Global Lifting Equipment Market Size, Share, and COVID-19 Impact Analysis, By Type (Lifts, Pallet Trucks, Forklifts, Hoists, Stackers, and Robotic Arms), By Mechanism (Electrical, Magnetic, Hydraulic, Pneumatic, and Scissor Lifts), By Application (Construction, Shipping Dockyards & Warehouses, Manufacturing Industry, and Process Industry), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Semiconductors & ElectronicsGlobal Lifting Equipment Market Insights Forecasts to 2035

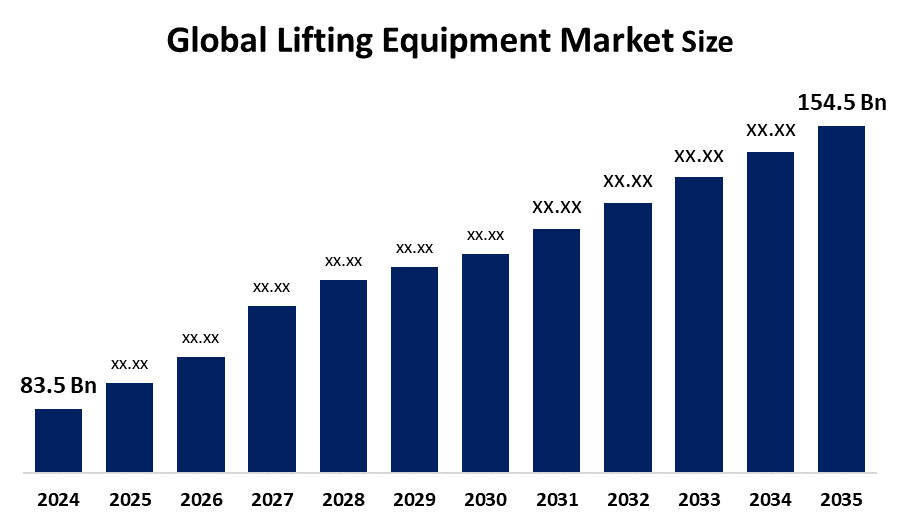

- The Global Lifting Equipment Market Size Was Estimated at USD 83.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.75% from 2025 to 2035

- The Worldwide Lifting Equipment Market Size is Expected to Reach USD 154.5 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global lifting equipment market size was worth around USD 83.5 Billion in 2024 and is predicted to grow to around USD 154.5 Billion by 2035 with a compound annual growth rate (CAGR) of 5.75% from 2025 and 2035. The market for lifting equipment has a number of opportunities to grow due to the large-scale construction projects, oil & gas exploration, and port expansion programs.

Market Overview

The global lifting equipment industry focuses on the sale of machinery used to move, lift, and position heavy loads, such as cranes, forklifts, hoists, and aerial work platforms. Lifting equipment, also known as lifting gear, refers to any equipment that can be used to lift and lower loads. It includes heavy machinery like patient lifts, overhead cranes, forklifts, jacks, building cradles, and passenger lifts, as well as smaller accessories like chains, hooks, and rope. The expanding renewable energy projects, especially in the wind, solar, and offshore sectors, are intensifying the need for specialized lifting and spreader equipment. For instance, in July 2025, Trishakti Industries announced that it had undertaken a significant deployment of heavy lifting equipment for a renewable energy project from Reliance Industries.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures and expanding partnerships. For instance, in April 2025, Accenture is working with Schaeffler AG to reinvent industrial automation with physical AI and robotics. The growing advancements in industrial engineering for improved business efficiency, fostering a safer & more economical sustainable industrial society, are driving a huge surge in the global lifting equipment market.

Report Coverage

This research report categorizes the lifting equipment market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the lifting equipment market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the lifting equipment market.

Driving Factors

The lifting equipment market is primarily driven by the expanding infrastructure, especially in emerging economies, with the support of investments and government funding programs. For instance, McKinsey estimated that a cumulative $106 trillion in investment would be necessary through 2040 to meet the need for new and updated infrastructure. Further, the evolving crane industry, with growing technological advancements that provide real-time data on load management, operational parameters, and preventive maintenance needs, is propelling the market growth. The retail and e-commerce industry is also supporting the market growth. For instance, in the U.S., e-commerce grew 32% in 2020, and tapered back to 14.2% in 2021 as lockdowns lifted and shoppers returned to brick-and-mortar stores. Additionally, the tailored solutions provided for fulfilling manufacturing lifting needs range from component handling to assembly to shipping, for safer and efficient & productive operations are promoting the market in the manufacturing sector.

Restraining Factors

The lifting equipment market is restricted by high capital expenditure, installation, and increased ownership, which heavily impact small-scale industries. Further, the shortage of skilled labour in regions with limited vocational training infrastructure is challenging the market growth.

Market Segmentation

The Lifting Equipment Market share is classified into type, mechanism, and application.

