Global Low-Speed Vehicle Market Size, Share, and COVID-19 Impact Analysis, By Type (Golf Cart, Commercial Utility Vehicle, Industrial Utility Vehicle, Personal Mobility Vehicle), By Power Output (<8, 8-15KW, >15 kW), By Propulsion Type (Electric Vehicle, ICE), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Low-Speed Vehicle Market Insights Forecasts to 2033

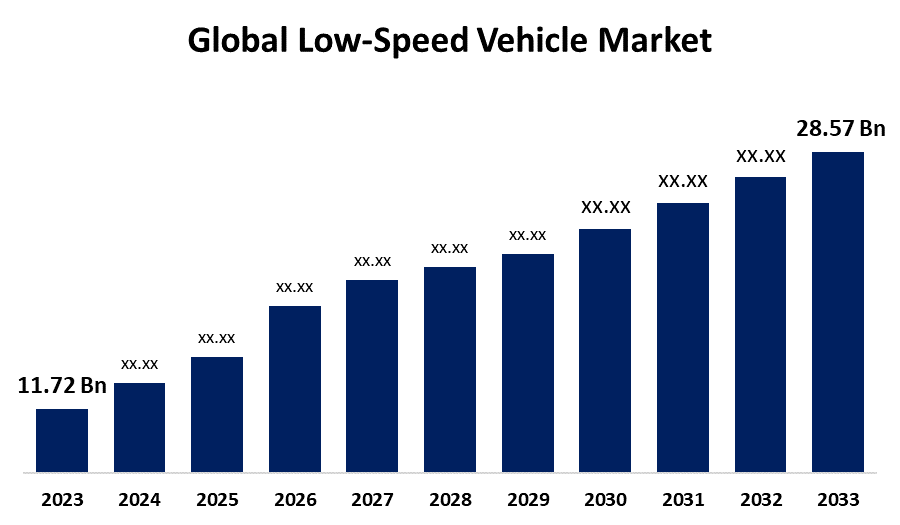

- The Global Low-Speed Vehicle Market Size was Valued at USD 11.72 Billion in 2023.

- The Market Size is Growing at a CAGR of 9.32% from 2023 to 2033.

- The Worldwide Low-Speed Vehicle Market Size is Expected to Reach USD 28.57 Billion by 2033.

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Low-Speed Vehicle Market Size is Anticipated to Exceed USD 28.57 Billion by 2033, Growing at a CAGR of 9.32% from 2023 to 2033.

Market Overview

The low-speed vehicle (LSV) market signifies the market for vehicles designed for low-speed travel, often between 20 and 25 mph (32 and 40 kph). LSVs are commonly used for short-distance travel in residential neighborhoods, schools, resorts, and other regulated environments. These electric cars provide a viable and environmentally sustainable mode of transportation. They incorporate safety safeguards and are designed to follow the standards that apply to low-speed vehicles. LSVs' primary function is to provide quick and efficient transportation over small distances. They are commonly used for small-space transportation in residential communities, retirement communities, and college campuses. Governments have passed demanding automobile emission laws and regulations, which are fueling market growth. Rising pollution, technological breakthroughs, a thriving car industry, and dwindling fossil fuel inventories all contribute to industrial growth. Advancements in ride-hailing and embedded mobility alternatives, as well as the elderly population's requirement for automobiles for mobility, are predicted to drive the low-speed vehicle market forward.

Report Coverage

This research report categorizes the market for the global low-speed vehicle market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global low-speed vehicle market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global low-speed vehicle market.

Global Low-Speed Vehicle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 11.72 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.32% |

| 2033 Value Projection: | USD 28.57 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Power Output, By Propulsion Type, By Region |

| Companies covered:: | ICON Electric Vehicles, AGT Electric Cars, KUBOTA Corporation, Moto Electric Vehicles, Motrec International Inc., Star EV Corporation, CLUB CAR, Columbia Vehicle Group Inc., Deere & Company, Evolution Electric Vehicles, Garia, American Landmaster, Bradshaw, and Others Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Leading governments are forming alliances to reduce emissions and enacting strong emission rules to combat climate change, which is primarily caused by transportation emissions. These vehicles are expected to help reduce vehicle pollution. As a result, these vehicles are expected to become increasingly popular in towns and cities for short-distance trips and campus rides in workplaces, hospitals, universities, golf courses, colleges, residential flats, and other settings. Thus, this aspect is expected to drive the market. LSVs have potential because of the development of smart cities and the implementation of smart mobility solutions. These vehicles might be integrated into the overall transportation ecosystem, improving existing modes of transportation and offering a practical and ecologically beneficial last-mile connection. To fulfil specific client needs, manufacturers can offer several flexible options and cutting-edge features in LSVs. This includes features like advanced security measures, networking choices, comfortable designs, and better comfort.

Restraining Factors

The high cost of EVs, a lack of a suitable charging infrastructure, and the fact that the technology is still in its early stages are impeding the growth of the low-speed electric vehicle market share internationally.

Market Segmentation

The global low-speed vehicle market share is classified into type, power output, and propulsion type.

- The commercial utility vehicle segment is expected to hold the largest share of the global low-speed vehicle market during the forecast period.

