Global Liquid Fertilizers Market Size, Share, and COVID-19 Impact Analysis By Product (Organic and Inorganic), By Application (Foliar, Fertigation, Aerial, Soil and Others), By Type (Nitrogen, Phosphorous, Potash and Micronutrients), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Analysis and Forecast 2021 - 2030

Industry: Advanced MaterialsGlobal Liquid Fertilizers Market Insights Forecasts to 2030

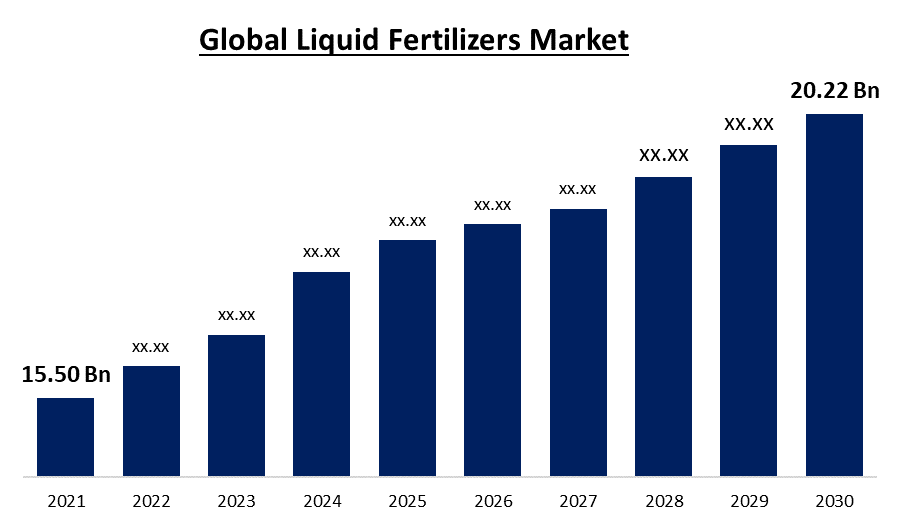

- The global Liquid Fertilizers Market was valued at USD 15.50 Billion in 2021.

- The Market is growing at a CAGR of 3.0% from 2022 to 2030

- The global Liquid Fertilizers Market is expected to reach USD 20.22 Billion by 2030

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The global Liquid Fertilizers Market is expected to reach USD 20.22 Billion by 2030, at a CAGR of 3.0% during the forecast period 2022 to 2030. One of the key drivers of Liquid Fertilizers market expansion is rising worldwide concerns about food security, rapid population growth, and the development of highly efficient liquid fertilisers, the need for liquid fertilisers is anticipated to expand in the market.

Market Overview

Any type of liquid solution that is given to plants as nourishment is referred to as liquid fertiliser. These fertilisers may give the nourishment that plants require to survive through a number of different techniques. In order to improve soil productivity and efficiency, which is a major market driver, farmers can use liquid fertilisers. The only way to produce enough food for everyone is to increase yield per unit of land. This can only happen if fertilisers are utilised wisely in conjunction with other innovative agriculture techniques. Liquid fertiliser sales have been expanding significantly, and long-term projections indicate that this trend will continue.

The market for liquid fertilisers is being driven by factors such as the increased demand for high-efficiency fertilisers, their ease of use, the adoption of sustainable agriculture practises, and rising environmental safety. Better efficiency fertilisers (EEF) are becoming more and more common in agriculture, especially in cereals and industrial crops, as a result of the development of innovative natural compounds and low-cost polymer coating technologies. Distributing liquid fertiliser more efficiently guarantees that plants and crops get the optimum quantity of nutrients at the right time and location with the least amount of waste. The harmful effects of nutrients leaking into water reservoirs are lessened by the use of high-efficiency fertilisers.

The growth of the liquid fertiliser sector is slowed significantly by the high cost of installation and storage for liquid fertiliser. Water is soluble in fertilisers that are liquid. The cost of mixing the nutrients in the water is significant, as are the transportation costs because liquid fertilisers need special handling and storage facilities. Lack of knowledge on the use of liquid fertilisers, notably in Africa and the Middle East, is limiting the growth of the global industry. Due to the sudden COVID-19 pandemic breakout and government-issued social segregation laws, numerous sectors will see a sharp fall in demand and output in the early 2020s. The COVID-19 epidemic had a minor influence on the market for liquid fertilisers. The main reason for the limited influence on the expansion of liquid fertilisers is the supportive government initiative to guarantee that farmers have access to enough fertilisers.

However, the expansion of the liquid fertiliser industry throughout the world has been significantly impacted by delays and disruptions at various country borders, disruptions in the supply chain, and poor transportation networks. Additionally, curfew laws and the worldwide lockdown reduced the availability of workers and raw materials, which restricted the expansion of the liquid Fertilizers market in the pandemic period. Food consumption has increased as a result of the world's expanding population and the increased requirement for fertiliser to produce crops with high yields. However, soil deterioration and pollution, as well as the negative effects on people and the ecosystem, are the main issues. To prevent these negative effects, governments use fertilisers that are favourable to the soil. Farmers' expertise of liquid fertilisers is growing as a result, especially in China and India. Through their collaboration with non-governmental groups, manufacturers educate farmers about the potential short- and long-term benefits.

