Global Liquid Nitrogen Market Size, Share, and COVID-19 Impact Analysis, By Technology (Cryogenic Distillation, Pressure Swing Adsorption, and Others), By Storage Type (Cylinders and Packaged Gas, Merchant Liquid/Bulk, Tonnage, and Others), By End User (Chemicals and Pharmaceuticals, Food and Beverage, Healthcare, Metal Manufacturing and Construction, Rubber and Plastic, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Liquid Nitrogen Market Insights Forecasts to 2035

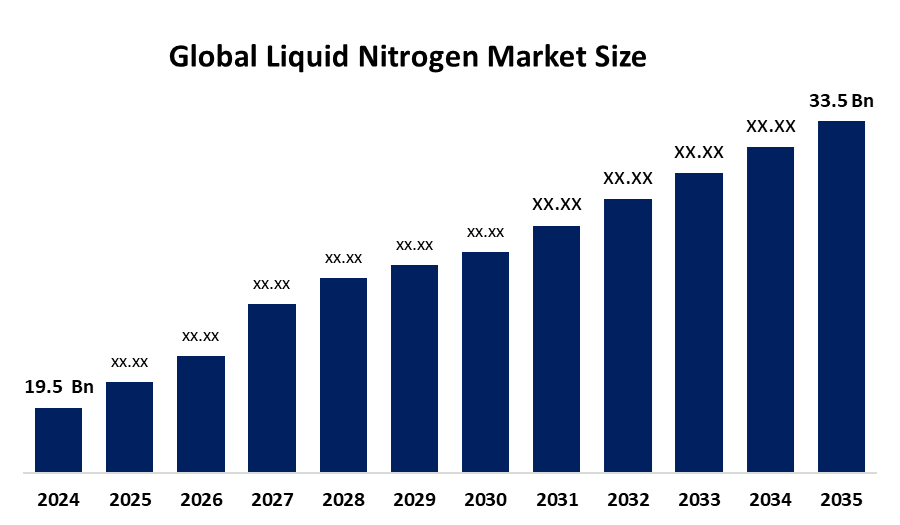

- The Global Liquid Nitrogen Market Size Was Estimated at USD 19.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.04% from 2025 to 2035

- The Worldwide Liquid Nitrogen Market Size is Expected to Reach USD 33.5 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Liquid Nitrogen Market Size was worth around USD 19.5 Billion in 2024 and is predicted to Grow to around USD 33.5 Billion by 2035 with a compound annual growth rate (CAGR) of 5.04% from 2025 to 2035. The international liquid nitrogen industry is witnessing growth due to rising consumption across sectors such as healthcare, food, chemical, and electronic industries, increasing industrial applications, technological developments, urbanization, as well as increasing requirement for effective preservative, cooling, or inerting solutions.

Market Overview

The global liquid nitrogen market deals with the manufacture and supply of nitrogen, a colorless, odourless, and inert cryogenic compound. The global market for liquid nitrogen is growing due to a number of reasons, including advances in technology and increasing applications in the medical, chemical, and food industries. Additionally, the increasing number of constructions, especially in the medical sector, and advancements in technology will propel the global liquid nitrogen market during the forecast period.

The U.S. EPA issued new GHG Reporting Rule changes in May 2024, which require improved GHG emissions reporting by petroleum and natural gas entities. Additionally, these changes stipulate the adoption of environmentally responsible and sustainable efforts by companies that manufacture and process liquid nitrogen. Opportunities are there in the developing area of cryogenic usage, as well as efficient production processes that can render operations more affordable. Leading players within the market are working towards enhanced production capacities as well as developing efficient networks: these players are Air Liquide, Linde plc, Praxair Inc., Air Products and Chemicals Inc., and Taiyo Nippon

Sanso Corp. This is a developing sector with increasing demands from industries as well as the healthcare sector around the globe.

Report Coverage

This research report categorizes the liquid nitrogen market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the liquid nitrogen market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the liquid nitrogen market.

