Global Life and Non-Life Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Life Insurance and Non-Life Insurance), By Coverage (Lifetime Coverage and Term Coverage) By Distribution Channel (Direct, Agency, Banks, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Life and Non-Life Insurance Market Insights Forecasts To 2033

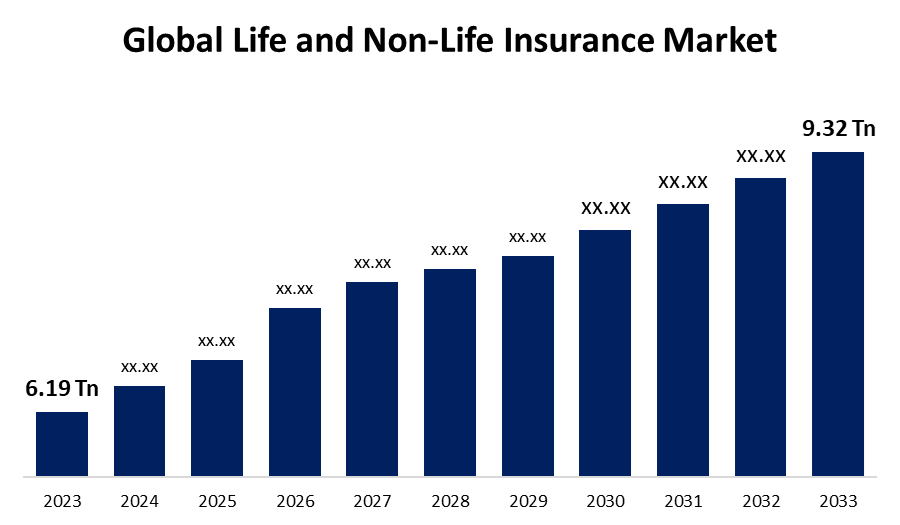

- The Global Life and Non-Life Insurance Market Size was Estimated at USD 6.19 Trillion in 2023

- The Market Size is Expected to Grow at a CAGR of around 4.18% from 2023 to 2033

- The Worldwide Life and Non-Life Insurance Market Size is Expected to Reach USD 9.32 Trillion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The global life and non-life insurance market size was worth around USD 6.19 Trillion in 2023 and is predicted to grow to around USD 9.32 Trillion by 2033 with a compound annual growth rate (CAGR) of 4.18% between 2023 and 2033. The non-life and life insurance sector is prompted by the increasing cost of healthcare, financial protection awareness, technological improvements, favorable governmental policies, urbanization, disposable incomes, and the need for coverage of risk across health, properties, and vehicles in emerging economies as well as developed economies.

Market Overview

The life and non-life insurance market describes the business that sells different categories of insurance products aimed at guarding people and firms against financial loss. The life and non-life insurance market focuses on minimizing financial risk, promoting security, and maintaining economic stability for people, households, and businesses through offering insurance products to secure a multitude of possible risks and losses. Additionally, as economies expand, particularly in emerging economies, disposable incomes increase, enabling individuals and enterprises to spend more on insurance premiums. With increased wealth, individuals are more likely to invest in financial security, propelling the expansion of both life and non-life insurance markets. With better information about risks associated with life incidents, medical ailments, and damages to properties, individuals are more inclined towards investment in insurance. This enhanced information is spurred on by insurance education programs, community awareness drives, and information available at their fingertips. Consequently, businesses and individuals alike are increasingly interested in safeguarding their well-being, property, and the future through effective insurance coverage.

Report Coverage

This research report categorizes the life and non-life insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the life and non-life insurance market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the life and non-life insurance market.

Global Life and Non-Life Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.19 Trillion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.18% |

| 2033 Value Projection: | USD 9.32 Trillion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Coverage, By Distribution Channel and By Region |

| Companies covered:: | AXA Group, China Life Insurance Company, Chubb Limited, Cigna, MetLife, Inc., New York Life Insurance Company, Northwestern Mutual, Ping An Insurance Group, Prudential Financial, UnitedHealth Group, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Medical costs are rising all over the world, and people are looking for health insurance as a protection against financial loss. This fuels robust growth in non-life insurance, particularly in health insurance, which has become a necessity for families in developed and emerging economies. Additionally, people are increasingly aware of the role of insurance in financial risk management through awareness campaigns, education, and social media. This change in thinking is a growing demand for life insurance (for the security of the family) and non-life products (for protection against everyday risks).