Based on the type, the global low-speed vehicle market is categorized into golf carts, commercial utility vehicles, industrial utility vehicles, and personal mobility vehicles. Among these, the commercial utility vehicle segment is expected to hold the largest share of the global low-speed vehicle market during the forecast period. Transportation of these vehicles between plants is becoming more and more important in the industry. The big players are focusing on commercial vehicles. For example, in December 2021, Deere & Company agreed to purchase majority control of Krisel Electric. Kreisel creates high-density, long-lasting electric battery modules and packs. John Deere has witnessed an increase in demand for batteries as a standalone or hybrid vehicle propulsion solution. Turf equipment, compact utility tractors, tiny tractors, compact construction, and road-building equipment are examples of Deere products that can be powered entirely by batteries.

- The 8-15KW segment is expected to grow at the fastest CAGR during the forecast period.

Based on the power output, the global low-speed vehicle market is categorized into <8, 8–15KW, and >15 KW. Among these, the 8–15KW segment is expected to grow at the fastest CAGR during the forecast period. 8–15 kW low-speed vehicles are a type of low-speed vehicle (LSV) with a maximum power output of 8–15 KW and a speed limit of 25 mph (40 km/h) or less. Small electric cars or golf carts are two examples of these vehicles, which are mostly used for personal transport. 8–15 KW LSVs are frequently more powerful and have a greater range per charge than LSVs with a maximum power output of 8 kW or less.

- The electric vehicle segment is expected to hold a significant share of the global low-speed vehicle market during the forecast period.

Based on the propulsion type, the global low-speed vehicle market is categorized into electric vehicles and ICE. Among these, the electric vehicle segment is expected to hold a significant share of the global low-speed vehicle market during the forecast period. A low-speed electric car emits no tailpipe emissions, lowering air pollution and greenhouse gas emissions as compared to regular internal combustion engine (ICE) vehicles. The increasing number of golf courses, as well as the government's efforts to reduce carbon emissions to satisfy pollution control rules, will benefit the automobile industry.

Regional Segment Analysis of the Global Low-Speed Vehicle Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global low-speed vehicle market over the predicted timeframe.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global low-speed vehicle market over the forecast period. These two countries' leading market positions are primarily owing to increased demand from expanding golf courses, industrial facilities, and travel. Other countries, including India, South Korea, and Thailand, have seen rising demand in recent years. Golf's popularity is also increasing throughout Asia, with 5,000 golf courses planned by 2021 and several new golf clubs set to open. In addition, tourism, product manufacturing, IT hubs, and warehousing have all grown significantly in recent years. Low-speed vehicles can be beneficial in these applications for moving people to specific locations, as well as for transporting medium- to large-sized goods. All of these factors are predicted to stimulate the rise of low-speed cars in the region.

North America is expected to grow at the fastest CAGR of the global low-speed vehicle market during the forecast period. Increasing government measures to promote sustainable mobility, as well as the expanding building and infrastructure industries, to tackle pollution, there is an increasing global demand for low-emission, environmentally friendly vehicles. To combat the harmful effects of deforestation, governments around the US are pushing electric vehicles and low-emission fuel sources. For instance, in February 2022, the US Department of Transportation announced plans to invest USD 5 billion in the future through the National Electrical Vehicle Infrastructure (NEVI) Formula Program. The president established this program to help develop a national electric car charging network.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global low-speed vehicle market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ICON Electric Vehicles

- AGT Electric Cars

- KUBOTA Corporation

- Moto Electric Vehicles

- Motrec International Inc.

- Star EV Corporation

- CLUB CAR

- Columbia Vehicle Group Inc.

- Deere & Company

- Evolution Electric Vehicles

- Garia

- American Landmaster

- Bradshaw

- Others

Key Market Developments

- In April 2023, United Rentals, Inc. has formed a relationship with Polaris Commercial, a Polaris division, to provide more all-electric utility vehicles that will help make job sites cleaner, more ecologically friendly, and quieter. This will also assist consumers in meeting their sustainability goals and reducing maintenance requirements. The Polaris RANGER XP Kinetic, an all-new electric utility vehicle, claims to have more features and the most horsepower and torque ever seen in a utility side-by-side.

- In January 2023, Golfers' performance on the course has been enhanced by E-Z-GO (Textron Specialized Vehicles Inc.) with the announcement that the company has revamped its RXV golf cart with various new features and improvements. The E-Z-GO RXV promises to have a new, streamlined design on the front end, resulting in a modern and stylish golf automobile for any course. The new RXV also has a redesigned dashboard for golfers, which includes an easy-to-load tee, golf ball holders, cups, and plenty of room for mobile devices, rangefinders, and personal things.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global low-speed vehicle market based on the below-mentioned segments:

Global Low-Speed Vehicle Market, By Type

- Golf Cart

- Commercial Utility Vehicle

- Industrial Utility Vehicle

- Personal Mobility Vehicle

Global Low-Speed Vehicle Market, By Power Output

- <8

- 8-15KW

- >15 KW

Global Low-Speed Vehicle Market, By Propulsion Type

- Electric Vehicle

- ICE

Global Low-Speed Vehicle Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global Low-Speed Vehicle market over the forecast period?The global low-speed vehicle market size is expected to grow from USD 11.72 billion in 2023 to USD 28.57 billion by 2033, at a CAGR of 9.32% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global low-speed vehicle market?Asia Pacific is anticipated to hold the largest share of the global low-speed vehicle market over the predicted timeframe.

-

3. Who are the top key players in the low-speed vehicle market?ICON Electric Vehicles, AGT Electric Cars, KUBOTA Corporation, Moto Electric Vehicles, Motrec International Inc., Star EV Corporation, CLUB CAR, Columbia Vehicle Group Inc., Deere & Company, Evolution Electric Vehicles, Garia, American Landmaster, Bradshaw, and others.

Need help to buy this report?