Global Manufacturing Execution Systems (MES) Market Size, Share, and COVID-19 Impact Analysis, By Offering (Software, Services, Solution), By Deployment Type (On-premises, On-demand, Hybrid), By Industry (Process Industry, Discrete Industry), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Semiconductors & ElectronicsGlobal Manufacturing Execution Systems (MES) Market Insights Forecasts to 2032

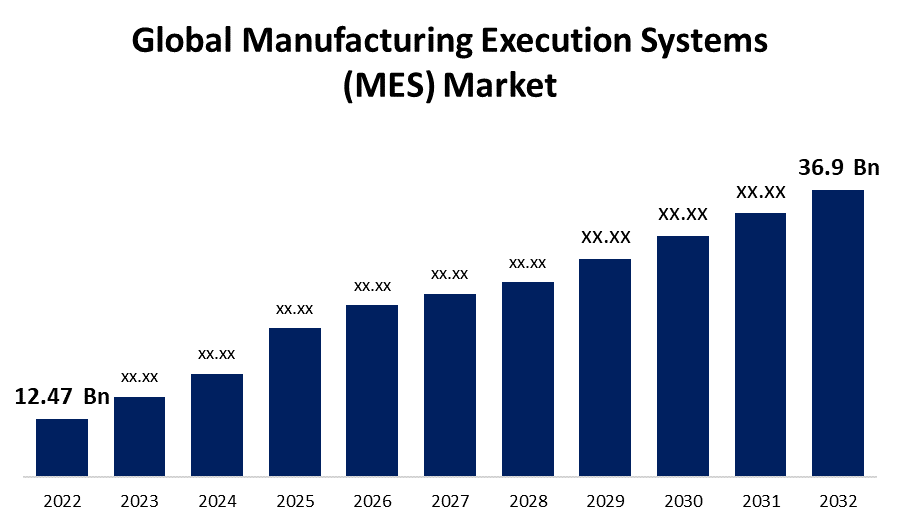

- The Global Manufacturing Execution Systems (MES) Market Size was valued at USD 12.47 Billion in 2022.

- The Market Size is growing at a CAGR of 11.4% from 2022 to 2032

- The Worldwide Manufacturing Execution Systems (MES) Market Size is expected to reach USD 36.9 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Manufacturing Execution Systems (MES) Market Size is expected to reach USD 36.9 Billion by 2032, at a CAGR of 11.4% during the forecast period 2022 to 2032.

The manufacturing execution system, also known as an MES, is a comprehensive, flexible software system that monitors, tracks, records, and manages every aspect of the manufacturing process from the beginning of production to finished commodities. An MES, which acts as a functional layer between enterprise resource planning (ERP) and process control systems, provides decision-makers with the data they need to improve plant floor efficiency and productivity. The manufacturing execution system functions as a real-time monitoring system, allowing control of numerous parts of the manufacturing process, such as inputs, workers, machines, and support services. The general objective of manufacturing execution systems is to ensure that manufacturing processes are carried out effectively in order to increase the level of output. This is accomplished by collecting and analyzing precise real-time data throughout the manufacturing process. It aids in the optimization of industrial operations in terms of effectiveness, financial viability, compliance, and integrity. As a result, it has applications throughout inventory management, quality analysis, resource allocation, production tracking, and other industries such as oil and gas, food and beverage, consumer electronics, and automotive. Automation technology advancements enable opportunities for the market to adopt improved and more efficient production execution methods.

Global Manufacturing Execution Systems (MES) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 12.47 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 11.4% |

| 2032 Value Projection: | USD 36.9 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Offering, By Deployment Type, By Industry, and By Region |

| Companies covered:: | Rockwell Automation, Honeywell International, Dassault Systemes, SAP, Siemens AG, General Electric Co., Schneider Electric S.A, Eyelit Inc., AVEVA, Emerson Electric Co., ABB Ltd, Werum IT Solutions GmbH, Yokogawa Electric Corporation, Birlasoft Limited, 3YOURMIND GmbH, FUJITSU, Tulip Interfaces, Inc, and other key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasingly complex nature of manufacturing processes, the growing utilization of automation technologies in process and discrete sectors, and the ever-growing significance of legal compliance are driving the global manufacturing execution system (MES) market growth. In addition, the incorporation of MES with systems such as ERP and PLM, as well as the expanding uses of MES in the chemical and oil & gas industries, are likely to provide major growth opportunities for market participants as well. Monitoring real-time data, improving data visibility, and managing off-site development operations are among the key variables in the growth of the manufacturing execution system (MES) market.