Restraining Factors

Insurance premiums, particularly for comprehensive or lifetime coverage, can be exorbitant for low- and middle-income families and individuals. High initial costs deter individuals from buying policies, particularly in the life and health insurance markets, where policies may involve long-term financial obligations.

Market Segmentation

The life and non-life insurance market share is classified into type, coverage, and distribution channel.

- The non-life insurance segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the life and non-life insurance market is divided into life insurance and non-life insurance. Among these, the non-life insurance segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to non-life insurance covers every day, and tangible perils faced by people daily such as car accidents, sick days, damage to property, or disruption to travel. Its real-world application creates ongoing demand, particularly with growing personal and commercial asset ownership.

- The term coverage segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the coverage, the life and non-life insurance market is divided into lifetime coverage and term coverage. Among these, the term coverage segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth is driven by term insurance provides high coverage at substantially lower premiums than lifetime or whole-life products. It becomes affordable to a larger section of the population, particularly first-time buyers or cost-conscious individuals and families.

- The agency segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the life and non-life insurance market is divided into direct, agency, banks, and others. Among these, the agency segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to insurance being a trust-driven product. Representatives offer in-person consultations, reveal policy information, and establish rapport with clients personally. Such interpersonal contact makes shoppers feel more relaxed buying sophisticated goods such as life insurance or coverage for a lifetime.

Regional Segment Analysis of the Life and Non-Life Insurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the life and non-life insurance market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the life and non-life insurance market over the predicted timeframe. The high and stable per capita income in North America's economy allows businesses and individuals to purchase varied insurance products. Maturity in the economy guarantees uniform demand across life, health, auto, and property insurance, maintaining the dominant market share for the region. Leading global insurers with headquarters in North America, including MetLife, Prudential, and AIG, fuel market growth and innovation. Their varied products and international operations add scale and impact, assisting North America in holding its leading percentage in the insurance sector.

Asia Pacific is expected to grow at a rapid CAGR in the life and non-life insurance market during the forecast period. Asia-Pacific economies such as China, India, and Southeast Asia are witnessing rapid GDP growth. With rising income levels, more businesses and individuals look for financial protection, and hence there is high demand for both life and non-life insurance products in emerging and developed markets. Most governments in the region are encouraging insurance awareness, regulatory reforms, and digital platforms to increase access. Programs such as India's PM-JAY or China's pension reforms are bringing millions into the formal insurance system, driving market penetration.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the life and non-life insurance market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AXA Group

- China Life Insurance Company

- Chubb Limited

- Cigna

- MetLife, Inc.

- New York Life Insurance Company

- Northwestern Mutual

- Ping An Insurance Group

- Prudential Financial

- UnitedHealth Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2023, IndiaFirst Life Insurance introduced a new plan known as the Guarantee of Life Dreams (G.O.L.D.) Plan. The plan is a non-linked, non-participating life insurance plan to provide customers with a fixed and guaranteed income in the long run. Under this plan, policyholders can choose premium payment periods of 6, 8, or 10 years, while experiencing policy tenures of 30 or 40 years. It's targeted at people who seek financial security and an assured income source to fund long-term objectives or retirement planning.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the life and non-life insurance market based on the below-mentioned segments:

Global Life and Non-Life Insurance Market, By Type

- Life Insurance

- Non-Life Insurance

Global Life and Non-Life Insurance Market, By Coverage

- Lifetime Coverage

- Term Coverage

Global Life and Non-Life Insurance Market, By Distribution Channel

- Direct

- Agency

- Banks

- Others

Global Life and Non-Life Insurance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East and Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the life and non-life insurance market over the forecast period?The global life and non-life insurance market is projected to expand at a CAGR of 4.18% during the forecast period.

-

2. What is the market size of the life and non-life insurance market?The global life and non-life insurance market size is expected to grow from USD 6.19 Trillion in 2023 to USD 9.32 Trillion by 2033, at a CAGR of 4.18% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the life and non-life insurance market?North America is anticipated to hold the largest share of the life and non-life insurance market over the predicted timeframe.

Need help to buy this report?