Global Liquid Fluoroelastomers Market Size, Share, and COVID-19 Impact Analysis, By Product (Liquid Fluorosilicone Elastomers, Liquid Fluorocarbon Elastomers, and Liquid Perfluoroelastomers), By Application (Automotive, Aerospace, Oil & Gas, Pharmaceutical & Food Processing, Chemical Processing, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Advanced MaterialsGlobal Liquid Fluoroelastomers Market Size Insights Forecasts to 2035

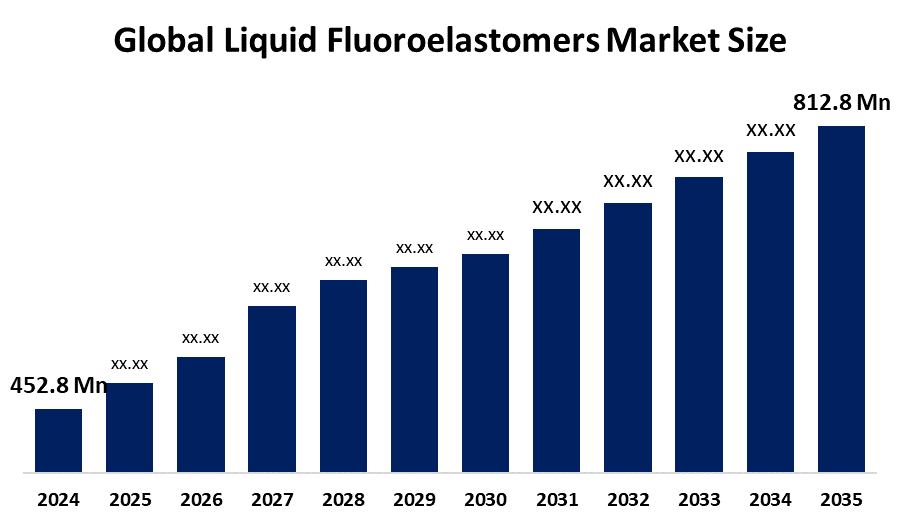

- The Global Liquid Fluoroelastomers Market Size Was Estimated at USD 452.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.46% from 2025 to 2035

- The Worldwide Liquid Fluoroelastomers Market Size is Expected to Reach USD 812.8 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Liquid Fluoroelastomers Market Size was worth around USD 452.8 Million in 2024 and is predicted to Grow to around USD 812.8 Million by 2035 with a compound annual growth rate (CAGR) of 5.46% from 2025 to 2035. The market is being driven by the growing requirement for chemical-resistant materials in severe industrial environments including oil and gas and chemical processing, as well as the growing need for high-performance sealing solutions in the automotive and aerospace industries.

Market Overview

The global liquid fluoroelastomers market involves the production and sale of high-performance synthetic rubbers with exceptional chemical, thermal, and solvent resistance, used across automotive, aerospace, and industrial applications. The market for liquid fluoroelastomers is expanding rapidly worldwide because of the growing need for high-performance sealing solutions in sectors such as chemical processing, oil and gas, automotive, and aerospace. These elastomers are prized for their remarkable resistance to solvents, heat, and chemicals, which makes them perfect for applications needing dependability in harsh environments. Since improved efficiency and durability require sophisticated sealing technologies, the growing popularity of electric vehicles (EVs) has further spurred industry expansion. Furthermore, the use of durable materials like fluoroelastomers, which lower maintenance and operating costs, is being encouraged by the increased focus on sustainability and strict environmental requirements. The healthcare and pharmaceutical industries present a significant development opportunity due to the growing demand for materials that are resistant to harsh fluids, preserve biocompatibility, and withstand sterilisation. Manufacturers can enter new markets and diversify their product lines by creating customised fluoroelastomers for various uses, which will support future market expansion on a worldwide scale. In October 2019, Solvay announced plans to increase the production capacity of the peroxide-curable fluoroelastomer Tecnoflon FKM at the Spinetta Marengo plant in Italy. The goal of this action is to satisfy the growing need for sealing solutions in the semiconductor, oil and gas, and automotive industries.

Report Coverage

This research report categorizes the liquid fluoroelastomers market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the liquid fluoroelastomers market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the liquid fluoroelastomers market.

