Global Liquid Paraffin Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Light Liquid Paraffin and Heavy Liquid Paraffin), By Application (Pharmaceuticals, Cosmetics, Food, Industrial and Others), By Distribution Channel (Online Stores, Supermarkets/Hypermarkets, Specialty Stores and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Liquid Paraffin Market Size Insights Forecasts to 2035

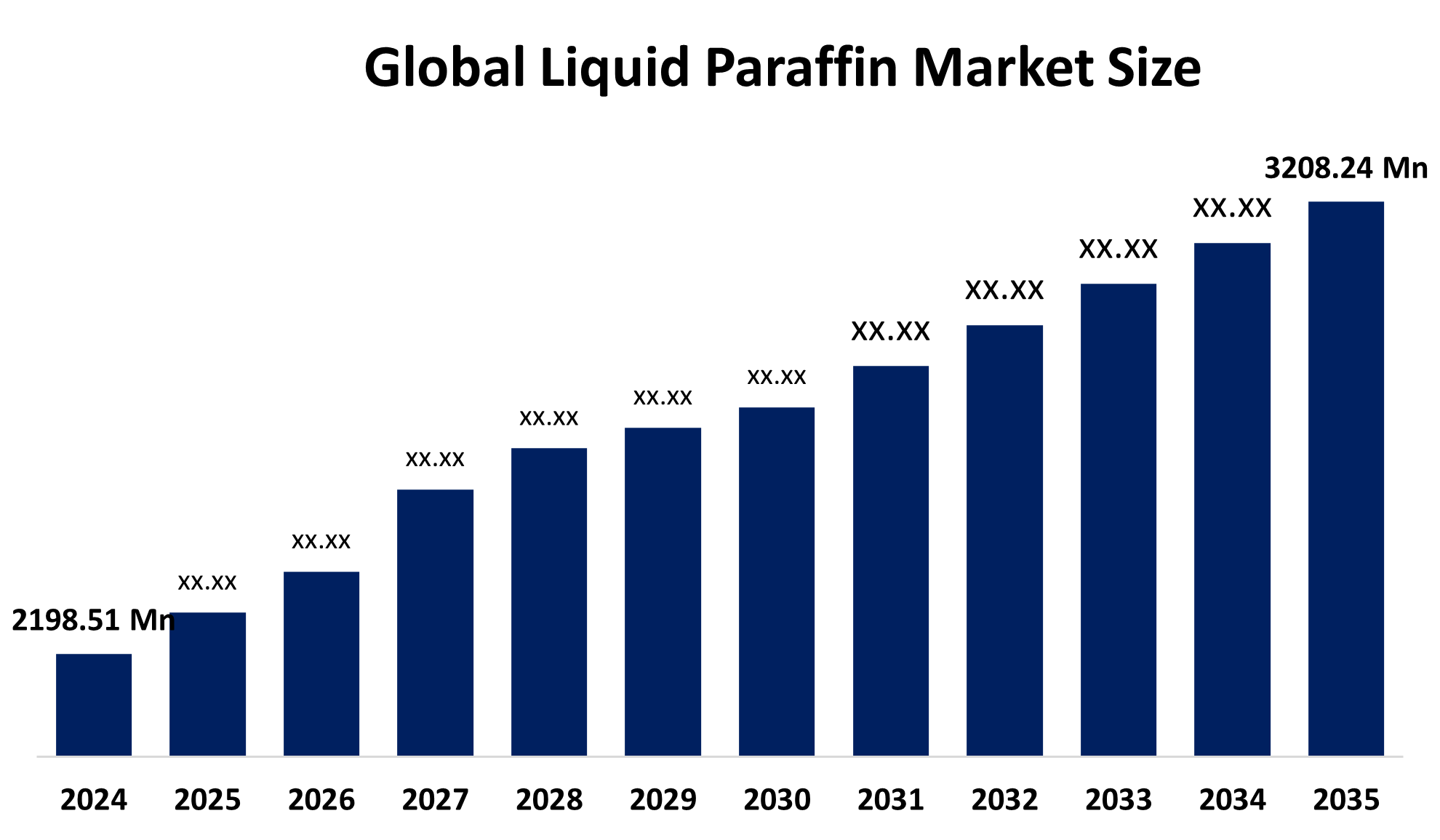

- The Global Liquid Paraffin Market Size Was Estimated at USD 2198.51 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.5% from 2025 to 2035

