Global Life Science Logistics Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Warehousing & Storage, Transportation and Value-added Services), By Application (Pharmaceuticals, Medical Device, Biologicals and Clinical Trial Materials), By End User (Pharmaceutical Companies, Hospitals and Clinics, Contract Research Organizations (CROs) and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Life Science Logistics Market Insights Forecasts to 2035

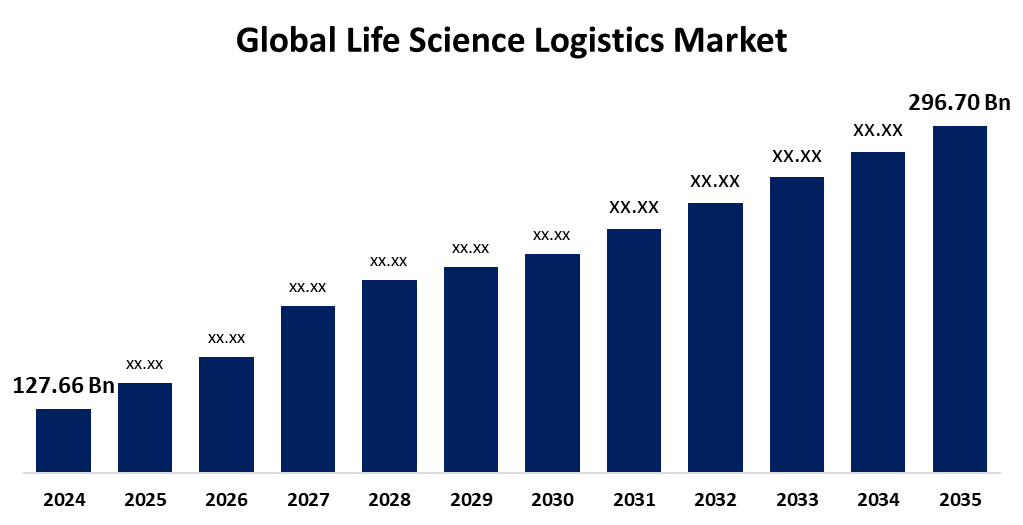

- The Global Life Science Logistics Market Size Was Estimated at USD 127.66 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.97% from 2025 to 2035

- The Worldwide Life Science Logistics Market Size is Expected to Reach USD 296.70 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global Life Science Logistics Market Size was Worth around USD 127.66 Billion in 2024 and is predicted to Grow to around USD 296.70 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 7.97% from 2025 and 2035. The Life Science Logistics Industry is fueled by the Growing need for biopharmaceuticals, global healthcare growth, clinical trials growth, demand for temperature-sensitive logistics, regulatory compliance, technological innovation, supply chain globalization, outsourcing logistics, and health awareness.

Market Overview

The life science logistics market is the portion of the logistics sector that deals with the transportation, storage, and distribution of life science products such as pharmaceuticals, biologics, medical devices, and clinical trial materials. The market provides safe, efficient, and compliant handling of time-sensitive and temperature-sensitive products and meets strict regulatory requirements like Good Distribution Practice (GDP) and FDA regulations. With the globalization of the life sciences industry, the complexity of international transportation, customs handling, and temperature-controlled shipping has increased enormously. This has spawned a requirement for more advanced logistics solutions able to address such challenges. In addition, the growing need for biopharmaceuticals, personalized medicine, and cell and gene therapies, which is being spurred on by the search to tackle prevalent as well as emerging diseases, is also contributing further to the demand for enhanced life science logistics solutions. Further, technology developments, including the utilization of data analytics, real-time visibility, and automation, are greatly enhancing visibility and transparency throughout the supply chain. These technologies are essential in the role they play in defining the market by improving the efficiency of logistics processes. In the pharmaceutical and biotechnology sectors, precision and security are critical, and these technologies assist in guaranteeing the secure and safe transportation of sensitive shipments.

Report Coverage

This research report categorizes the life science logistics market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the life science logistics market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the life science logistics market.

Global Life Science Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 127.66 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.97% |

| 2035 Value Projection: | USD 296.70 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 242 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Service Type, By Application, By End User and By Region |

| Companies covered:: | DHL, World Courier, Quick STAT, CEVA Logistics, Marken, Agility, Rhenus Group, MNX Global Logistics, CRYOPDP, Langham Logistics, Life Science Logistics, Biocair, and Other Key Vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

As increasing trends of chronic diseases, aging populations, and personalized medicine gain momentum, there is a growing demand for biopharmaceuticals. Biopharmaceuticals like biologics and gene therapies need advanced logistics support such as temperature management, storage, and secure transport, thus fueling the life science logistics market. Moreover, the growing number of clinical trials, particularly in oncology and immunotherapy, propels the demand for clinical trial logistics. These trials involve the shipping of sensitive materials, biological specimens, and investigational medications, which demand effective and secure logistics solutions.