Additionally, the manufacturing execution system (MES) market has grown significantly from its initial stages of basic production tracking to the present-day offer of an increasing number of functions such as real-time data analytics, connectivity with IoT devices, and more. The continuing industrial change known as Industry 4.0, which highlights automation, digitalization, and data-driven decision-making in manufacturing, is driving this market. Further, as companies aim for better efficiency, compliance, and real-time operational insights, manufacturing execution system (MES) solutions will certainly have a more significant role in the coming years of manufacturing.

Market Segmentation

By Offering Insights

The software segment is dominating the market with the largest revenue share over the forecast period.

On the basis of software, the global manufacturing execution systems (MES) market is segmented into the software, services, and solution. Among these, the software segment is dominating the market with the largest revenue share of 68.2% over the forecast period. The manufacturing execution systems market's software segment is critical in streamlining and optimizing production processes. It includes a variety of software solutions for managing, monitoring, and controlling various parts of production. MES software facilitates real-time data gathering, processing, and reporting, hence facilitating decision-making and improving overall operational visibility. Because software solutions are frequently configurable to meet the specific needs of various industries, they are an essential component of digital transformation programs.

By Deployment Type Insights

The on-demand segment is witnessing significant CAGR growth over the forecast period.

On the basis of deployment type, the global manufacturing execution systems (MES) market is segmented into on-premises, on-demand, and hybrid. Among these, the on-demand segment is witnessing significant CAGR growth over the forecast period. With the rapid development of cloud-based services and a rising focus on scalability and flexibility, the on-demand model has seen considerable CAGR growth and implementation. The on-demand concept, also known as cloud-based or Software-as-a-Service (SaaS), includes connecting to a third-party provider's MES system via the Internet. On-demand solutions are accessible from any location with an internet connection, allowing for remote work and worldwide collaboration.

By Industry Insights

The discrete industry segment accounted for the largest revenue share of more than 54.2% over the forecast period.

On the basis of Industry, the global manufacturing execution systems (MES) market is segmented into process industry and discrete industry. Among these, the discrete industry segment is dominating the market with the largest revenue share of 54.2% over the forecast period, because of the wide range of products and industries, it entails, such as automotive and electronics, which are experiencing significant MES implementation. Automobile, electronics, aerospace, and machinery manufacture are examples of discrete industries. These industries are concerned with the creation of distinct, independent things, frequently through assembly or machining techniques. The discrete industry's MES solutions concentrate on areas such as production scheduling, inventory management, work order monitoring, and equipment maintenance.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 43.7% market share over the forecast period. This is attributed, in considerable measure, to its technological dominance, strong manufacturing sectors, and early embrace of digital manufacturing solutions. The demand for operational efficiency, product quality, and compliance with severe laws has propelled the development of the manufacturing execution systems (MES) market in this region. Furthermore, manufacturing execution systems (MES) solutions have been widely adopted by the automotive, aerospace, pharmaceutical, and food and beverage industries. The focus on real-time data, reliability, and automation has accelerated the adoption of MES. Moreover, in North America, the advent of Industry 4.0, the Internet of Things (IoT), and advanced analytics have enabled a more comprehensive integration of manufacturing execution systems (MES) with different enterprise systems, providing integrated manufacturing solutions.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period, owing to its extensive manufacturing base, increasing modernization, and advancements in innovative technology. China, India, South Korea, and Japan have individually established manufacturing powerhouses, offering anything from electronics to automobiles. With increased competition and the demand for productivity, many APAC manufacturers are investing in modern technology, such as manufacturing execution systems (MES), to simplify their processes.

