Global Marine & Container Terminal Operation Market Size, Share, and COVID-19 Impact Analysis, Russia-Ukraine War Impact, Tariff Analysis, By Operation Type (Stevedoring Services, Container Handling, Cargo Storage and Warehousing, Equipment Maintenance and Repair, and Customs and Logistics Support), By End User (Shipping Lines, Freight Forwarders, Logistics Companies, and E-commerce Companies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Construction & ManufacturingMarine & Container Terminal Operation Market Summary, Size & Emerging Trends

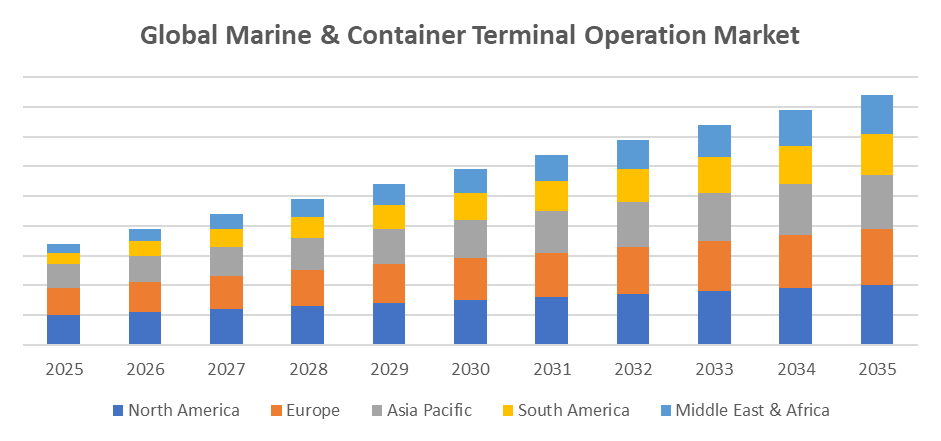

According to Spherical Insights, the Global Marine & Container Terminal Operation Market Size is Expected to Grow from USD 67.20 Billion in 2024 to USD 138.50 Billion by 2035, at a CAGR of 6.8 % during the forecast period 2025-2035. Global trade growth, strategic port projects, improved supply chain integration, technology breakthroughs, and the rising need for automated, sustainable, and efficient terminal operations are all driving growth opportunities in the marine & container terminal operation market.

Key Market Insights

Get more details on this report -

- Asia Pacific is expected to account for the largest share in the marine & container terminal operation market during the forecast period.

- In terms of operation type, the container handling segment is projected to lead the marine & container terminal operation market in terms of equipment throughout the forecast period

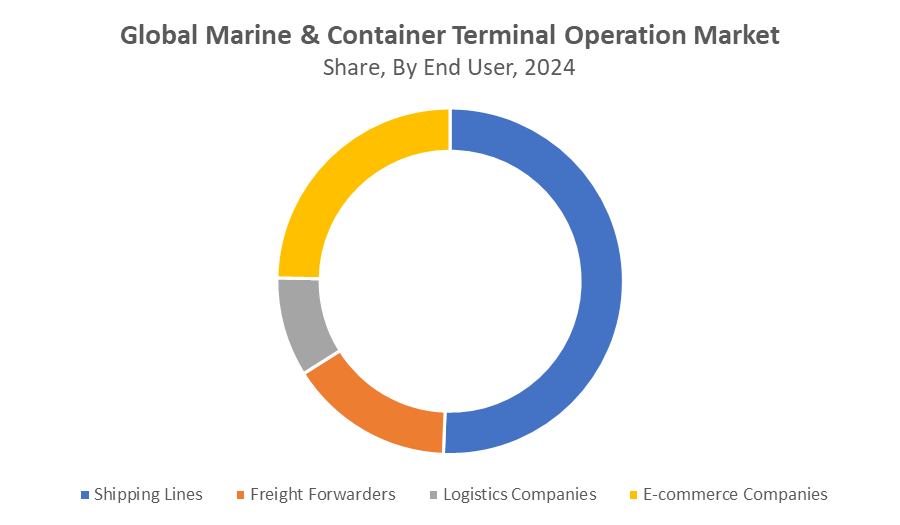

- In terms of end user, the shipping lines segment captured the largest portion of the market

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 67.20 Billion

- 2035 Projected Market Size: USD 138.50 Billion

- CAGR (2025-2035): 6.8 %

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Marine & Container Terminal Operation Market

The global industry that manages, coordinates, and facilitates the handling of marine cargo at seaports and container terminals is known as the marine & container terminal operation market. A variety of services are included in the marine & container terminal operation market, including storage, intermodal transfer, customs clearance, vessel berthing, container loading and unloading, and logistical assistance. The effective flow of commodities through ports is the responsibility of operators in this industry, who use automated systems, specialized equipment, and cutting-edge technology to maximize throughput and shorten turnaround times. For Instance, in July 2025, the Vadhavan Port, a pivotal infrastructure project on the India-Middle East-Europe Economic Corridor (IMEC), is poised to improve India’s container handling capacity by 23.2 million TEUs. This deep-draft port development is strategically positioned to bolster India’s status as a prominent global maritime hub and trade facilitator. Increased international trade, port capacity expansion, and the use of cutting-edge technology in operations are some of the factors propelling growth.

