Global Liquid Oxygen Devices Market Size, Share, and COVID-19 Impact Analysis, By Tank Type (Vertical Storage Tanks and Horizontal Storage Tanks), By End User (Hospitals, Outpatient Facilities and Home Care), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Liquid Oxygen Devices Market Insights Forecasts to 2035

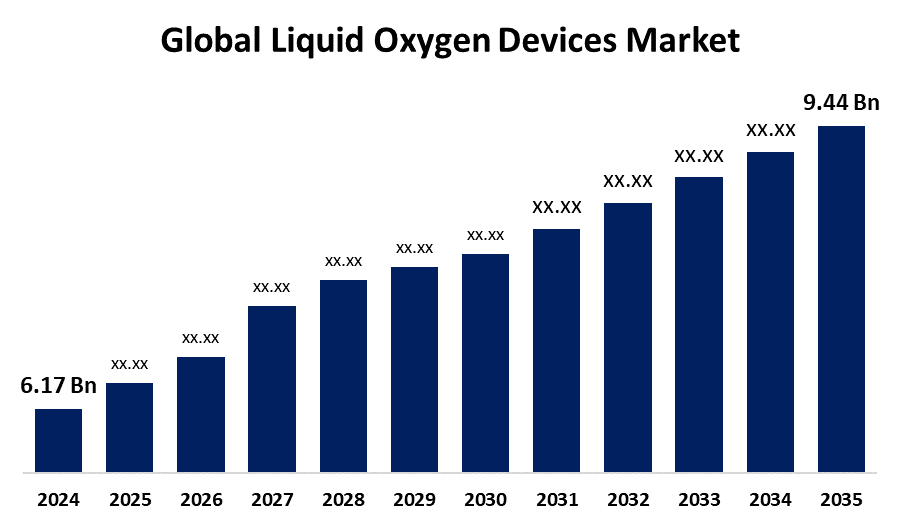

- The Global Liquid Oxygen Devices Market Size Was Estimated at USD 6.17 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.94% from 2025 to 2035

- The Worldwide Liquid Oxygen Devices Market Size is Expected to Reach USD 9.44 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Liquid Oxygen Devices Market Size was worth around USD 6.17 Billion in 2024 and is predicted to Grow to around USD 9.44 Billion By 2035 with a compound annual growth rate (CAGR) of 3.94% from 2025 to 2035. The liquid oxygen devices market is fuelled by increasing rates of chronic respiratory diseases, the aging population, technological innovations in portable and energy-efficient devices, government healthcare programs with subsidies, and increased demand for homecare oxygen therapy products.

Market Overview

The market of liquid oxygen devices involves the manufacturing, distribution, and utilization of equipment used to store and supply oxygen in its liquid state for therapeutic use. Liquid oxygen has a higher volume and concentration than compressed gas, and it guarantees efficient therapy for patients in need of continuous or high-flow oxygen. Liquid oxygen systems are appreciated due to their effectiveness in supplying long-term, portable oxygen therapy in hospitals as well as homecare settings. As hospitals ran out of space during health emergencies, there was an evident move towards treating less severe patients at home to limit infection risks and relieve the pressure on healthcare facilities. This trend increased the demand for liquid oxygen therapy equipment that is safe and effective for home use immensely. Meanwhile, several government initiatives to increase the production of liquid oxygen supported the development of supply chains further and contributed to the market's growth. For instance, in August 2021, the Delhi Government notified and sanctioned the Medical Oxygen Production Promotion Policy of Delhi, 2021, to ensure there would be no scarcity of medical oxygen due to Covid 19. The said policy has been formulated to provide time-bound completion of targets like establishing liquid oxygen (LOX) production units, non-captive & captive oxygen generation units, and so on, thus increasing the market.

Report Coverage

This research report categorizes the liquid oxygen devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the liquid oxygen devices market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the liquid oxygen devices market.

Liquid Oxygen Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.17 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 3.94% |

| 2035 Value Projection: | USD 9.44 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Tank Type, By End User, and COVID-19 Impact Analysis |

| Companies covered:: | Air Liquide Healthcare, Air Products and Chemicals, Inc., AmcareMed, Brise Chemicals, CAIRE Inc., Chart Industries, Cryofab Inc., DEHAS Medical Systems, DFC Tank Pressure Vessel Manufacturer, Essex Industries, Krison Engineering Works, Linde Engineering, MATHESON, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The rise of chronic respiratory diseases like COPD, asthma, and pulmonary fibrosis is fueling the market for oxygen therapy. Since patients need to be administered oxygen in the long term, liquid oxygen devices are becoming indispensable in both clinical and home care settings. Ongoing innovations in liquid oxygen device technology, including more portable, compact, and user-friendly devices, are making it more appealing to healthcare professionals and patients alike. Advancements, such as small and convenient systems, are improving patient comfort and uptake rates. Additionally, governments everywhere, especially in developed nations, are investing in healthcare infrastructure and subsidizing or reimbursing oxygen therapy equipment. These efforts make liquid oxygen equipment more accessible and affordable, driving market growth and increasing its application in home care.