- The forklifts segment dominated the market, accounting for the largest revenue share of about 36.8% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the lifting equipment market is divided into lifts, pallet trucks, forklifts, hoists, stackers, and robotic arms. Among these, the forklifts segment dominated the market, accounting for the largest revenue share of about 36.8% in 2024 and is projected to grow at a substantial CAGR during the forecast period. Forklifts are used for loading and unloading goods on forks and are a widely known industrial vehicle that lifts and maneuvers heavy loads ranging from 3,000 lbs to more than 70,000 lbs to varying elevations. The MOM/OSHD/2022-02 was issued in July 2022, about the safe use of excavators and forklifts as lifting machines. Adoption of forklifts for optimizing logistics, as well as in manufacturing and warehouse operations, along with its cost-effective production & scalability, is propelling the segmental market growth.

- The hydraulic segment accounted for the largest market share of about 41.2% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the mechanism, the lifting equipment market is divided into electrical, magnetic, hydraulic, pneumatic, and scissor lifts. Among these, the hydraulic segment accounted for the largest market share of about 41.2% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The hydraulic mechanism of lifting equipment includes the use of hydraulic fluid and a piston system for moving the lift car up and down smoothly. They are used in various industries, including car braking systems and forklift trucks, to industrial presses and machinery. Introduction of industry 4.0 & IoT, the agriculture sector, and the construction industry are several factors that are driving the segmental market growth.

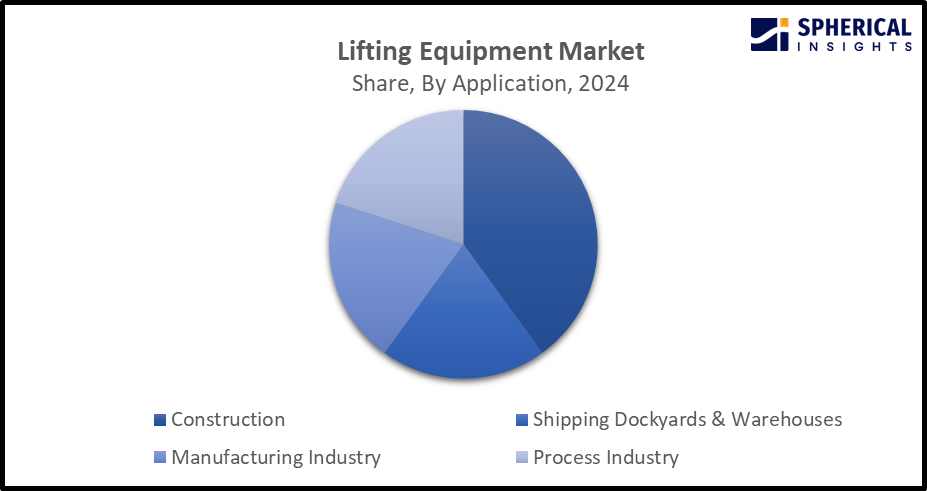

- The construction segment accounted for the largest market revenue share of about 38.5% in 2024 and is expected to grow at a remarkable CAGR during the projected period.

Based on the application, the lifting equipment market is divided into construction, shipping dockyards & warehouses, manufacturing industry, and process industry. Among these, the construction segment accounted for the largest market revenue share of about 38.5% in 2024 and is expected to grow at a remarkable CAGR during the projected period. Lifting equipment is used in high-rise construction for lifting and lowering loads on site and can include cranes, forklifts, trucks, and lifts. Implementing lifting equipment during construction projects aids in easing the load and improving safety, efficiency, and client satisfaction. Adoption of advanced lifting technologies and infrastructure development is driving the segmental market growth.

Get more details on this report -

Regional Segment Analysis of the Lifting Equipment Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the lifting equipment market over the predicted timeframe.

North America is anticipated to hold the largest share of nearly 36.0% in the lifting equipment market over the predicted timeframe. The market ecosystem in North America is strong, due to increasing investment programs supporting innovation. For instance, Amazon Industrial Innovation Fund is a $1 billion venture investment program that supports emerging technology companies with direct investments. The market for lifting equipment has been driven by the region's well-established manufacturing & construction industries, focus on work safety & energy efficiency, and replacement of outdated equipment with electric models. Due to their innovative lifting equipment products and partnerships with other industry players, played a significant role in propelling the market's expansion. For instance, in September 2025, PotisEdge, a world-leading provider of energy storage systems, signed a landmark agreement with Lion Power, the originator of Autonomous Power Management (APM) systems for the Material Handling market, at RE+ 2025. The U.S. is dominating the North America lifting equipment market with the largest share, owing to the increased demand for heavy lifting equipment in construction, energy, and logistics sectors.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR of 10.6% in the lifting equipment market during the forecast period. The Asia Pacific area has a thriving market for lifting equipment due to the region’s rapid industrialization and growth of the e-commerce industry. Further, the expanding partnership agreements for providing reliable solutions for lifting operations aid in driving market growth. For instance, M&O extended a partnership agreement with Red Rock, which is a Norwegian company that provides reliable offshore cranes for wind farms and marine lifting operations. China accounted for the leading market share in the Asia Pacific lifting equipment market, driven by large-scale industrial expansion, significant infrastructure development, and government initiatives for supporting modern manufacturing. For instance, in October 2025, SANY unveiled the 50-ton energy storage reach stacker as the pioneer to meet the industry challenge.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the lifting equipment market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Komatsu Ltd.