Global Liquid Nitrogen Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 19.5 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.04% |

| 2035 Value Projection: | USD 33.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Technology |

| Companies covered:: | Linde plc, Praxair Inc., Air Liquide S.A., Taiyo Nippon Sanso Corporation, Air Products and Chemicals, Inc, Messer Group GmbH, Gulf Cryo, Southern Industrial Gas Berhad, Nexair LLC, AMCS Corporation, Cryomech Inc., Parker Hannifin Corporation, Chart Industries, Inc., SOL Group, Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The driving factors associated with the liquid nitrogen market around the world include rising usage in various fields such as healthcare, food, chemical, and electronic manufacturing. In the healthcare sector, liquid nitrogen is primarily utilized as a medium for cryopreservation, cryosurgery, and laboratory work. In the food industry, it assists in fast freezing, conservation, and transportation of perishable commodities. The chemical industry, as well as the pharmaceutical industry, uses liquid nitrogen as a tool for nitrification, cooling, or processing. Increasing semiconductor manufacturing, which is a requirement of the electronics industry, necessitates exact cooling solutions from liquid nitrogen.

Restraining Factors

The growth of the global liquid nitrogen market is restricted by high production, storage, and transportation costs, besides stringent safety and handling requirements, due to the extremely low temperature. Further hindrance to market adoption and overall growth potential comes from limited awareness in developing regions, dependency on industrial gas infrastructure, and logistical challenges.

Market Segmentation

The liquid nitrogen market share is classified into technology, storage type, and end user.

