Global Low Cost Carrier Market Size By Aircraft Type (Narrow Body, Wide Body), By Application (Individual, Commercial), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Low Cost Carrier Market Insights Forecasts to 2033

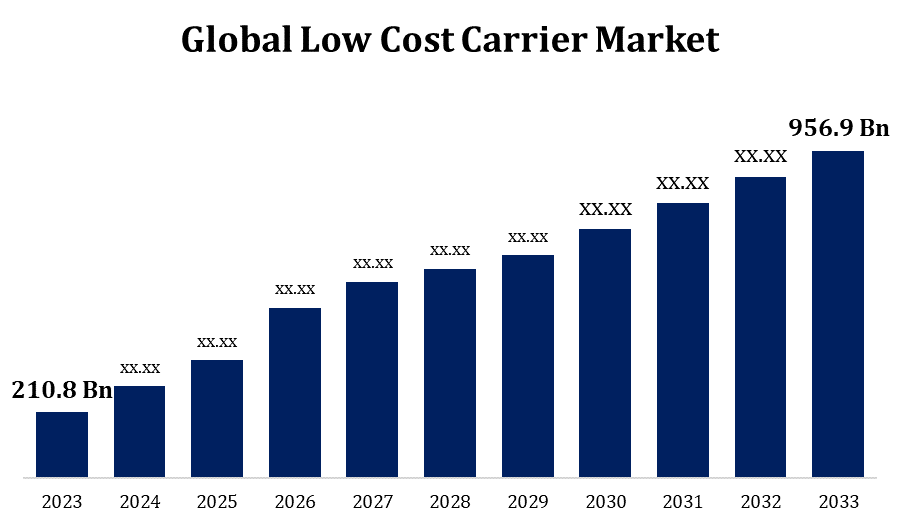

- The Global Low Cost Carrier Market Size was valued at USD 210.8 Billion in 2023.

- The Market Size is Growing at a CAGR of 16.33% from 2023 to 2033.

- The Worldwide Low Cost Carrier Market Size is expected to reach USD 956.9 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Low Cost Carrier Market is expected to reach USD 956.9 Billion by 2033, at a CAGR of 16.33% during the forecast period 2023 to 2033.

Low-cost carriers have developed globally, offering both short- and long-haul flights. Low-cost carriers have taken a large share of the aviation business, posing a challenge to traditional carriers. The actual market share varied by area, with certain markets having a bigger proportion of low-cost carriers than others. The low-cost carrier industry is quite competitive. Airlines frequently participate in price wars to attract customers, and this fierce competition has resulted in creative business structures and cost-cutting strategies. Some low-cost airlines used hybrid models, offering additional services or collaborating with other airlines to provide a more diverse variety of options. This change was intended to attract a larger consumer base. Despite their success, low-cost carriers had problems such as fuel price volatility and regulatory limits.

Low Cost Carrier Market Value Chain Analysis

LCCs prioritise acquiring fuel-efficient and cost-effective aircraft, frequently from a single manufacturer to simplify maintenance and training. To gain cost advantages, establish partnerships with providers of gasoline, spare parts, and other operating essentials. Streamlining ground processes such as quick turnaround times, better worker scheduling, and minimal idle time to enhance operational efficiency. LCCs often fly direct flights rather than hub-and-spoke structures to save money on layovers and connecting flights. Using online platforms and direct distribution methods to reduce distribution expenses while reaching a larger customer base. Employing cost-effective marketing tactics, frequently leveraging digital channels, to promote reduced prices and attract budget-conscious passengers. The success of low-cost carriers is dependent on optimising each phase of the value chain to generate cost savings.

Low Cost Carrier Market Opportunity Analysis

As the aviation sector recovers from the effects of the COVID-19 epidemic, low-cost carriers have opportunities to capitalise on pent-up demand and adjust their tactics to the new travel scenario. Leveraging digital technologies for better customer experiences, such as streamlined booking processes, mobile apps, and personalised services, can boost customer happiness and loyalty. Identifying and entering new markets, particularly in emerging economies with a growing middle class and rising air travel demand, offers prospects for growth. Investing in modern, fuel-efficient aircraft can help to reduce costs, improve operational efficiency, and promote environmental sustainability. Continuously optimising operating procedures, establishing favourable supplier agreements, and investigating cost-effective airport options all help to reduce overall costs.

Global Low Cost Carrier Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 210.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 16.33% |

| 2033 Value Projection: | USD 956.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Aircraft Type, By Application, By Region, By Geographic |

| Companies covered:: | Alaska Air Group, Inc., Azul S.A., Norwegian Air Shuttle ASA, AirAsia Group Berhad, easyJet plc, Qantas Airways Limited, WestJet Airlines Ltd., Air Arabia PJSC, New World Aviation, Inc., Ryanair Holdings Plc, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Market Dynamics

Low Cost Carrier Market Dynamics

The rising demand for domestic flights

Low-cost carriers are well-known for their low airfares, which make air travel more accessible to a wider range of people. This affordability is especially appealing for domestic travel, encouraging more people to fly rather than choose other modes of transportation. Economic expansion and urbanisation frequently result in a rise in domestic travel for both business and recreational objectives. As more people relocate to cities, the demand for air travel inside a country increases. Low-cost airlines frequently focus on market segmentation, targeting specific demographics or traveller profiles. Tailoring services to the needs of domestic travellers enables LCCs to gain a larger market share. Low-cost carriers excel at implementing competitive pricing strategies.