- The Worldwide Liquid Paraffin Market Size is Expected to Reach USD 3208.24 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Liquid Paraffin Market Size was worth around USD 2198.51 Million in 2024 and is Predicted to Grow to around USD 3208.24 Million by 2035 with a Compound Annual Growth Rate (CAGR) of 3.5% from 2025 to 2035. The global liquid paraffin market is growing due to rising demand for skin hydration products in cosmetics, increasing pharmaceutical use of ointments, and growing industrial requirements for lubrication. The expansion process accelerates owing to rising hygiene awareness and fast urban development that is occurring throughout the Asia-Pacific region.

Market Overview

The Global Liquid Paraffin Market Size refers to the production and sale of highly refined mineral oil, which serves multiple industries because of its chemical inertness, lubricating properties and emollient characteristics. The product is extensively used in pharmaceuticals as a component of laxatives and ointments, and in cosmetics and personal care products as moisturisers and lotions and in food processing as lubricants and coatings and in industrial applications for machinery lubrication and textile processing. The market experiences growth because healthcare demand increases, skincare and grooming product usage expands, pharmaceutical developments grow, and industrial applications spread throughout the world. The industry experiences growth because consumers become more aware of personal hygiene, emerging economies enhance their healthcare systems, and technological advances enable higher purity grade refining processes.

The Global Symposium on Resource Efficiency of March 2025, FICCI-RECEIC-Deloitte, demonstrated India's potential for used oil recycling through its recycling presentation. The government’s EPR framework mandates recycling of used oil from 5% in FY25 to 50% by FY31. The progress of collection and processing activities will decrease the need for imports while enhancing circular practices and developing the Indian lubricants sector, which includes white oils and light liquid paraffin. The market presents opportunities through its development of new lubricant applications, which include veterinary and food-grade products, and through its growth in industrial areas throughout the Asia Pacific and Latin America regions. ExxonMobil, Royal Dutch Shell, Sasol Limited, Chevron, TotalEnergies, Sonneborn, and Calumet Specialty Products represent the primary market competitors in their industry.

Report Coverage

This research report categorizes the Global Liquid Paraffin Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the liquid paraffin market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the liquid paraffin market.

Global Liquid Paraffin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2198.51 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.5% |

| 2035 Value Projection: | USD 3208.24 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | ExxonMobil Corporation, Sasol Limited, TotalEnergies, Shell plc, ADNOC, Chevron Corporation, Sinopec, Renkert Oil, LLC, Petrobras, Reliance Industries, Sonneborn, LLC, Calumet Specialty Products, Savita Oil Technologies Limited, Eastern Petroleum Private Limited and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The cosmetics and personal care market represents the main force that drives the Global Liquid Paraffin Market Size because this industry uses liquid paraffin as an economical solution that delivers exceptional performance. The pharmaceutical industry requires high-purity grades of materials because they need these products for making laxatives, ointments and medicinal creams. The rising industrialization in the Asia-Pacific region has increased the consumption of food-grade machinery lubrication and plastic processing materials. The market grows because customers want better skincare products and safe, non-comedogenic ingredients, and new refining technologies become available.

Restraining Factors

The Global Liquid Paraffin Market Size experiences two major restraining factors because crude oil prices undergo high volatility, which affects production expenses. The rising consumer preference for natural and bio-based cosmetic products creates competition for synthetic cosmetics. The industry faces growth obstacles because of strict environmental regulations and strong competition from synthetic oils, which include PAOs.

Market Segmentation

The liquid paraffin market share is classified into product type, application, and distribution chaneel.

- The light liquid paraffin segment dominated the market in 2024, approximately 61% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the Global Liquid Paraffin Market Size is divided into light liquid paraffin and heavy liquid paraffin. Among these, the light liquid paraffin segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The light liquid paraffin segment dominated the market due to its widespread application in pharmaceuticals, cosmetics and personal care products, which require products to meet high purity and safety standards. The global liquid paraffin market maintains its leading status because people increasingly use laxatives, ointments, moisturizers, and skincare products, which are used by the healthcare and cosmetic industries.