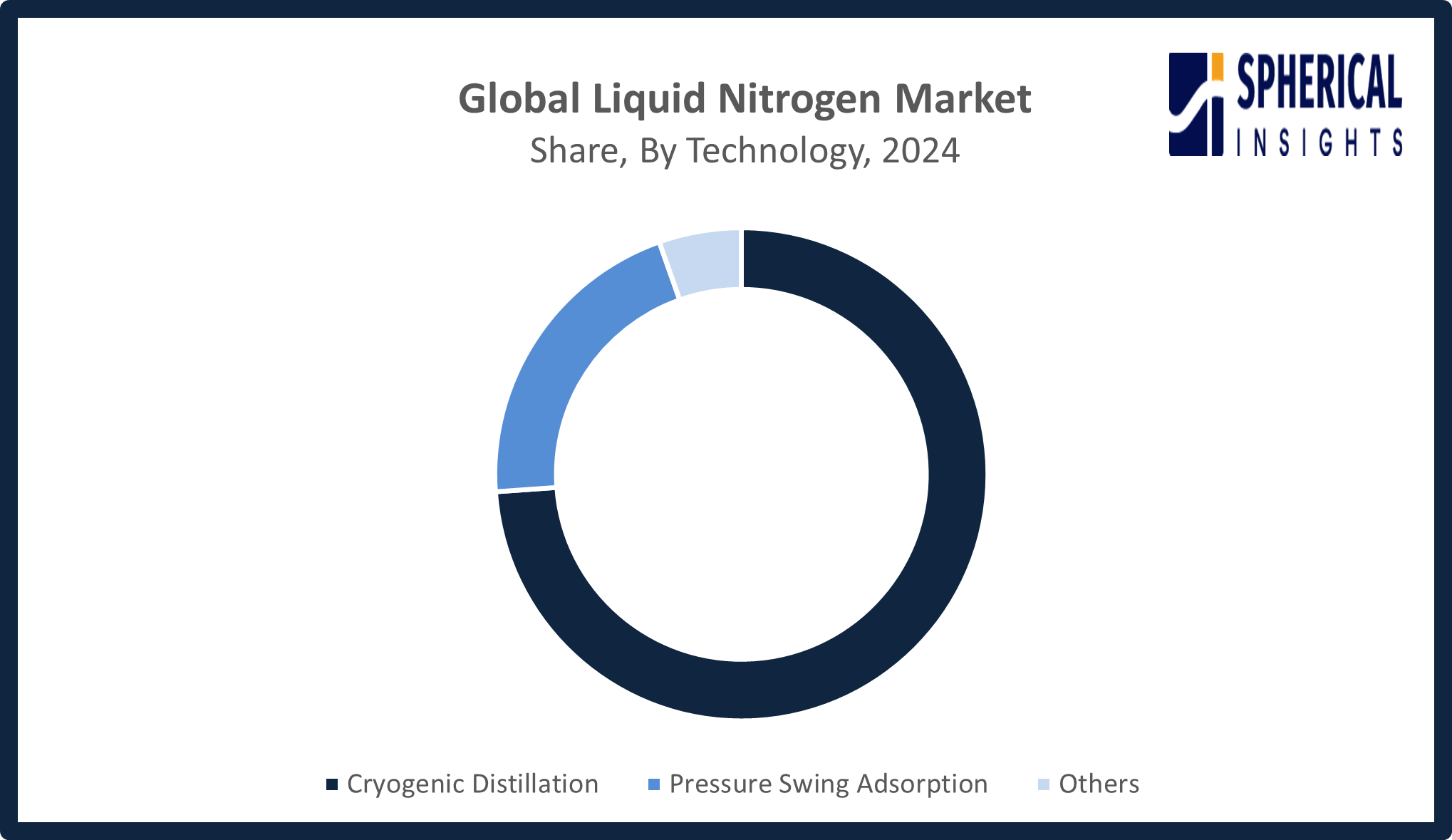

- The cryogenic distillation segment dominated the market in 2024, approximately 74% and is projected to grow at a substantial CAGR during the forecast period.

Based on the technology, the liquid nitrogen market is divided into cryogenic distillation, pressure swing adsorption, and others. Among these, the cryogenic distillation segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The cryogenic distillation segment led this market, due to its potential for bulk production of highly pure liquid nitrogen at a larger scale and consistent quality. The technology finds significant applications in the chemical, pharmaceutical, electronics, and food sectors, which demand bulk production, reliability, and economy for uninterrupted supply and sustained growth in this market.

Get more details on this report -

- The cylinders and packaged gas segment accounted for the largest share in 2024, approximately 66% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the storage type, the liquid nitrogen market is divided into cylinders and packaged gas, merchant liquid/bulk, tonnage, and others. Among these, the cylinders and packaged gas segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Cylinders & packaged gas held the maximum revenue within the global liquid Nitrogen market, owing to its widespread application in laboratories, hospitals, food processing units, & small-scale industries. Additionally, easy handling & transportation, & moderate infrastructure requirements facilitated the growth prospects of this segment in 2024.

- The chemicals and pharmaceuticals segment accounted for the highest market revenue in 2024, approximately 34% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the liquid nitrogen market is divided into chemicals and pharmaceuticals, food and beverage, healthcare, metal manufacturing and construction, rubber and plastic, and others. Among these, the chemicals and pharmaceuticals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The chemicals and pharmaceuticals industry experienced the maximum growth in terms of the market, as liquid nitrogen is abundantly used in chemical synthesis, for temperature regulation, formulation, and cryopreservation. The increasing production of pharmaceuticals, advancements in biotechnology, development of vaccines, and the increased need for a cold chain have fueled the demand for high-quality liquid nitrogen.

Regional Segment Analysis of the Liquid Nitrogen Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the liquid nitrogen market over the predicted timeframe. The Asia Pacific market is expected to have the 42% share within the liquid nitrogen market due to the fast-growing industries and high demand for applications from the medical and processing industries. The Chinese market dominates the Asia Pacific market with the production of huge amounts of chemical substances, metal processing, and semiconductors. The Indian market also grows remarkably because of the medical and processing industries for storage. The Japanese and South Korean markets also have a huge share in the Asia Pacific market, with the existence of the electronics and automobile industries. In July 2025, the Union Cabinet approved an additional outlay amount of RS 1,920 crore for the cold chain and food processing sector as part of the Integrated Cold Chain Scheme. Such storage and handling indirectly influence the market for liquid nitrogen.

North America is expected to grow at a rapid CAGR in the liquid nitrogen market during the forecast period. The North American market is projected to have a 30% share of the liquid nitrogen market, driven by a significant demand from the healthcare, pharmaceutical, food processing, and manufacturing sectors. In the United States, the usage is common in biotech research, cryopreservation processes, metal processing, and semiconductor production. In Canada, healthcare infrastructure and food freezing are the leading contributors. In October 2024, within the Integrated Cross-Sector Technologies Fund from Canada, there were sustainable nitrogen-related initiatives, such as the reduction of emissions. On the international front, more regulations regarding industrial gases, as well as a drive towards a low-carbon economy, are responsible for increasing sustainable production rates for nitrogen.