Restraints & Challenges

Fuel price fluctuations have a considerable impact on airlines' operational costs. Low-cost carriers, which rely significantly on cost efficiency, may struggle to remain profitable during times of high fuel prices. Economic recessions or downturns can cause a drop in consumer spending and travel. Low-cost carriers, who frequently cater to price-sensitive travellers, may face a greater impact during economic downturns. The low-cost carrier business is extremely competitive, and price wars between airlines can reduce profit margins. Differentiating from competitors while keeping pricing low is a continual problem. Maintaining great operational efficiency, especially rapid turnaround times at airports, is critical to the low-cost airline business model. Delays or disruptions can upset plans and raise costs.

Regional Forecasts

North America Market Statistics

North America is anticipated to dominate the Low Cost Carrier Market from 2023 to 2033. Low-cost carriers now account for a sizable portion of the domestic market in North America. They compete with traditional carriers for both pleasure and business travellers, providing competitive fares and a diverse range of destinations. Low-cost airlines in North America have modified their business models throughout time. While some carriers began with a concentration on no-frills, point-to-point service, they have since added additional services and amenities to appeal to a wider range of customers. Many low-cost carriers in North America have expanded their route networks to serve a diverse variety of destinations, including both primary and secondary airports. This expansion plan enables them to enter new markets and service a variety of consumer segments.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific area has had strong growth in air travel demand, which has aided the establishment of low-cost carriers. The rise of a booming middle class, more urbanisation, and a growing desire to travel have all contributed to the demand for low-cost flights. The Asia-Pacific LCC market is diversified, with carriers operating in Malaysia, India, Japan, South Korea, Indonesia, and Thailand, among others. Each market has its own distinct traits and challenges. Low-cost carriers have increased their market share, notably in domestic markets. They fight against both traditional carriers and other low-cost carriers, resulting in fierce competition and pricing competition. Similar to other regions, Asia-Pacific low-cost carriers frequently rely on supplementary revenue streams to bolster their earnings.

Segmentation Analysis

Insights by Aircraft Type

The narrow body segment accounted for the largest market share over the forecast period 2023 to 2033. In general, narrow-body aircraft are less expensive than wide-body aircraft, both in terms of acquisition and running costs. Low-cost carriers prioritise cost-effectiveness, and the lower operational costs of narrow-body planes are consistent with their business strategy. Low-cost carriers sometimes use a point-to-point approach, connecting passengers directly between city pairs rather than via hubs. This concept works best with narrow-body aircraft, allowing carriers to efficiently serve a wide range of locations. Demand for short-haul and regional travel is increasing, particularly in densely populated areas and emerging economies. Narrow-body aircraft are ideal for satisfying this demand because they are intended for shorter itineraries and can fly into airports with shorter runways.

Insights by Application

The individual segment accounted for the largest market share over the forecast period 2023 to 2033. The leisure travel segment of the low-cost carrier industry is frequently characterised by budget-conscious travellers seeking low-cost airfares for vacations and holidays. This segment's growth is being driven by rising disposable incomes, a desire for unique travel experiences, and the convenience afforded by low-cost carriers. Low-cost carriers have increasingly targeted business travellers by providing competitive rates, flexible scheduling, and services tailored to specific business requirements. Business travel segment growth is affected by cost-conscious corporate travel regulations, the demand for quick and frequent connections, and the expansion of low-cost carrier route networks. The point-to-point concept connects passengers directly between city pairs, eliminating the requirement for hub-and-spoke operations. This technique provides travellers with more direct routes, shorter travel times, and frequently reduced rates.

Recent Market Developments

- In June 2023, Norse Atlantic Airways launched a flight from Rome to New York. The new service provides a low-cost travel option for customers during the summer. The flights will be operated by a Boeing 787 Dreamliner.

Competitive Landscape

Major players in the market

- Alaska Air Group, Inc.

- Azul S.A.

- Norwegian Air Shuttle ASA

- AirAsia Group Berhad

- easyJet plc

- Qantas Airways Limited

- WestJet Airlines Ltd.

- Air Arabia PJSC

- New World Aviation, Inc.

- Ryanair Holdings Plc

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Low Cost Carrier Market, Aircraft Type Analysis

- Narrow Body

- Wide Body

Low Cost Carrier Market, Application Analysis

- Individual

- Commercial

Low Cost Carrier Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Low Cost Carrier Market?The global Low Cost Carrier Market is expected to grow from USD 210.8 billion in 2023 to USD 956.9 billion by 2033, at a CAGR of 16.33% during the forecast period 2023-2033.

-

2. Who are the key market players of the Low Cost Carrier Market?Some of the key market players of the market are Alaska Air Group, Inc., Azul S.A., Norwegian Air Shuttle ASA, AirAsia Group Berhad, easyJet plc, Qantas Airways Limited, WestJet Airlines Ltd., Air Arabia PJSC, New World Aviation, Inc., Ryanair Holdings Plc.

-

3. Which segment holds the largest market share?The individual segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Low Cost Carrier Market?North America is dominating the Low Cost Carrier Market with the highest market share.

Need help to buy this report?