Malaysia Ammonia Market Size, Share, and COVID-19 Impact Analysis, By Chemical Form (Anhydrous Ammonia, Aqueous Ammonia, and Ammonium Compounds), By End Use (Agriculture, Chemical & Petrochemical, Food & Beverage, Mining & Metallurgy, Energy & Utilities, and Others), and Malaysia Ammonia Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsMalaysia Ammonia Market Insights Forecasts to 2035

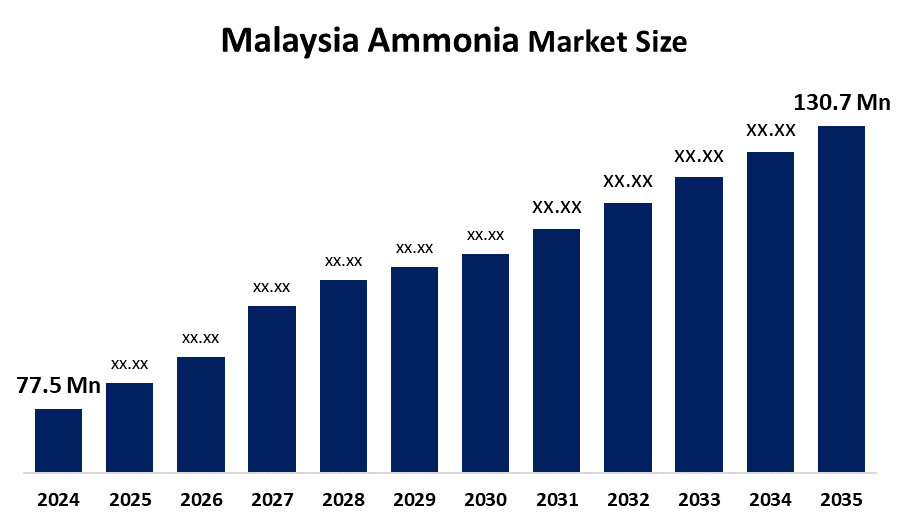

- The Malaysia Ammonia Market Size Was Estimated at USD 77.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.87% from 2025 to 2035

- The Malaysia Ammonia Market Size is Expected to Reach USD 130.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Malaysia ammonia Market Size Is Anticipated To Reach USD 130.7 Million By 2035, Growing At A CAGR Of 4.87% From 2025 to 2035. The ammonia market in Malaysia is driven by developing fertilizer demand, developing chemical industries, increasing use of green ammonia, the development of the hydrogen economy, energy transition programs, industrial decarbonization objectives, and favorable government regulations.

Market Overview

The Malaysia Ammonia Market Size exists to handle ammonia supply and demand for both industrial and commercial applications. Ammonia finds applications across numerous fields, including agricultural fertilizers, chemical processing, pharmaceuticals, refrigeration systems, water treatment, and industrial cleaning. The increasing interest in environmentally friendly ammonia and hydrogen energy solutions has expanded their functionality because it helps Malaysia achieve agricultural productivity, industrial growth, environmental protection, and international trade.

The Malaysia Ammonia Market Size receives support through government programs which operate under the Hydrogen Economy and Technology Roadmap (HETR) and National Energy Transition Roadmap (NETR). The Green Investment Tax Allowance (GITA) and Green Income Tax Exemption (GITE), along with hydrogen production targets and biomass strategy funding and infrastructure development programs, create financial incentives for businesses to produce sustainable ammonia, which they will use in industrial operations and international trade.

The MISC-Gentari clean ammonia shipping partnership from Malaysia plans to develop new ammonia transportation methods by 2027. Gentari announced its joint investment with a green ammonia platform, which aims to establish large-scale production and export operations for green ammonia starting from October 2023. The upcoming projects will develop green ammonia facilities, create export centers, and support low-carbon energy projects throughout Southeast Asia.

Report Coverage

This research report categorizes the market for the Malaysia Ammonia Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Malaysia ammonia market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Malaysia ammonia market.

