Global Low Alloy Steels Powder Market Size, Share, and COVID-19 Impact Analysis, By Type (Atomization, Reduction, and Others), By Application (Automobile, Machinery, Aerospace, Chemical Industry, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsAsia Pacific Large Molecule Bioanalytical Technologies Market Insights Forecasts to 2035

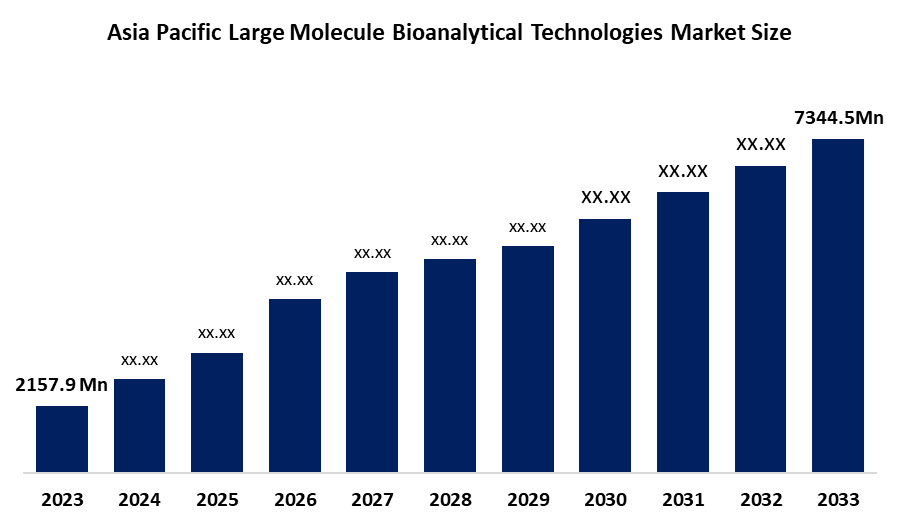

- The Asia Pacific Large Molecule Bioanalytical Technologies Market Size Was Estimated at USD 2157.9 Million in 2024.

- The Market Size is Growing at a CAGR of 11.78% between 2025 and 2035.

- The Asia Pacific Large Molecule Bioanalytical Technologies Market Size is Anticipated to Reach USD 7344.5 Million by 2035.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global low alloy steels powder market size was worth around USD 0.96 Billion in 2024 and is predicted to grow to around USD 1.56 Billion by 2035 with a compound annual growth rate (CAGR) of 4.51 % from 2025 to 2035. The low alloy steels powder market has the opportunity in advanced manufacturing, additive manufacturing, automotive and aerospace applications, cost-efficient production, increased material characteristics, expanding industrial demand, and technological breakthroughs in powder metallurgy processes.

Market Overview

The market of low alloy steel powder comprises the production, distribution, and using of extremely finely powdered low-alloy steels, which consist of alloying elements less than 5% such as molybdenum, nickel, and chromium. The aforementioned elements are added in small amounts to carbon steel in order to generate low-alloy steels, thus improving mechanical qualities including strength, durability, wear resistance and corrosion resistance. The U.S. Export-Import Bank’s $27.4M loan to 6K Additive and Canada’s tariff quotas, underscore policy support for domestic production amid reinstated U.S. Section 232. The low alloy steels powder market includes the whole supply chain, from sourcing raw materials and producing powders to processing methods including atomization, pressing, and sintering, as well as a variety of end-use industries like automotive, aerospace, construction, and machinery. The growing requirement for low alloy steel powders in sectors including manufacturing, automotive, and aerospace where lightweight, high-performance materials are required for applications requiring exceptional strength, wear resistance, and corrosion resistance, is what is driving the low alloy steels powder market expansion. The low alloy steels powder market expansion is further encouraged by the increasing attention on energy efficiency and sustainability in industrial production.

Report Coverage

This research report categorizes the low alloy steels powder market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the low alloy steels powder market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the low alloy steels powder market.

Global Low Alloy Steels Powder Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 0.96 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.51% |

| 2035 Value Projection: | 1.56 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type Atomization, By Application |

| Companies covered:: | AK Steel Holding AMETEK Carpet Technology Daido Steel Haining Feida Höganäs Jiande Yitong KOBELCO Laiwu Iron & Steel Group NanoSteel Pellets Pometon Powder Rio Tinto Sandvik Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing trend of electric vehicles (EVs) and the necessity for high-performance materials in EV motors and batteries are projected to substantially raise demand for low alloy steel powders in the future years. The increasing need for unique, on-demand manufacturing solutions has led to a rise in the use of low-alloy steel powders in additive manufacturing methods, especially 3D printing. The need for low-alloy steel powders is also being driven by the shift to additive manufacturing, especially 3D printing, since these materials provide better quality and efficiency in additive processes.

