Global Liquid Sealing Agents Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Silicone, Polyurethane, Acrylic, and Others), By Application (Automotive, Construction, Electronics, Aerospace, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Liquid Sealing Agents Market Insights Forecasts to 2035

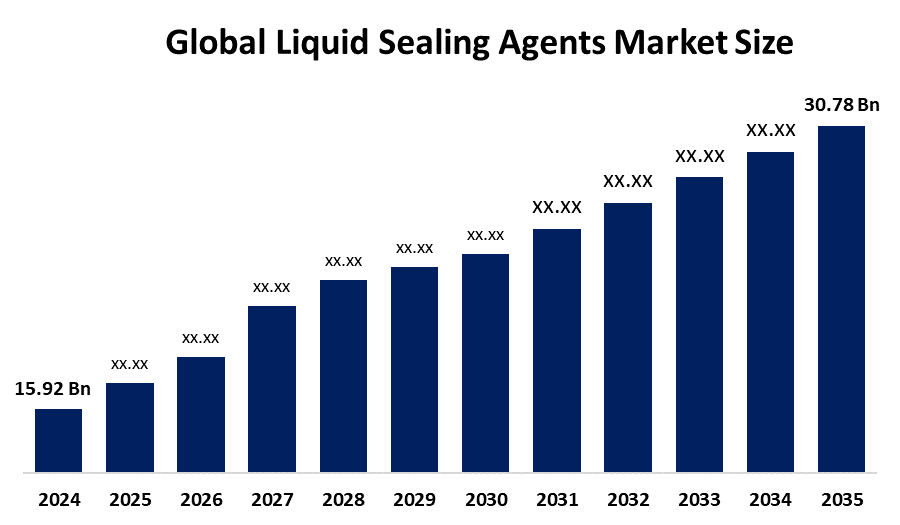

- The Global Liquid Sealing Agents Market Size Was Estimated at USD 15.92 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.18% from 2025 to 2035

- The Worldwide Liquid Sealing Agents Market Size is Expected to Reach USD 30.78 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global Liquid Sealing Agents market size was worth around USD 15.92 Billion in 2024 and is predicted to grow to around USD 30.78 Billion by 2035 with a compound annual growth rate (CAGR) of 6.18% from 2025 and 2035. The market for liquid sealing agents has a number of opportunities to grow due to an increase in infrastructure and construction projects around the world, the production of automobiles and electric vehicles, which call for sophisticated sealing solutions, and the growing need for high performance, long lasting, and energy efficient sealing agents across a range of industries.

Market Overview

Liquid sealing agents are materials designed to seal joints, cracks, and gaps in a range of substrates, forming a barrier that prevents the passage of fluids, gases, or contaminants. The increasing production of automobiles and the demand for cutting edge materials that can endure harsh circumstances have a major impact on the market's growth. Liquid sealing agents are essential in the automotive industry for maintaining the integrity of several parts, including body assemblies, engines, and transmissions. High performance sealing agents are becoming more and more in demand as automakers work to create vehicles that are more durable, lightweight, and efficient. Further demand is also being created by the growing interest in electric vehicles, which need specific sealing solutions to shield delicate electrical components from dust and moisture. The market for liquid sealing agents is therefore expected to increase significantly due to the global trend toward energy efficient and sustainable transportation options. Seal for Life Industries LLC, a US based expert in protective coating and sealing solutions serving infrastructure markets like water, oil & gas, and renewable energy, has agreed to be acquired by Henkel AG & Co. KGaA. In April 2024, Seal for Life was fully acquired by Henkel. Seal for Life Industries was previously purchased by Arsenal Capital Partners for US$328 million in 2019, demonstrating the high level of interest in sealing and coating technology among investors.

Governments globally are actively fostering the expansion of the global market for liquid sealing agents by establishing regulatory frameworks, building infrastructure, and implementing sustainability programs. The goal of the Indian government's Housing for All program is to construct 20 million reasonably priced urban homes by 2024. Furthermore, the Smart Cities Mission, which has allocated USD 31 billion, encourages the construction of infrastructure, including cutting-edge waterproofing techniques for urban developments. These programs are speeding up the use of liquid applied membranes in projects in the public and private sectors.

Report Coverage

This research report categorizes the liquid sealing agents market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the liquid sealing agents market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the liquid sealing agents market.

