Global Liquid Chlorine Market Size, Share, and COVID-19 Impact Analysis, By Grade (Industrial, Food, Water Treatment, Other), By End-Use Industry (Chemicals, Plastics, Pulp Paper, Food Beverages, Textiles, Pharmaceuticals, Other), By Application (Bleaching, Disinfection, Deodorization, Water treatment, Industrial synthesis, Other), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Liquid Chlorine Market Insights Forecasts to 2035

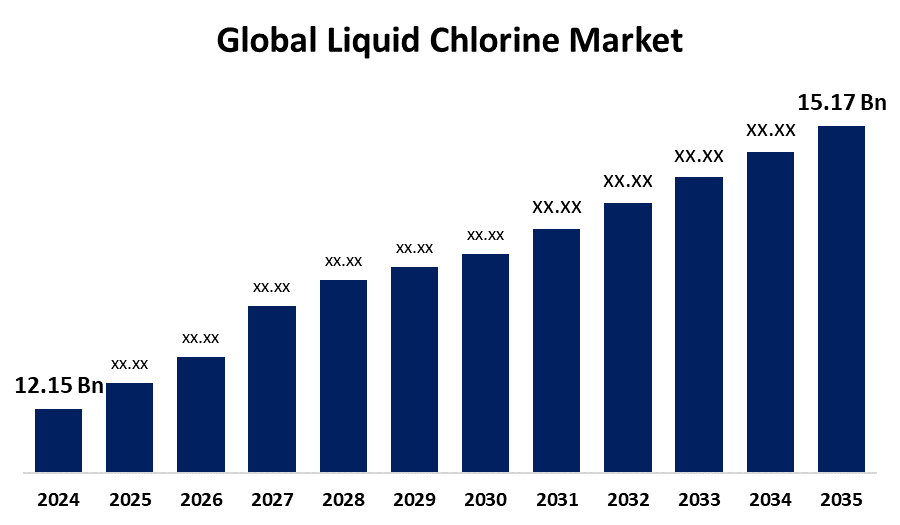

- The Global Liquid Chlorine Market Size Was Estimated at USD 12.15 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.04% from 2025 to 2035

- The Worldwide Liquid Chlorine Market Size is Expected to Reach USD 15.17 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Liquid Chlorine Market Size was worth around USD 12.15 Billion in 2024 and is predicted to Grow to around USD 15.17 Billion by 2035 with a compound annual growth rate (CAGR) of 2.04% from 2025 to 2035. The extensive application of liquid chlorine across water purification and wastewater treatment is driving the liquid chlorine market globally.

Market Overview

The liquid chlorine market is the industry of buying and selling liquid chlorine, which is a potent disinfectant and oxidizing agent for diverse applications. Liquid chlorine is sodium hypochlorite, commonly used in commercial and residential swimming pools, effectively used for destroying bacteria and preventing algae. It refers to elemental chlorine in its liquid form, which is achieved by compressing and cooling the gas. The market is primarily driven by the increasing need from the water treatment sector and the shift towards safer alternatives & storage solutions. The growth of the chemical industry, with an increasing usage of liquid chlorine in chemical processing, is creating market growth opportunities for liquid chlorine.

Report Coverage

This research report categorizes the liquid chlorine market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the liquid chlorine market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the liquid chlorine market.

Global Liquid Chlorine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12.15 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.04% |

| 2035 Value Projection: | USD 15.17 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Grade, By End-Use Industry, By Application and By Region |

| Companies covered:: | Solvay, PPG Industries, AkzoNobel N.V., Tata Chemicals, Reliance Industries Limited, LG Chem, Formosa Plastics Corporation, Olin Corporation, Dow Chemical Company, Westlake Chemical Corporation, Kemira Oyj, Hanwha Chemical Corporation, Ascend Performance Materials, INEOS Group, JSR Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The widespread application of liquid chlorine for water purification and wastewater treatment is driving the liquid chlorine market. Liquid chlorine is a critical raw material used for various chemical industries, especially for producing PVC and other chlorinated compounds. Further, the need for disinfectants for diverse applications, including municipal wastewater contributing to propel the market demand. Additionally, the growing urbanization, population growth, and strict regulations on water quality and sanitation are escalating the market for liquid chlorine.

