Global Marine Biofuel Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Fuel Type (FAME/Biodiesel, HVO), By Blend (B20 & below, B21-B50, and >B50/HVO neat), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsMarine Biofuel Market Summary, Size & Emerging Trends

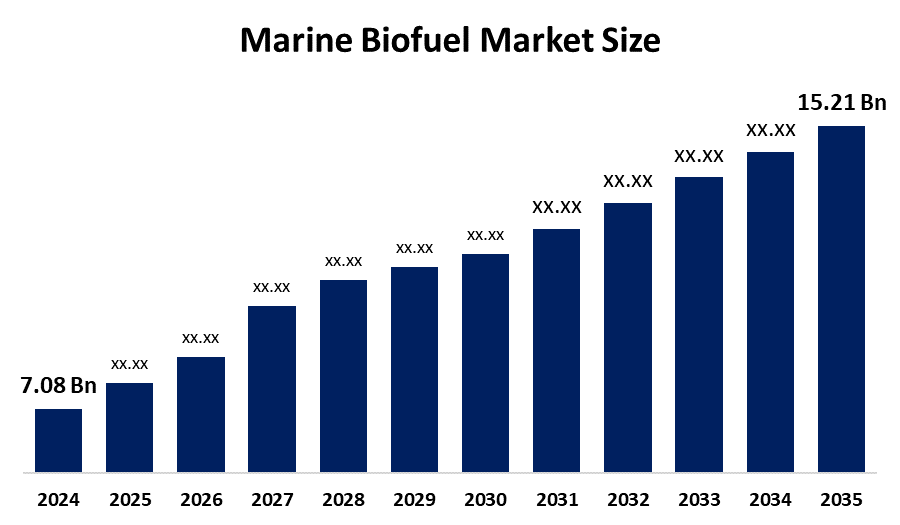

According to Decision Advisor, The Global Marine Biofuel Market Size is expected to grow from USD 7.08 Billion in 2024 to USD 15.21 Billion by 2035, at a CAGR of 7.2% during the forecast period 2025-2035. Increasing regulatory pressures on reducing greenhouse gas emissions and the growing adoption of sustainable marine fuels are key drivers for the marine biofuel market.

Get more details on this report -

Key Market Insights

- Asia Pacific is expected to account for the largest share in the marine biofuel market during the forecast period.

- In terms of fuel type, the FAME/Biodiesel segment dominated in terms of revenue during the forecast period.

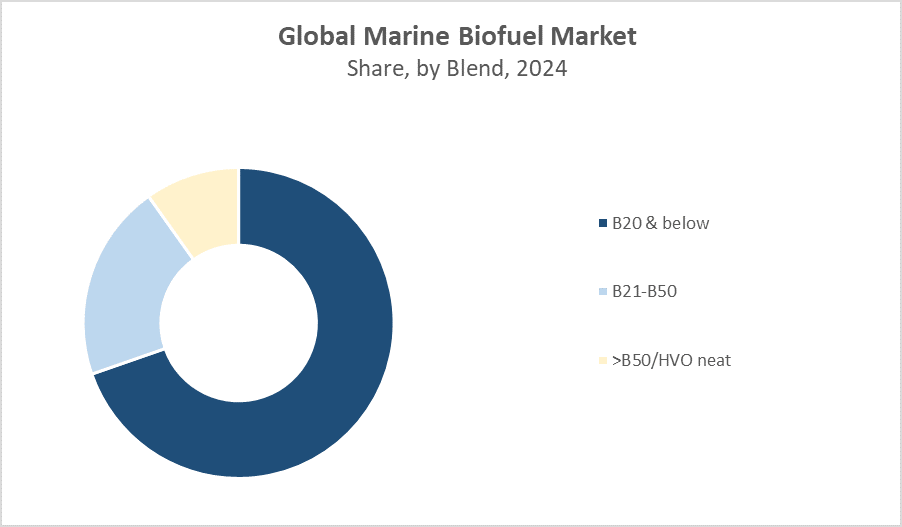

- By blend, the B20 & below segment accounted for the largest revenue share in the global marine biofuel market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 7.08 Billion

- 2035 Projected Market Size: USD 15.21 Billion

- CAGR (2025-2035): 7.2%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

Marine Biofuel Market

The marine biofuel market focuses on the production and adoption of biofuels specifically formulated for maritime vessels to reduce carbon emissions and comply with international environmental regulations such as IMO 2020. These biofuels include Fatty Acid Methyl Esters (FAME)/Biodiesel and Hydrotreated Vegetable Oil (HVO), which serve as sustainable alternatives to conventional marine diesel and heavy fuel oils. The market is driven by the maritime industry's need for cleaner energy sources to meet stringent emission norms and to support decarbonization goals. Governments worldwide are supporting biofuel adoption through subsidies, tax incentives, and mandates, encouraging shipping companies to shift towards greener fuels. The market's growth is bolstered by rising environmental awareness, advances in biofuel technology, and increasing investments in sustainable marine energy solutions.