Malaysia Ammonia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 77.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 4.87% |

| 2035 Value Projection: | USD 130.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 154 |

| Segments covered: | By End Use, By Chemical Form |

| Companies covered:: | Tekimia Sdn Bhd Petronas Chemicals Ammonia Sdn. Bhd. Core Tech CMC Sdn Bhd May Chemical Sdn Bhd Wakomas Chemical Sdn Bhd A A Venture Sdn Bhd Teknogas (M) Sdn Bhd Lindan Malaysia Kong Long Huat Chemicals Sdn Bhd MAY Chemical Sdn Bhd (Ammonia Solution) Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Ammonia Market in Malaysia is driven by the agricultural sector demand, which requires fertilizers and chemical industrial growth, and refrigeration and water treatment applications. Government support through energy transition policies, hydrogen economy initiatives, and tax incentives enables market growth. The market expansion continues to strengthen because of increasing interest in green and low-carbon ammonia, which receives support from technological progress and export market possibilities.

Restraining Factors

The ammonia market in Malaysia is mostly constrained by the high capital expenses for green ammonia projects and changing natural gas markets, the need to meet environmental regulations, the absence of domestic hydrogen facilities, the difficulties related to safety and storage, and the market's reliance on imported advanced ammonia technologies.

Market Segmentation

The Malaysia ammonia market share is classified into chemical form and end use.

- The anhydrous ammonia segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Malaysia Ammonia Market Size is segmented by chemical form into anhydrous ammonia, aqueous ammonia, and ammonium compounds. Among these, the anhydrous ammonia segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because of its high nitrogen concentration, affordability, and widespread use in industrial and fertilizer production, the anhydrous ammonia segment leads the Malaysian ammonia market. Higher demand and revenue growth are fueled by its applicability for large-scale agriculture, chemical production, and refrigeration systems.

- The agriculture segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Malaysia ammonia market is segmented by end use into agriculture, chemical & petrochemical, food & beverage, mining & metallurgy, energy & utilities, and others. Among these, the agriculture segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because ammonia is widely used in fertilizer manufacture to increase crop yields, the agriculture sector dominates the Malaysian ammonia market. Sustained consumption and market expansion are fueled by robust agricultural activity, growing food demand, and government emphasis on food security.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Malaysia ammonia market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tekimia Sdn Bhd

- Petronas Chemicals Ammonia Sdn. Bhd.

- Core Tech CMC Sdn Bhd

- May Chemical Sdn Bhd

- Wakomas Chemical Sdn Bhd

- A A Venture Sdn Bhd

- Teknogas (M) Sdn Bhd

- Lindan Malaysia

- Kong Long Huat Chemicals Sdn Bhd

- MAY Chemical Sdn Bhd (Ammonia Solution)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, MISC's ammonia floating production, storage, and offloading (FPSO) facility design is approved in principle (AiP).

- In April 2024, MISC advances ammonia as a marine fuel by signing contracts to build the first ammonia dual-fuel Aframax ships in history.

- In October 2023, a large-scale green ammonia platform is being developed by Gentari and AM Green to start exports by late 2025.

Market Segment

This study forecasts revenue at the Malaysia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Malaysia ammonia market based on the below-mentioned segments:

Malaysia Ammonia Market, By Chemical Form

- Anhydrous Ammonia

- Aqueous Ammonia

- Ammonium Compounds

Malaysia Ammonia Market, By End Use

- Agriculture

- Chemical & Petrochemical

- Food & Beverage

- Mining & Metallurgy

- Energy & Utilities

- Others

Frequently Asked Questions (FAQ)

-

What is the Malaysia ammonia market size?Malaysia ammonia market size is expected to grow from USD 77.5 million in 2024 to USD 130.7 million by 2035, growing at a CAGR of 4.87% during the forecast period 2025-2035

-

What are the key growth drivers of the market?Market growth is driven by agricultural sector demand, which requires fertilizers and chemical industrial growth, and refrigeration and water treatment applications. Government support through energy transition policies, hydrogen economy initiatives, and tax incentives enables market growth.

-

What factors restrain the Malaysia ammonia market?Constraints include the high capital expenses for green ammonia projects, changing natural gas markets, and the need to meet environmental regulations.

-

How is the market segmented by chemical form?The market is segmented into anhydrous ammonia, aqueous ammonia, and ammonium compounds

-

Who are the key players in the Malaysia ammonia market?Key companies include Tekimia Sdn Bhd, Petronas Chemicals Ammonia Sdn. Bhd., Core Tech CMC Sdn Bhd, May Chemical Sdn Bhd, Wakomas Chemical Sdn Bhd, A A Venture Sdn Bhd, Teknogas (M) Sdn Bhd, Lindan Malaysia, Kong Long Huat Chemicals Sdn Bhd, MAY Chemical Sdn Bhd (Ammonia Solution), and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?