Global Liquid Sulfur Dioxide Market Size, Share, and COVID-19 Impact Analysis, By Grade (Food Grade, Industrial Grade, and Pharmaceutical Grade), By Application (Food and Beverages, Chemical Manufacturing, Pharmaceuticals, Pulp and Paper, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Liquid Sulfur Dioxide Market Insights Forecasts to 2035

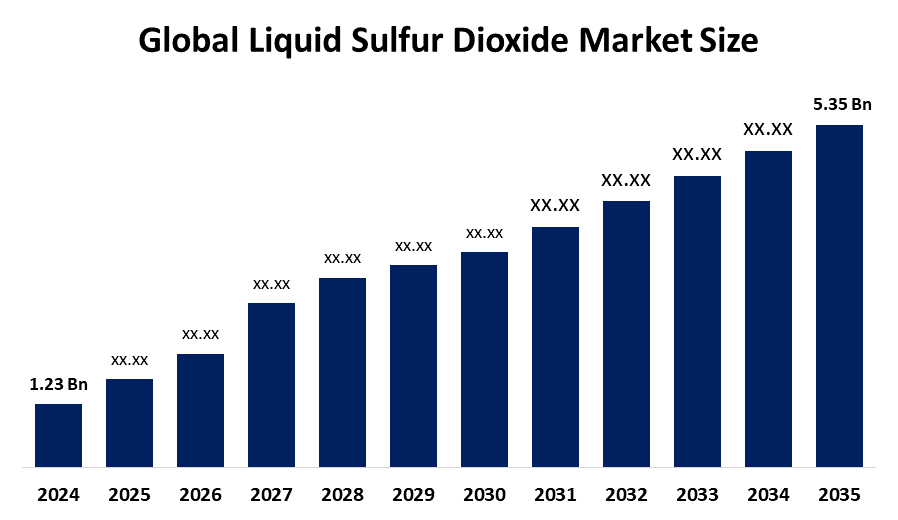

- The Global Liquid Sulfur Dioxide Market Size Was Estimated at USD 1.23 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 14.3 % from 2025 to 2035

- The Worldwide Liquid Sulfur Dioxide Market Size is Expected to Reach USD 5.35 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Liquid Sulfur Dioxide Market Size was valued at around USD 1.23 Billion in 2024 and is predicted to Grow to around USD 5.35 Billion by 2035 with a compound annual growth rate (CAGR) of 14.3 % from 2025 to 2035. With the growing demand for industrial processing solutions and antimicrobial agents worldwide, the liquid sulfur dioxide market offers opportunities for growing applications in the food preservation, beverage, and chemical industries.

Market Overview

The production, liquefaction, distribution, and application of sulfur dioxide SO2 an inorganic, colorless, and odorous gas transformed into liquid form for improved handling and transport efficiency, make up the specialized global commercial ecosystem known as the liquid sulfur dioxide market. Liquid SO2, which is mostly derived from sulfur combustion or industrial byproducts, is used as a vital reducing agent, antimicrobial preservative, bleaching compound, and dechlorination medium in important industries such as mining, chemical synthesis, pulp and paper production, water treatment, and food and beverage preservation. For instance, in December 2025, to improve atmospheric protection and encourage the use of cleaner SO2 in industrial operations, the U.S. Environmental Protection Agency (EPA) announced updated Secondary National Ambient Air Quality Standards (NAAQS) for SO2, tightening welfare-based emission levels from 0.5 ppm. The growth in applications across numerous industries, including food and beverage, chemical manufacturing, pharmaceuticals, and pulp and paper, is what drives the market's size. Growing chemical output, growing pharmaceutical uses, and growing preservative needs are the major factors driving this strong increase.

Report Coverage

This research report categorizes the liquid sulfur dioxide market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the liquid sulfur dioxide market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the liquid sulfur dioxide market.