Marine & Container Terminal Operation Market Trends

- Automation and Smart Port Technologies: AI, IoT, and robotics are being used more and more to increase terminal efficiency, decrease human error, and save operating expenses.

- Sustainability and Green Initiatives: Increasing focus on environmentally beneficial practices, such as electrifying machinery, using renewable energy sources, and reducing carbon emissions.

- Global Trade Route Expansion: Growing infrastructure investments to facilitate new trade routes such as the Arctic shipping lanes and the India-Middle East-Europe Economic Corridor (IMEC).

- Integration of Digital Supply Chain Solutions: Better decision-making, increased transparency, and real-time tracking throughout the logistics chain through the usage of blockchain, cloud platforms, and data analytics.

Marine & Container Terminal Operation Market Dynamics

Global Marine and Container Terminal Operation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 67.20 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.8 % |

| 2035 Value Projection: | USD 138.50 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 296 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Operation Type, By End User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | DP World, Eurogate, Hutchison Ports, PSA International, Port of Rotterdam Authority, COSCO Shipping Ports Limited, APM Terminals (Maersk Group), Terminal Investment Limited (TIL), Nippon Yusen Kabushiki Kaisha (NYK Line), Hamburger Hafen und Logistik AG (HHLA), and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors: Rising global trade demands efficient terminal operations.

The need for more container operations is mostly driven by the availability of terminals that can effectively manage the growing volume of international trade. The focus on improving port operations in the nation is developing as a result of the rising demand for commodities both locally and abroad. They are essential to global trade due to they make it easier for products to move across borders. Seaborne trade is essential to the global economy; thus, the market has been redefined by the rise of automation, digitization, and green initiatives. Global trade dynamics, infrastructure growth, technology innovation, and regulatory frameworks contribute to the marine & container terminal operation market.

Restrain Factors: High operational costs limit terminal market growth.

The limited things in the marine & container terminal operation market are the high expense of port and terminal operations. Operations may be disrupted and the flow of commodities slowed down by bottlenecks caused by heavy traffic and inadequate physical infrastructure. The expansion of the marine and container terminal operating market is being negatively impacted by stricter international maritime environmental requirements for sulfur and greenhouse gas emissions.

Opportunity: AI and IoT Integration for Terminal Operations

In using data analytics for the best possible maintenance and decision-making, the integration of artificial intelligence and the Internet of Things into terminal management systems increases productivity and proactiveness. A renewed focus on environmentally friendly production enables ports to create electric machinery, renewable energy, and efficient ecological processes. These advancements put terminal operators in a position to benefit from changing trade patterns and global economic integration by creating opportunities for increased cargo handling capacity, quicker turnaround times, and increased competitiveness.

Challenges: Costly operations pose a challenge to terminal and maritime operations.

High capital expenditure and operating costs related to port infrastructure and cutting-edge technologies are among the difficulties facing the marine and container terminal operator business. Adherence to strict sustainability standards is necessary due to added constraints from environmental concerns and regulatory compliance. Digital system integration necessitates professional personnel training and poses cybersecurity hazards.

Global Marine & Container Terminal Operation Market Ecosystem Analysis

Port authorities, terminal operators, shipping firms, logistics providers, equipment manufacturers, and technology solution vendors make up the ecosystem of the global marine and container terminal operation market. Effective cargo processing, storage, and transportation are made possible by this network's interconnection. Innovation, infrastructure development, and digital transformation are fueled by stakeholder collaboration, which also improves global trade connections, operational efficiency across land-based and maritime transport systems, and facilitates seamless supply chain integration.

Global Marine & Container Terminal Operation Market, By Operation Type

The container handling segment led the marine & container terminal operation market, generating the largest revenue share. The growing amount of containerized trade and the incorporation of cutting-edge handling technologies are the main drivers of container handling. This increase is indicative of how important container handling is to improving operational effectiveness, cutting turnaround times, and meeting the growing need for dependable and smooth maritime cargo transportation and terminal services worldwide.

The customs and logistics support segment in the marine & container terminal operation market is expected to grow at the fastest CAGR over the forecast period. The growing need for effective supply chain integration and regulatory compliance is what motivates Customs and Logistics Support. The Customs and Logistics Support segment is demonstrating its vital role in enabling smooth cargo movement, improving operational effectiveness, and meeting the changing needs of terminal operations and international marine trade.

Global Marine & Container Terminal Operation Market, By End Use

Get more details on this report -

The shipping lines segment held the largest market share in the marine & container terminal operation market, the shipping lines segment is driven by the expansion of global maritime trade and shipping networks. It is anticipated to experience a remarkable growth reflecting its pivotal role in facilitating international cargo transportation and supporting the growth of marine and container terminal operations.