Restraining Factors

The low alloy steels powder market encounters several restraining factors, such as high production costs, complicated manufacturing processes, restricted availability of raw materials, strict environmental regulations, technological obstacles in powder metallurgy, and varying demand in final user industries, all of which may hinder the growth of the market.

Market Segmentation

The low alloy steels powder market share is classified into type and application.

- The atomization segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the low alloy steels powder market is divided into atomization, reduction, and others. Among these, the atomization segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The atomization segment is the most preferred one because it has the best particle size distribution, the highest uniformity, and the greatest density. The process of atomized powders consists of changing the molten metal into small particles, a technique that makes it possible to get the best and the same quality powders with different characteristics.

- The automobile segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the low alloy steels powder market is divided into automobile, machinery, aerospace, chemical industry, and others. Among these, the automobile segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The need for metals to be light and at the same time strong led to the use of low-alloy steels powders in the production process by the automotive industry. The automotive industry's insistence on getting high-performance materials without spending a lot of money increases the demand for advanced powder metallurgy techniques.

Get more details on this report -

Regional Segment Analysis of the Low Alloy Steels Powder Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the low alloy steels powder market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the Low Alloy Steels Powder market over the predicted timeframe. Asia Pacific is driven primarily by the region's robust industrial expansion and rapidly increasing manufacturing base. Countries such as China, India, and Japan display substantial demand for materials with superior performance in sectors like automotive, aerospace, equipment, and construction. With a 6.1% CAGR, China is the market leader for low alloy steel powder due to its extensive industrialization and rising demand for innovative materials in a variety of industries. The country’s desire for durable components that can handle severe stress and wear has propelled the development of low-alloy steel powders. For Instance, in March 2025, AKS introduced their B700C-R high-strength steel bar in industrial construction, while Sandvik launched Osprey MAR 55 tool steel powder in August 2025, enhancing precision, performance, and eco-efficiency.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the low alloy steels powder market during the forecast period. The North America region benefits from advanced technological infrastructure, widespread use of additive manufacturing and powder metallurgy, and large R&D investments aimed at improving material performance. The USA is witnessing a constant increase in the low alloy steels powder market, with a 4.3% CAGR, driven by the increasing demand for high-performance materials in industries including automotive, aerospace, and heavy machinery. The demand for low alloy steel powders is expanding not only in the automotive industry but also as renewable energy sources like solar and wind power are included in the national grid. For instance, in February 2025, Alleima introduced its TD high-temperature alloy for aircraft, for metal additive manufacturing, fostering technological advancement and innovation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the low alloy steels powder market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Key Companies:

-

AK Steel Holding

-

AMETEK

-

Carpet Technology

-

Daido Steel

-

Haining Feida

-

Höganäs

-

Jiande Yitong

-

KOBELCO

-

Laiwu Iron & Steel Group

-

NanoSteel

-

Pellets (Generic Category – specify company if needed)

-

Pometon Powder

-

Rio Tinto

-

Sandvik

-

Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, Union Minister H.D. Kumaraswamy launched the Production Linked Incentive (PLI) Scheme for Specialty Steel, aiming to boost India’s low-alloy steel powder production, high-value steel manufacturing, and industrial self-reliance.

- In March 2025, Union Minister Bhupathiraju Srinivasa Varma launched three initiatives under SRTMI, enhancing R&D in steelmaking and advancing Low Alloy Steels Powder technology, strengthening India’s domestic steel industry and innovation capabilities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the low alloy steels powder market based on the below-mentioned segments:

Global Low Alloy Steels Powder Market, By Type

- Atomization

- Reduction

- Others

Global Low Alloy Steels Powder Market, By Application

- Automobile

- Machinery

- Aerospace

- Chemical Industry

- Others

Global Low Alloy Steels Powder Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the low alloy steels powder market over the forecast period?The global low alloy steels powder market is projected to expand at a CAGR of 4.51% during the forecast period.

-

2. What is the market size of the low alloy steels powder market?The global Low Alloy Steels Powder market size is expected to grow from USD 0.96 billion in 2024 to USD 1.56 billion by 2035, at a CAGR of 4.51 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the low alloy steels powder market?North America is anticipated to hold the largest share of the low alloy steels powder market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global low alloy steels powder market?AK Steel Holding, AMETEK, Carpenter Technology, Daido Steel, Haining Feida, Höganäs, Jiande Yitong, KOBELCO, Laiwu Iron & Steel Group, NANOSTEEL, Pellets, Pometon Powder, Rio Tinto, Sandvik, and Others.

-

5. What factors are driving the growth of the low alloy steels powder market?The low alloy steels powder market is expanding due to several factors, including increased demand from the automotive, aerospace, and construction industries, the use of additive manufacturing, improved mechanical qualities, cost-effectiveness, sustainability initiatives, and technological developments in powder metallurgy.

-

6. What are the market trends in the low alloy steels powder market?Key trends include increasing use in additive manufacturing, development of high-performance alloys, focus on eco-efficient production, integration of advanced powder

Need help to buy this report?