Global Liquid Sealing Agents Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 15.92 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.18% |

| 2035 Value Projection: | USD 30.78 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Henkel AG & Co. KGaA, 3M Company, Sika AG, Dow Inc., H.B. Fuller Company, Bostik SA, Wacker Chemie AG, Illinois Tool Works Inc., PPG Industries Inc., Huntsman Corporation, Master Bond Inc., ThreeBond Co. Ltd., TESA SE, Delta Adhesives, Pidilite Industries Ltd., and other players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The liquid sealing agents market is driven by the growing focus on ecofriendly and sustainable solutions across industries is one of the biggest opportunities. There is a strong push for the creation and use of low VOC, ecofriendly sealing agents that adhere to strict environmental standards, as customers and regulatory agencies want greener products. Innovation and the development of novel formulations that not only work well but also have a minimal negative impact on the environment are made possible by this trend. Businesses can obtain a competitive advantage and seize a growing market of eco aware customers and enterprises by investing in sustainable product development.

Restraining Factors

The liquid sealing agents market is restricted by factors like the price volatility of raw materials, which can affect pricing and manufacturing costs. Due to their reliance on petrochemical derivatives, many sealing agents are vulnerable to changes in the price of oil.

Market Segmentation

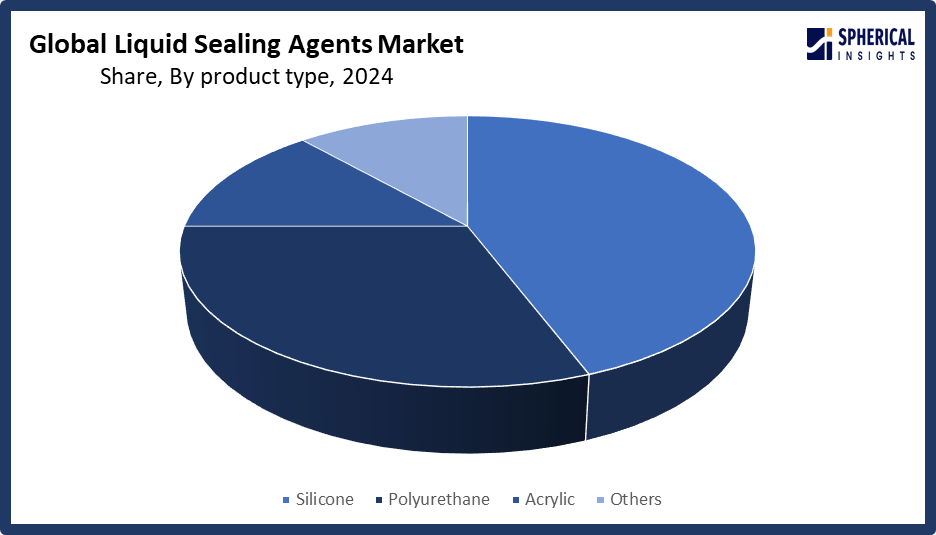

The liquid sealing agents market share is classified into product type and application.

- The silicone segment dominated the market in 2024, accounting for approximately 44% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the liquid sealing agents market is divided into silicone, polyurethane, acrylic, and others. Among these, the silicone segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven because of their exceptional flexibility, toughness, and tolerance to high temperatures. Silicone based sealing agents are highly prized and perfect for use in the electronics and automotive sectors. They are the go to option in industries needing strong sealing solutions because of their capacity to continue operating in harsh conditions and throughout a broad temperature range. Additionally, silicone sealants are well known for having outstanding adhesion qualities that allow them to adhere to a wide range of substrates, hence broadening the range of industries in which they can be used.

Get more details on this report -

- The automotive segment accounted for the largest share in 2024, accounting for approximately 35% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the liquid sealing agents market is divided into automotive, construction, electronics, aerospace, and others. Among these, the automotive segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is because liquid sealing agents are essential for improving vehicle performance and safety in the automotive sector. They are often utilized to stop fluid leaks, seal engine parts, and shield electronic parts from dust and moisture. The need for specialized sealing solutions that address the particular needs of electric vehicles is expected to increase as the automotive sector electrifies, propelling additional expansion in this market.

Regional Segment Analysis of the Liquid Sealing Agents Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share, representing nearly 30% of the liquid sealing agents market over the predicted timeframe.