- MITSUBISHI LOGISNEXT CO., LTD

- Jungheinrich AG

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- Linamar

- Hyster-Yale Materials Handling, Inc.

- Columbus McKinnon Corporation

- KITO CORPORATION

- Anhui Heli Co., Ltd.

- HAULOTTE GROUP

- Ingersoll Rand

- SSAB

- PALFINGER AG

- Cargotec Corporation

- TOYOTA INDUSTRIES CORPORATION

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, the IMO’s SOLAS Regulation II-1/3-13 introduces mandatory safety requirements for onboard lifting appliances. The rules cover all lifting appliances on vessels with a safety construction certificate, including all cranes greater than 1 tonne SWL, moveable decks, ramps lifted with cargo, as well as other lifting appliances.

- In September 2025, the Ministry of Manpower (MOM) has completed a review of the test and examination requirements for statutory lifting equipment. This is part of ongoing efforts to strengthen workplace safety and health (WSH) standards while reducing costs for businesses.

- In July 2025, a Doncaster lifting equipment manufacturer was acquired by a Swedish group. A South Yorkshire-based manufacturer of heavy lifting equipment has been acquired by a Swedish corporate group. APP Lifting Services Limited, which is based in Doncaster and also has a smaller business unit in Barking, East London, has more than two decades of experience in the manufacture, hire, repair and supply of lifting equipment.

- In June 2025, Siemens Digital Industries Software announced that Cimolai Technology, a leader in the design, production, and installation of lifting and handling equipment, had adopted the Siemens Xceletor portfolio of industry software.

- In June 2025, Packline Materials Handling and Ultrasource LLC announced their latest innovation in roll handling solutions: the vertical Spindle Attachment with Powered Ejector Mechanism.

- In June 2025, Siemens Digital Industries Software announced that Cimolai Technology, a company specializing in the design, production, and installation of lifting and handling equipment, had adopted the Siemens Xcelerator portfolio of industry software.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the lifting equipment market based on the below-mentioned segments:

Global Lifting Equipment Market, By Type

- Lifts

- Pallet Trucks

- Forklifts

- Hoists

- Stackers

- Robotic Arms

Global Lifting Equipment Market, By Mechanism

- Electrical

- Magnetic

- Hydraulic

- Pneumatic

- Scissor Lifts

Global Lifting Equipment Market, By Application

- Construction

- Shipping Dockyards & Warehouses

- Manufacturing Industry

- Process Industry

Global Lifting Equipment Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the lifting equipment market?The global lifting equipment market size is expected to grow from USD 83.5 Billion in 2024 to USD 154.5 Billion by 2035, at a CAGR of 5.75% during the forecast period 2025-2035.

-

2.Which region holds the largest share of the lifting equipment market?North America is anticipated to hold the largest share of the lifting equipment market over the predicted timeframe.

-

3.What is the forecasted CAGR of the Global Lifting equipment Market from 2024 to 2035?The market is expected to grow at a CAGR of around 5.75% during the period 2024–2035.

-

4.Who are the top companies operating in the Global Lifting equipment Market?Key players include Komatsu Ltd., MITSUBISHI LOGISNEXT CO., LTD, Jungheinrich AG, Zoomlion Heavy Industry Science & Technology Co., Ltd., Linamar, Hyster-Yale Materials Handling, Inc., Columbus McKinnon Corporation, KITO CORPORATION, Anhui Heli Co., Ltd., HAULOTTE GROUP, Ingersoll Rand, SSAB, PALFINGER AG, Cargotec Corporation, and TOYOTA INDUSTRIES CORPORATION.

-

5.Can you provide company profiles for the leading lifting equipment manufacturers?Yes. For example, Komatsu Ltd. is a multinational corporation that develops and supplies technologies, equipment and services for the construction, mining, forklift, industrial and forestry markets. MITSUBISHI LOGISNEXT CO., LTD. develop, designs, manufactures, and sells electric and engine-powered forklifts, container carriers, transfer cranes, transport robots, automated warehouses, warehouse management systems (WMS) and other logistics equipment and systems.

-

6.What are the main drivers of growth in the lifting equipment market?An expanding infrastructure, evolving crane industry, retail and e-commerce industry, and demand in the manufacturing sector are major market growth drivers of the lifting equipment market.

-

7.What challenges are limiting the lifting equipment market?High capital expenditure, installation, and increased ownership, which heavily impact small-scale industries, remain key restraints in the lifting equipment market.

Need help to buy this report?