Marine Biofuel Market Trends

- Rising environmental regulations are accelerating the shift towards marine biofuels.

- Technological improvements in biofuel production are enhancing fuel quality and engine compatibility.

- Strategic collaborations between biofuel producers and shipping companies are expanding market penetration.

Global Marine Biofuel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.08 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.2% |

| 2035 Value Projection: | USD 15.21 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Fuel Type, By Blend and By Region |

| Companies covered:: | Neste Corporation, Renewable Energy Group, REG Life Sciences, Pacific Biodiesel, Eni S.p.A, SkyNRG, Argent Energy, GoodFuels, Alfa Laval, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Marine Biofuel Market Dynamics

Driving Factors: Environmental Regulations and Demand for Sustainable Shipping Fuels

One of the most significant drivers of the marine biofuel market is the tightening global environmental regulations aimed at reducing greenhouse gas (GHG) and sulfur emissions from maritime vessels. Simultaneously, technological advancements in biofuel production are making it easier to scale adoption. Innovations in processing technologies have improved the quality and performance of biofuels, while expanding the range of usable feedstocks including waste oils, algae, and non-food biomass. This not only enhances fuel availability but also aligns with sustainability goals by promoting circular economy practices. Moreover, government support through subsidies, tax benefits, and the development of infrastructure such as biofuel bunkering stations at key ports is facilitating a more robust marine biofuel ecosystem. Together, these factors are accelerating the market's expansion and encouraging broader industry adoption.

Restrain Factors: High Production Costs and Feedstock Availability Concerns

Despite its growth potential, the marine biofuel market faces several constraints. Chief among these is the relatively high cost of marine biofuels when compared to traditional fossil-based marine fuels such as heavy fuel oil (HFO) and marine diesel oil (MDO). The production of biofuels, especially high-quality types like HVO (Hydrotreated Vegetable Oil), involves energy-intensive processes and advanced technologies, which can significantly raise production costs. As a result, many shipping companies hesitate to adopt biofuels at scale, especially in regions where cost sensitivity is high and profit margins are thin.

Opportunity: Growing Demand for Low-Carbon Marine Fuels and Innovation in Fuel Blends

Amid these challenges, the marine biofuel market presents compelling opportunities, especially as the shipping industry seeks innovative ways to meet its decarbonization targets. The demand for low-carbon marine fuels is expected to surge as shipping companies, port authorities, and governments align with global climate goals. This shift is prompting a reevaluation of conventional fuels and a growing interest in biofuels as a bridge between current practices and future zero-emission solutions. Particularly promising are higher blend biofuels and neat fuels like HVO, which offer significant emissions reductions without major engine modifications. Innovation in fuel blending techniques is a key growth enabler. By developing advanced blends that offer high performance, improved engine compatibility, and extended shelf life, producers can appeal to a broader range of vessel types and operational conditions.

Challenges: Infrastructure Gaps and Regional Regulatory Disparities

Despite growing momentum, several systemic challenges must be addressed for the marine biofuel market to realize its full potential. A critical issue is the lack of developed infrastructure for storing and delivering biofuels at major ports. Many global ports are not yet equipped to handle different biofuel blends or ensure contamination-free fueling, which limits the availability of marine biofuels along key shipping routes. This not only creates operational uncertainty but also discourages fleet owners from making the switch without guaranteed fuel access.

Global Marine Biofuel Market Ecosystem Analysis

The global marine biofuel market ecosystem involves key players across biofuel feedstock suppliers, bio-refineries producing FAME/Biodiesel and HVO, shipping companies, port authorities, and regulatory agencies. Major producers such as Neste Corporation and Renewable Energy Group lead the market with advanced production technologies. Shipping companies and vessel operators are increasingly partnering with biofuel suppliers to secure sustainable fuel supply agreements. Port infrastructure developers and governments play a critical role in establishing bunkering facilities and enforcing environmental policies. This interconnected ecosystem drives the adoption and growth of marine biofuels worldwide.

Global Marine Biofuel Market, By Fuel Type

The FAME (Fatty Acid Methyl Esters)/Biodiesel segment held the largest revenue share of approximately 64% in the global marine biofuel market in 2024 and is expected to maintain a strong position throughout the forecast period. This dominance is primarily attributed to the segment's high compatibility with existing marine diesel engines, making it a cost-effective and easily adoptable solution for fleet operators. Produced from renewable feedstocks like vegetable oils, animal fats, and recycled cooking oils, FAME biodiesel is already well-integrated into the current fuel supply infrastructure, especially in Europe and North America.

The HVO segment accounted for approximately 36% of the marine biofuel market in 2024 and is expected to register the fastest growth rate, driven by its superior performance characteristics and increasing demand from regions with stringent environmental standards. HVO is a second-generation biofuel produced through hydrotreatment, offering better fuel stability, higher cetane number, and lower water content compared to FAME, which makes it particularly suitable for use as a neat fuel or in high blend ratios exceeding B50.