Global Liquid Fluoroelastomers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 452.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.46% |

| 2035 Value Projection: | USD 812.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 145 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | 3M, DuPont, Shin-Etsu Chemical Co., Ltd., Solvay S.A., Daikin Industries, Ltd., Momentive Performance Materials Inc., Wacker Chemie AG, Dow, AGC Chemicals, James Walker Group, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A number of important reasons are driving the market for liquid fluoroelastomers. One of the main drivers is the growing need for high-performance materials that can survive harsh chemical conditions and high temperatures in industries including chemical processing, automotive, and aerospace. Adoption is also being fuelled by developments in material science that result in superior features like increased flexibility, shortened curing periods, and improved processability. Furthermore, the use of excellent sealing and component materials is required due to strict regulatory requirements for safety and dependability in critical applications. The need for these cutting-edge elastomers is further increased by the complexity of contemporary machinery and equipment, which calls for more durable and specialized parts.

Restraining Factors

The high expense of manufacturing these materials. Fluoroelastomers are more expensive than regular elastomers because they need specialised raw materials and intricate manufacturing procedures. Their adoption may be constrained by this cost aspect, particularly in areas with tighter budgets or in businesses where prices are crucial. Furthermore, this problem can be made worse by economic downturns or changes in the availability of raw materials, which makes it difficult for manufacturers to retain profitability while guaranteeing competitive pricing.

Market Segmentation

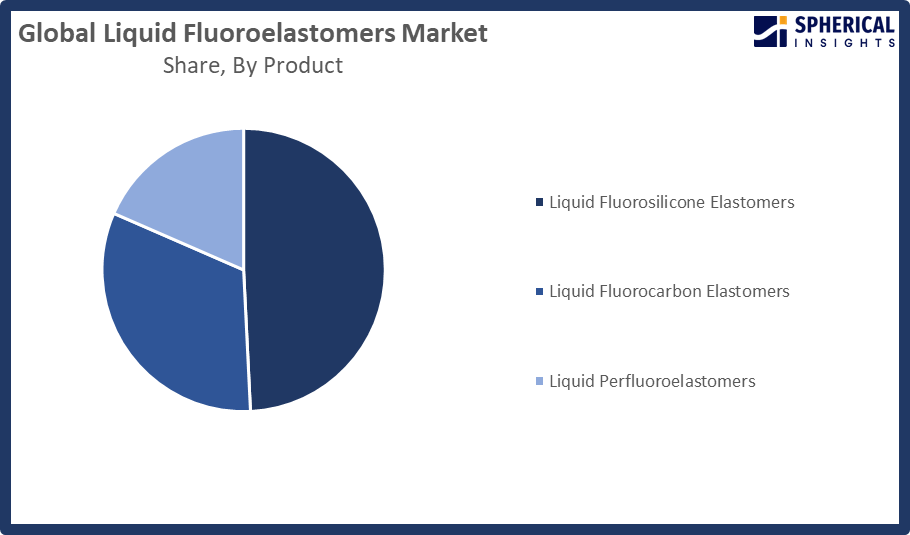

The Liquid Fluoroelastomers market share is classified into product and application.

- The liquid fluorosilicone elastomers segment dominated the market in 2024, approximately 49% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the liquid fluoroelastomers market is divided into liquid fluorosilicone elastomers, liquid fluorocarbon elastomers, and liquid perfluoroelastomers. Among these, the liquid fluorosilicone elastomers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The increasing demand, especially in sectors like electronics, automotive, and aerospace, for materials that can function dependably under harsh environmental conditions. FSR has remarkable resistance to a broad temperature range, from extremely low to extremely high, and also withstands deterioration from chemicals, fuels, and lubricants. For sealing, gasketing, and insulating applications where conventional materials would not work, this makes them the material of choice. The special qualities of fluorosilicone elastomers make them indispensable for fulfilling stringent operating and safety criteria as the need for high-performance components in sectors like electric vehicles and aircraft keeps growing.

Get more details on this report -

- The automotive segment accounted for the largest share in 2024, approximately 50% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the liquid fluoroelastomers market is divided into automotive, aerospace, oil & gas, pharmaceutical & food processing, chemical processing, and others. Among these, the automotive segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Traditional materials find it difficult to withstand the harsh chemicals found in oils, coolants, and fuels, as well as the greater operating temperatures of current vehicles including electric and hybrid models that push the boundaries of performance. For sealing and gasketing applications, liquid fluoroelastomers provide a dependable solution due to their exceptional resilience to high temperatures and chemical degradation, extending the lifespan and functionality of vital automotive components. As the automotive industry concentrates on increasing economy, lowering emissions, and adhering to more stringent environmental rules, they become essential.