The Europe market is expected to register a substantial CAGR growth rate during the forecast period. Europe has been a forerunner in the industry 4.0 trend, emphasizing digital manufacturing transformation. This has essentially sped up the widespread use of manufacturing execution system (MES) technologies. Furthermore, Europe has a strong manufacturing sector, particularly in Germany, France, and Italy. This region is notably strong in the automotive, chemical, and manufacturing industries.

List of Key Market Players

- Rockwell Automation

- Honeywell International

- Dassault Systemes

- SAP

- Siemens AG

- General Electric Co.

- Schneider Electric S.A

- Eyelit Inc.

- AVEVA

- Emerson Electric Co.

- ABB Ltd

- Werum IT Solutions GmbH

- Yokogawa Electric Corporation

- Birlasoft Limited

- 3YOURMIND GmbH

- FUJITSU

- Tulip Interfaces, Inc.

Key Market Developments

- On February 2023, GE Digital has announced updates to its cloud-based Manufacturing Execution Systems (MES) software. The Proficy Smart Factory cloud MES software can help process, discrete, and mixed-environment manufacturers of any size reduce total cost of ownership (TCO) by up to 30%, decrease maintenance, and improve security by lowering capital expenditures (CAPEX) and operating expenses (OPEX) compared to on-premises implementations. Manufacturers may reduce maintenance resource overhead while increasing performance with the latest features and software upgrades delivered promptly via cloud infrastructure.

- On February 2023, AVEVA has announced the availability of the AVEVA Manufacturing Execution System 2023. It promises to reduce the costs and difficulties of multi-site Manufacturing Execution System (MES) solutions. The latest edition of AVEVA MES will help standardize and implement best practices more rapidly and at scale. This, in turn, will improve operational efficiency and sustainability. The new AVEVA Manufacturing Execution System 2023 also enables enhanced supply chain resilience and agility. Furthermore, it features unified visibility, reporting, and KPIs across multi-site operations.

- On July 2022, CAI Software, LLC, a provider of mission-critical enterprise resource planning (ERP), manufacturing execution systems (MES), eCommerce EDI (electronic data interchange), and warehouse management software (WMS) and services, announced the acquisition of OpenMFG LLC, doing business as xTuple.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Manufacturing Execution Systems (MES) Market based on the below-mentioned segments:

Manufacturing Execution Systems (MES) Market, Offering Analysis

- Software

- Services

- Solution

Manufacturing Execution Systems (MES) Market, Deployment Type Analysis

- On-premises

- On-demand

- Hybrid

Manufacturing Execution Systems (MES) Market, Industry Analysis

- Process Industry

- Food & Beverages

- Oil & Gas

- Chemicals

- Pulp & Paper

- Pharmaceuticals & Life Sciences

- Energy & Power

- Water & Wastewater Management

- Others

- Discrete Industry

- Automotive

- Aerospace

- Medical devices

- Consumer packaged goods

- Others

Manufacturing Execution Systems (MES) Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Manufacturing Execution Systems (MES) market?The Global Manufacturing Execution Systems (MES) Market is expected to grow from USD 12.47 billion in 2022 to USD 36.9 billion by 2032, at a CAGR of 11.4% during the forecast period 2022-2032

-

2. Which are the key companies in the market?Rockwell Automation, Honeywell International, Dassault Systemes, SAP, Siemens AG, General Electric Co., Schneider Electric S.A, Eyelit Inc., Emerson Electric Co., ABB Ltd, Werum IT Solutions GmbH, Yokogawa Electric Corporation, Birlasoft Limited, 3YOURMIND GmbH, FUJITSU, Tulip Interfaces, Inc.

-

3. Which segment dominated the Manufacturing Execution Systems (MES) market share?The discrete industries segment in end-use type dominated the Manufacturing Execution Systems (MES) market in 2022 and accounted for a revenue share of over 54.2%.

-

4. Which region is dominating the Manufacturing Execution Systems (MES) market?North America is dominating the Manufacturing Execution Systems (MES) market with more than 43.7% market share.

-

5. Which segment holds the largest market share of the Manufacturing Execution Systems (MES) market?The DIN rail segment based on type holds the maximum market share of the Manufacturing Execution Systems (MES) market.

Need help to buy this report?