Global Marine Biofuel Market, By Blend

The B20 & below blend segment accounted for the largest revenue share of approximately 68% in the global marine biofuel market in 2024. This segment dominates due to its high compatibility with existing marine engines and fuel infrastructure, allowing widespread adoption without the need for significant modifications. Blends such as B5, B10, and B20 (representing 5%, 10%, and 20% biodiesel content, respectively) are widely used by ship operators seeking a cost-effective transition to cleaner fuels while still maintaining engine reliability and performance.

Get more details on this report -

The B21–B50 blend segment captured an estimated 22% market share in 2024 and is experiencing rapid growth, driven by increasing pressure on the maritime sector to adopt higher biofuel concentrations for enhanced greenhouse gas (GHG) reduction. These mid-level blends offer a more significant reduction in carbon intensity than B20 or lower blends, while still remaining technically feasible for many marine engine types especially modern vessels or fleets that have undergone minor fuel system upgrades. With ongoing innovations in fuel quality and blend stability, higher blends like B30 and B50 are becoming more acceptable, particularly in regions with strong environmental regulations and supportive government policies.

Asia Pacific is projected to hold the largest share of the global marine biofuel market during the forecast period

Get more details on this report -

driven by a combination of expanding maritime trade, stringent environmental policies, and rising investments in renewable energy infrastructure. Major economies such as China, Japan, and South Korea are at the forefront of this regional growth. These countries are aggressively decarbonizing their shipping industries through fuel mandates, clean port initiatives, and carbon neutrality commitments. China, in particular, has been expanding its biodiesel production capacity, while South Korea and Japan are heavily investing in next-generation marine fuels as part of their broader green transition strategies. The region's high volume of commercial shipping traffic, combined with increasing regional collaboration on sustainable maritime practices, reinforces Asia Pacific’s leadership in marine biofuel adoption.

India is experiencing steady growth in the marine biofuel market

primarily driven by its rising maritime activities and a strong policy push toward cleaner fuel alternatives. As one of the fastest-growing economies with a strategic focus on expanding its port infrastructure and shipping fleet, India is integrating sustainable energy solutions into its maritime sector. Government initiatives under programs such as the National Bio-Energy Mission and Maritime India Vision 2030 are promoting the development and use of biofuels in shipping to reduce dependency on fossil fuels and meet climate commitments. Additionally, increased collaboration with international bodies for green port development and renewable fuel adoption is expected to accelerate biofuel deployment in Indian waters over the coming decade.

Europe represents one of the most mature and progressive markets for marine biofuels

driven by strong environmental regulations, early adoption of green technologies, and consistent government support. The European Union has established some of the world’s most ambitious maritime decarbonization targets through policies such as the FuelEU Maritime Initiative, the European Green Deal, and inclusion of shipping emissions in the EU Emissions Trading System (EU ETS). These regulations are pushing shipping companies and port authorities across the continent to seek out sustainable alternatives, with biofuels emerging as a key transitional fuel.

WORLDWIDE TOP KEY PLAYERS IN THE MARINE BIOFUEL MARKET INCLUDE

- Neste Corporation

- Renewable Energy Group

- REG Life Sciences

- Pacific Biodiesel

- Eni S.p.A

- SkyNRG

- Argent Energy

- GoodFuels

- Alfa Laval

- Others

Product Launches in Marine Biofuel Market

- In March 2024, Neste Corporation, one of the global leaders in renewable fuels, announced the launch of a new renewable marine diesel fuel specifically formulated for high-performance shipping applications. This strategic product introduction is aligned with the growing demand for low-emission marine fuels, driven by increasingly stringent global regulations, most notably the IMO 2020 sulfur cap, which limits sulfur content in marine fuels to 0.5%.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the marine biofuel market based on the below-mentioned segments:

Global Marine Biofuel Market, By Fuel Type

- FAME/Biodiesel

- HVO

Global Marine Biofuel Market, By Blend

- B20 & below

- B21-B50

- >B50/HVO neat

Global Marine Biofuel Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

Q: What is the market size of the Global Marine Biofuel Market in 2024?A: The Global Marine Biofuel Market size was estimated at USD 7.08 billion in 2024.

-

Q: What is the projected market size of the Global Marine Biofuel Market by 2035?A: The market is expected to reach USD 15.21 billion by 2035.

-

Q: What is the forecasted CAGR of the Global Marine Biofuel Market from 2025 to 2035?A: The market is projected to grow at a CAGR of 7.2% during the forecast period.

-

Q: Which region accounted for the largest share of the Marine Biofuel Market in 2024?A: Asia Pacific held the largest market share in 2024.

-

Q: Which region is expected to grow the fastest in the Marine Biofuel Market?A: Europe is projected to be the fastest-growing region during the forecast period.

-

Q: Which fuel type dominated the Global Marine Biofuel Market in 2024?A: The FAME/Biodiesel segment dominated the market, accounting for approximately 64% of revenue in 2024.

-

Q: Which biofuel type is expected to grow the fastest over the next decade?A: The HVO (Hydrotreated Vegetable Oil) segment is expected to register the fastest growth rate due to its superior performance and environmental benefits.

Need help to buy this report?