Restraining Factors

Life science logistics comprises sophisticated, temperature-sensitive products that need to be stored, transported, and handled in a specialized manner. Keeping these systems running is costly, involving investment in cold chain infrastructure, sophisticated technologies, and regulatory compliance, making it costly for companies to run. The life sciences logistics demands highly skilled professionals to handle sophisticated and sensitive shipments. The lack of qualified workers, including those with experience in the handling of temperature-sensitive and hazardous materials, restricts scaling and high-quality service maintenance.

Market Segmentation

The life science logistics market share is classified into service type, application, and end user.

- The warehousing & storage segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the service type, the life science logistics market is divided into warehousing & storage, transportation, and value-added services. Among these, the warehousing & storage segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to numerous life science products, such as vaccines and biologics, that need to be kept at strict temperatures. There is a need for specialized cold storage facilities to ensure product integrity and compliance with regulations, creating demand for high-quality, dedicated warehousing services in the biotech and pharmaceutical industries.

- The pharmaceuticals segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the application, the life science logistics market is divided into pharmaceuticals, medical devices, biologicals, and clinical trial materials. Among these, the pharmaceuticals segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The growth is driven by pharmaceutical products, specifically vaccines and biologics, which need tight temperature control for transport. Cold chain logistics allows these products to remain effective, generating high demand for specialized services in the logistics segment of pharmaceuticals to adhere to regulations and protect product quality.

- The pharmaceuticals companies segment accounted for the biggest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the life science logistics market is divided into pharmaceutical companies, hospitals and clinics, contract research organizations (CROS), and others. Among these, the pharmaceutical companies segment accounted for the biggest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is due to the pharmaceutical and biotechnology industries are subjected to stringent regulatory requirements, i.e., good distribution practice (GDP) and FDA requirements. These regulatory requirements mandate highly advanced logistics systems for monitoring, tracking, and maintaining product integrity during transit and storage, leading to heightened demand for logistics services.

Regional Segment Analysis of the Life Science Logistics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the life science logistics market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the life science logistics market over the predicted timeframe. North America, and particularly the U.S., is home to numerous of the world's leading pharmaceutical and biotechnology companies. The drug development process runs continuously for these companies, which requires high production volumes and distribution worldwide. All these companies create considerable logistics demand as a result of high production volumes, intricate distribution requirements, and rigorous storage needs for biologics, rendering critical dependence on specialized logistics networks across the region.

Asia Pacific is expected to grow at a rapid CAGR in the life science logistics market during the forecast period. The Asia-Pacific region is spending lavishly on cold chain assets to facilitate the shipment of temperature-sensitive biopharmaceuticals such as vaccines and biologics. New chilled storage facilities, improved transport networks, and sophisticated tracking technologies are being implemented with great speed, allowing safe delivery and placing the region in a position of leadership in rapidly developing life science logistics capabilities.

Europe is predicted to hold a significant share of the life science logistics market throughout the estimated period. Europe is expanding as a center for biotech innovation and clinical research, and countries such as France, the Netherlands, and Belgium are taking the lead. Clinical trials are creating demand for accurate, temperature-controlled logistics of investigational products, biological specimens, and equipment, further propelling the need for sophisticated life science logistics solutions in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the life science logistics market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DHL

- World Courier

- Quick STAT

- CEVA Logistics

- Marken

- Agility

- Rhenus Group

- MNX Global Logistics

- CRYOPDP

- Langham Logistics

- Life Science Logistics

- Biocair

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, DHL acquired U.S.-based pharmaceutical logistics company CryoPDP. The strategic step is designed to further strengthen DHL's expertise in temperature-controlled logistics, specifically for the life sciences and healthcare industries. The deal is worth in the three-digit million-euro range and is subject to regulatory approvals.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the life science logistics market based on the below-mentioned segments:

Global Life Science Logistics Market, By Service Type

- Warehousing & Storage

- Transportation

- Value-added Services

Global Life Science Logistics Market, By Application

- Pharmaceuticals

- Medical Device

- Biologicals

- Clinical Trial Materials

Global Life Science Logistics Market, By End User

- Pharmaceutical Companies

- Hospitals and Clinics

- Contract Research Organizations (CROs)

- Others

Global Life Science Logistics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the life science logistics market over the forecast period?The global life science logistics market is projected to expand at a CAGR of 7.97% during the forecast period.

-

2. What is the market size of the life science logistics market?The global life science logistics market size is expected to grow from USD 127.66 Billion in 2024 to USD 296.70 Billion by 2035, at a CAGR of 7.97% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the life science logistics market?North America is anticipated to hold the largest share of the life science logistics market over the predicted timeframe.

Need help to buy this report?