North America is anticipated to hold the largest share, representing nearly 30% of the liquid sealing agents market over the predicted timeframe. In the North America market, the market is rising due to different growth trajectories revealed by the geographical prognosis for the liquid sealing agent market, which is driven by local industry dynamics, economic conditions, and regulatory environments. The construction and automotive sectors are the main drivers of North America's continuous expansion, making it a mature market. Advanced sealing technologies have been used as a result of the region's emphasis on innovation and sustainability, with the US serving as a key hub for research and development efforts.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR, representing nearly 6% in the liquid sealing agents market during the forecast period. The Asia Pacific area has a thriving market for liquid sealing agents due to an increase at the fastest rate, as a result of the region's growing manufacturing activity, urbanization, and industrialization. Liquid sealing agents are in increasing demand in countries like China, India, and Japan due to their growing automotive, electronics, and construction industries. The growing middle class, more disposable income, and government initiatives for infrastructure development are all factors contributing to the region's robust market growth. The availability of affordable raw materials and the large number of regional producers provide a competitive advantage that fosters the expansion of local markets.

Europe offers a steady market with room to develop for environmentally friendly sealing solutions because of its strict environmental laws and emphasis on sustainability. The need for high performance sealing agents is primarily driven by the automotive and aerospace sectors in the region, with Germany, France, and the United Kingdom leading the way. With an emphasis on lowering carbon emissions and advances in material science, the European market is anticipated to increase moderately. Furthermore, new prospects for sealing agents designed for these uses are presented by the growing use of electric cars and renewable energy technology.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the liquid sealing agents market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

-

Henkel AG & Co. KGaA

-

3M Company

-

Sika AG

-

Dow Inc.

-

H.B. Fuller Company

-

Bostik SA

-

Wacker Chemie AG

-

Illinois Tool Works Inc.

-

PPG Industries Inc.

-

Huntsman Corporation

-

Master Bond Inc.

-

ThreeBond Co. Ltd.

-

TESA SE

-

Delta Adhesives

-

Pidilite Industries Ltd.

-

Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

-

In March 2025, Cosmo Specialty Chemicals launched an innovative coating solution for heat-seal packaging applications, offering enhanced performance in the 120–160 °C range.

-

In April 2024, Henkel AG & Co. KGaA signed an agreement to acquire Seal for Life Industries LLC, a US-based firm specializing in protective coating and sealing solutions, to strengthen its Adhesive Technologies business, particularly in infrastructure.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the liquid sealing agents market based on the below-mentioned segments:

Global Liquid Sealing Agents Market, By Product Type

- Silicone

- Polyurethane

- Acrylic

- Others

Global Liquid Sealing Agents Market, By Application

- Automotive

- Construction

- Electronics, Aerospace

- Others

Global Liquid Sealing Agents Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the liquid sealing agents market over the forecast period?The global liquid sealing agents market is projected to expand at a CAGR of 6.18% during the forecast period.

-

What is the market size of the liquid sealing agents market?The global liquid sealing agents market size is expected to grow from USD 15.92 Billion in 2024 to USD 30.78 Billion by 2035, at a CAGR of 6.18% during the forecast period 2025-2035.

-

Which region holds the largest share of the liquid sealing agents market?North America is anticipated to hold the largest share of the liquid sealing agents market over the predicted timeframe.

-

Who are the top 15 companies operating in the global liquid sealing agents market?Henkel AG & Co. KgaA, 3M Company, Sika AG, Dow Inc., H.B. Fuller Company, Bostik SA, Wacker Chemie AG, Illinois Tool Works Inc., PPG Industries, Inc., Huntsman Corporation, Master Bond Inc., ThreeBond Co., Ltd., TESA SE, Delta Adhesives, Pidilite Industries Ltd., and Others.

-

What factors are driving the growth of the liquid sealing agents market?The liquid sealing agents market growth is driven by advanced liquid sealing agents that offer waterproofing, weather resistance, and joint sealing in buildings and industrial structures are in high demand due to the rapid expansion of construction and infrastructure projects.

-

What are the market trends in the liquid sealing agents market?The liquid sealing agents market trends include eco friendly & low‑VOC formulations, expansion into automotive, EVs & lightweight materials, growth in construction & infrastructure applications, emerging markets & regional growth, and product innovation & multi functional.

-

What are the main challenges restricting wider adoption of the liquid sealing agents market?The liquid sealing agents market trends include price and availability changes for raw materials, particularly petroleum based polymers and specialist additives, increase production costs and undermine price stability.

Need help to buy this report?