Global Liquid Crystal Polymer Market Size, By Application (Electrical Connectors, Fiber Optics, Automotive Lamps, Cookware Coatings), By End-user (Automotive, Medical, Electrical and Electronics), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Chemicals & MaterialsGlobal Liquid Crystal Polymer Market Insights Forecasts to 2033

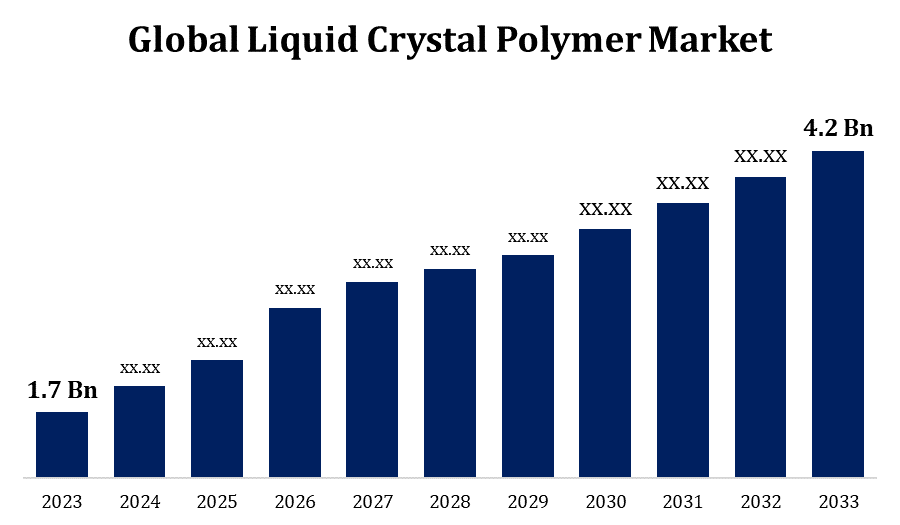

- The Global Liquid Crystal Polymer Market was valued at USD 1.7 Billion in 2023.

- The Market is Growing at a CAGR of 9.47% from 2023 to 2033

- The Worldwide Liquid Crystal Polymer Market Size is expected to reach USD 4.2 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Liquid Crystal Polymer Market Size is expected to reach USD 4.2 Billion by 2033, at a CAGR of 9.47% during the forecast period 2023 to 2033.

In recent years, the market for Liquid Crystal Polymers has grown steadily. An important impetus has been the growing demand for lightweight and high-performance materials in a variety of industries, including electronics and automobiles. The rise of 5G technology, the demand for miniaturisation in electronic gadgets, and the push for more fuel-efficient vehicles have all contributed to the LCP market's expansion. LCPs have found a sweet spot with the increasing desire for smaller and more powerful electronic gadgets. Because of their superior dielectric qualities and tolerance to high temperatures, they are perfect for electronic components, particularly in the 5G era where miniaturisation is critical. LCPs are also gaining popularity in the aerospace industry. Their high strength-to-weight ratio and durability to extreme climatic conditions make them valuable for a variety of aerospace applications, helping to drive market expansion.

Liquid Crystal Polymer Market Value Chain Analysis

The chain starts with the production of raw ingredients, which are often petrochemical-based and used to make liquid crystal polymers. These raw materials are subjected to a variety of chemical processes in order to produce the base components required for LCP synthesis. The basic components are then converted into liquid crystal polymers during the polymerization process. Following the formation of the basic LCP, compounding may take place, in which additives and reinforcing materials are introduced to improve certain qualities such as strength, heat resistance, or conductivity. Depending on the intended application, the compounded LCP is subsequently processed into various forms like as pellets, films, or fibres. LCP products are subsequently distributed to a variety of industries, including electronics, automotive, and aerospace. LCPs are commonly used in electronics as connections, switches, and other components. Finally, end-user industries use LCP products to make finished things. Electronic devices, automobile parts, aircraft components, and other items may fall within this category.

Liquid Crystal Polymer Market Opportunity Analysis

LCPs have a tremendous opportunity as the need for smaller and more powerful electronic gadgets grows. Their outstanding dielectric qualities make them perfect for use in connections, switches, and other miniaturised components. The introduction of 5G technology is increasing the demand for high-performance materials in the telecommunications industry. LCPs can play a critical role in the construction of 5G infrastructure due to their ability to retain stability at high frequencies and resist signal interference. As the automobile industry transitions to electric vehicles, there is an increased demand for lightweight materials to improve overall efficiency and range. Because LCPs are lightweight and heat-resistant, they have potential applications in EV components. The aerospace sector, which is continuously looking for materials with excellent strength-to-weight ratios, sees potential in LCPs. Because of their biocompatibility and resistance to sterilisation treatments, LCPs are becoming more popular in the medical profession. This opens up new possibilities for medical devices and equipment.

Global Liquid Crystal Polymer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.47% |

| 2033 Value Projection: | USD 4.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By End-user, By Region. |

| Companies covered:: | Asia International Enterprise (HK) Limited, Celanese Corporation, Kuraray Co. Ltd, PolyOne Corporation, Polyplastics Co. Ltd., Rogers Corporation, RTP Company, Shanghai Pret Composites Co., Ltd., Solvay SA, Sumitomo Chemicals Co. Ltd., Toray Industries, Inc., Ueno Fine Chemicals Industry Limited and Other Key Vendors. |

| Growth Drivers: | Next-generation technologies including 3D printing and 5G |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Liquid Crystal Polymer Market Dynamics

Next-generation technologies including 3D printing and 5G

The introduction of 3D printing or additive manufacturing has opened up new opportunities for materials such as LCPs. Because of their high performance, they are suitable for 3D printing applications in a variety of industries. The precision and complexity attained by 3D printing are perfectly matched by the qualities of LCPs, making them a potential material for creating intricate parts and components. The introduction of 5G technology is a major driving force in the LCP market. As 5G networks expand, so does the demand for materials that can sustain high-frequency and high-speed data transmission. LCPs may find use in the production of antennas, connectors, and other components essential to the 5G telecommunications infrastructure. 3D printing and 5G both contribute to the miniaturisation trend in the electronics industry.

