Global Low Density Polyethylene Market Size, Share, and COVID-19 Impact Analysis, By Technology (Autoclave, Roving, and Tubular), By Application (Film & Sheets, Extrusion Coating, Injection Moulding, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Low Density Polyethylene Market Size Insights Forecasts to 2035

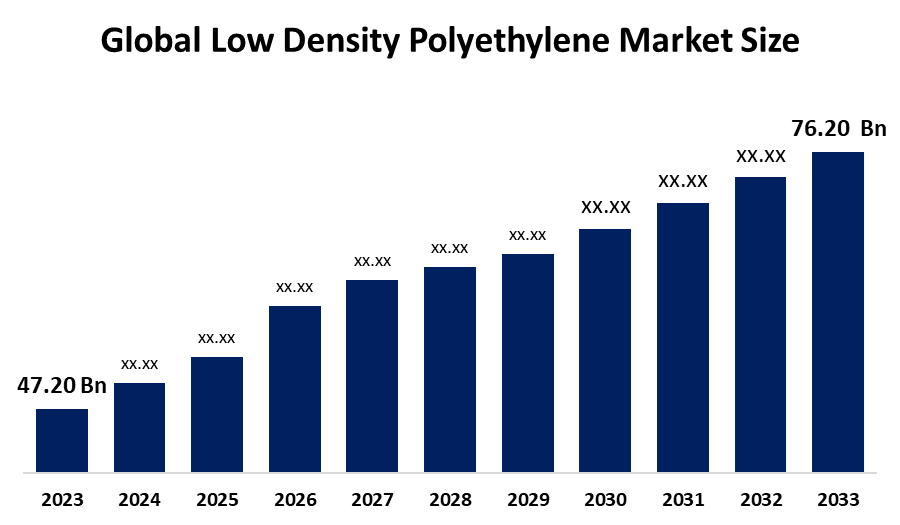

- The Global Low Density Polyethylene Market Size Was Estimated at USD 47.20 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.45% from 2025 to 2035

- The Worldwide Low Density Polyethylene Market Size is Expected to Reach USD 76.20 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Low Density Polyethylene Market Size was valued at around USD 47.20 Billion in 2024 and is predicted to grow to around USD 76.20 billion by 2035 with a compound annual growth rate (CAGR) of 4.45% from 2025 to 2035. Opportunities in the Low Density Polyethylene Market Size include expanding uses in healthcare and agriculture, growing demand for packaging, the development of flexible plastics, technical developments, and rising consumption in emerging nations.

Market Overview

The manufacturing, distribution, and consumption of low-density polyethylene (LDPE), a thermoplastic polymer made from ethylene using high-pressure polymerization techniques, are all included in the LDPE market. Low-density polyethylene (LDPE) is crucial for applications in flexible films, extrusion coatings, agricultural films, wire/cable insulation, and packaging solutions due to its flexibility, toughness, translucency, moisture resistance, chemical inertness, and superior heat-seal qualities. The Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) program in India allocates INR 50,000 crore between 2018 and 2023 to support micro-irrigation development through increased usage of LDPE material in agricultural films.

In October 2024, LyondellBasell launched a strategic expansion by finalizing the acquisition of Germany-based APK AG, strengthening solvent-based recycling technology to address LDPE flexible plastic challenges and improve circular solutions for personal-care packaging across global sustainability initiatives efforts. The Low Density Polyethylene Market Size is primarily driven by the increasing need for flexible, lightweight, and reasonably priced polymer solutions in packaging and manufacturing applications. Growing e-commerce, growing urbanization, and growing food and beverage industries are all major factors in the Low Density Polyethylene Market Size's growth.

Report Coverage

This research report categorizes the Low Density Polyethylene Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Low Density Polyethylene Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the Low Density Polyethylene Market Size.