Restraining Factors

Challenges associated with transportation hazards and the availability of alternatives, such as UV treatment, are restraining the market growth for liquid chlorine.

Market Segmentation

The liquid chlorine market share is classified into grade, end-use industry, and application.

- The industrial segment dominated the market with a major revenue share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the grade, the liquid chlorine market is divided into industrial, food, water treatment, and other. Among these, the industrial segment dominated the market with a major revenue share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Industrial liquid chlorine is a highly reactive and corrosive chemical element used for a wide range of industrial applications for producing chemicals, like hydrochloric acid, bleach, and chlorinated solvents. The widespread application of liquid chlorine in industrial processes, including plastics, chemicals, and textile production, is driving the market in the industrial segment.

- The chemicals segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use industry, the liquid chlorine market is divided into chemicals, plastics, pulp paper, food beverages, textiles, pharmaceuticals, and other. Among these, the chemicals segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. In the chemical industry, liquid chlorine is used as a raw material for various products and a key component in manufacturing processes. An increasing application of liquid chlorine in the production of chemicals, like hydrochloric acid, sodium hypochlorite, and chlorinated solvents, is driving the market in the chemicals segment.

- The bleaching segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the liquid chlorine market is divided into bleaching, disinfection, deodorization, water treatment, industrial synthesis, and other. Among these, the bleaching segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Liquid chlorine is used for bleaching paper pulp, which aids in removing lignin and other impurities, which ultimately results in brighter and higher-quality paper.

Regional Segment Analysis of the Liquid Chlorine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the liquid chlorine market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the liquid chlorine market over the predicted timeframe. The steady chlor-alkali production and consistent downstream consumption are driving the market demand for liquid chlorine. Further, the versatility of inorganic chemicals used across numerous industrial and consumer applications is contributing to propelling the market for liquid chlorine.

Asia Pacific is expected to grow at a rapid CAGR in the liquid chlorine market during the forecast period. The stable supply from chlor alkali producers and steady demand from key downstream sectors, including hydrochloric acid and polyvinyl chloride industries, is driving the market for liquid chlorine. An increasing need for liquid chlorine in water treatment, chemical manufacturing, and pulp & paper industries is promoting the market demand.

Europe is anticipated to hold a significant share of the liquid chlorine market during the projected timeframe. The extensive use of liquid chlorine in pool and spa sanitation, effectively eliminating bacteria, algae, and other contaminants, is driving the market demand. The steady demand from the PVC industry, utilizing chlorine in the production of polyvinyl chloride, is driving the liquid chlorine market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the liquid chlorine market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

- Solvay

- PPG Industries

- AkzoNobel N.V.

- Tata Chemicals

- Reliance Industries Limited

- LG Chem

- Formosa Plastics Corporation

- Olin Corporation

- Dow Chemical Company

- Westlake Chemical Corporation

- Kemira Oyj

- Hanwha Chemical Corporation

- Ascend Performance Materials

- INEOS Group

- JSR Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2025, Maochun Cao announced new developments in pool water treatment, emphasizing intelligent systems and green disinfection. Maochun Cao launches intelligent pH system and chlorine-free solutions, advancing eco-friendly and efficient practices in pool water treatment.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the liquid chlorine market based on the below-mentioned segments:

Global Liquid Chlorine Market, By Grade

- Industrial

- Food

- Water Treatment

- Other

Global Liquid Chlorine Market, By End-Use Industry

- Chemicals

- Plastics

- Pulp Paper

- Food Beverages

- Textiles

- Pharmaceuticals

- Other

Global Liquid Chlorine Market, By Application

- Bleaching

- Disinfection

- Deodorization

- Water treatment

- Industrial synthesis

- Other

Global Liquid Chlorine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the liquid chlorine market over the forecast period?The global liquid chlorine market is projected to expand at a CAGR of 2.04% during the forecast period.

-

2. What is the market size of the liquid chlorine market?The global liquid chlorine market size is expected to grow from USD 12.15 Billion in 2024 to USD 15.17 Billion by 2035, at a CAGR of 2.04% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the liquid chlorine market?North America is anticipated to hold the largest share of the liquid chlorine market over the predicted timeframe.

Need help to buy this report?