Restraints & Challenges

LCP manufacture can be complicated, requiring specialised equipment and raw ingredients. This can result in greater production costs as compared to other traditional polymers, making widespread adoption difficult, particularly in cost-sensitive industries. Despite its benefits, there may be a lack of awareness and understanding of LCPs in particular industries. It is critical to educate producers and end users about the benefits and applications of LCPs in order to gain market acceptability. The LCP supply chain can be subject to disruptions due to its reliance on specialised raw ingredients and complicated manufacturing procedures. External variables like as geopolitical difficulties, natural disasters, or regulatory changes can all have an impact on the availability of critical resources.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Liquid Crystal Polymer Market from 2023 to 2033. LCPs have been widely used in the North American electronics industry. The region's use of LCPs has been pushed by the demand for lightweight and high-performance materials in the fabrication of electronic components. The automotive sector in North America has recognised the benefits of LCPs, particularly with the increased emphasis on electric vehicles (EVs). LCPs' small weight contributes to the overall efficiency and range of EVs. LCPs are used in the aerospace industry in North America for a variety of applications due to its excellent strength-to-weight ratio and tolerance to harsh temperatures. In North America, LCPs are used in a wide range of end-user industries, including healthcare, consumer electronics, industrial equipment, and others.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Asia Pacific, particularly China, Japan, South Korea, and Taiwan, is a hub for electronic device production. The desire for lightweight and high-performance materials in electronics has accelerated the use of LCPs in the manufacture of components such as connections, switches, and electronic housings. With the rise of electric cars (EVs), the Asia Pacific automotive sector has been increasingly embracing LCPs. LCPs help to lighten the weight of EV components, improving overall efficiency and range. For LCPs, Asia Pacific is a major manufacturing and export hub. The region's countries play an important role in the manufacturing of LCPs and their distribution to worldwide markets. The growing industrialization and urbanisation of various Asian countries has increased demand for sophisticated materials.

Segmentation Analysis

Insights by Application

The automotive lamps segment accounted for the largest market share over the forecast period 2023 to 2033. As LCPs are lightweight and strong, they are perfect for use in automotive components. As the automotive sector emphasises lightweight materials to increase vehicle fuel efficiency, LCPs are used in the production of components such as lamp housings and structural elements. LCPs enable the construction of elaborate and complicated shapes by providing design flexibility. This is especially useful in vehicle lamp design, where aesthetics and aerodynamics are vital. LED technology in lamps is increasingly being used in the car sector because to its energy economy and creative options. LCPs are well-suited for components connected to LED applications in vehicle lighting due to their electrical qualities and ability to endure high temperatures.

Insights by End Use

The electrical and electronics segment accounted for the largest market share over the forecast period 2023 to 2033. The demand for materials that can allow miniaturisation has been pushed by the trend towards smaller and more compact electronic devices, including as smartphones, tablets, and wearables. LCPs are well-suited for complicated and small components due to their high dimensional stability and flow properties. Because of their high dielectric strength, LCPs are useful for electrical applications. They are utilised in the production of connections, switches, and insulating components where electrical performance must be maintained. LCPs are used in the manufacture of high-frequency PCBs. Because of their low water absorption and stable dielectric properties, they are suited for use in RF/microwave applications, improving the performance of electronic equipment.

Recent Market Developments

- In July 2022, Sumitomo Chemical Advanced Technologies has developed SUMIKASUPER, a new long-fiber thermoplastic liquid crystal polymer that will be used in optical fibre applications.

Competitive Landscape

Major players in the market

- Asia International Enterprise (HK) Limited

- Celanese Corporation

- Kuraray Co. Ltd

- PolyOne Corporation

- Polyplastics Co. Ltd.

- Rogers Corporation

- RTP Company

- Shanghai Pret Composites Co., Ltd.

- Solvay SA

- Sumitomo Chemicals Co. Ltd.

- Toray Industries, Inc.

- Ueno Fine Chemicals Industry Limited

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Liquid Crystal Polymer Market, Application Analysis

- Electrical Connectors

- Fiber Optics

- Automotive Lamps

- Cookware Coatings

Liquid Crystal Polymer Market, End User Analysis

- Automotive

- Medical

- Electrical and Electronics

Liquid Crystal Polymer Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Liquid Crystal Polymer Market?The global Liquid Crystal Polymer Market is expected to grow from USD 1.7 billion in 2023 to USD 4.2 billion by 2033, at a CAGR of 9.47% during the forecast period 2023-2033.

-

2. Who are the key market players of the Liquid Crystal Polymer Market?Some of the key market players of market are Asia International Enterprise (HK) Limited, Celanese Corporation, Kuraray Co. Ltd, PolyOne Corporation, Polyplastics Co. Ltd., Rogers Corporation, RTP Company, Shanghai Pret Composites Co., Ltd., Solvay SA, Sumitomo Chemicals Co. Ltd., Toray Industries, Inc., and Ueno Fine Chemicals Industry Limited.

-

3. Which segment holds the largest market share?The electrical and electronics segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Liquid Crystal Polymer Market?North America is dominating the Liquid Crystal Polymer Market with the highest market share.

Need help to buy this report?