Global Liquid Sulfur Dioxide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.23 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 14.3% |

| 2035 Value Projection: | USD 5.35 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Air Liquide S.A., Air Products and Chemicals, Inc., BASF SE, Ellenbarrie Industrial Gases Ltd., Gulf Cryo, Linde Group, The (The Linde Group), Matheson Tri-Gas, Inc., Messer Group GmbH, Praxair Grade, Inc., Showa Denko K.K., Solvay S.A., Taiyo Nippon Sanso Corporation, Universal Industrial Gases, Inc., INOX Air Products Ltd., Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The widespread application of liquid sulfur dioxide in the food and beverage sector is one of the main factors propelling the liquid sulfur dioxide market's expansion. Additionally, the food and beverage industry is expanding due to the global trend toward urbanization and the rising disposable income of consumers in developing nations, which is propelling the market for liquid sulfur dioxide. The development of environmentally friendly industrial processes and the increased emphasis on sustainable chemical practices both contribute to the market's expansion. Liquid SO2 is used in sterilization and purification procedures by the growing pharmaceutical and water treatment sectors.

Restraining Factors

The market for liquid sulfur dioxide is restricted by its high toxicity, strict regulations, and intricate handling and storage needs. These elements raise operational risks and expenses, which restricts broad adoption and slows market growth in a number of industries.

Market Segmentation

The liquid sulfur dioxide market share is classified into grade and application.

- The food grade segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the grade, the liquid sulfur dioxide market is divided into food grade, industrial grade, and pharmaceutical grade. Among these, the food grade segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The food and beverage industry uses food-grade liquid sulfur dioxide mainly as an antioxidant and preservative. The expansion of food-grade liquid sulfur dioxide is being driven by the rising demand for processed and ready-to-eat food products.

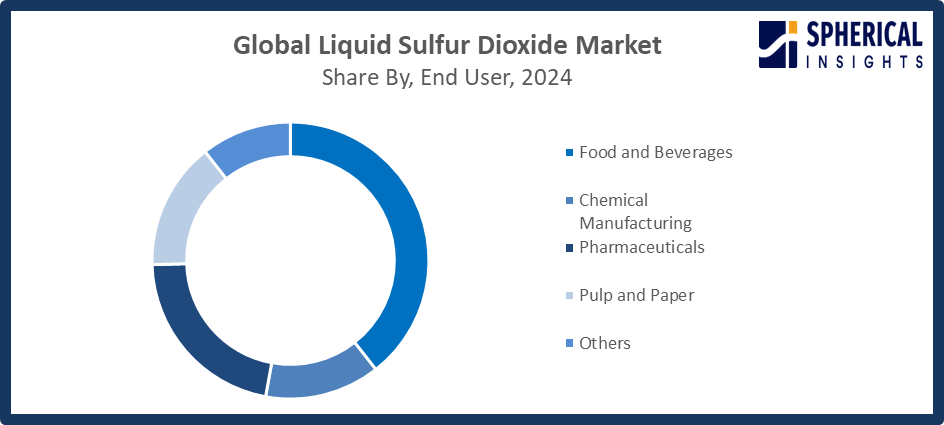

- The food and beverages segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the liquid sulfur dioxide market is divided into food and beverages, chemical manufacturing, pharmaceuticals, pulp and paper, and others. Among these, the food and beverages segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Liquid sulfur dioxide is used as an antioxidant and preservative in the food and beverage industry. The market for liquid sulfur dioxide is being driven by an increase in the consumption of processed and ready-to-eat food products.

