Global Life Insurance Software Market Size, Share, and COVID-19 Impact Analysis, By Type (On-Premise and Cloud-Based), By Application (Term Life, Annuity, Whole Life, Group Life and Unit-linked), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal Life Insurance Software Market Insights Forecasts to 2035

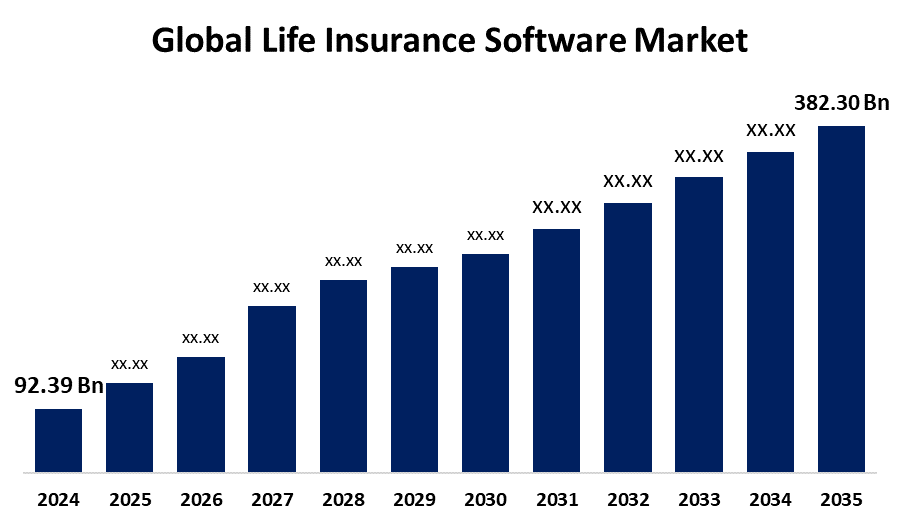

- The Global Life Insurance Software Market Size Was Estimated at USD 92.39 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.78% from 2025 to 2035

- The Worldwide Life Insurance Software Market Size is Expected to Reach USD 382.30 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Life Insurance Software Market size was worth around USD 92.39 Billion in 2024 and is predicted to grow to around USD 382.30 Billion by 2035 with a compound annual growth rate (CAGR) of 13.78% from 2025 to 2035. The life insurance software market is fueled by digital transformation, growth in demand for customized policies, growing use of AI and automation, regulatory compliance requirements, customer experience focus, growth in middle-class populations, and improved risk management capabilities.

Market Overview

The life insurance software industry is the business that offers software solutions tailored for life insurance firms to automate, streamline, and optimize their processes. These include policy administration, underwriting, claims handling, billing, and customer relationship management (CRM) applications. These software solutions assist insurance companies in improving operational efficiency, enhancing customer service, complying with regulatory needs, and achieving cost savings. Technologies like artificial intelligence (AI), machine learning, cloud computing, and data analytics are usually combined to facilitate improved decision-making, personalized products, and enhanced risk management in the life insurance industry. With digital technologies being more widely embraced by many industries, life insurance software solutions are more urgently needed to enhance customer experience, automate processes, and stay competitive. Demographic and lifestyle trends influence demand for insurance products. Life insurance software to capture market potential must enable the creation and adaptation of tailored solutions to meet evolving consumers' needs and preferences.

Report Coverage

This research report categorizes the life insurance software market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the life insurance software market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the life insurance software market.

Global Life Insurance Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 92.39 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 13.78% |

| 2035 Value Projection: | USD 382.30 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 246 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Type, By Application and By Region |

| Companies covered:: | Accenture, Infosys, Cognizant, Wipro, TCS, IBM, Oracle, Microsoft, SAP, Pegasystems, FSS, Sopra Steria, Vertafore, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Customers are looking for more personalized life insurance coverage to suit their individual needs. Life insurance software allows insurers to leverage data analytics and AI to deliver customized, flexible coverage, increasing customer satisfaction and spurring demand for sophisticated software solutions. Further, AI and automation in life insurance software assist insurers in enhancing underwriting, risk assessment, claim processing, and customer service. These technologies allow insurers to lower operational costs, accelerate decision-making, and provide more efficient services, which are among the main drivers of software adoption.