Low Density Polyethylene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 47.20 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.45% |

| 2035 Value Projection: | USD 76.20 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Technology, By Application |

| Companies covered:: | BASF-YPC Company Limited, Braskem S.A., Dow Chemical Company, DuPont de Nemours, Inc., ExxonMobil Corporation, Formosa Plastics Corporation, GE Analytical Instruments, LG Chem Ltd, LyondellBasell Industries N.V., Qatar Petrochemical Company Q.S.C, Saudi Basic Industries Corporation (SABIC), and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing need for flexible packaging solutions in the food, beverage, pharmaceutical, and consumer goods industries, where LDPE is prized for its flexibility, light weight, and moisture resistance is one of the main motivators in Low Density Polyethylene Market Size. The use of LDPE in films, sheets, and molded products is also being fueled by growing consumer awareness of product quality and durability. It is anticipated that the market will continue to rise due to the need for effective and adaptable materials that can support creative packaging solutions. The creation of sustainable and recyclable LDPE solutions is propelling Low Density Polyethylene Market Size innovation and long-term growth.

Restraining Factors

Strict environmental restrictions, rising worries about plastic waste, price volatility for raw materials, increased demand for sustainable alternatives, and recycling issues with flexible plastic products are all factors restraining the market for low density polyethylene.

Market Segmentation

The Low Density Polyethylene Market Size share is classified into technology and application.

- The roving segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the Low Density Polyethylene Market Size is divided into autoclave, roving, and tubular. Among these, the roving segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Roving-based materials are now more widely used in packaging, construction, and composite applications due to improvements in their uniformity, strength, and durability brought about by advancements in polymer composition and processing. The steady need for lightweight, high-strength polymer strands with improved mechanical qualities for a range of industrial uses has propelled the roving market.

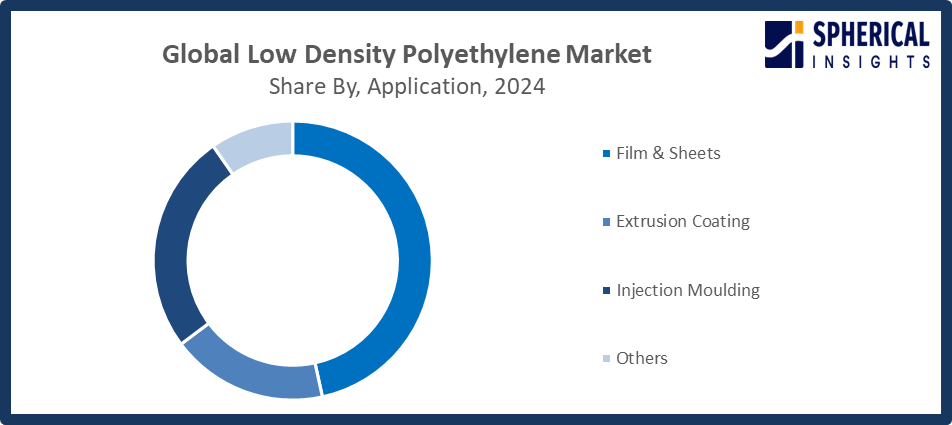

- The film & sheets segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the Low Density Polyethylene Market Size is divided into film & sheets, extrusion coating, injection moulding, and others. Among these, the film & sheets segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The widespread use of LDPE in flexible packaging, protective films, and industrial sheets which provide lightweight, long-lasting, and affordable solutions has contributed to the expansion of the Film & Sheets segment.

Get more details on this report -

Regional Segment Analysis of the Low Density Polyethylene Market Size

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the Low Density Polyethylene Market Size over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the Low Density Polyethylene Market Size over the predicted timeframe. The demand for flexible packaging, agricultural films, and consumer goods made with LDPE has dramatically expanded due to rapid urbanization, population expansion, and rising disposable incomes in countries like China, India, Japan, and Southeast Asian countries. Additionally, the deployment of LDPE-based irrigation systems and greenhouse films has accelerated due to growing agricultural activity and government measures supporting contemporary farming techniques. One of the new announcements is BASF's 500,000 metric ton polyethylene factory at the Verbund site in Zhanjiang, which will start operations in 2025 and improve regional supplies.