Restraining Factors

Liquid oxygen equipment, especially bigger storage tanks and carry systems, has high upfront expenses, which may be a hindrance for various medical practitioners or patients. Installation, maintenance, and refilling costs may render such equipment unaffordable, particularly in impoverished areas. Additionally, liquid oxygen is extremely volatile and requires careful handling. Misuse or storage of devices inappropriately can cause safety hazards like a fire or device malfunction. These issues may deter potential adopters of liquid oxygen devices, particularly in home care.

Market Segmentation

The liquid oxygen devices market share is classified into tank type and end user.

- The vertical storage tanks segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the tank type, the liquid oxygen devices market is divided into vertical storage tanks and horizontal storage tanks. Among these, the vertical storage tanks segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to vertical storage tanks being more space-efficient, and hence they find applications in both hospital and homecare scenarios where space could be limited. Since their space-occupying shapes are reduced due to less base area, they can hold more volume of liquid oxygen in a smaller space as compared to horizontal tanks.

- The home care segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the end user, the liquid oxygen devices market is divided into hospitals, outpatient facilities, and home care. Among these,the home care segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The growth is attributed to home care is often cheaper than extended hospitalization, both for patients and health systems. Liquid oxygen equipment allows for economical long-term oxygen therapy in patient homes, minimizing hospitalization and overall healthcare costs, which stimulates homecare uptake.

Regional Segment Analysis of the Liquid Oxygen Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the liquid oxygen devices market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the liquid oxygen devices market over the predicted timeframe. North America, particularly the U.S., accounts for a high incidence of chronic respiratory diseases such as COPD, asthma, and sleep apnea, fueling demand for long-term oxygen therapy. Liquid oxygen devices are a critical component of treatment. The region is also dominated by leading industry stakeholders such as Invacare, Chart Industries, and OxyGo, whose R&D investments and innovation improve product quality and penetration, supporting North America's dominance in the global liquid oxygen devices market.

Asia Pacific is expected to grow at a rapid CAGR in the liquid oxygen devices market during the forecast period. Nations such as China, India, and Indonesia are investing heavily in developing healthcare infrastructure, particularly in rural and semi-urban segments. Government programs for upscaling respiratory care facilities and hospitals with advanced equipment are driving demand for liquid oxygen systems, thereby fueling market growth at a rate higher than in developed nations.

Europe is predicted to hold a significant share of the liquid oxygen devices market throughout the estimated period. European countries are endowed with highly developed healthcare systems that are conducive to early diagnosis, ongoing monitoring, and sophisticated treatment. Clinics and hospitals are well-suited to incorporate liquid oxygen devices into breathing care plans. Such robust infrastructure supports high usage rates and easy access to oxygen therapy, conducive to maintaining a stable market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the liquid oxygen devices market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Air Liquide Healthcare

- Air Products and Chemicals, Inc.

- AmcareMed

- Brise Chemicals

- CAIRE Inc.

- Chart Industries

- Cryofab Inc.

- DEHAS Medical Systems

- DFC Tank Pressure Vessel Manufacturer

- Essex Industries

- Krison Engineering Works

- Linde Engineering

- MATHESON

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2023, Air Liquide S.A. recently introduced a new transportable liquid oxygen device, aimed at patients who need supplementary oxygen therapy beyond the realm of conventional healthcare facilities. The design of the unit emphasizes mobility and ease of use for the increasing number of patients in need of long-term oxygen therapy.

- In April 2023, OxyGo HQ Florida LLC launched the OxyHome 5L Stationary Concentrator in April 2023. The product provides a constant flow of oxygen up to 5 liters per minute for domestic application. One of its notable features is twin-blower cooling, which guarantees reliable operation in the long run.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the liquid oxygen devices market based on the below-mentioned segments:

Global Liquid Oxygen Devices Market, By Tank Type

- Vertical Storage Tanks

- Horizontal Storage Tanks

Global Liquid Oxygen Devices Market, By End User

- Hospitals

- Outpatient Facilities

- Home Care

Global Liquid Oxygen Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the liquid oxygen devices market over the forecast period?The global liquid oxygen devices market is projected to expand at a CAGR of 3.94% during the forecast period.

-

2. What is the market size of the liquid oxygen devices market?The global liquid oxygen devices market size is expected to grow from USD 6.17 Billion in 2024 to USD 9.44 Billion by 2035, at a CAGR of 3.94% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the liquid oxygen devices market?North America is anticipated to hold the largest share of the liquid oxygen devices market over the predicted timeframe.

Need help to buy this report?