Global Lithium Metal Market Size, Share, and COVID-19 Impact Analysis, By Form (Powder, Ingot, Wire, and Liquid) By Purity (99% (4N), 99% (5N), 999% (6N), and 9999% (7N)), By Application (Batteries, Electronics, Medicine, Lubricants, and Glass and Ceramics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Lithium Metal Market Size Insights Forecasts to 2035

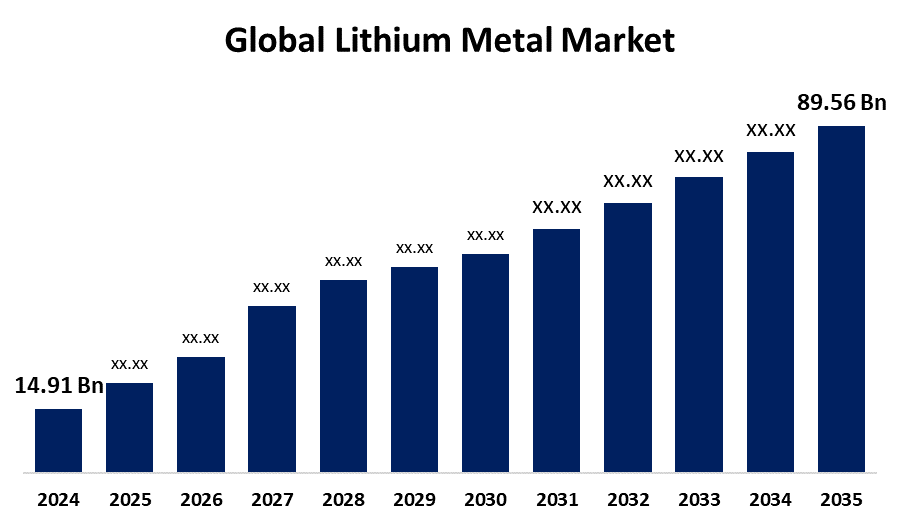

- The Global Lithium Metal Market Size Was Estimated at USD 14.91 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 17.7% from 2025 to 2035

- The Worldwide Lithium Metal Market Size is Expected to Reach USD 89.56 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Lithium Metal Market Size was worth around USD 14.91 Billion in 2024 and is predicted to Grow to around USD 89.56 Billion by 2035 with a compound annual growth rate (CAGR) of 17.7% from 2025 to 2035. The lithium metal market is expanding due to increasing demand for high energy density batteries, growth in the adoption of electric vehicles, growing needs for renewable energy storage, and technological improvement in battery performance, in combination with favorable government policies in favor of clean energy and electrification.

Market Overview

The lithium metal market refers to the process, distribution, and utilization of lithium in the metallic state, a light, extremely reactive alkali metal possessing outstanding electrochemical characteristics. Lithium metal is mainly used in batteries, specifically in high-energy-density lithium-ion and lithium-metal batteries, and is therefore pivotal for electric vehicles (EVs), portable electronics, and renewable energy storage systems. Apart from batteries, lithium metal has uses in aerospace, ceramics, glass manufacturing, and specialty alloys owing to its low density and high reactivity. The growth of the market is primarily influenced by the swift uptake of electric vehicles, rising demand for cost-efficient energy storage solutions, and the transition to renewable energy integration. Technological innovations in battery design, including solid-state batteries and high-performance lithium-metal batteries, further accelerate the demand by providing higher energy density, safety, and longevity. Innovations in lithium extraction and recycling technologies also advance supply sustainability and cost effectiveness, underpinning market growth.

Government policies focusing on clean energy, along with increased consumer demand for green technologies, present important growth opportunities. Growing markets, especially in the Asia Pacific, present high potential due to increased EV adoption and industrialization. Major participants in the worldwide lithium metal market are Albemarle Corporation, Livent Corporation, Ganfeng Lithium, SQM, and China's Tianqi Lithium, which invest heavily in R&D and strategic alliances to enhance market presence. During 2025, the U.S. Department of Energy (DOE) purchased a 5% interest in Lithium Americas' Thacker Pass lithium project joint venture with General Motors. This $2.26 billion project is emblematic of the U.S. emphasis on having a secure domestic supply chain for lithium used in electric vehicle batteries and energy storage.

Report Coverage

This research report categorizes the lithium metal market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the lithium metal market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the lithium metal market.