North America is expected to grow at a rapid CAGR in the Low Density Polyethylene Market Size during the forecast period. The growing focus on high-performance, long-lasting, and lightweight materials has further increased the use of LDPE in a variety of industries. The adoption of recovered LDPE is encouraged by the U.S. Plastics Pact, which aims to have all packaging be recyclable, biodegradable, or reusable by 2025. In January 2025, Gulf Coast Growth Ventures was launched by ExxonMobil and SABIC, which are based in the United States. The company opened a manufacturing facility in San Patricio County, Texas, with two polyethylene units that can produce up to 1.3 million metric tons annually.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Low Density Polyethylene Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF-YPC Company Limited

- Braskem S.A.

- Dow Chemical Company

- DuPont de Nemours, Inc.

- ExxonMobil Corporation

- Formosa Plastics Corporation

- GE Analytical Instruments

- LG Chem Ltd

- LyondellBasell Industries N.V.

- Qatar Petrochemical Company Q.S.C

- Saudi Basic Industries Corporation (SABIC)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Repeats Group BV launched its expansion in Italy by acquiring Polimero Srl, strengthening its recycled LDPE portfolio and enhancing the supply of high-quality sustainable resin.

- In July 2025, Siegwerk Druckfarben AG announced a strategic partnership with Wildplastic GmbH and TU-Hamburg to improve plastic recyclability, sustainability, and innovation in eco-friendly inks and coatings across industries.

- In May 2025, SABIC launched LNP ELCRIN WF0061BiQ PBT resin, produced from chemically upcycled ocean-bound PET bottles, reducing CO2 emissions by 14% and energy demand by 25% versus traditional glass fiber.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Low Density Polyethylene Market Size based on the below-mentioned segments:

Global Low Density Polyethylene Market Size, By Technology

- Autoclave

- Roving

- Tubular

Global Low Density Polyethylene Market Size, By Application

- Film & Sheets

- Extrusion Coating

- Injection Moulding

- Others

Global Low Density Polyethylene Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Low Density Polyethylene Market Size over the forecast period?The global Low Density Polyethylene Market Size is projected to expand at a CAGR of 4.45% during the forecast period.

-

2. What is the market size of the Low Density Polyethylene Market Size?The global Low Density Polyethylene Market Size is expected to grow from USD 47.20 billion in 2024 to USD 76.20 billion by 2035, at a CAGR of 4.45% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Low Density Polyethylene Market Size?Asia Pacific is anticipated to hold the largest share of the Low Density Polyethylene Market Size over the predicted timeframe.

-

4. Who are the top companies operating in the global Low Density Polyethylene Market Size?BASF-YPC Company Limited, Braskem S.A., Dow Chemical Company, DuPont de Nemours, Inc., ExxonMobil Corporation, Formosa Plastics Corporation, GE Analytical Instruments, LG Chem Ltd, LyondellBasell Industries N.V., Qatar Petrochemical Company Q.S.C, Saudi Basic Industries Corporation (SABIC), and Others.

-

5. What factors are driving the growth of the Low Density Polyethylene Market Size?The LDPE market is driven by growing demand for flexible packaging, consumer goods, and agricultural films; technical developments; urbanization; infrastructure expansion; cost-effectiveness; and growing usage in healthcare, construction, and electrical applications.

-

6. What are the market trends in the Low Density Polyethylene Market Size?The transition to sustainable and recyclable LDPE, solvent-based recycling technologies, lightweight packaging options, creative polymer blends, and expanding uses in the industrial, personal care, and agricultural sectors are some of the significant themes.

-

7. What are the main challenges restricting the wider adoption of the Low Density Polyethylene Market Size?low density polyethylene wider use is restricted by environmental laws, worries about plastic waste, a lack of infrastructure for recycling, volatile raw material prices, and growing demand for biodegradable and other sustainable materials.

Need help to buy this report?