The e-commerce segment in the marine & container terminal operation market is projected to register the fastest CAGR The dynamics of international shipping have been profoundly impacted by the growth of e-commerce. The rise in internet shopping has raised demand for quick and effective port operations and cargo handling.

Asia Pacific is expected to account for the largest share of the marine & container terminal operation market during the forecast period.

Get more details on this report -

The Asia Pacific region is a result of its advantageous geographic location, growing trade volumes, and large investments in the construction of port infrastructure. Infrastructure modernization initiatives are being spearheaded by major economies like China, India, Japan, and South Korea, which are incorporating cutting-edge technologies to improve operational capacity and efficiency. Additionally, the presence of major shipping routes and the rise of emerging economies further bolster the region’s prominence in the global maritime sector.

China is experiencing steady growth in the marine & container terminal operation market.

China has the potential to succeed in East Asian greater sea port trade due to its substantial exports of low-cost raw materials and its aggressive infrastructure development plan. China is the manufacturing center of the globe, producing a wide range of goods at low rates, which makes it an essential supplier for global markets.

North America is expected to grow at the fastest CAGR in the marine & container terminal operation market during the forecast period.

The expansion of trade operations, growing automation and sophisticated technology use, and significant investments in port infrastructure upgrades are what propel North America. Market expansion is further supported by the region's strategic initiatives to increase operational efficiency and supply chain resilience. Green technology integration is also encouraged by the growing need for environmentally responsible and sustainable port operations.

The United States is the largest market for marine & container terminal operation market

The US is establishing itself as one of North America's top trading nations due to its extensive coastline and strong infrastructure. The United States has the means to make significant investments in port infrastructure, increasing capacity and operating efficiency, as a result of its status as a worldwide superpower.

WORLDWIDE TOP KEY PLAYERS IN THE MARINE & CONTAINER TERMINAL OPERATION MARKET INCLUDE

- DP World

- Eurogate

- Hutchison Ports

- PSA International

- Port of Rotterdam Authority

- COSCO Shipping Ports Limited

- APM Terminals (Maersk Group)

- Terminal Investment Limited (TIL)

- Nippon Yusen Kabushiki Kaisha (NYK Line)

- Hamburger Hafen und Logistik AG (HHLA)

- Others

Product Launches in Plant Phenotyping Equipment

- In April 2025, The Hateco Hai Phong International Container Terminal (HHIT), which was recently launched, has significantly improved logistics for one of the major industrial centers in Northern Vietnam. The expected economic advantages for Vietnam as it looks to solidify its standing as a competitive Asian manufacturing hub are examined in this article.

- In May 2024, the Port of Portland announced that it intends to retain offering marine container shipping services at Terminal 6, ensuring that shippers, as well as the employees and local companies that depend on them throughout the state, have access to Oregon's only international container terminal.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the marine & container terminal operation market based on the below-mentioned segments:

Global Marine & Container Terminal Operation Market, By Operation Type

- Stevedoring Services

- Container Handling

- Cargo Storage and Warehousing

- Equipment Maintenance and Repair

- Customs and Logistics Support

Global Marine & Container Terminal Operation Market, By End User

- Shipping Lines

- Freight Forwarders

- Logistics Companies

- E-commerce Companies

Global Marine & Container Terminal Operation Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the marine & container terminal operation market over the forecast period?The global marine & container terminal operation market is projected to expand at a CAGR of 6.8% during the forecast period.

-

2.What is the market size of the marine & container terminal operation market?The global marine & container terminal operation market size is expected to grow from USD 67.20 billion in 2024 to USD 138.50 billion by 2035, at a CAGR of 6.8% during the forecast period 2025-2035.

-

3.Which region holds the largest share of the marine & container terminal operation market?Asia Pacific is anticipated to hold the largest share of the marine & container terminal operation market over the predicted timeframe.

-

4.Who are the top 10 companies operating in the global marine & container terminal operation market?Key players include DP World, Eurogate, Hutchison Ports, PSA International, Port of Rotterdam Authority, COSCO Shipping Ports Limited, APM Terminals (Maersk Group), Terminal Investment Limited (TIL), Nippon Yusen Kabushiki Kaisha (NYK Line), Hamburger Hafen und Logistik AG (HHLA), and Others.

-

5.What factors are driving the growth of the marine & container terminal operation market?The growth of the marine and container terminal operation market is driven by increasing global trade, advancements in port infrastructure, rising containerization, technological innovations, and expanding maritime logistics and supply chain demands.

-

6.What are the main challenges restricting wider adoption of marine & container terminal operation market?The main challenges restricting wider adoption include high capital investment, operational complexities, regulatory compliance, environmental concerns, technological integration difficulties, and vulnerability to geopolitical and economic uncertainties affecting global trade.

Need help to buy this report?