Restraining Factors

The adoption of life insurance software, particularly on-premises technology, demands substantial investment in infrastructure, licenses, and training. This may pose a significant deterrent to smaller insurers or organizations with low budgets. The processing of sensitive customer data also raises fears of possible breaches or cyberattacks. Insurers have to make heavy investments in good cybersecurity technologies, particularly if using cloud-based technology, rendering the uptake of such technologies gradual owing to security fears.

Market Segmentation

The life insurance software market share is classified into type and application.

- The on-premise segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the life insurance software market is divided into on-premise and cloud-based. Among these, the on-premise segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to on-premises solutions give insurers control over sensitive information themselves. This is important for compliance with strict regulations such as GDPR and HIPAA. Insurers can establish strong security measures, minimizing the chances of data breaches and privacy breaches.

- The term life segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the application, the life insurance software market is divided into term life, annuity, whole life, group life, and unit-linked. Among these, the term life segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The growth is attributed to term life insurance is among the cheapest forms of insurance, thus more people can afford it. Its simple design, providing pure risk protection without savings features, makes policy administration easier, allowing insurers to manage it more efficiently using software packages, thus leading to higher take-up rates.

Regional Segment Analysis of the Life Insurance Software Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the life insurance software market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the life insurance software market over the predicted timeframe. North America has a highly advanced digital ecosystem, which allows for quick take-up of life insurance software. With strong internet connectivity, cloud computing, and extensive adoption of sophisticated IT systems, insurers are able to implement and scale software solutions efficiently. This solid platform facilitates innovation and ongoing upgrades in life insurance technologies throughout the region.

Asia Pacific is expected to grow at a rapid CAGR in the life insurance software market during the forecast period. With a rising need across APAC for affordable and highly customizable life insurance products, especially among younger generation populations, the insurers are switching to AI software that enables data-driven product crafting and dynamic pricing. These AI tools enable the insurers to design, market, and manage tailor-made offerings on a large scale, leading to the swift rollout of modern life insurance platforms.

Europe is predicted to hold a significant share of the life insurance software market throughout the estimated period. Europe's life insurance market is governed by stringent regulatory guidelines like Solvency II and GDPR. These regulations demand meticulous data handling, risk evaluation, and openness, compelling insurers to implement sophisticated software solutions. Life insurance software assists businesses in maintaining compliance while enhancing operational efficiency and reporting accuracy, making it a must-have solution throughout the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the life insurance software market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Accenture

- Infosys

- Cognizant

- Wipro

- TCS

- IBM

- Oracle

- Microsoft

- SAP

- Pegasystems

- FSS

- Sopra Steria

- Vertafore

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2023, InsurTech Company’s, insurance software automation introduced the Best Plan Pro 2.0, an underwriting solution utilizing artificial intelligence intended to automate the life insurance application process. The new version provides an improved user experience with a more interactive interface and enhanced data entry platform, allowing agents to pre-qualify applicants for final expense, term life, and Medicare supplement products in mere seconds.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the life insurance software market based on the below-mentioned segments:

Global Life Insurance Software Market, By Type

- On-Premise

- Cloud-Based

Global Life Insurance Software Market, By Application

- Term Life

- Annuity

- Whole Life

- Group Life

- Unit-linked

Global Life Insurance Software Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the life insurance software market over the forecast period?The global life insurance software market is projected to expand at a CAGR of 13.78% during the forecast period.

-

2. What is the market size of the life insurance software market?The global life insurance software market size is expected to grow from USD 92.39 Billion in 2024 to USD 382.30 Billion by 2035, at a CAGR of 13.78% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the life insurance software market?North America is anticipated to hold the largest share of the life insurance software market over the predicted timeframe.

Need help to buy this report?