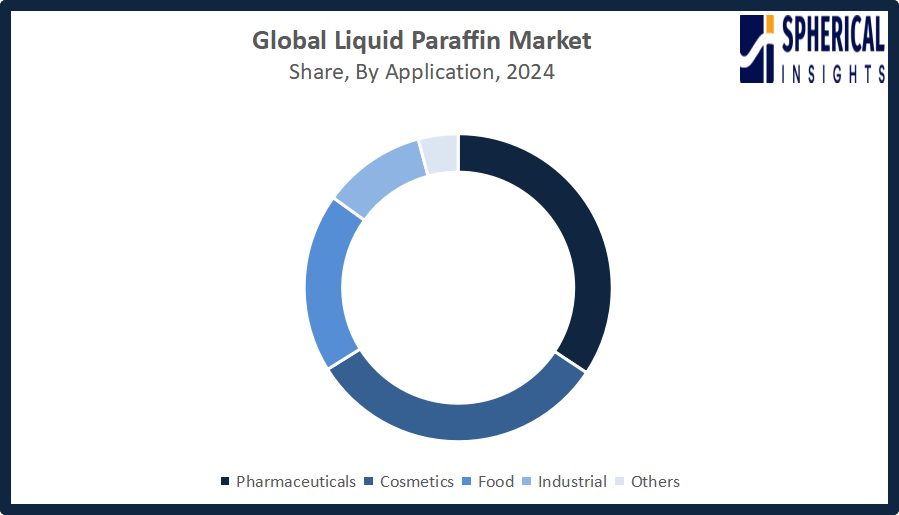

- The pharmaceuticals segment accounted for the largest share in 2024, approximately 34% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the Global Liquid Paraffin Market Size is divided into pharmaceuticals, cosmetics, food, industrial and others. Among these, the pharmaceuticals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The pharmaceuticals segment accounted for the largest share due to the extensive use of liquid paraffin in laxatives, ointments, and medicinal formulations. The pharmaceuticals sector leads global liquid paraffin usage because of rising healthcare spending, increasing need for safe, high-purity excipients and growing rates of digestive and dermatological disorders.

Get more details on this report -

- The online stores segment accounted for the highest market revenue in 2024, approximately 42% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the Global Liquid Paraffin Market Size is divided into, supermarkets/hypermarkets, specialty stores and others. Among these, the online stores segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The online stores segment market grows because customers can easily access products that exist in large quantities at affordable rates. The distribution channel experienced rapid growth because consumers increasingly preferred e-commerce platforms, which provided product details and enabled home delivery of liquid paraffin products used in pharmaceuticals, cosmetics and personal care products.

Regional Segment Analysis of the Liquid Paraffin Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the liquid paraffin market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the Global Liquid Paraffin Market Size over the predicted timeframe. The Asia Pacific region will become the 37% share market for liquid paraffin because industrial growth, healthcare system development, and personal care industry expansion work together to drive market demand. The market in the region shows growth because customers require pharmaceutical and cosmetic products that meet their requirements for high-purity items. China and India are key contributors because their populations are large, their healthcare spending increases, and their pharmaceutical production capacity grows. The rising demand for cosmetics and skincare products drives an increase in liquid paraffin usage. The government supports domestic chemical and pharmaceutical companies, which helps them to boost their production capabilities. India conducted its largest offshore oil and gas bidding process in 2025 under HELP and OALP, which will strengthen upstream production while increasing feedstock availability, which will create an indirect rise in liquid paraffin demand.

North America is expected to grow at a rapid CAGR in the liquid paraffin market during the forecast period. The liquid paraffin market will experience a 26% share of rapid growth in North America due to strict regulatory requirements, high demand for pure pharmaceutical and cosmetic products and technological advancements in production methods. The United States leads regional growth due to its well-established pharma and personal care industries, rising healthcare spending, and greater awareness of safe excipients. The U.S. states established PFAS restrictions on consumer products starting from January 1, 2025, which cover cosmetics and cleaning products. The EPA's expanded PFAS agenda creates additional requirements for paraffin applications, which need to be reformulated to comply with these new standards.