Global Lithium Metal Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.91 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 17.7% |

| 2035 Value Projection: | USD 89.56 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 157 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Form, By Purity and COVID-19 Impact Analysis |

| Companies covered:: | Ganfeng Lithium, Albemarle Corporation, Tianqi Lithium, Mineral Resources Limited, Livent Corporation, Li-Metal Corp., SQM, Orocobre Limited, Rio Tinto, Lithium Americas Corp., Merck KGaA, Chengxin Lithium Group, ATT Advanced Elemental Materials Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for lithium metal is driven by the fast uptake of electric vehicles (EVs) and increasing demand for high-energy-density batteries in portable electronics and renewable energy storage systems. Energy efficiency, safety, and battery longevity are improved through technological innovations in solid-state and lithium-metal batteries, boosting demand. Increased investment in the production of batteries and government support for clean energy also support market expansion. In addition, rising perceptions of environmental sustainability and the move towards low-carbon economies spur the use of lithium-based energy solutions. Growing industrial uses in aerospace, ceramics, and specialty alloys also drive the market upwards.

Restraining Factors

The lithium metal market is constrained by the expense of production and extraction, an energy-hungry process, and environmental issues such as water depletion and ecosystem disturbance. Geopolitical tensions, supply chain constraints, and price volatility further constrain expansion. Flammability and reactivity hazards, along with the threat of alternative battery technology, are also important challenges.

Market Segmentation

The lithium metal market share is classified into form, purity, and application.

- The powder segment dominated the market in 2024, approximately 68% and is projected to grow at a substantial CAGR during the forecast period.

Based on the form, the lithium metal market is divided into powder, ingot, wire, and liquid. Among these, the powder segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The powder segment led the lithium metal market, driven by its extensive application in advanced lithium-ion and lithium-metal batteries, energy storage systems, and electronic devices. Its higher reactivity, ease of use, and compatibility with cutting-edge battery technologies render it an attractive option for manufacturers, stimulating long-term market growth.

- The 99% (4N) segment accounted for the largest share in 2024, approximately 41% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the purity, the lithium metal market is divided into 99% (4N), 99% (5N), 999% (6N), and 9999% (7N). Among these, the 99% (4N) segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The 99% (4N) segment is propelled by its cost-effectiveness and applicability for battery production, electronics, and energy storage uses. Its controlled purity level is balanced to guarantee high performance with affordability, which leads it to be the most sought-after large-scale industrial and commercial application.

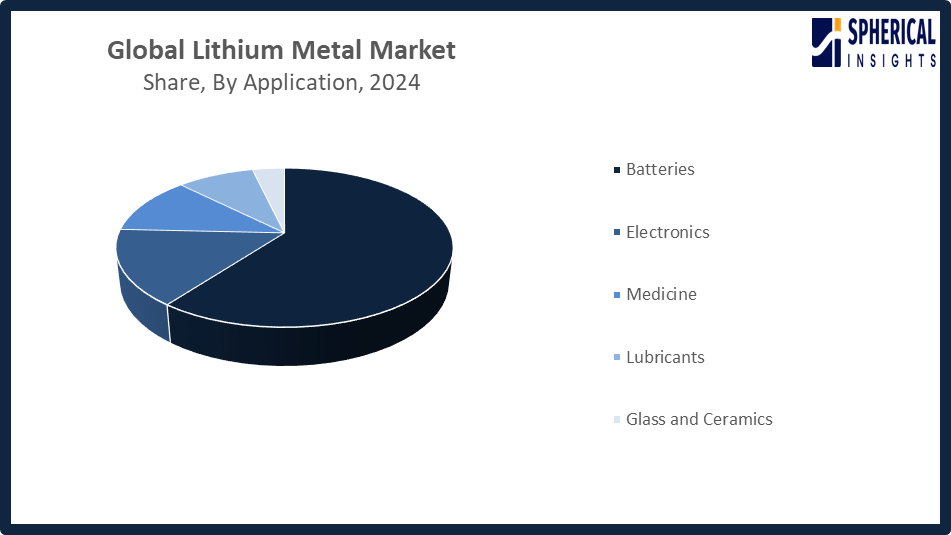

- The batteries segment accounted for the highest market revenue in 2024, approximately 60% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the lithium metal market is divided into batteries, electronics, medicine, lubricants, and glass and ceramics. Among these, the batteries segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The batteries segment, due to the expansion, is led by the growing usage of electric vehicles, the growing need for portable electronics, and the growth in renewable energy storage systems. Technological innovations in lithium-metal as well as high-energy-density battery technologies improve performance, efficiency, and lifespan, driving the segment's demand internationally.

Get more details on this report -

Regional Segment Analysis of the Lithium Metal Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the lithium metal market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the lithium metal market over the predicted timeframe. Asia Pacific is dominant in the lithium metal market during the forecast period, approximate market share of 58%, owing to high-speed industrialization, robust government support for electric vehicle (EV) uptake, and increasing battery production capacity. Regional demand for lithium metal is boosted by countries such as China, Japan, South Korea, and India. China is at the forefront with vast lithium refining and EV manufacturing, Japan and South Korea lead in high-end battery technologies, and India is spending massively on clean energy infrastructure. These countries collectively enhance regional demand for lithium metal for energy storage and electronics uses.