Get more details on this report -

Regional Segment Analysis of the Liquid Sulfur Dioxide Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the liquid sulfur dioxide market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the liquid sulfur dioxide market over the predicted timeframe. Large-scale industrialization, the developing food and beverage industry, and the expanding pharmaceutical sector in nations like China and India are the main drivers of the Asia Pacific. The region's market expansion is further supported by rising investments in the pharmaceutical, water treatment, and chemical manufacturing sectors. Asia Pacific's need for liquid sulfur dioxide is being driven by the region's expanding pharmaceutical industry and increased consumption of processed foods and drinks. China's Ministry of Ecology and Environment announced changes to ambient air quality requirements for SO2 in September 2025, attributing emission reductions of more than 85% since 2013 to strict coal controls. This increased demand for liquid SO2 for pollution mitigation and desulfurization.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the liquid sulfur dioxide market during the forecast period. Sulfur dioxide is being used more frequently for sterilization and purification as the pharmaceutical and water treatment industries grow in North America. Due to the rising demand for processed and convenience meals, the food and beverage sector in North America is also expanding. Launches by the U.S. Environmental Protection Agency (EPA) are crucial to this acceleration. To improve atmospheric protection and encourage compliance with SO2 deployment in industrial scrubbing systems, the EPA finalized a stricter secondary National Ambient Air Quality Standard (NAAQS) for SO2 on January 27, 2025, lowering the welfare-based threshold.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the liquid sulfur dioxide market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- BASF SE

- Ellenbarrie Industrial Gases Ltd.

- Gulf Cryo

- Linde Group, The (The Linde Group)

- Matheson Tri-Gas, Inc.

- Messer Group GmbH

- Praxair Grade, Inc.

- Showa Denko K.K.

- Solvay S.A.

- Taiyo Nippon Sanso Corporation

- Universal Industrial Gases, Inc.

- INOX Air Products Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2024, Lyten launched a project demonstrating liquid sulfur dioxide-based energy storage technology on the International Space Station, supported by the Defense Innovation Unit, advancing next-generation rechargeable battery development in space applications.

- In January 2023, Technip Energies launched a project to enhance Aramco’s Riyadh Refinery by upgrading sulfur recovery units and implementing tail gas treatment systems, reducing liquid sulfur dioxide emissions in compliance with regulations.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the liquid sulfur dioxide market based on the below-mentioned segments:

Global Liquid Sulfur Dioxide Market, By Grade

- Food Grade

- Industrial Grade

- Pharmaceutical Grade

Global Liquid Sulfur Dioxide Market, By Application

- Food and Beverages

- Chemical Manufacturing

- Pharmaceuticals

- Pulp and Paper

- Others

Global Liquid Sulfur Dioxide Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the liquid sulfur dioxide market over the forecast period?The global liquid sulfur dioxide market is projected to expand at a CAGR of 14.3% during the forecast period.

-

2.What is the market size of the liquid sulfur dioxide market?The global liquid sulfur dioxide market size is expected to grow from USD 1.23 billion in 2024 to USD 5.35 billion by 2035, at a CAGR of 14.3 % during the forecast period 2025-2035.

-

3.Which region holds the largest share of the liquid sulfur dioxide market?Asia Pacific is anticipated to hold the largest share of the liquid sulfur dioxide market over the predicted timeframe.

-

4.Who are the top 10 companies operating in the global liquid sulfur dioxide market?Air Liquide S.A., Air Products and Chemicals, Inc., BASF SE, Ellenbarrie Industrial Gases Ltd., Gulf Cryo, Linde Group, The (The Linde Group), Matheson Tri-Gas, Inc., Messer Group GmbH, Praxair Grade, Inc., Showa Denko K.K., Solvay S.A., Taiyo Nippon Sanso Corporation, Universal Industrial Gases, Inc., INOX Air Products Ltd., and Others.

-

5.What factors are driving the growth of the liquid sulfur dioxide market?The market for liquid sulfur dioxide is fueled by growing demand in the food preservation, chemical production, water treatment, and pharmaceutical industries. This demand is bolstered by industrialization, technical improvements, and growing regulatory focus on product safety.

-

6.What are the market trends in the liquid sulfur dioxide market?The increasing use of liquid sulfur dioxide as a preservative and antibacterial agent, its use in processed foods and beverages, the growth of chemical applications, and advancements in safe storage and transportation are some of the major trends.

-

7.What are the main challenges restricting the wider adoption of the liquid sulfur dioxide market?High toxicity, strict regulations, complicated handling and storage requirements, and safety issues all hinder market growth by raising operating risks and preventing wider adoption across commercial and industrial sectors.

Need help to buy this report?