Global Legal Marijuana Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Flower, and Oil & Tinctures), By Application (Medical, and Adult Use), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Legal Marijuana Market Insights Forecasts to 2035

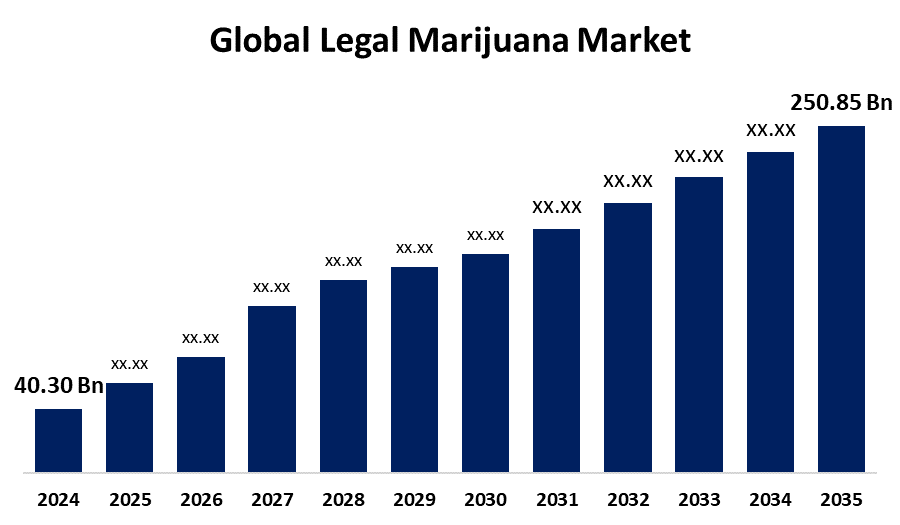

- The Global Legal Marijuana Market Size Was Estimated at USD 40.30 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 18.08% from 2025 to 2035

- The Worldwide Legal Marijuana Market Size is Expected to Reach USD 250.85 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Legal Marijuana Market size was Worth around USD 40.30 Billion in 2024 and is Predicted to Grow to around USD 250.85 Billion by 2035 with a compound annual Growth rate (CAGR) of 18.08% from 2025 and 2035. The market for legal marijuana offers opportunities in the fields of wellness products, pharmaceutical uses, medical research, sustainable farming, technology development, and growing legality.

Market Overview

The regulated sector that includes the production, distribution, and retailing of cannabis products that are allowed by federal, state, or local regulations is known as the "legal marijuana market." It comprises cannabis used for medical and recreational purposes, and it is subject to stringent compliance standards to guarantee quality, safety, and taxes. Investment trends, customer demand, and changing laws all focus on the legal marijuana market. Essential categories include edibles, tinctures, oils, and buds, with uses in personal care, medicine, and pharmaceuticals.

The FDA has approved the cannabinoids dronabinol for nausea and vomiting brought on by cancer treatment and cannabidiol for particular types of severe epilepsy. It's exclusively another element propelling the legal marijuana market. The main factors driving the legal marijuana market are the changing attitudes about cannabis usage, the growing legalization of cannabis, and the expanding acceptability of cannabis for both medical and recreational uses. The market is expanding as a result of rising demand for products containing cannabidiol (CBD) and its therapeutic applications.

Report Coverage

This research report categorizes the legal marijuana market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the legal marijuana market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the legal marijuana market.

Global Legal Marijuana Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 40.30 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 18.08% |

| 2035 Value Projection: | USD 250.85 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product Type, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | AURORA CANNABIS INC., Canopy Growth Corporation, Tikun Olam, ABcann Medicinals, Inc., The Cronos Group, Tilray Brands Inc., MARICANN INC., Lexaria Bioscience, Organigram Holdings Inc., GW Pharmaceuticals, United Cannabis Corporation, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

Growing investment in R&D programs and rising demand for cannabis-containing vapes, pre-rolls, and edibles have contributed to the moderate-to-high growth of the legal marijuana market. A major factor driving the rise in demand for legal marijuana is the growing awareness of its therapeutic benefits, which include its ability to effectively treat chronic pain, anxiety, epilepsy, and other illnesses. The legal marijuana market expansion has been driven by the rising demand for CBD-based products as a result of increased knowledge about CBD and its medicinal applications.