Regional Segment Analysis of the Liquid Fluoroelastomers Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share with approximately 45% of the Liquid Fluoroelastomers market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the liquid fluoroelastomers market over the predicted timeframe. High-performance materials that can withstand harsh conditions are becoming more and more necessary as the area becomes a centre for military technologies and aircraft manufacturing. In these industries, where accuracy and safety are crucial, liquid fluoroelastomers known for their resistance to chemicals and high temperatures are crucial for guaranteeing the dependability of components. Due in large part to the burgeoning electric vehicle (EV) sector, the liquid fluoroelastomers market in the United States is rising. Materials that can tolerate high temperatures, exposure to chemicals, and extended operating life are becoming more and more in demand as automakers concentrate on enhancing the functionality and longevity of EV components.

Asia Pacific is expected to grow the fastest market share with approximately 38% at a rapid CAGR in the liquid fluoroelastomers market during the forecast period. The Asia Pacific automotive and electronics industries' fast industrialisation and expansion are major factors propelling the market for liquid fluoroelastomers. High-tech electronics and sophisticated automotive systems are being produced at an increasing rate in nations like South Korea, India, and Japan; both of these industries demand materials that can endure harsh environments. The region's growing industrial base depends heavily on liquid fluoroelastomers because they offer the required durability and chemical resistance. The demand for sustainable industrial solutions and strict environmental restrictions are driving the European market for liquid fluoroelastomers.

Europe is expected to grow at a rapid CAGR in the liquid fluoroelastomers market during the forecast period. The demand for sustainable industrial solutions and strict environmental restrictions are driving the European market for liquid fluoroelastomers. These elastomers are being used more and more in sectors including energy, chemical processing, and automobiles because of their resilience and capacity to cut waste and emissions by requiring less maintenance and having a longer lifespan. The need for high-performance materials like liquid fluoroelastomers is accelerated by the region's emphasis on green technology and adherence to environmental regulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the liquid fluoroelastomers market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- DuPont

- Shin-Etsu Chemical Co., Ltd.

- Solvay S.A.

- Daikin Industries, Ltd.

- Momentive Performance Materials Inc.

- Wacker Chemie AG

- Dow

- AGC Chemicals

- James Walker Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2023, SHIN-ETSU Chemical introduced a new line of low-viscosity liquid fluoroelastomers for advanced injection molding applications in the automotive sector.

- In October 2019, Solvay revealed its intention to expand the manufacturing capacity of Tecnoflon FKM, a peroxide-curable fluoroelastomer, at the Spinetta Marengo production facility in Italy. This move aims to meet the rising demand for sealing solutions in the automotive, oil & gas, and semiconductor sectors.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the liquid fluoroelastomers market based on the below-mentioned segments:

Global Liquid Fluoroelastomers Market, By Product

- Liquid Fluorosilicone Elastomers

- Liquid Fluorocarbon Elastomers

- Liquid Perfluoroelastomers

Global Liquid Fluoroelastomers Market, By Application

- Automotive

- Aerospace

- Oil & Gas

- Pharmaceutical & Food Processing

- Chemical Processing

- Others

Global Liquid Fluoroelastomers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Liquid Fluoroelastomers market over the forecast period?The global Liquid Fluoroelastomers market is projected to expand at a CAGR of 5.46% during the forecast period.

-

2. What is the market size of the Liquid Fluoroelastomers market?The global Liquid Fluoroelastomers market size is expected to grow from USD 452.8 Million in 2024 to USD 812.8 Million by 2035, at a CAGR of 5.46% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Liquid Fluoroelastomers market?North America is anticipated to hold the largest share of the Liquid Fluoroelastomers market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global Liquid Fluoroelastomers market?3M, DuPont, Shin-Etsu Chemical Co., Ltd., Solvay S.A., Daikin Industries, Ltd., Momentive Performance Materials Inc., Wacker Chemie AG, Dow, AGC Chemicals, and James Walker Group.

-

5. What factors are driving the growth of the Liquid Fluoroelastomers market?The market for liquid fluoroelastomers is growing due to the need for high-performance sealing materials, the expansion of the automotive and aerospace industries, the growing use of electric vehicles, and the need for materials that are resistant to heat, chemicals, and solvents in oil and gas, industrial, and chemical processing applications.

-

6. What are the market trends in the Liquid Fluoroelastomers market?Key trends in the liquid fluoroelastomers market include growing adoption in electric vehicles, advancements in low-viscosity grades for precision molding, rising demand from healthcare and pharmaceutical sectors, increased focus on sustainable production, and regional expansion in Asia-Pacific driven by industrial growth and stricter performance standards globally.

-

7. What are the main challenges restricting wider adoption of the Liquid Fluoroelastomers market?High production costs, complex manufacturing processes, limited raw material availability, and stringent environmental regulations restricting fluorinated compounds are the main challenges limiting wider adoption of liquid fluoroelastomers across global industries.

Need help to buy this report?