North America is expected to grow at a rapid CAGR in the lithium metal market during the forecast period. The North America region is rapidly growing in the market for lithium metal in the prediction period, approximate market share of 25%, with a rise in investment in domestic lithium mining projects, energy storage solutions, and electric vehicle (EV) manufacturing. The United States is leading among its counterparts in the region with firm government policies favoring clean energy and battery fabrication. Canada contributes with vast lithium deposits and environmentally friendly mining, while Mexico is developing as an EV factory. These elements combined fuel North America's fast expansion in the lithium metal industry.

Europe's expansion in the lithium metal market is fueled by aggressive government policy backing electric mobility, renewable energy consumption, and battery manufacturing. Germany, France, and the United Kingdom are among the notable contributors. Germany is a leader with significant EV production and battery development, France is the hub of clean energy transformation, and the UK has invested in gigafactories. All these reinforce regional demand for lithium metal in advanced energy storage solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the lithium metal market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ganfeng Lithium

- Albemarle Corporation

- Tianqi Lithium

- Mineral Resources Limited

- Livent Corporation

- Li-Metal Corp.

- SQM

- Orocobre Limited

- Rio Tinto

- Lithium Americas Corp.

- Merck KGaA

- Chengxin Lithium Group

- ATT Advanced Elemental Materials Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, Albemarle (ALB.N), the world’s largest lithium producer, reported a surprise second-quarter profit driven by strong demand. Lithium usage in EVs, large-scale storage, and electronics rose 24% last year and is expected to grow 12% annually.

- In March 2025, Tianqi Lithium Corp. reported its first full-year loss since 2020, citing volatile lithium prices and rising geopolitical risks. The Chinese company posted a 7.9 billion yuan ($1.1 billion) net loss in 2024, down from a 7.3 billion yuan profit the previous year.

- In February 2025, China’s Ganfeng Lithium (002460.SZ) began lithium production at its Mariana project in northern Argentina, marking the start of multiple South American ventures. Ganfeng is among the world’s largest producers of lithium for rechargeable batteries.

- In August 2024, Arcadium Lithium plc acquired Li-Metal Corp.’s lithium metal business for US$11 million. The deal includes intellectual property, a pilot facility in Ontario, and key personnel, with co-founder Maciej Jastrzebski joining as a consultant to support technology transfer and integration.

- In November 2021, Livent Corporation unveiled LIOVIX, a proprietary printable lithium metal product that enhances lithium-ion battery performance, lowers manufacturing costs, supports next-generation battery technology, and improves both safety and sustainability.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the lithium metal market based on the below-mentioned segments:

Global Lithium Metal Market, By Form

- Powder

- Ingot

- Wire

- Liquid

Global Lithium Metal Market, By Purity

- 99% (4N)

- 99% (5N)

- 999% (6N)

- 9999% (7N)

Global Lithium Metal Market, By Application

- Batteries

- Electronics

- Medicine

- Lubricants

- Glass and Ceramics

Global Lithium Metal Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the lithium metal market over the forecast period?The global lithium metal market is projected to expand at a CAGR of 17.7% during the forecast period.

-

2. What is the market size of the lithium metal market?The global lithium metal market size is expected to grow from USD 14.91 billion in 2024 to USD 89.56 billion by 2035, at a CAGR of 17.7% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the lithium metal market?Asia Pacific is anticipated to hold the largest share of the lithium metal market over the predicted timeframe.

-

4. What is the lithium metal market?The lithium metal market is a global industry for the production and sale of lithium metal, a key material in high-performance applications like next-generation electric vehicle (EV) batteries, energy storage systems, and aerospace.

-

5. Who are the top 10 companies operating in the global lithium metal market?Ganfeng Lithium, Albemarle Corporation, Tianqi Lithium, Mineral Resources Limited, Livent Corporation, Li-Metal Corp., SQM, Orocobre Limited, Rio Tinto, Lithium Americas Corp., Merck KGaA, Chengxin Lithium Group, ATT Advanced Elemental Materials Co., Ltd.

-

6. What factors are driving the growth of the lithium metal market?The lithium metal market is driven by rising electric vehicle demand, expanding battery production, advancements in energy storage technology, renewable energy integration, and increasing government support for sustainable energy solutions.

-

7. What are the market trends in the lithium metal market?Key market trends in the Lithium-metal market include a shift toward solid-state battery technologies, increased recycling and sustainability efforts, rapid capacity expansion of production and refining, and volatile supply-demand with emerging supply chain diversification.

-

8. What are the main challenges restricting wider adoption of the lithium metal market?The main challenges restricting wider adoption of the lithium metal market relate to its high reactivity, which causes dendrite formation, unstable interfaces, and significant safety risks.

Need help to buy this report?