Global Liquid Fertilizers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021 : | USD 15.50 Billion |

| Forecast Period: | 2022-2030 |

| Forecast Period CAGR 2022-2030 : | 3.0 % |

| 2030 Value Projection: | USD 20.22 Billion |

| Historical Data for: | 2019-2020 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By Type, By Region |

| Companies covered:: | Yara International ASA, Nutrien Ltd, Israel Chemical Ltd., Haifa Chemical Ltd, GrupaAzoty, The Mosaic Company, IFFCO, GURBETA, Plant Food Company Inc., EuroChem Group, Bunge Limited, Inc., Sumitomo Chemical Co, Haifa Group, and Syngenta AG. |

| Growth Drivers: | Improved food security is expected to drives the markets growth over the forecast period. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Report Coverage

This research report categorizes the Market for global Liquid Fertilizers based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Global Liquid Fertilizers Market. Recent Market developments and competitive strategies such as expansion, Product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the Market. The report strategically identifies and profiles the key Market players and analyses their core competencies in each global Liquid Fertilizers Market sub-segments.

Market Drivers:

Better efficiency fertilisers (EEF) are becoming more and more common in agriculture, especially in cereals and industrial crops, as a result of the development of innovative natural compounds and low-cost polymer coating technologies. Distributing liquid fertiliser more efficiently guarantees that plants and crops get the optimum quantity of nutrients at the right time and location with the least amount of waste. The harmful effects of nutrients leaking into water reservoirs are lessened by the use of high-efficiency fertilisers.

Market Restraints:

The growth of the liquid fertiliser sector is slowed significantly by the high cost of installation and storage for liquid fertiliser. Water is soluble in fertilisers that are liquid. The cost of mixing the nutrients in the water is significant, as are the transportation costs, because liquid fertilisers need special handling and storage facilities. Lack of knowledge on the use of liquid fertilisers, notably in Africa and the Middle East, is limiting the growth of the global industry.

Due to the sudden COVID-19 pandemic breakout and government-issued social segregation laws, numerous sectors will see a sharp fall in demand and output in the early 2020s. The COVID-19 epidemic had a minor influence on the market for liquid fertilisers. The main reason for the limited influence on the expansion of liquid fertilisers is the supportive government initiative to guarantee the farmers have access to enough fertilisers. However, the expansion of the liquid fertiliser industry throughout the world has been significantly impacted by delays and disruptions at various country borders, disruptions in the supply chain, and poor transportation networks. Additionally, curfew laws and the worldwide lockdown reduced the availability of workers and raw materials, which restricted the expansion of the liquid Fertilizers market in the pandemic period.

Opportunities:

Food consumption has increased as a result of the world's expanding population and the increased requirement for fertiliser to produce crops with high yields. However, soil deterioration and pollution, as well as the negative effects on people and the ecosystem, are the main issues. To prevent these negative effects, governments use fertilisers that are favourable to the soil. Farmers' expertise of liquid fertilisers is growing as a result, especially in China and India. Through their collaboration with non-governmental groups, manufacturers educate farmers about the potential short- and long-term benefits.

Segmentation Analysis

- In 2021, the Organic segment dominated the Market with the largest Market share of 60.7% and Market revenue of 9.40 billion.

Based on the Product, the global Liquid Fertilizers Market is categorized into Organic and Inorganic. In 2021, the Organic segment dominated the Market with the largest Market share of 60.7% and Market revenue of 9.40 billion. The organic market category now has the largest market share and is anticipated to expand at a high CAGR over the anticipated years because Organic liquid fertilizers are being used more frequently due to their advantageous, non-toxic, and eco-friendly qualities. Animal waste, vegetable waste, and excrement are used to create organic fertilisers (like crop residue). In addition to giving the plant nutrients, these organic fertilisers support the growth and maintenance of a diverse soil ecosystem that is home to earthworms and other microorganisms. They are less harmful to the environment than synthetic fertilisers.

- In 2021, the Fertigation segment accounted for the largest share of the Market, with 25.6% and a Market revenue of 3.96 billion.

Based on the Application, the Liquid Fertilizers Market is categorized into Foliar, Fertigation, Aerial, Soil and Others. In 2021, the Fertigation segment accounted for the largest share of the Market, with 25.6% and a Market revenue of 3.96 billion. Throughout the forecast period, the Fertigation segment is anticipated to maintain its leading position while expanding at the fastest CAGR. Plants can get nutrients in a regulated and timely manner through fertilisation. Due to the simplicity of usage and greater dependability of the dispenser unit, fertilisation is most frequently employed in horticulture, vast agriculture, and landscaping. Row crop fields, horticultural crop fields, fruit crop fields, vegetable crop fields, and decorative & blooming crop fields all make use of fertilisation. An evolution in agricultural operations toward cutting-edge procedures that use both fertiliser and water application techniques is driving the growth of the fertigation market.

