd.

- Ametek, Inc

- JEOL Ltd.

- PerkinElmer, Inc.

- Waters Corporation

- Shimadzu Corporation

- Rigaku Corporation

- LECO Corporation

- Bruker Corporation

- MKS Instruments

- Danaher Corporation (SCIEX)

- Hitachi High-Tech Corporation

- Teledyne Technologies Incorporated

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2024, PerkinElmer and Emphor DLAS collaborated to provide analytical laboratory solutions in Qatar and the United Arab Emirates. The services will include heat analysis, chromatography, atomic spectroscopy, mass spectrometry, and more.

- In June 2024, SCIEX (Danaher Corporation) announced a partnership to handle data from the ZenoTOF 7600 system and SCIEX 7500+ mass spectrometers using artificial intelligence quantitation (AI quant) software.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the mass spectrometry market based on the below-mentioned segments:

Global Mass Spectrometry Market, By Product

- Instruments

- Consumables & Services

Global Mass Spectrometry Market, By End User

- Government & Academic Institutions

- Pharmaceutical & Biotechnology Companies

- Others

Global Mass Spectrometry Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the mass spectrometry market over the forecast period?The global mass spectrometry market is projected to expand at a CAGR of 7.75% during the forecast period.

-

2. What is the market size of the mass spectrometry market?The global mass spectrometry market size is expected to grow from USD 6.58 Billion in 2024 to USD 14.95 Billion by 2035, at a CAGR of 7.75% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the mass spectrometry market?North America is anticipated to hold the largest share of the mass spectrometry market over the predicted timeframe.

Need help to buy this report?