European liquid nitrogen market development is stimulated by the intensive requirements of the chemical and pharmaceutical industries, food processing plants, and metal production. Germany has the leading share in this market because of the strong chemical and automotive industries in the country. France and the UK follow with the development of the health care and biotechnology sectors and food preservation requirements in these countries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the liquid nitrogen market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Linde plc

- Praxair Inc.

- Air Liquide S.A.

- Taiyo Nippon Sanso Corporation

- Air Products and Chemicals, Inc

- Messer Group GmbH

- Gulf Cryo

- Southern Industrial Gas Berhad

- Nexair LLC

- AMCS Corporation

- Cryomech Inc.

- Parker Hannifin Corporation

- Chart Industries, Inc.

- SOL Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2025, Taiyo Nippon Sanso Corporation (TNSC) signed a long-term PPA with Mitsubishi Corporation Clean Energy to procure renewable electricity. TNSC will launch Japan’s first third-party certified carbon dioxide-free Green Liquid Nitrogen, advancing carbon neutrality and offering environmentally friendly industrial gas solutions.

- In July 2025, Linde announced new investments to expand its Mims, Florida, facility, supplying bulk liquid oxygen and nitrogen for U.S. rocket launches. Two long-term agreements strengthen its space industry leadership, with additional capacity expected by Q1 2027, following 2020 and 2024 expansions

- In May 2025, Chart Industries and Crane Company successfully tested a new CRYOFLO bellow seal vacuum jacketed globe valve for liquid hydrogen applications. Final validation occurred at Chart’s New Prague, MN facility, ensuring reliable operation at extremely low temperatures far below those of liquid nitrogen, advancing cryogenic hydrogen technology.

- In May 2024, Air Products will showcase its Freshline liquid nitrogen freezing solutions at Bakery China 2024 in Shanghai, debuting a new-generation batch freezer and digital remote-monitoring technology, helping Chinese baked food manufacturers improve product quality, efficiency, and overall economic performance with advanced cryogenic solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the liquid nitrogen market based on the below-mentioned segments:

Global Liquid Nitrogen Market, By Technology

- Cryogenic Distillation

- Pressure Swing Adsorption

- Others

Global Liquid Nitrogen Market, By Storage Type

- Cylinders and Packaged Gas

- Merchant Liquid/Bulk

- Tonnage

- Others

Global Liquid Nitrogen Market, By End User

- Chemicals and Pharmaceuticals

- Food and Beverage

- Healthcare

- Metal Manufacturing and Construction

- Rubber and Plastic

- Others

Global Liquid Nitrogen Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the liquid nitrogen market over the forecast period?The global liquid nitrogen market is projected to expand at a CAGR of 5.04% during the forecast period.

-

2. What is the market size of the liquid nitrogen market?The global liquid nitrogen market size is expected to grow from USD 19.5 billion in 2024 to USD 33.5 billion by 2035, at a CAGR of 5.04% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the liquid nitrogen market?Asia Pacific is anticipated to hold the largest share of the liquid nitrogen market over the predicted timeframe

-

4. What is the liquid nitrogen market?The liquid nitrogen market involves producing, storing, and supplying cryogenic liquid nitrogen for industries like healthcare, chemicals, food, and manufacturing.

-

5. Who are the top 10 companies operating in the global liquid nitrogen market?Linde plc, Praxair Inc., Air Liquide S.A., Taiyo Nippon Sanso Corporation, Air Products and Chemicals, Inc, Messer Group GmbH, Gulf Cryo, Southern Industrial Gas Berhad, Nexair LLC, AMCS Corporation, and Others.

-

6. What factors are driving the growth of the liquid nitrogen market?The liquid nitrogen market is driven by rising demand in healthcare, pharmaceuticals, chemicals, food processing, electronics, and industrial manufacturing, along with expanding cold-chain infrastructure and growing biotechnology and research activities.

-

7. What are the market trends in the liquid nitrogen market?Key trends include increased on‑site generation, sustainable production, expanding industrial applications, cold‑chain infrastructure growth, and rising demand from healthcare, electronics, and food processing sectors

-

8. What are the main challenges restricting wider adoption of the liquid nitrogen market?The main challenges restricting the wider adoption of the liquid nitrogen (LN2) market primarily involve high costs, significant safety concerns and handling issues, and complex logistics and infrastructure requirements

Need help to buy this report?