The European liquid paraffin market shows consistent market growth because of strict safety regulations, rising pharmaceutical and personal care product demand and healthcare spending increases. Germany, France, and the UK together dominate the market through their strong pharmaceutical and cosmetic sectors. The EU established Regulation (EU) 2026/78 in January 2026 to modernize cosmetics regulations. The regulation establishes new compliance standards for mineral oil derivatives, which indirectly affects liquid paraffin products because it requires manufacturers to produce higher-purity products and better safety documentation for cosmetic products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Global Liquid Paraffin Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ExxonMobil Corporation

- Sasol Limited

- TotalEnergies

- Shell plc

- ADNOC

- Chevron Corporation

- Sinopec

- Renkert Oil, LLC

- Petrobras

- Reliance Industries

- Sonneborn, LLC

- Calumet Specialty Products

- Savita Oil Technologies Limited

- Eastern Petroleum Private Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, TotalEnergies Marketing India partnered with Energy Core Lanka to launch high-performance lubricants in Sri Lanka. The collaboration leverages innovation, global engineering expertise, and advanced lubrication technology to enhance mobility, support industrial growth, and drive operational excellence across multiple sectors.

- In March 2025, Sasol sold its German subsidiary, Sasol Wax, to AWAX S.p.A., which rebranded it as Hywax GmbH. The acquisition enables the development of new wax blends incorporating liquid paraffin for enhanced adhesives and coatings applications.

- In April 2024, ExxonMobil launched Prowaxx, a new wax product brand, enhancing differentiation across wax types. The move reflects strategic investment in wax innovation, scalable naming, and customer clarity. ExxonMobil continues expanding global wax production through advanced technology, operational integration, and deep expertise in wax molecules and applications.

- In November 2023, Shell highlighted the versatility of gas-to-liquid (GTL) isoparaffins, noting their broad applications across industries. Often underutilized, these synthetic products can be repurposed into new solutions and markets, offering manufacturers significant opportunities for diversification, innovation, and profitable expansion into multiple product categories.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Global Liquid Paraffin Market Size based on the below-mentioned segments:

Global Liquid Paraffin Market, By Product Type

- Light Liquid Paraffin

- Heavy Liquid Paraffin

Global Liquid Paraffin Market, By Application

- Pharmaceuticals

- Cosmetics

- Food

- Industrial

- Others

Global Liquid Paraffin Market, By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Global Liquid Paraffin Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the liquid paraffin market over the forecast period?The global liquid paraffin market is projected to expand at a CAGR of 3.5% during the forecast period.

-

2.What is the market size of the liquid paraffin market?The global liquid paraffin market size is expected to grow from USD 2198.51 million in 2024 to USD 3208.24 million by 2035, at a CAGR of 3.5% during the forecast period 2025-2035.

-

3.Which region holds the largest share of the liquid paraffin market?Asia Pacific is anticipated to hold the largest share of the liquid paraffin market over the predicted timeframe.

-

4.What is the global liquid paraffin market?The global liquid paraffin market refers to the production, distribution, and sales of purified mineral oil for pharmaceuticals, cosmetics, and industrial uses.

-

5.Who are the top 10 companies operating in the global liquid paraffin market?ExxonMobil Corporation, Sasol Limited, TotalEnergies, Shell plc, ADNOC, Chevron Corporation, Sinopec, Renkert Oil, LLC, Petrobras, Reliance Industries, and Others.

-

6.What factors are driving the growth of the liquid paraffin market?Key factors driving the liquid paraffin market include rising demand for skincare/haircare, increasing pharmaceutical applications (ointments, laxatives), growth in food-grade industrial lubricants, and expansion in Asian cosmetic manufacturing.

-

7.What are the market trends in the liquid paraffin market?Key trends include rising pharmaceutical and cosmetic demand, e‑commerce growth, stricter safety regulations, advanced formulations, and expanding Asia Pacific consumption.

-

8.What are the main challenges restricting wider adoption of the liquid paraffin market?Main challenges restricting wider liquid paraffin adoption include volatile crude oil prices impacting production costs, stringent environmental/regulatory hurdles, increasing competition from natural/plant-based alternatives, and negative consumer perception regarding its petroleum origin.

Need help to buy this report?