Restraining Factors

Regulatory complexity, hefty taxes, banking restrictions, societal stigma, a lack of research, and varying legalization policies are some of the issues facing the legal marijuana market. Such variables restrict market expansion, investment, and consumer accessibility.

Market Segmentation

The legal marijuana market share is classified into product type and application.

- The oil & tinctures segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the legal marijuana market is divided into flower and oil & tinctures. Among these, the oil & tinctures segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. In several countries, marijuana oil and tinctures are being thoroughly investigated for a variety of purposes. Medical professionals use cannabis oils to treat cancer-related nausea and vomiting. Furthermore, the industry is growing due to the increasing introduction of cannabis-based products for medical use.

- The medical segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the legal marijuana market is divided into medical and adult use. Among these, the medical segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The recent legalization and decriminalization of marijuana for medical purposes are among the factors that have driven this market's expansion. Due to its accessibility and affordability, patients in these areas have been shown to favor medical marijuana use.

Regional Segment Analysis of the Legal Marijuana Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the legal marijuana market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the legal marijuana market over the predicted timeframe. North America is one of the main factors propelling the regional market, as the quick rise in the rate at which the government is decriminalizing cannabis for both medical and adult use, as well as recreational purposes. The organized regulatory framework and the participation of the bulk of market participants in the cannabis industry reinforce this stance. North America's leadership is being further strengthened by the fact that both supply and demand have expanded as more than two-thirds of the United States is legal.

Asia Pacific is expected to grow at a rapid CAGR in the legal marijuana market during the forecast period. Asia-Pacific is being driven by fast-evolving legal frameworks, growing healthcare infrastructures, and growing knowledge of cannabis's therapeutic potential. Growing interest in CBD products, government backing for cannabis research, and progressive steps toward medicinal cannabis legalization have made countries like South Korea, Thailand, and Australia important markets. A key market for legal marijuana products is still Australia, with its well-established medicinal cannabis program.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the legal marijuana market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AURORA CANNABIS INC.

- Canopy Growth Corporation

- Tikun Olam

- ABcann Medicinals, Inc.

- The Cronos Group

- Tilray Brands Inc.

- MARICANN INC.

- Lexaria Bioscience

- Organigram Holdings Inc.

- GW Pharmaceuticals

- United Cannabis Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2024, In the UK, Village Farms International, Inc. announced the opening of two cannabis brands: The Original Fraser Valley Weed Co. (Fraser Valley) and Pure Sunfarms. These products will be distributed by 4C LABS, a medicinal cannabis firm situated in the United Kingdom.

- In March 2023, Canopy Growth's six new beverage varieties were launched. The company unveiled the first cannabis-infused beverage with naturally occurring caffeine in Canada under the Deep Space brand. In addition, the business introduced four springtime flavors under the Tweed brand.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the legal marijuana market based on the below-mentioned segments:

Global Legal Marijuana Market, By Product Type

- Flower

- Oil & Tinctures

Global Legal Marijuana Market, By Application

- Medical

- Adult Use

Global Legal Marijuana Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the legal marijuana market over the forecast period?The global legal marijuana market is projected to expand at a CAGR of 18.08% during the forecast period.

-

2. What is the market size of the legal marijuana market?The global legal marijuana market size is expected to grow from USD 40.30 Billion in 2024 to USD 250.85 Billion by 2035, at a CAGR of 18.08% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the legal marijuana market?North America is anticipated to hold the largest share of the legal marijuana market over the predicted timeframe.

Need help to buy this report?