- In 2021, the Nitrogen segment accounted for the largest share of the Market, with 34.4% and a Market revenue of 5.33 billion.

Based on the Type, the Liquid Fertilizers Market is categorized into Nitrogen, Phosphorous, Potash and Micronutrients. In 2021, the Nitrogen segment accounted for the largest share of the Market, with 34.4% and a Market revenue of 5.33 billion. Throughout the forecast period, the Nitrogen segment is anticipated to maintain its leading position while expanding at the fastest CAGR. Compared to solid nitrogen fertilisers, liquid nitrogen fertilisers are substantially less costly and easier to apply. Additionally, common for grasses and small grains are nitrogen solutions. As a result, the demand for nitrogen liquid fertilisers is anticipated to grow significantly during the next few years.

Regional Segment Analysis of the Liquid Fertilizers Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Get more details on this report -

Asia-Pacific emerged as the largest Market for the global Liquid Fertilizers Market, with a Market share of around 43.0% and 6.66 billion of the Market revenue in 2021.

- Asia-Pacific emerged as the largest Market for the global Liquid Fertilizers Market, with a Market share of around 43.0% and 6.66 billion of the Market revenue in 2021. The demand for Liquid Fertilizers is being driven by the rising acceptance by the market. The market for Liquid Fertilizers was dominated by the Asia Pacific region. The existence of significant fertiliser users in this area is the main cause of this increase. More than 50% of the urea utilised in China, according to estimates from the World Fertilizer, is used as a fertiliser for cereal and oilseed crops like maize, soybean, rapeseed, and others.

- On the other hand, North America is anticipated to account for a sizeable portion of the worldwide market for liquid fertilisers. The market for liquid fertilisers is expected to be driven by the availability of significant areas that are sprinkler-irrigated throughout the region. The demand for effective agricultural inputs for crop production as well as rising concerns about the residues of conventional agricultural inputs are expected to increase sales of liquid fertilisers in the region.

- North America Market is expected to grow at the fastest CAGR between 2021 and 2030, owing to the increasing encouragement and benefits for foreign businesses to enter the region. Throughout the projection period, market expansion will be driven by the presence of a wide range of fertiliser producers in the region, as well as by the construction of new manufacturing facilities and distribution networks. In addition, growing consumer demand for high-end items and improved awareness of the usage of organic fluid fertilisers will encourage market growth in North America region.

Competitive Landscape

The report offers the appropriate analysis of the key organizations/companies involved within the global Liquid Fertilizers Market along with a comparative evaluation primarily based on their Product offering, business overviews, geographic presence, enterprise strategies, segment Market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including Product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the Market.

List of Key Market Players:

- Yara International ASA

- Nutrien Ltd

- Israel Chemical Ltd.

- Haifa Chemical Ltd

- GrupaAzoty

- The Mosaic Company

- IFFCO

- GURBETA

- Plant Food Company Inc.

- EuroChem Group

- Bunge Limited, Inc.

- Sumitomo Chemical Co

- Haifa Group

- Syngenta AG

Key Target Audience

- Market Players

- Investors

- Applications

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Some of the Key Developments:

- In September 2019, In order to improve the quality of its services and product offerings in Australia, Nutrien Ltd. finalised the acquisition of Ruralco Holdings.

Market Segment

This study forecasts global, regional, and country revenue from 2019 to 2030. Spherical Insights has segmented the global Liquid Fertilizers Market based on the below-mentioned segments:

Global Liquid Fertilizers Market, By Product

- Organic

- Inorganic

Global Liquid Fertilizers Market, By Application

- Foliar

- Fertigation

- Aerial

- Soil

- Others

Global Liquid Fertilizers Market, By Type

- Nitrogen

- Phosphorous

- Potash

- Micronutrients

Global Liquid Fertilizers Market, Regional Analysis

North America

- US

- Canada

- Mexico

Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

South America

- Brazil

- Argentina

- Rest of South America

Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Liquid Fertilizers market?As per Spherical Insights, the size of the Liquid Fertilizers market was valued at USD 15.50 billion in 2022 to USD 20.22 billion by 2030.

-

What is the market growth rate of the Liquid Fertilizers market?The Liquid Fertilizers market is growing at a CAGR of 3.0% from 2022 to 2030.

-

Which country dominates the Liquid Fertilizers market?Asia Pacific emerged as the largest market for Liquid Fertilizers.

-

Who are the key players in the Liquid Fertilizers market?Key players in the Liquid Fertilizers market are Yara International ASA, Nutrien Ltd, Israel Chemical Ltd., Haifa Chemical Ltd, GrupaAzoty, The Mosaic Company, IFFCO, GURBETA, Plant Food Company Inc., EuroChem Group, Bunge Limited, Inc., Sumitomo Chemical Co, Haifa Group, and Syngenta AG.

-

Which factor drives the growth of the Liquid Fertilizers market?Improved food security is expected to drives the market's growth over the forecast period.

Need help to buy this report?